Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Introduction

1. The subject of accounting and its elements. Accounting objects

2. Place and role of economic analysis in enterprise management

2.1 Place of economic analysis in the system of economic sciences. The concept of economic analysis

2.2 Subject of economic analysis

2.3 Business entity as an object of study at the micro level

2.5 The value of economic analysis in enterprise management and improving its efficiency

Bibliography

Introduction

accounting economic analysis

Accounting studies the quantitative side of economic phenomena in their continuous connection with the qualitative side by registering economic facts, both in kind and in monetary terms. Each accomplished economic fact, documented is called business transaction.

Here takes place continuous reflection of the financial and economic activities of the organization, all of its property and sources of its formation, all types of inventories, fixed assets, costs of production and sales of products, cash, debts of the enterprise.

Business facts reflected in accounting, continuously recorded over time in the form of records. Moreover, each economic fact is formalized documented- paper primary document or on machine data carriers. Documentation of a business transaction gives it legal force.

In accounting, all means and business processes are necessarily reflected in monetary expression, based on the generalization of natural and labor indicators.

Thus, accounting is an ordered system for collecting, registering and summarizing information in monetary terms about the property and obligations of an organization and their movement through continuous, continuous, documentary accounting of all business transactions.

It is this definition that most fully characterizes accounting. Therefore, it is enshrined at the highest legislative level - in the Federal Law "On Accounting" dated 11/21/1996. (Article 1, paragraph 1)

First, it emphasizes that accounting is an ordered system.

Secondly, this definition very briefly reflects the stages of the accounting process: the collection, registration and generalization of information.

Thirdly, the main features of accounting are noted - this is a continuous, continuous, strictly documentary accounting.

Fourthly, the main meter used in accounting is indicated - the monetary meter.

Fifthly, the main objects of accounting are noted.

Depending on who the information is provided to, accounting is divided into two types.

1. Financial Accounting, whose information is provided mainly in the form of mandatory reporting forms to external users - a higher organization (department), founders, creditors, investors, government agencies, etc.

2. Management Accounting- its information is necessary for various services and departments of the organization, i.e. internal users.

The main group of external users are founders, shareholders who need information about the effectiveness of their contributions, the amount of dividends and the prospects for the development of the organization.

Investors, both present and potential, information is needed on the feasibility of investing. Therefore, first of all, these users study the financial results and its components, which are also formed in the accounting process.

Lenders organizations are banks, suppliers, contractors, etc., to which there are obligations of the enterprise, the so-called external debts. Employees of the organization can also act as creditors in the event of wage arrears. Lenders are mainly interested in information about the solvency of the enterprise.

State bodies information is required on tax payments (to tax authorities), on statistical indicators (to statistical authorities), etc.

internal users interested in accounting information for analysis and management decisions at all levels of management.

Accounting is central to the management system in a market economy due to the following requirements:

· documentation of all business transactions provides that all facts of economic activity must be documented in writing;

· timeliness of accounting means that accounting must provide all the necessary information about the activities of the organization within a strictly defined time frame;

· accuracy and objectivity of accounting- implies that all accounting information must be correct, correctly reflecting reality;

· completeness of accounting- provides for coverage of all aspects of the organization's activities and a complete description of all operations performed;

· content over form assumes that compliance with the legal norm and economic feasibility of business operations should prevail over the form regulated by the relevant regulatory documents;

· materiality means that information is recognized as significant in Russian accounting if its omission or distortion may affect the adoption of economic decisions by interested users. This information is subject to mandatory reflection separately in the reporting or in the explanatory notes to the reporting;

· consistency of accounting information provides that current accounting data in the context of certain types of assets and liabilities must correspond to the turnovers and balances of an economically homogeneous accounting object that combines them at the beginning and end of the reporting period;

· clarity and accessibility of accounting involves, first of all, the need to provide information about the activities of the organization to all users, both internal and external;

· cost-effectiveness and rationality of accounting- this is the need to ensure maximum cheapness and a clear organization of accounting work. In this regard, it is very important to prevent an excessive increase in the costs of accounting, which in turn is associated with its rational organization.

Based on these requirements, the main tasks of accounting are:

1) the formation of complete and reliable information about the economic processes and results of the activities of enterprises, necessary for external and internal users of information;

2) ensuring control over the presence and movement of property, capital and liabilities of the organization;

3) timely prevention of negative processes, identification and mobilization of on-farm reserves.

In a market economy, more and more attention is paid to the quality training of specialists who are able not only to make competent economic decisions, but also to take risks if necessary, take initiative and responsibility, take into account constant changes in the internal and external environment of the enterprise, be a competent leader and subtle psychologist.

Economic analysis is one of the most effective methods of management, the main element of justification of management decisions. With the help of economic analysis, a strategy and tactics for the development of an enterprise are developed, plans and management decisions are justified, their implementation is monitored, a comparative analysis of marketing activities is carried out, including a comparison of the actual development of events with the expected one for a certain period of time, an analysis of specific consumers and the latter's assessment of the quality of manufactured goods. , an assessment of the financial and economic activities of the enterprise, its financial stability, liquidity, solvency is carried out. A variety of methodological tools allows you to study the internal and external environment of the company, evaluate the performance of the entire enterprise, its structural divisions, individual employees; determine the competitive environment and the place of the business entity in the competitive market.

The study of the discipline "Economic Analysis" should equip students with the necessary theoretical knowledge and practical skills in mastering modern methods of economic research, the methodology of a systematic, comprehensive economic analysis of the results of an enterprise. A qualified economist, financier, auditor should know well not only the general patterns and trends in the development of the economy in the conditions of market relations, but also subtly understand the manifestations of general, specific and particular economic laws in the practice of their enterprise, timely notice development trends and opportunities to increase the competitiveness of their enterprise.

The formation of a market economy determines the development of economic analysis, primarily at the micro level - at the level of individual enterprises and their structural divisions, since these grassroots links (with any form of ownership) form the basis of a market economy.

All processes occurring at the enterprise are considered in relation to the internal and external economic environment, taking into account dynamic changes, political and social aspects of the development of society.

1. Subject of accountingand its elements. Accounting objects

The subject of accounting in a generalized form is the financial and economic activities of the organization. Any phenomenon that can be objectively expressed in valuation and is necessary for the management of an organization is an object of accounting. Any organization operating separately from others must have a certain property (complex of economic assets), which is called the assets of the organization. The property comes from different sources and for different periods of time. There are two types of sources - equity and liabilities of the organization. Equity and liabilities are called liabilities of the organization. Naturally, the assets and liabilities of the organization are characteristics of the same property - the sum of assets and liabilities is the same. In addition, any phenomenon that leads to a change in the assets or liabilities of the organization should also be taken into account in accounting.

Thus, the objects of accounting are the assets, liabilities of the organization and business transactions carried out in the process of financial and economic activities. A business transaction is understood as any event that leads to a change in the composition of the assets or liabilities of the organization.

The subject of accounting is an ordered and regulated information system that reflects the totality of property in terms of composition and location, according to the sources of their formation, business transactions and financial results of the enterprise in monetary terms.

Accounting objects can be combined into two groups:

objects that support the economic activity of the organization;

objects that make up the economic activity of the organization.

The first group includes the property of the organization, consisting of various types of funds and obligations, and the second - business processes and their results.

The assets of the enterprise are classified according to the speed of their turnover - durable funds (in circulation for more than 1 year - non-current assets) and current use funds (in circulation for no more than 1 year - current assets). For the effective use of assets, it is necessary to know what types of assets are available in the organization and how they are located, as well as the sources of formation of this property and their intended purpose. Therefore, it is necessary to classify property in two sections:

1) by composition and placement;

2) by sources of education and purpose.

By composition and placement property can be divided into the following main groups: non-current assets, current assets and abstract assets (Figure 1).

Non-current assets are divided into fixed assets and intangible assets.

Fixed assets - this is the value of movable and immovable property used as means of labor in the implementation of the economic activity of the enterprise for a period of more than 1 year. Fixed assets include buildings, structures, working and power machines and equipment, measuring and control instruments and devices, computers, vehicles, tools, production and household equipment, working productive and breeding livestock, perennial plantations, on-farm roads, land plots and objects of nature management (water, subsoil and natural resources). They are used for a long time, without changing their appearance, wear out in parts during the standard period of use. In the process of use, fixed assets gradually wear out and their cost is included in the cost of products (works, services) in parts by depreciation.

Intangible assets- objects of long-term use that have a valuation, but are not material values (the right of the patent holder to patents, inventions, industrial designs, as well as other property rights to intellectual property objects). Intangible assets, like fixed assets, transfer their initial cost to production costs during their useful life. Feature - the absence of their material structure.

Non-current assets can be conventionally classified attachments in non-current assets - funds that are still in unfinished construction, invested in the acquisition, reconstruction of non-current assets, modernization and technical re-equipment.

Moreover, part of non-current assets can be diverted or transferred for temporary use to other organizations, for example, under lease agreements. This group may include Deferred tax assets formed as a result of the difference according to accounting and tax accounting.

current assets are divided into the following groups: inventories, cash, financial assets and funds in settlements.

A significant part of current assets are inventories: materials, finished products, work in progress and goods.

materials necessary for production activities mainly as raw materials, fuel and various auxiliary materials.

Unfinished production- these are the resources of the enterprise that are directly in the production process, but have not yet been turned into finished products. For example, these are the costs of raw materials, materials, wages, etc. for the production of products that have not yet passed all stages of processing (a car on an assembly line in the engineering industry, etc.).

Finished products- products manufactured in the organization, which have passed all the stages of processing, meet the standards and are intended for sale.

Goods shipped- this is a finished product that is sent as a cargo to the buyer, but the ownership of which still belongs to the supplier organization.

Other goods- various types of goods purchased for further sale and resale without further processing.

Cash- cash kept at the cash desk and on various bank accounts.

Financial assets- these are the organization's contributions to the authorized capital of other organizations, in various securities (shares, bonds, bills, etc.), as well as loans provided to other organizations.

All of the assets listed above constitute the resources of the organization, but to fully characterize them, it is necessary to know the sources of the formation of these resources. These can be own and attracted sources (see Figure 2).

1. Own sources or equity- this is the capital of the organization, registered in the charter, formed from the contributions of the founders during the creation of the organization (authorized capital), additional capital, created reserves (reserve capital, various reserves), targeted financing (funds of other legal entities, funds of various budgets that are intended for performance of a specific type of work and are non-refundable), trust funds, profits received as a result of the financial and economic activities of the organization.

Figure 1. Classification of the organization's assets by composition and location

2. Raised capital- these are various loans from banks (short-term, long-term), other organizations (short-term, long-term loans) and accounts payable (debts of the enterprise on various transactions with suppliers and contractors, to the budget, in settlements with staff for remuneration and other creditors). An organization may owe to another organization upon receipt of various materials and goods from it (suppliers), services and work performed by them (contractors), etc., to the state - for various taxes and mandatory contributions, (pension fund and other off-budget funds), and also to their employees (for wages). All debts listed are included in the group accounts payable.

Figure 2. Classification of the organization's capital by type and purpose

The object of accounting, as mentioned above, is also a business transaction - the actual action taken to change the objects of accounting or one separate fact of economic activity. Moreover, any business transaction must be documented.

From the mass of business operations, processes are formed that can be divided into:

1) procurement process - procurement of raw materials, materials, i.e. providing the organization with fixed and working capital;

2) production process - economic operations for the expenditure of raw materials and materials, labor resources (calculation of wages), fixed assets (accrual depreciation) and posting of finished products;

3) the sale process - a set of operations for the shipment of products to buyers and customers, settlements for shipped products, receipt of money to the accounts of the organization and determining the financial result from the sale.

At the same time, all business processes in the activities of a separate organization can occur simultaneously, and the main task of accounting is their timely and reliable reflection in accounting. The solution of these tasks is carried out by accounting with the help of appropriate methods and techniques, which together constitute the accounting method.

2. Place and role of economic analysis in enterprise management.

2.1 The place of economic analysis in the system of economic sciences. The concept of economic analysis

The needs of society are limitless, and the resources needed to create wealth and services are limited. The scarcity of resources necessitates a choice: what to produce, how many goods and services to produce; for whom to produce; how to distribute. In practice, the choice is made not according to the principle “either one or the other”, but according to the principle “something more, something less”.

The purpose of the choice is to establish the optimal ratio between the maximum possible range of products, works, services, on the one hand, and the maximum possible number of them, providing a certain standard of living, on the other. It is necessary to carry out the distribution of resources in accordance with the choice of the structure of production.

Determining the optimal structure of production is possible only on the basis of an analysis of the demand for products, works, services; sales markets, their capacity; potential buyers and clients; the possibility of acquiring all types of resources necessary for the production of products, the provision of services and the performance of work.

The choice process in an economy - the decision to produce, acquire, or reject a particular product - is what ultimately governs the economic system. At the level of an economic entity, the problem of choice is realized in the form of creating specific types of products (works, services). Each business entity, in accordance with supply and demand, determines what, in what quantities, how, where to produce in order to ensure maximum profit, ensuring economic growth and a certain standard of living for the staff.

The economic entity as an economic system is the main link where the realization of the goal of production takes place. Accounting, planning and analysis are important components of this system.

In order to reveal this or that position, this or that situation, to precisely formulate specific proposals or recommendations, it is necessary to study, investigate the phenomenon, process, economic situation. The study, study of the phenomenon involves the identification of internal cause-and-effect relationships, its essence.

Analysis (from Greek - analesis) - means the decomposition of the object under study into elements, into internal components inherent in this object, their study. The dialectical tandem (analysis-synthesis) is understood as a synonym for any scientific research.

The study of economic phenomena and processes is based on the theory of knowledge, which acts as a methodological basis for all branches of science. It determines the essence, necessity and sequence of economic analysis, determines the object and subject of knowledge. The process of cognition makes extensive use of such important tools as analysis and synthesis, experiments and modeling. Human thinking acts as an active constituent element of this knowledge. The process of thinking (the process of analytical-synetic activity of the human brain) goes through three stages:

contemplation (collection of facts required for analysis);

scientific abstraction (multivariance of theoretical judgments, conclusions - the more judgments, the greater the probability of choosing the optimal solution);

Formation of new practical proposals and conclusions.

Abstract thinking, based on real facts that have undergone not only arithmetic, but also logical processing of the primary material, as a rule, reveals the content of the studied phenomena, reveals internal cause-and-effect relationships, certain patterns in their development. This ensures the adoption of specific management decisions, practical proposals aimed at further improvement of one or another economic phenomenon or economic process. Decisions are made on the basis of a generalized conclusion and assessment of the real situation. Economic analysis, based on the theory of knowledge, provides an increase in the economic efficiency of human practical activity. According to G. V. Savitskaya, “analysis in a broad sense” means a way of knowing objects and phenomena of the environment, based on the division of the whole into its component parts, and studying them in all the variety of connections and 0 is unable to answer all the requirements of practice. Economic analysis comprehensively, systematically uses actual data, resorting to techniques and methods for studying statistics, accounting, and mathematics. Economic analysis is closely related to special disciplines such as statistics, accounting, marketing, economic cybernetics, auditing, controlling.

Accounting is the main supplier of economic information about the economic activity of an economic entity. Initially, analytical functions were performed by an accountant. The accountant, having compiled a report for himself, determined what the state of economic assets and sources of their formation is, how efficiently resources are used, whether all reserves are used to increase production efficiency, what are the problems in management. With the development of market relations, the emergence of hundreds of thousands of small and medium-sized firms, which, in the person of an accountant, have the entire economic service, the importance of the analytical activities of accountants is increasing.

Along with accounting and reporting data, statistical reporting is used in analytical work. The share of statistical data in analytical work is not large, since the analytical developments of statisticians are carried out mainly at the sectoral, regional and national economic levels. Economic analysis is closely related to the planning and management of production. Planned indicators are widely used in analytical work, at the same time, evidence-based planning and management at the micro and macro levels is impossible without the use of the results of economic analysis. It creates an information base for developing plans and choosing the most optimal management decisions.

The use of mathematical methods in analytical studies has greatly enriched economic analysis. With the help of mathematical methods, it became possible to study a larger number of objects, to study a larger amount of information. Economic analysis can be carried out more quickly. It follows that the analysis of financial and economic activity is a systematic science. It was formed by integrating a number of sciences and united their individual elements. At the same time, the results of the analysis are widely used by other sciences in the study of various aspects of economic activity.

2 .2 Subject of economic analysis

Each science has its own subject of study, which it studies with an appropriate purpose and methods inherent in it. Science subject shows what the science is studying, and method - how he studies, i.e. what techniques and methods are used in the study of this subject of research. One and the same object can be considered from different angles by different sciences.

The object of study in political science and medicine is a person, but the subject of medicine is the organs - their functions and interaction, and in political science - the relationship between groups, the social behavior of individual leaders, groups, etc.

Production, economic and financial activities is the subject of study of many economic sciences: statistics, accounting, enterprise finance.

Under subject of economic analysis is understood as the study of economic processes, phenomena, situations of economic entities in terms of their effectiveness, i.e., the final financial results of their activities, which are formed under the influence of internal and external, objective and subjective factors, and their socio-economic efficiency. A feature of studying the economic analysis of the economic activity of a subject is that economic processes, indicators characterizing the activities of an economic entity, are studied not only in statics, but also in dynamics.

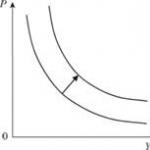

The subject of study is economic processes (as a condition for the economic results of management), and the factors influencing them (economic processes). External factors influencing economic activity mainly reflect the operation of the economic laws of a market economy. The law of supply and demand is reflected in price formation. Changes in prices for raw materials, materials, energy tariffs, prices for finished products, components affect the production and financial results of an economic entity, lead to the complication of economic calculations in the analysis process.

Along with external factors, economic activity is influenced by subjective (internal) factors associated with specific human activities. They are entirely dependent on human actions. Successful effective management with the correct organization of production and labor, skillful use of the resources of an economic entity can be defined as a phenomenon of a subjective (internal) factor.

Economic phenomena and processes, their results, formed under the influence of various factors, are appropriately reflected in the system of economic information, which is a collection of data characterizing economic activity. The subject of economic analysis is the whole system of indicators:

Resources (production and other activities)

products (works, services)

financial results (profit, profitability)

resources.

Thus, the object of analysis of economic activity at the micro level is economic entities, economic results of their activities, financial condition, solvency, liquidity, financial results (profit, profitability), sales and production, cost and resources.

The subject of the analysis is the cause-and-effect relationships of economic phenomena, processes, situations, revealing the mechanism for achieving the set goals, tasks in production and other activities.

2 .3 Economic entity as an object of study at the micro level

An economic entity as an economic system is the main link where the factors of the production process are combined.

Business entity is a legal entity, has an independent balance sheet, acts in accordance with its charter, has rights and performs duties related to its activities, represents jobs, pays wages, and implements social programs. Using the means of production and other property, an economic entity carries out production and economic activities for the production and sale of products, the performance of work, the provision of services in accordance with the concluded contracts, agreements with consumers (clients) on a self-sufficiency and self-financing basis.

Being a structural link in the economy as a whole, an economic entity acts as a commodity producer, and therefore solves a number of interrelated tasks:

Providing consumers with products (works and services) of appropriate quality;

Receiving the amount of profit sufficient to perform its functions;

fulfillment of its obligations, both external and internal;

Compliance with laws, regulations and standards.

To solve these problems, an economic entity must have a clear idea of the current state and development prospects. The core of economic activity is the production of products, works, services (these are the specific results of production activities), profit (this is the financial result of the activity).

To determine the perspective, you need to study:

Demand for this type of product (works, services);

· the ability of this economic entity to produce products (works, services), based on production capacity and its increase;

the possibility of competing industries in the market for this product;

Possibilities of suppliers of raw materials, materials, etc.

In the course of the analysis, the need for material (fixed and circulating), labor (labor) and financial (cash) resources is revealed; an assessment is given of the expected economic results of economic activity for the production of products, the provision of services and the performance of work; cost, profit and profitability are determined. It follows that the object of analysis at the micro level is an economic entity (plant, factory, organization, farm, etc.), since it forms the basis of a market economy. Analysis at the level of business entities has a specific content related to daily financial and economic activities.

2 .4 The content and objectives of economic analysis

The development of the economy in the context of the transition to the market creates the prerequisites for the use of economic analysis in enterprise management. The complication and strengthening of cooperative relations between business entities increases the dependence of the performance of some business entities on the performance of others, which determines the need and enhances the importance of economic analysis, and therefore changes the content and tasks of the analysis.

Conducted analytical studies must meet certain requirements that must be met in the organization, conduct and practical use of the results of activities.

Compliance with laws, standards and regulations in the process of implementation of production, economic and financial activities is one of the tasks of the functioning of economic entities.

The change in economic results is influenced by various factors. The analysis involves finding out the causes-factors and determining their quantitative and qualitative impact on the resulting indicators.

Factors internal and external are studied, classified into groups. are revealed main(first order) and secondary(second, third order), determining and non-determining factors. After that, the quantitative influence of each of the essential (main, determining) factors on the change in economic processes is determined. To determine the quantitative influence of factors, various techniques and methods are used: traditional And mathematical.

Then the influence of factors is calculated first, second, third order to change the analyzed indicator.

For example. A generalizing indicator of the effectiveness of the use of fixed assets is the return on assets. Its level depends on:

from return on assets;

from profitability.

In turn, the return on assets depends on the change:

· the share of the active part of fixed assets in the total cost;

· return on assets of the active part of fixed assets.

The return on assets of the active part of fixed assets depends on:

from the structure of the active part of fixed assets;

the operating time of the equipment;

average hourly output.

Changing the operating time of the equipment depends on:

from the number of days worked;

· all-day losses of working hours;

shift coefficient;

average shift duration (intra-shift losses).

The change in the volume of production, production of equipment, and, consequently, the level of capital productivity of the active part of fixed assets depends on:

replacement of equipment;

modernization;

· scientific and technological progress;

social factors.

Establishing the influence of all factors is difficult and practically not always necessary. As a rule, generalizing factors and factors of the first, second order are determined.

To comprehend the main reasons that influenced the analyzed indicators, to find out their actions and interactions means to understand the specifics of the economic activity of the analyzed object. An important point in the analysis is the identification of untapped reserves of production growth and the determination of a system of specific measures to mobilize the identified reserves in production.

· scientific and economic substantiation of business plans and standards (in the process of their development);

· an objective and comprehensive study of the implementation of established business plans and compliance with standards based on accounting and reporting data;

· assessment of the economic efficiency of the use of labor, material and financial resources in order to improve the efficiency of production;

· monitoring the implementation of the requirements of commercial calculation (self-sufficiency and self-financing) and evaluation of the results of its implementation (end financial results);

Identification and measurement of internal reserves at all stages of the production process;

· adoption of optimal managerial decisions on the basis of a preliminary analysis, evaluation of economic activity and identification of trends in development.

The tasks solved in the course of the analysis are changing, since the approaches and requirements for economic analysis are changing.

2 .5 The value of economic analysis in the management ofenterprisem and increase its efficiency

Economic analysis is a necessary element in the performance of each function of economic management. The main functions of economic activity (functions of economic management) are:

· management information support(collection, processing, systematization and grouping of information about economic processes and phenomena);

· analysis of the course of economic activity and its results, assessment of economic activity opportunities;

· planning(operational, current, prospective);

· management organization(organization of the effective functioning of all elements of the economic system of an economic entity in order to rationally use material, labor and financial resources).

The effectiveness of managerial decision-making is determined by the quality of analytical research. Accounting, planning and analysis ensure the quality of management decisions. The initial element of the management system is planning, which determines the direction and content of the activities of an economic entity. An important element of planning is the determination of ways to achieve the set goal - to achieve the best financial results.

Without reliable and complete information, it is almost impossible to make optimal management decisions. Accounting ensures constant systematization and generalization of data necessary for production management and control over the implementation of business plans.

To optimize management, it is necessary to have a clear idea of the trends and nature of changes in the economy of an economic entity. Achieving this information is possible only on the basis of economic analysis. In the process of analysis, "raw" primary information is checked. Compliance with established forms, correctness of arithmetic calculations, reducibility and comparability of indicators are determined. Then the information is processed: there is a general familiarization with the documents and their content; deviations are determined and compared; the influence of factors on the analyzed object is determined, reserves and ways of their use are identified. Identifies shortcomings and errors. The results of the analysis are systematized and summarized. Based on the results of the analysis, management decisions are made. It follows that economic analysis substantiates managerial decisions, ensures the objectivity and efficiency of production management.

The role of analysis in enterprise management is increasing due to the fact that the management mechanism, principles and methods of management are changing. The limited resources and the need for choice force managers to constantly conduct research in the field of sales markets, sources of raw materials, study of demand, pricing, which should ensure an increase in production efficiency.

Denationalization, privatization, the development of new organizational and legal forms of management require new management methods and involve constant monitoring of all components of the production cost, require a deep analysis of costs by elements and items of expenditure, analysis of unproductive costs and losses, which increases the economic efficiency of production, increases the net profits and financial incentives.

All management decisions made at the level of an economic entity are optimal, justified and motivated. In order to make optimal management decisions, operational, current And perspective analysis. Each of them is associated with a specific management and planning function.

Decision-making requires the development of several options for solving economic situations, their justification by conducting an economic analysis, choosing the best option for a management decision.

Thus, in market conditions, the problem of minimizing the cost of living and materialized labor is the starting point in pricing. Price is one of the defining competitive advantages in market conditions and survival conditions. Under these conditions, the role of economic analysis increases as an important means of managing the economy of an economic entity, identifying reserves to increase the efficiency of an enterprise.

WITHlist of literature

1. Accounting: Textbook for university students / Yu.A. Babaev, I.P. Komissarov, V.A. Borodin; Ed. prof. YuA Babaeva, prof. I.P. Komissarova.-- 2nd ed., Revised. and additional - M.: UNITI-DANA, 2005. - 527p.

2. Guseva T. M., Sheina T. N. Self-tutor in accounting: textbook. allowance. -- 2nd ed. - M.: Prospekt, 2009. - 464 p.

3. Lytneva N. A., Malyavkina L. I., Fedorova T. V. Accounting: Textbook. - M.: FORUM: INFRA-M, 2006.--496 p.

4. Posherstnik N.V. Accounting: Educational and practical guide. - St. Petersburg: Peter, 2007. - 416 p.

5. Lysenko D.V. Economic analysis. - M.: Velby, 2008.

6. Markaryan E.A. Economic analysis of economic activity. - M.: KnoRus, 2008.

7. Savitskaya G.V. Analysis of the economic activity of the enterprise: Textbook. - M.: INFRA-M, 2008.

8. Savitskaya G.V. Economic Analysis: Textbook. - M.: New knowledge, 2007

9. Types of economic analysis and their role in enterprise management. M. "Stack", 2002

10. Economic analysis of the enterprise. Prykin B.V., M. "Unity", 2000

Hosted on Allbest.ru

...Similar Documents

Accounting in economic analysis in the enterprise management system. Analysis of the profit and loss statement on the example of JSC "Federal Grid Company of the Unified Energy System". Analysis of the financial and economic activities of the enterprise.

term paper, added 03/29/2014

The essence of the subject of accounting and its place in the management system of the organization. Economic processes, characteristics of accounting objects and methods of their knowledge. Ways of grouping the property of an economic entity.

test, added 12/23/2010

Determining the place of the balance sheet in the organization's management system. The study of the procedure for compiling the balance sheet and its reformation. Analysis of the financial condition of OJSC "Plant Burevestnik" and assessment of the impact of the balance sheet on the management of the enterprise.

thesis, added 09/18/2012

Study of the concept, goals and content of management accounting. Studying the role of economic analysis in the enterprise management system. Information support of management analysis. Determination of deviations of actually received data from planned ones.

term paper, added 11/28/2014

The role of accounting in business management. The concept of the accounting method, its use in enterprise management. Documentation and inventory, evaluation and costing. The system of accounts and double entry. Balance sheet and reporting.

term paper, added 08/17/2013

The study of the economic essence of the concept of fixed assets. Valuation, depreciation and reproduction of fixed assets. Peculiarities of accounting and tax accounting of fixed assets of "Musson" LLC. Factor analysis of the efficiency of the use of fixed assets.

term paper, added 02/06/2014

Significance and tasks of accounting and economic analysis of small businesses. Organization of accounting in small enterprises. Analysis of the economic activity of small enterprises, ways to improve its main indicators.

thesis, added 01/01/2009

Analysis and development of proposals for improving the accounting and auditing system at the enterprise. Studying the practice of organizing accounting at the enterprise. Consolidation of the main provisions of the theory and study of the theoretical aspects of financial analysis.

training manual, added 06/02/2008

Inventories as an object of accounting and economic analysis: essence, composition, classification, evaluation. Reflection of the expenditure of material resources in the accounting system of the enterprise: composition, structure, efficiency of resources.

thesis, added 08/07/2012

The role and importance of accounting in enterprise management in modern conditions. The structure of the balance sheet and the technique of its preparation. The relationship of its sections and articles. Accounting automation is the basis of effective management.

Ministry of Education and Science of the Russian Federation

Federal state budget educational

institution of higher professional education

"Moscow State University

design and technology"

Institute of Economics and Management

Department of Audit and Controlling

Specialty 080109 (060500) "Accounting, analysis and audit"

GRADUATION

QUALIFYING WORK

on the topic: Features of the organization of accounting in a small business

Moscow 2015

ANNOTATION

Thesis work 67 pages, 6 figures, 14 tables, 29 sources.

FEATURES OF THE ORGANIZATION OF ACCOUNTING AT A SMALL BUSINESS ENTERPRISE

The purpose of the work is to study the basics of accounting in theory and practice.

In the process of research, various methods of analysis were used - comparison, factor analysis, trend analysis.

The final qualifying work is made in the text editor Microsoft Word, presented on paper.

work of 67 pages, 14 tables, 6 figures, 29 references.ORGANISATION OF ACCOUNTING FOR SMALL BUSINESSESof research is the financial statements in the society with limited liability "Liverton".of research is the accounting in the society with limited liability "Liverton". purpose of work - carrying out of the analysis of accounting for small businesses in theory and in practice. work is executed on the basis of the analysis of financial statements.the given work various strategies of analysis are considered: comparison, factor analysis, trend analysis.work is executed in text editor Microsoft Word.

INTRODUCTION

CHAPTER 1. THEORETICAL QUESTIONS CHARACTERIZING SMALL BUSINESS ENTERPRISES

1 Criteria for classifying small businesses

2 Accounting for a small business

3 Accounting in wholesale trade

4 Simplified tax system

Chapter 2. Features of accounting and analysis in Liverton LLC

1 Brief description of the activities of the small wholesale trade enterprise Liverton LLC

2 Organization of accounting in Liverton LLC

3 Analysis of the financial condition of Liverton LLC

2 Audit and tax reporting in Liverton LLC

3 Better bookkeeping

CONCLUSION

BIBLIOGRAPHY

Annex 1

Appendix 2

INTRODUCTION

accounting trade tax

Small business maintains a competitive environment in the market environment, and therefore is an important element of a market economy. Among the primary tasks of the state is to ensure the stable development of small businesses, as this not only reduces the degree of monopolization of the market, but also ensures a decrease in the level of unemployment in the economy, as well as the further spread of product differentiation in the markets.

The concept of a small enterprise is associated with the concept of doing business, and therefore can be characterized by the following elements:

The main purpose of doing business is to make a profit.

Achieving the goal is achieved by selling economic goods on the market.

A relatively low indicator of capital in the financial statements with a high level of its turnover.

Having economic freedom.

The role of small enterprises in the economy of any state is certainly great. So, small business helps to meet the needs of the population in the consumption of any goods or services. In addition, there is an expansion of the labor market by providing new jobs in the emerging small businesses. Tax deductions from small businesses contribute to the accumulation of a state budget surplus at the federal and regional levels. Thus, small business is a necessary element of a market economy, contributing to an increase in the level of competition and meeting the needs of citizens and the state as a whole.

Small business is considered the basis of the economy of any developed country. Thus, in the US and EU countries, the share of small businesses in total GDP is more than 50%. In Russia, 17 million citizens are officially employed in small and medium-sized businesses, and the mentioned share in GDP, according to estimates for 2015. is 20%. Currently, the government is stimulating the development of small businesses in Russia by introducing financial support and conducting public service announcements that encourage the population to open small businesses. In general, the Government of the Russian Federation proposed the following measures to support small businesses:

Financial support for Russian banks lending to small businesses in order to reduce the lending interest rate.

Allocation of a larger share of the federal budget to finance small businesses.

Opening the possibility of filing an application for a tender of the state order for the purchase of goods and services.

Create discounted rental rates for small businesses on leases of five years or more.

Small business is an integral part of the economy and its development significantly correlates with the economic growth of the state, as well as with the social situation in the country. It is important to clearly understand the role and place of small business in the economy, as well as its specific characteristics. Such a strong influence on the economic and social situation in the country by small businesses is explained by a large proportion of the involvement of the economically active population in this area.

The main element of financing the state budget is tax revenues - the tax system has existed for many centuries, and the assessment of the impact of a particular taxation system on the economic situation within the country in retrospect reflected the importance of maintaining a correct tax policy. Thus, taxes play an important role in the economic development of any country. The impact of taxes on small business is certainly great: the presence of a high level of taxes can scare Russian citizens away from starting small businesses, and frequent changes in the taxation system can lead to uncertainty associated with problems in calculating expected profit for a certain period.

Ensuring the stable creation and further development of small businesses in Russia is in the priority areas of reforming state policy. Ensuring the growth of entrepreneurial activity of citizens includes the regulation by the government of such important elements that affect the functioning of small businesses as: motivation and interest of citizens in creating enterprises of this type; relevant market conditions; comprehensive support from the state. Thus, the government assigns a proper role to small business in the economic arena.

The study of small businesses in the Russian economy is especially important, since at the moment Russia is characterized by a transitional economy and is at the stage of formation of a market economy. Without a detailed understanding of the functioning of small businesses, it is impossible to correctly carry out and evaluate the measures taken by the state that have affected this market segment.

The relevance of studying accounting in small businesses lies in the fact that accounting and the taxation system has its own specifics in small businesses, and these elements are constantly being adjusted at the legislative level. The adjustment of the tax system is due to the fact that there is a relationship of this element with the socio-economic situation in the country, with the political system and many other factors. That is why a change in one of these factors should lead to changes in the requirements for the functioning of the taxation system, which in turn leads to changes in the latter. For example, during the existence of the Russian Federation, the tax system of our country has been subject to regular changes. Some taxes such as the sales tax and the unified social tax have been abolished, while some other taxes have been introduced: the transport tax, the unified tax on imputed income, etc. The tax reform also affected the taxes that existed at that time, reducing the income tax rate to 20% and setting the income tax at 13%. For small businesses, taxes, as already mentioned, carry a large degree of influence. Thus, the government, in an effort to increase the attractiveness of small businesses and the growth of entrepreneurial activity of the population, has established special gentle taxes on small businesses, for example, a simplified taxation system.

In this work, the goal was to comprehensively analyze the conduct of accounting in a small business. The work tasks include:

Research of theoretical aspects of financial accounting in a small enterprise

Research of theoretical aspects of tax accounting in a small business

Practical analysis of accounting and tax reporting of the company.

The object of the study is accounting in LLC "Liverton".

The subject of the study is financial relations arising in the process of maintaining accounting records in Liverton LLC.

The research methods include the study of the theoretical foundations on this topic and the analysis of practical data of Liverton LLC.

This work includes an introduction, three chapters, a conclusion, a list of references and applications.

CHAPTER 1. THEORETICAL QUESTIONS CHARACTERIZING SMALL BUSINESS ENTERPRISES

1 Criteria for classifying small businesses

Small business entities can include not only commercial organizations that meet certain criteria, but also individuals holding the status of an individual entrepreneur without any direct connection with the establishment of a legal entity. This definition is set out in detail in subparagraph one of article three of the Federal Law in force on June 14, 1995. No. 88-FZ "On State Support for Small Business in the Russian Federation". Numerous amendments were made to the law, which, on the whole, did not change the essence of the provisions originally set out in it, adjusting only Law No. 88-FZ to changes in the definition of legal entities and other changes in the legislative framework of the Russian Federation.

So, in accordance with Law No. 88-FZ, there are criteria for determining small businesses, globally divided into 3 categories (Table 1):

The first subdivision is the criterion of the purpose of the activity. In accordance with it, only those commercial organizations for which the main purpose of activity is to make a profit can be classified as small businesses.

The second division is the composition of the founders. In accordance with it, the composition of small businesses can include only those commercial organizations in which the participation of religious or public associations, the Russian Federation as a whole or the constituent entities of the Russian Federation separately, as well as various foundations (charitable and so on) does not exceed 25 percent of the total authorized capital. Also, the equity participation of legal entities (both in the singular and in the plural) in the authorized capital should not exceed a quarter - in this case, only those legal entities that do not belong to small businesses are taken into account.

At the same time, the possible participation of foreign individuals in the authorized capital is regulated - there are no restrictions on this item. However, the participation of foreign legal entities in the creation of small businesses is limited to one quarter of the authorized capital.

The third division is the average number of employees for the reporting period. In accordance with it, only those commercial organizations in which the average number of employees for the reporting period under consideration does not exceed the appropriate maximum values can be classified as small businesses:

In the industrial sector, the maximum number of employees should not exceed 100 people.

In the construction industry, the maximum number of employees should not exceed 100 people.

In the transport industry, the maximum number of employees should not exceed 100 people.

In the agricultural sector, the maximum number of employees should not exceed 60 people.

In the scientific and technical branch, the maximum number of employees should not exceed 60 people.

In the wholesale trade sector, the maximum number of employees should not exceed 50 people.

In the retail trade or provision of personal services to the population, the maximum number of employees should not exceed 30 people.

In all other areas of activity and other types of entrepreneurial activity, the maximum number of employees should not exceed 50 people.

In order for an open enterprise to be assigned to any field of activity, it is necessary to use the All-Russian Classification of Economic Activities - OKVED, in force in the Russian Federation since the beginning of 2003. In the USSR and later in the Russian Federation, there was an All-Union classifier "Industries of the national economy" (OKONH), but OKVED replaced it.

In the event that an enterprise operates in several industries at once - such firms are called diversified small enterprises - they can be recognized as a specific small business entity, guided by which type of activity prevails when calculating the amount of profit for the reporting period or when determining the amount of cash turnover for the reporting period. Thus, the enterprise is given the opportunity to personally choose which of the two indicators listed will be used to recognize the industry of the enterprise.

In order to improve understanding of the essence of small businesses, it is paramount to determine the stages of creating this enterprise.

First of all, a business plan is developed, in accordance with which the enterprise will conduct its activities in the future. A business plan can be developed in two ways:

personally by the entrepreneur (in the event that he has sufficient knowledge for this)

an entrepreneur can hire a specialist in this field for this purpose.

A business plan is essentially a serious document that identifies the strategy of a small business in every detail and evaluates the possible profit even before the project begins to operate. In the event that the business plan is well drawn up, it may allow the entrepreneur to find lenders for the development of the project.

The first step in creating a business plan is writing an annotation to justify the scope of the proposed project and assess future cash flows.

The main sections of the business plan may include the following chapters:

Forecasting prices for the products and services provided, as well as determining their competitiveness.

Evaluation of the sales market and its detailed analysis. The section includes an assessment of buyer preferences, an assessment of the size of the market, and a breakdown of the market into segments.

Marketing strategy. This section includes a description of how goods and services are introduced to the market, as well as a forecast of equilibrium prices.

Production. This section details such elements of the production process as: materials used, equipment, workers, etc.

The financial analysis. This section provides a detailed analysis of risks and cash flows and assesses the overall profitability of the enterprise.

Often, the entire analysis in a business plan is provided in more than one way: realistic, pessimistic, and optimistic. In a realistic variant, the most probable and real outcome of the creation of an enterprise is presented.

In the event that the business plan appeals to the entrepreneur, the process of creating a small business enterprise begins.

The table below shows the division of a small enterprise into organizational and legal forms in accordance with the Civil Code of the Russian Federation (Table 2):

Table 2 - Forms of small enterprises.

In accordance with Article 66 of the Civil Code of the Russian Federation, business partnerships and companies include commercial organizations in which there is a division of the authorized capital into shares of the founders (participant contributions).

All property that was created, produced or acquired by a business partnership or company constitutes the property of this partnership or company by the right of ownership.

A business company can be organized by both individuals and legal entities.

Of all the listed commercial organizations in the Russian Federation, the most common are limited liability companies (LLC) and joint-stock companies, namely: an open joint-stock company (OJSC) and a closed joint-stock company (CJSC).

A joint-stock company, unlike an LLC, is a more complex and complex form of a commercial organization. This is due to the fact that an LLC is more convenient for the functioning of small businesses for the following reasons: the founders of an LLC can personally draw up most of the provisions of the documents drawn up when opening an enterprise regarding the distribution of profits, the composition of management bodies and management in the enterprise as a whole.

Another positive side of the LLC is the absence of the need for official publication of financial statements. This fact explains the noticeably lower interaction of a limited liability company with the state, in contrast to the same joint-stock companies.

Another positive feature of an LLC is the initial size of the authorized capital - it is only 100 times the minimum wage established by the government at the time of registration of a small business. At the same time, the value of the authorized capital for an OJSC is at least 1,000 times the minimum wage.

When registering an LLC, at least half of the authorized capital must be paid. In the contract itself, the terms for further payment of the missing part will already be indicated, but not more than 1 year from the date of registration. In case of non-payment of this amount within the established period, either the closure of the enterprise or the registration of a decrease in the amount of the authorized capital takes place.

When registering a joint-stock company, at least half of the authorized capital must be paid within 3 months. In the contract itself, the terms for further payment of the missing part will already be indicated, but not more than 1 year from the date of registration. In case of non-payment of this amount within the established period, the consequences will be similar to the consequences for the LLC. All shares of a joint-stock company at the time of its establishment are distributed among the founders in accordance with the amounts established by the agreement.

Basically, small businesses in the Russian Federation operate in three main areas:

Trade in goods. Due to the ease of adaptability to the market environment, small businesses choose markets where there is a high level of demand as a guide. Such enterprises include various small shops, pavilions and stalls - all operating in an extremely efficient and organized manner.

Mediation. This type of activity is especially developed in large cities, when medium or large enterprises entrust individual tasks of logistics or delivery of goods to the market to small ones, thereby reducing their costs and covering more markets.

Provision of services. The service sector is currently one of the fastest growing sectors of the economy of all developed and transition economies. Just like the trade in goods, the market for services exists where there is a large demand from consumers.

2 Accounting for a small business

Accounting at an enterprise of any level is a very important element in the development of an organization. Tracking costs at the enterprise, losses and, as a result, the prevention of sanctions from the control authorities depends on this activity.

Small businesses, being legal entities in accordance with the laws of the Russian Federation, are required to follow the same methodologies, which are regulated in the following documents:

Federal Law "On Accounting".

Federal Law "On State Support for Small Business in the Russian Federation".

Regulations on bookkeeping and bookkeeping in the Russian Federation.

Small businesses face an important task: to simplify the accounting process, but at the same time retain the ability to effectively fulfill the goals of accounting. This task is a priority, as it contributes to financial savings at the enterprise.

For successful accounting, it is paramount to determine the main tasks that the correct statement of accounting allows you to perform:

Ensuring the safety of property.

Increasing efficiency in the use of resources.

Determination of taxes.

Calculation of the profit of the enterprise.

However, not necessarily any small business will strive to achieve all of the above objectives. So, if the enterprise consists of only one employee, then there is obviously no need to ensure the safety of property. In the event that an enterprise specializes in one-time transactions, the task of calculating profit will also not be significant, since the profit will be equal to the ordinary difference between purchase and sale.

In view of the significant differences between medium and large enterprises from small ones, accounting at these enterprises is also different. Before proceeding to consider the features of accounting for small businesses, it is necessary to determine those specific characteristics of the functioning of these enterprises that are very common on the territory of the Russian Federation and may affect the organization of accounting operations:

The lack of the possibility of hiring high-level workers in various fields of activity due to the financial limitations of the enterprise.

State limit.

The need for a thorough knowledge of the legislation of the Russian Federation.

Lack of management awareness of the basics of accounting and its main tasks.

The first characteristic associated with the lack of necessary funding for a high-level employee, for example, an accountant, can lead to negative consequences. So, for example, due to inexperience, an accountant may commit tax violations, which in the future will either have to be dealt with on their own, in case of timely detection, or report to a supervisory authority - a tax inspector.

The above example is related to the second characteristic - the need to know the legislation of the Russian Federation - the civil code, tax, and so on. If this requirement is met, the number of emerging negative moments will noticeably decrease in the enterprise.

The third characteristic, associated with a small number of employees, indicates the need to hire such workers, whose knowledge allows them to vary the list of duties, simultaneously performing some abstract work in addition to their specialty duties. This property is very useful even if an employee who specializes in his type of activity suddenly falls ill, then it becomes necessary that his colleague in the enterprise can perform his functions, albeit in a limited form.

And the fourth characteristic, associated with the lack of an adequate level of management knowledge, leads to the impossibility of the control element to independently interpret the results of accounting. Since the list of the main goals of accounting includes ensuring the safety of property and evaluating the results of the functioning of the enterprise, often ignorance of these goals by management leads to the emergence of "double" work in the enterprise. So, for example, at small enterprises, in contrast to medium and large ones, the following regular features are observed: the absence of a division of labor in the accounting department; execution by accountants of works for which special departments are assigned in large and medium-sized enterprises; Tax legislation has a strong influence on the organization of accounting.

For small businesses with a simple way of producing products or providing services, the Ministry of Finance of Russia in the Standard Recommendations for the Organization of Accounting for Small Business Entities recommends using a simplified form of accounting.

When organizing the work of a small business, a manager, relying on the volume of accounting work, can:

Create a separate division of the accounting service.

Hire a separate employee - an accountant.

Outsourcing - hire accounting services from a third party organization.

Do personal accounting.

Nevertheless, according to the Federal Law “On Accounting”, no matter what choice the head of the enterprise makes - to keep accounting records personally or to hire third-party employees for these purposes - he bears the main responsibility for organizing and complying with the law when performing the activities performed by the enterprise.

The chief accountant of the organization reports directly to the head of the organization and is responsible for accounting, drawing up an accounting policy, as well as presenting all information in full on time.

So, the necessary articles of financial statements when conducting a small business include accounting for the following elements:

Authorized capital and settlements with the founders. The main account for accounting for the authorized capital is account 80 “Authorized capital”, but additional accounts can be added to it - “Declared authorized capital”, “Paid-up authorized capital”. The property contributed as a contribution to the authorized capital shall be valued on the basis of the debit of the property accounting accounts.

Costs in small businesses are accounted for on account 20 "Main production" - it takes into account the costs attributable to the production and sale of goods or services. The subdivision of all costs occurs in the following categories: the type of costs (depreciation, labor, raw materials), the type of goods or services, the place where the product was produced, etc.

Cash. All cash and non-cash receipts of funds fall on account 50 "Cashier" or 51 "Settlement account".

Calculations with accountable persons. For the purposes of this accounting, account 76 “Settlements with various debtors and creditors” is used.

VAT on acquisitions - account 19 "Value added tax on acquired valuables".

Fixed assets, materials and intangible assets. Since these elements can be attributed to investments in non-current assets, account 08 corresponds to them.

Depreciation of fixed assets and intangible assets - is displayed in account 02. The entire period of use of fixed assets is accrued depreciation, except for the case of conservation (fixed assets for 3 or more months or the entire organization - for intangible assets).

Settlements with personnel for wages, social insurance and security - is displayed in account 70, which has a similar name.

3 Accounting in wholesale trade

Wholesale trade enterprises sell products to individual entrepreneurs and legal entities who purchase them for subsequent sale in the form of resale, organizations that purchase products with the aim of using them in the production of other goods or for any other non-personal use. In order to formalize the sale and purchase relationship between the parties, a supply contract is usually used.

Only the correct and effective organization of accounting of a wholesale trade enterprise will allow to fulfill the tasks facing it. If there are shortcomings in the organization of accounting, they can cause a delay in accounting and a lag in the provision of financial statements. And if there are significant time gaps between the beginning of the appearance of accounting information and the moment when such information is used, then the efficiency of trade enterprises decreases. In addition, the shortcomings that have appeared in the organization of accounting can lead to its complication and confusion, and conditions may also arise for material theft and other abuses, and an increase in the cost of maintaining personnel involved in accounting.

Most of the business operations of wholesale trade enterprises are commodity operations that are associated with the purchase, storage and sale of products. All of the above points make it possible to characterize the features of accounting for trading enterprises as features of accounting for transactions with goods when buying and selling products, including both cash and non-cash payments.

The object in accounting for trading enterprises is manufactured goods. That is why the main task for a good accountant is the correct organization of commodity accounting.

Since in the modern world there are high requirements for trade organizations, there is a need for a more detailed study of the movement of goods in the field of wholesale trade, the topic of this thesis is relevant for the current conditions of relations in the field of economics.

The purchase of goods is the basis for the functioning of any commercial enterprise. The main factors that determine the accounting of operations for the purchase of products by a trade organization are:

owner of the purchased goods

method of spending on the manufacture and delivery of products

seller of goods

location of goods in a trading enterprise

organization of empty and containers under the goods

There is a special balance account for accounting for goods, called 41 "Goods", as well as two more off-balance accounts 004 "Goods accepted for commission" and 002 "Inventory accepted for safekeeping".

Accounting is divided according to the principle of ownership of products:

products for which the ownership has already passed to the enterprise is reflected in the balance sheet account 41

products in storage are recorded on off-balance account 002

products accepted for commission are accounted for on account 004.

Accordingly, the products in accounting are divided into those that are already owned by the enterprise itself, and those that belong to other persons.

According to agreements concluded with wholesale organizations that define the rights and obligations of the parties, suppliers must ship products to their address.

The main details specified in the contract are: the names of the supplier and the buyer, the name and quantity of products (the subject of the contract), the liability of the property of both parties for non-fulfillment or poor-quality fulfillment of the terms of the concluded contract, delivery time, packaging, payment procedure, price, packaging, etc. d. Accordingly, if the conditions are not met, the contract provides for penalties in the form of penalties. Moreover, those losses that are not covered by a penalty or a fine can be recovered from the culprit. To monitor the progress of the conclusion of the contract, it is subject to registration in a special journal. With a certain frequency, the results of the execution of contracts are checked and, if they are not fulfilled, claims are made against the supplier.

For the safety of incoming goods, the following conditions must be provided by the supplier: compliance with the rules for packaging goods, marking individual places and sealing them, packing; attachment to each container place of a specific document (label for packaging, etc.), which should indicate the quantity and name of the goods that are in this particular container; correct execution of settlement and shipping documents and compliance of the data indicated in them with the actually shipped products, timely sending of these data to the recipient of the goods; compliance with the rules for the delivery of goods for further transportation, loading, securing, etc., in force on transport.

There are also a number of specific rules for the buyer: ensuring the acceptance of products in accordance with the established quantity, quality and terms; ensuring the correct posting of goods by responsible financial persons; creation of conditions that would ensure the safety of products and prevent illegal theft and shortages.

The sequence of product acceptance and its formalization may depend on several factors: location (buyer's warehouse, supplier's warehouse, transport authorities); nature of acceptance (quality, quantity or completeness); the presence of accompanying documents with the goods, and so on.

Most often, products in the supplier's warehouse are taken over by a responsible trustee from the buyer. There is a standard form for issuing such a power of attorney, which must be signed either by the head, or the chief accountant, or the person to whom they delegated authority. Then, the power of attorney must be stamped, and it itself is registered in a special accounting journal, which certainly indicates the number of the received power of attorney, its validity period, the personal data of the person and the position to whom it was issued, the name of the supplier and the name of the goods that need to be received and mark of direct receipt of products by proxy.

Such forms of power of attorney are documents of strict accountability. In accounting, illegal issuance of powers of attorney cannot be allowed. It is possible to replace the use of one-time powers of attorney when accepting goods with a list of employees of the organization whom the company trusts to receive inventory items on an ongoing basis. Such a list must contain sample signatures, and if the employee is fired from the enterprise, then this organization must report the cancellation of such a power of attorney.

There are special conditions for receiving goods at a pier or railway station. Receipt is carried out by a financially responsible person from the enterprise who must receive the goods, which may be a forwarder, storekeeper or other official. A prerequisite for such acceptance is the presentation of a power of attorney, passport and cargo receipt.

When accepting goods, the power of attorney must be presented to the supplier together with documents that verify the identity of the recipient. Upon receipt of products, the compliance of the quality and quantity of goods with the accompanying documents with them must be checked. Goods are usually received by the number of places in a container and by gross weight. If the goods do not have containers, they can be accepted according to weight by weighing or recounting.

4 Simplified tax system

In general, taxes on small businesses are divided into the following systems:

The general (traditional) taxation system - small businesses pay VAT, income tax, etc.

Special purpose tax systems:

Single agricultural tax.

Simplified tax system.

A single tax on imputed income for certain types of activities.

The system of taxation consent to production sharing.

On a voluntary basis, the choice can only concern the traditional system or the simplified one, in view of the fact that the adoption of a single tax on imputed income accompanies the adoption of a regulatory legal act.

The simplified taxation system is used by small businesses due to the fact that it is applied to the enterprise as a whole, and not to specific types of activities as a single tax on imputed income.

Payment in accordance with the simplified taxation system exempts from paying:

income tax

on personal income

on property

However, the following taxes and fees remain to be paid:

insurance premiums for compulsory pension insurance.

taxes not mentioned in the list of those from which this tax exempts.

Responsibilities for conducting cash register operations.

There are special criteria for applying the simplified taxation system. So this system can be applied only to those commercial organizations in which: