In modern practice, there is such a tendency that when assessing the receivables of an enterprise, its value reaches 30% of the organization's balance sheet asset, there is a significant impact on the formation of the final indicators of the organization's activities, possibly on shares, individual assets, i.e. on the market organization price.

Accounts payable - means of a third party who is in non-permanent use of the company. The relative increase is twofold. On the one hand, this is a favorable trend, because accounts payable can also be called an additional and significant source of financing for the enterprise. On the other hand, an increase in the amount of accounts payable due to the risk of bankruptcy.

The actual unfavorable situation is most often evidenced by losses (overdue accounts payable), while with a small margin of safety, overdue receivables are not so terrible. At present, one can judge the significance of "sick" articles that consistently "tell" about the various financial condition of the company.

Accounts receivable in a holistic picture of the activities of the unit

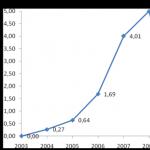

Figure 1 shows the relationship between the key performance indicators of the department.

Let's talk a little more about turnover. As you know, from prepaid sales and, accordingly, sales on credit, the turnover is obtained. Often the main source of receivables from the enterprise is credit sales. Further, prepayment transactions should be referred to as cash inflows, which are identified from the amount of advances and repaid receivables. Accordingly, the speed of repayment of debts will be considered revenue, depending on the deferral and delay in payment. These values are determined by the credit policy of the organization. For individual counterparties, the amount of delay can characterize the significance of debt collection, therefore, according to the terms of the debt and the size, it is displayed in the structure of receivables.

Figure 1. The company's debt turnover

It is known that enterprises often use such indicators as absolute and relative, which play an important role, as a result, help to identify solutions in a difficult situation for the organization. Absolute indicators serve to fully determine the type of financial condition of the organization, and, accordingly, measures and meaningful and useful recommendations or measures to improve financial stability. Now consider the relative indicators that play an important role in assessing the performance of the organization. Reveal the relationship of the financial condition and in the direction of increasing the effective operation of the organization.

Let's consider the analysis of receivables and payables using the example of JSC "SSC RIAR". The analysis of the structure and dynamics of receivables for 2010-2012. presented in table 1.

Table 1.

Assessment of the composition and structure of receivables of JSC "SSC RIAR" for 2010-2012.

Chair Accounting, analysis and audit

Discipline Comprehensive economic analysis of financial activity

COURSE WORK

Students of group B91/S

Kozlova Irina Yurievna

(Full Name)

Accounts receivable analysis

(on the example of OOO Trade House North-Western)

(topic title)

Checked by Sologubova L.V.

Date of__________________

Grade________________

Saint Petersburg

2011

Content

INTRODUCTION 3

CHAPTER 1. ACCOUNTS RECEIVABLE AS PART OF THE FINANCIAL RESOURCES OF THE ENTERPRISE 5

1.1.

Economic essence and structure of receivables 5

1.2.

Accounts Receivable Management Methods 10

1.3.

Methods of analysis of receivables 13

CHAPTER 2. ANALYSIS OF ACCOUNTS RECEIVABLE 19

OOO Trade House NORTH-WEST 19

2.1. Brief description of OOO "TD "NORTH-WEST" 19

2.2. Analysis of accounts receivable LLC "TD "NORTH-WEST" 19

2.3. The main directions of improving the management of accounts receivable LLC "TD "NORTH-WEST" 28

Findings 32

LIST OF USED LITERATURE 34

INTRODUCTION

In the process of financial and economic activity, there is a constant need for settlements with counterparties, the budget, and tax authorities. When shipping manufactured products or providing certain services, the company, as a rule, does not receive money in payment immediately, thus lending to buyers. Thus, during the period from the moment of shipment of products to the moment of receipt of payment, the company's funds are stagnant in the form of receivables, the level of which is determined by many factors, such as: type of product, market capacity, degree of market saturation with this product, terms of the contract, the system adopted at the enterprise calculations, etc.Carrying out entrepreneurial activities, participants in the property turnover offer that as they carry out business operations, they will not only return the invested funds, but also receive income.

However, in real conditions, situations often arise when, for one reason or another, an enterprise cannot collect debts from counterparties. Accounts receivable "freeze" for many months, and sometimes even years. The growth of receivables worsens the financial condition of enterprises, and sometimes leads to bankruptcy.

As part of working capital, namely, part of the circulation funds, receivables, especially unjustified ones, drastically reduce the turnover of working capital and thereby reduce the income of the enterprise.

Therefore, today the most important problems, the solution of which should contribute to the improvement of the financial condition of economic entities, are:

- correct organization of accounts receivable accounting in connection with the transition to a new chart of accounts and a new accounting system, as well as in connection with the termination of almost all inter-economic relations after the collapse of the administrative-command system of management;

analysis of accounts receivable, which should be aimed at identifying factors affecting the growth of accounts receivable and determining reserves aimed at eliminating unjustified, “hanging” debt and reducing its growth.

CHAPTER 1. ACCOUNTS RECEIVABLE AS PART OF THE FINANCIAL RESOURCES OF THE ENTERPRISE

- Economic essence and structure of receivables

All firms try to sell goods with immediate payment, but the requirements of competition force them to agree to deferred payments, resulting in receivables (Fig. 1).

Accounts receivable- this is the amount of money owed to the company by buyers who have purchased any products or services from it on credit.

Accounts receivable- This is an important part of current assets, also called accounts receivable, and has a direct impact on the position of cash and payments.

Figure 1.Cycle of current assets 1 .

Accounts receivable is one of the types of assets of the organization that can be sold, transferred, exchanged for property, products, the result of work or services 2 .

In its economic essence, receivables are funds temporarily diverted from the turnover of the enterprise. It's just money. The money that the enterprise, in theory, has, but not "live", but in the form of obligations, expressed in one form or another. Money, whatever it is, is also a commodity. And the goods, as you know, can be sold. The question is whether such a transaction can be carried out, whether there is a buyer for this product and how expedient such a sale is, in particular, in comparison with other debt collection options. Depending on the size of accounts receivable, the most likely timing of its repayment, as well as on the probability of non-payment of debt, we can draw a conclusion about the state of the organization's working capital and its development trends 3 .

The obligation to exercise control over the completeness and timeliness of settlements, the state of receivables lies primarily with the enterprise itself. For these purposes, a special subdivision of the financial service is provided in the structure of managerial personnel.

According to the nature of education, receivables are divided into normal and unjustified. The normal debt of the enterprise includes debt, which is due to the progress of the production task of the enterprise, as well as the current forms of payment (debt on claims, debt to accountable persons, goods shipped, the payment deadline for which has not come). Unjustified receivables are debts that arose as a result of a violation of settlement and financial discipline, a weakening of control over the release of material assets, the occurrence of shortages and theft (goods shipped but not paid on time, debt for shortages and theft).

A receivable is a future economic benefit embodied in and associated with legal rights, including ownership. In accounting, receivables are understood as a property right that relates to civil law, in accordance with Article 128 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). Thus, receivables are part of the property of the enterprise, and, therefore, the requirement to repay the debt is the property right of the organization.

An accounts receivable asset has three significant characteristics:

1) it embodies a future benefit that provides an increase in cash;

2) represents the resources managed by the economic entity.

3) the rights to the benefit or potential services must be legal or have legal evidence of the possibility of obtaining them.

So, when reflecting the fact of the sale of an asset, the seller has a receivable. The sales contract allows you to determine the likely future benefits.

Defaults, the economic crisis, are the primary cause of the receivables liquidity problem. But these are far from all the prerequisites that create the problem of the growth of receivables.

The quality indicator of receivables determines the probability of paying off the debt in full, which depends on the period of debt formation. Practice shows that the longer the term of receivables, the lower the probability of its collection. According to Article 96 of the Civil Code of the Russian Federation, a general limitation period of three years is established. It should be borne in mind that the legislation also provides for special limitation periods, both shortened and long in comparison with the general period (for example, Article 797 and Article 966 of the Civil Code of the Russian Federation).

A significant proportion of accounts receivable in the composition of current assets determines their special place in the assessment of the turnover of working capital. The amount of receivables is affected by 4:

1. The volume of sales and the share of sales in them on the terms of subsequent payment. With the growth of revenue (sales volume), as a rule, the balances of receivables also grow.

2. Terms of settlements with buyers and customers. The more favorable payment terms are provided to buyers (increasing the terms, reducing the requirements for assessing the reliability of debtors), the higher the balance of receivables.

3. Receivables collection policy. The more active the company is in collecting receivables, the smaller its balances and the higher the "quality" of receivables.

4. Payment discipline of buyers. objective reason, which determines the payment discipline of buyers and customers, should be called the general economic condition of the industries to which they belong. The crisis state of the economy, massive non-payments significantly complicate the timeliness of settlements, lead to an increase in the balance of unpaid products, instead of cash, surrogates are used as means of payment. Subjective reasons are determined by the conditions for granting a loan and the measures taken by the enterprise to collect receivables: the more favorable the conditions for granting a loan, the lower the payment discipline of debtors.

5. The quality of the analysis of receivables and consistency in the use of its results. With a satisfactory state of analytical work at the enterprise, information should be generated on the size and age structure of receivables, the presence and volume of overdue debts, as well as on specific debtors, the delay in settlements with which creates problems with the current solvency of the enterprise.

The problem of liquidity (the ability of an asset to be converted into cash without a significant loss in value) of receivables is becoming a key problem for almost every organization. It, in turn, is divided into several problems: optimal volume, turnover, quality of receivables.

Solution

These problems require skilled management of receivables, which is one of the ways to strengthen the financial position of the company. Repayment of debt in a short time is a real opportunity to replenish scarce working capital.

Accounts receivable management 5 can be identified with any other type of management as a process of implementing specific management functions: planning, organization, motivation and control.

It can be considered that the management of receivables is part of the overall management of current assets and the marketing policy of the enterprise, aimed at expanding the volume of sales of products and consisting in optimizing the total amount of this debt, ensuring its timely collection. The basis of the qualified management of the receivables of the company is the adoption of financial decisions on the following fundamental issues:

- Accounting for receivables for each reporting date;

Diagnostic analysis of the state and reasons due to which the company has a negative position with the liquidity of receivables;

Development of an adequate policy and introduction into the practice of the company of modern methods of managing receivables;

Monitoring the current state of receivables.

The tasks of receivables management are:

- limiting the acceptable level of receivables;

- selection of sales conditions that ensure guaranteed receipt of funds;

- determination of discounts or surcharges for various groups of buyers in terms of their observance of payment discipline;

- acceleration of debt collection;

- reduction of budget debts;

- assessment of possible costs associated with receivables, that is, lost profits from not using funds frozen in receivables.

The problem of receivables is of particular relevance in the context of inflation, when there is a depreciation of money. In order to calculate the losses of the enterprise from late payment of accounts by debtors, it is necessary to subtract its amount from the overdue receivables, adjusted for the inflation index for this period.

- Accounts Receivable Management Methods

With regard to Russian conditions, leading experts in the field of financial management offer the following measures to improve the receivables management system 7:

- exclusion from the number of partners of enterprises with a high degree of risk;

- periodic review of the maximum loan amount;

- use of the possibility of paying accounts receivable with promissory notes, securities;

- formation of the principles of settlements of the enterprise with counterparties for the forthcoming period;

- identification of financial opportunities for the provision of commodity (commercial credit) by the enterprise;

- determination of the possible amount of current assets diverted into accounts receivable on a commodity loan, as well as on advances issued;

- formation of conditions for ensuring debt collection;

- formation of a system of penalties for delay in fulfilling obligations by counterparties;

- use of modern forms of debt refinancing;

- diversification of clients in order to reduce the risk of non-payment by a monopoly customer.

The determination of the possible amount of financial resources invested in receivables is carried out according to the following formula:

( 1.1)

where IDZ - the required amount of financial resources invested in receivables;

OR K - the planned volume of sales of products on credit;

K SP - the ratio of the cost and price of products, expressed as a decimal fraction;

PP K - the average period of the loan to buyers, in days;

PR - the average period of delay in payments on the granted loan, in days.

If the financial capabilities of the enterprise do not allow investing the estimated amount of funds in full, then with the unchanged lending conditions, the planned volume of sales of products on credit should be adjusted accordingly.

The basis for the formation of standards for evaluating buyers and the conditions for granting a loan is their creditworthiness. The creditworthiness of the buyer characterizes the system of conditions that determine his ability to attract credit in various forms and in full, within the stipulated time frame, to fulfill all financial obligations associated with it.

The formation of a debt collection procedure (receipt or collection by an enterprise of funds from its debtors) provides for the terms and forms of preliminary and subsequent reminders to buyers of the payment date; the possibilities and conditions for prolonging the debt on the granted loan; conditions for initiating bankruptcy proceedings against insolvent debtors.

There are many ways to maximize the return on receivables and minimize potential losses.

You can resort to credit insurance, this measure against unforeseen losses of bad debt. When deciding whether to purchase such protection, one must evaluate the expected average bad debt losses, the company's financial ability to withstand these losses, and the cost of insurance.

It is possible to resell the rights to collect receivables if this results in net savings. However, in a factoring transaction, confidential information may be disclosed.

These methods of assessment and methods of debt management should help reduce the risk of not receiving money from debtors.

- Methods of analysis of receivables

An analysis of receivables is best started with the compilation of an aging register of accounts receivable 9 , which reflects the distribution of debt by maturity for each debtor, as well as the percentage attributable to each of the periods of delay in the context of customers and in general for the total amount of receivables. It is advisable to draw up this type of report at least once a month, as well as summarize the results for the quarter and for the year. The initial information for its compilation is accounting data on the debt of specific counterparties, while it is important to obtain information not only about the amount of debt, but also about the timing of its occurrence. To obtain information on the degree of overdue debt, it is necessary to analyze contracts with counterparties, after which all debtors are sorted in descending order of the amount of debt. As a rule, the accounts receivable of the first 20-30 largest counterparties is 70-80% of the total debt. Data on these debtors should be entered in the table. In the future, active work on the return of debts will be carried out with this group of debtors.

For each debtor included in the table of the largest debtors, it is necessary to carry out work to return the debt. Based on the experience of restructuring and reforming Russian enterprises, the following measures can be proposed to organize such work:

- creation of a task force for work with receivables;

- compilation and analysis of the register of "aging" accounts receivable;

- development of an action plan for working with specific counterparties, indicating the terms, responsible persons, assessment of costs and the effect obtained;

- Entering information about the planned amounts of repayable debts into the financial plan of the enterprise with subsequent monitoring of implementation;

- development and approval of a provision on motivation for the result achieved by the target group.

As a rule, after the beginning of the study of the register of accounts receivable, the costs necessary to return the debt and the amount of the return are determined.

The experience of Russian enterprises shows that measures to recover receivables are among the most effective measures to increase efficiency through the internal reserves of the enterprise and can quickly lead to good results. Repayment of debt in a short time is a real opportunity to replenish scarce working capital.

However, from the point of view of effective enterprise management, it is important not only to return the funds in a short time, but also to prevent a subsequent increase in debt above the allowable limit. There is a problem of planning and managing receivables.

Planning the timing and volume of increasing and paying off receivables must be carried out in conjunction with financial planning at the enterprise. To do this, when drawing up a plan (budget) for sales of finished products of the enterprise, it is necessary to indicate how much of it is shipped with the formation of receivables. The corresponding amounts are reflected in the plan for the movement of receivables in the "increase" column.

When forming a plan for the receipt of means of payment, it is also necessary to indicate what amounts are received to pay off the debt, while a breakdown into cash and commodity and material resources (barter) is desirable. The corresponding amounts are reflected in the plan for the movement of receivables in the "repayment" column.

When forming a sales plan, the allowable (normalized) amount of receivables and the allowable repayment period for each major counterparty can be determined. This is done in order to prevent uncontrolled growth of debt, to ensure a given average turnover.

After drawing up the initial version of the financial plan, you should check whether there are enough working capital for the operation of the enterprise in each planning period. If there are not enough funds, the plan is adjusted.

The planned movement of debt (both receivable and payable) should be controlled. This requires operational accounting information. If accounting does not provide the necessary efficiency, you need to use management accounting data.

Monitoring the implementation of the plan must be combined with monitoring the work of managers, for each of which it is advisable to assign the appropriate counterparty. Increasing contractual discipline, strict operational control of contracts at the stage of their preparation, signing and implementation is a necessary measure to ensure the implementation of the plan for the movement of receivables.

It is necessary to provide for the responsibility of managers for the shipment of products with the formation of excess receivables, and encourage them to reduce the period of their turnover.

Analyzing the financial plan, terms and volumes of receivables, it is possible to determine various options for discounts from the price of shipped products, depending on the maturity of the debt. It may be more profitable to introduce an advance payment, while significantly reducing the price.

The next step in the analysis of receivables is to determine the structure and dynamics of changes in each item of the receivables of the enterprise.

Based on the results of this type of analysis, it is necessary to identify the items of receivables that have the most significant impact on its final value.

When analyzing other receivables, it must be borne in mind that the amounts related to it are taken into account in various balance sheet items. When analyzing other receivables, one should consider those amounts that relate to debts owed to accountable persons for the funds issued to them. The analysis considers the prescription of the advance, reveals cases of a long gap in time between the receipt of the advance and their spending. Normal debt can be considered a debt for which the deadline for submitting reports on the expenditure of funds has not yet expired.

The debts of workers and employees for rent and utilities are analyzed by clarifying overdue payments and considering the measures taken by the enterprise to pay them off.

The analysis of other debtors reflects the timeliness of payments by workers and employees for goods purchased on credit. Arrears are usually allocated in the balance sheet as a separate item. In the liabilities side of the balance sheet, the source of coverage for such debts are bank loans received to pay for goods and materials sold on credit. If, due to untimely repayment of the loan by workers and employees, their debt to the enterprise exceeds the bank loan available to the enterprise, the excess amount is considered as a receivable.

An analysis of receivables should also show how calculations are made to compensate for material damage accrued by shortages and theft of valuables, including claims filed for recovery through the court, as well as amounts awarded by the court, but not recovered.

Determining the turnover period of receivables 10 is necessary to further determine the possibility of reducing the value of a particular item of receivables.

For a more visual representation of the impact of the receivables turnover period on the performance of the enterprise, it is recommended to consider this indicator in the context of the production and commercial cycle. Determining the turnover period for each item of receivables allows you to determine the possibility of reducing the value of a particular item of receivables.

Determination of the optimal period for reducing the turnover of receivables in order to achieve the tasks set for the enterprise can be carried out according to the following algorithm for minimizing it separately for each item of receivables:

a) Determination of the actual turnover of an enterprise's receivables item:

(1.2)

where O dz - the actual turnover of the item of receivables of the enterprise;

B - gross revenue;

DZ cf - the average value of the article of the receivables of the enterprise.

b) Determination of the repayment period of the enterprise's receivables item:

(1.3)

where P dz - the period of repayment of the article of the receivables of the enterprise;

n is the duration of the analyzed period in days.

c) Determination of turnover for the required increase in the paid gross proceeds of the enterprise:

(1.4)

where O p - turnover for the required increase in gross revenue;

P ds - the necessary increase in cash to paid gross revenue, rub.

d) Determination of the turnover period for the required increase in the paid gross proceeds of the enterprise:

(1.5)

where Sp is the period of turnover of the increase in gross revenue.

e) Determination of the optimal period for reducing the turnover of the receivables item in order to implement the tasks set for the enterprise:

(1.6)

where OSdz is the optimal maturity of an enterprise's receivables item.

In addition, the analysis of the receivables of the enterprise should be supplemented with a methodology for estimating the costs of financing, depending on the turnover period of receivables.

The study of various sources led to the following conclusions. Since about 20% of the assets of an average company are listed in its receivables, the effective organization of the analysis and management of receivables contributes to the solution of the following tasks facing the enterprise:

- ensuring constant and effective control over the state of debt, timely receipt of reliable and complete information on the state and dynamics of debt, necessary for making management decisions;

- compliance with the allowable amounts of receivables and their optimal ratio;

- ensuring timely receipt of funds on the accounts of debtors and creditors, excluding the possibility of applying penalties and causing losses;

- identification of insolvent and dishonest payers;

- determination of the company's policy in the field of settlements, in particular, the provision of commodity credit, discounts and other benefits to consumers of products, the receipt of commercial loans in settlements with suppliers.

CHAPTER 2. ANALYSIS OF ACCOUNTS RECEIVABLE

OOO Trade House NORTH-WEST

2.1. Brief description of LLC "TD "NORTH-WEST"

The company "TD "North-West" LLC has been successfully operating in the market of Russia and the North-West region since 1995.The company has its own production and storage facilities in the city of St. Petersburg, the total area of which is 10,000 sq.m. The offered range of production makes more than 3000 names. Having our own fleet of vehicles allows you to complete, ship and deliver the order to the buyer within a few hours.

More than 200 manufacturers are partners of the enterprise.

OOO Trade House North-West offers a complete set of engineering and plumbing equipment for the construction, repair and operation of facilities of any purpose and scale.

Ease of ordering, flexible pricing policy, expanding the range of products offered, the possibility of complex deliveries, constant stock, as well as the quality of services provide the company with a leading position in the regional market.

2.2. Analysis of accounts receivable LLC "TD "NORTH-WEST"

Preliminary assessment of the financial condition OOO Trade House Severo-Zapadny is the first step in the analysis of receivables. Carrying it out according to the model of E. Altman 11 involves the calculation of two financial ratios:1) the liquidity ratio is 0.8 (1,421,740 / 1,722,680) or 80%. According to international practice, the values of the liquidity ratio should be in the range from one to two. In this case, the liquidity ratio is less than 1. Therefore, working capital is not enough to pay off short-term liabilities. And this, in turn, means that the company is in danger of bankruptcy.

2) the coefficient of financial dependence is 27 (1 872 790 / 70 100) or 2700%. This high ratio reflects the risk of insolvency. Further calculations according to the E. Altman formula are not required, since it is obvious that the value of Z > 0, therefore, the probability of bankruptcy is high.

Summarizing the results of the analysis of the preliminary assessment of the financial position of OOO TH NORTH-WEST, we can conclude that this company is in a deep financial crisis.

Having clarified the picture of the financial condition of the company in question, we will determine how effectively the management of receivables in the organization is built, whether miscalculations in the management of receivables were one of the reasons for the insolvency of the company in question.

In the first phase of the analysis the volume of receivables of the organization in question is estimated, receivables in relation to working capital (table 1). In the period from 2007 to 2010 the share of accounts receivable in the amount of working capital varied from 4% to 24%. These values do not exceed the average indicators from practice (the volume of accounts receivable for enterprises ranges from 10% to 25% of the total value of the enterprise's assets). Theoretically, the fact of an increase in receivables in the period from 2007 to to 2010 reflects an increase in working capital, and therefore an improvement in the financial situation. But in practice, in order to assess the increase in receivables, an analysis of its quality will be required in the future. Decrease in accounts receivable since 2009 to 2010 (by 42%) is considered a negative sign. When developing a credit policy, one should take into account the possibility of increasing the volume of receivables.

Table 1. Coefficient of diversion of current assets into accounts receivable

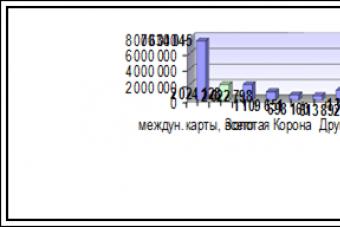

The diagram shown in Figure 2 clearly demonstrates the volume (or level) of receivables of a closed joint-stock company "" and its dynamics in the previous period.

Figure 2. Volume (or level) of receivables

OOO Trade House NORTH-WEST

In

second phase analysis

the turnover and quality of receivables are assessed according to the following set of parameters:

- turnover of receivables and the average term for payment of accounts receivable (average collection period);

weighted "aging" of accounts receivable;

register of "aging" accounts receivable;

overdue accounts receivable ratio;

forecasting bad receivables.

RT=NS/AR (2.1)

where RT is the number of turnovers of receivables,

NS - total revenue for the year,

AR is the average value of receivables.

The values given in table 2 clearly show that the number of turnovers (conversion into cash) of receivables has changed insignificantly over the last 4 years and amounts to 6 times a year.

Table 2. The number of turnovers of receivables of LLC "TH "NORTH-WEST"

A significant proportion of accounts receivable in the composition of current assets (in our example, more than 40%) determines their special place in the assessment of the turnover of working capital. The amount of receivables in the balance sheet is affected by:

the volume of sales and the share of sales in it on the terms of subsequent payment. With the growth of revenue, as a rule, the balances of receivables also grow;

terms of settlements with buyers and customers. The more favorable settlement conditions are provided to buyers (increasing the terms, reducing the requirements for assessing the reliability of debtors, etc.), the higher the balance of receivables;

receivables collection policy. The more active the company in collecting receivables, the smaller its balances and the higher the "quality" of receivables;

payment discipline of buyers. The objective reasons that determine the payment discipline of buyers and customers should be called the general economic condition of the industries to which they belong. The crisis state of the economy, massive non-payments significantly complicate the timeliness of settlements, lead to an increase in the balance of unpaid products, instead of cash, surrogates are used as means of payment. Subjective reasons are determined by the terms of the loan and the measures taken by the company to collect receivables: the more favorable the terms of the loan, the lower the payment discipline of the debtors;

the quality of the analysis of receivables and the consistency in the use of its results. With a satisfactory state of analytical work at the enterprise, information should be generated on the size and age structure of receivables, the presence and volume of overdue debts, as well as specific debtors, the delay in settlements with which creates problems with the current solvency of the enterprise.

In the most general form, changes in the volume of receivables for the year can be characterized by balance sheet data. For the purposes of internal analysis, analytical accounting information should be involved: data from order journals or records of settlements replacing them with buyers and customers, with suppliers on advances issued, accountable persons, with other debtors. It is convenient to present information on the status of settlements with buyers and customers in the form of a table (Table 27).

Table 27

Information about the status of settlements with buyers and customers

|

Buyer (customer) |

Date of debt formation |

Debt at the beginning of the period |

Shipped |

Paid |

Debt at the end of the period |

||

|

PO "Tavria" | |||||||

|

JSC "Temp" | |||||||

|

MP "Suite" | |||||||

|

JV "Song" | |||||||

|

NPO Cryogen | |||||||

|

JSC Vega | |||||||

|

JV "Utah" | |||||||

|

MP "Hope" | |||||||

|

Software "Change" | |||||||

|

JSC Salyut | |||||||

From the data in Table. 27 it follows that the amount of accounts receivable of buyers and customers as of January 1, 1999 amounted to 3,873,200 thousand rubles. (3,012,000 + 3,848,900 - 2,987,700), including debt with a maturity of more than a year - 104,300 thousand rubles, for a period of more than 9 months - 710,000 thousand rubles.

To summarize the results of the analysis, a summary table is compiled in which receivables are classified according to the terms of formation (Table 28).

Table 28

Analysis of the state of receivables by the terms of formation,

thousand roubles.

|

Total at the end of the year |

Including by terms of education |

|||||

|

from 1 to 3 months |

from 3 to 6 months |

from 6 months up to a year |

over a year |

|||

|

Accounts receivable for goods, works and services | ||||||

|

Other debtors | ||||||

|

overpayment on deductions from profits and other payments | ||||||

|

debt for accountable persons | ||||||

|

other types of debt | ||||||

|

including | ||||||

|

in settlements with suppliers | ||||||

|

Total accounts receivable | ||||||

Analysis of the age structure of receivables gives a clear picture of the state of settlements with buyers and allows you to identify overdue debts. In addition, it greatly facilitates the inventory of the state of settlements with debtors, which makes it possible to assess the activity of the enterprise in collecting receivables and its "quality".

It would be incorrect to give general instructions on how long the delay in payment allows to classify the debt as doubtful. For the purposes of internal analysis, enterprises themselves decide this issue, taking into account the specific situation and existing settlement practices.

An external analyst has reporting information and, therefore, will proceed from the breakdown of receivables (overdue debts, including those with a maturity of more than 3 months).

A fairly common technique for analyzing accounts receivable is the analysis of its composition by maturity, which makes it possible to single out that part of it that can be classified as doubtful. For this purpose, the data of tables 29 and 30 can be used (figures are conditional).

Based on the initial data on the amount of shipped products and their payment, the average payment percentages by months can be calculated and the average percentage of the remaining unpaid products for the period can be determined, as shown in Table. thirty.

Table 29

Analysis of receivables by maturity, rub.

Table 30

Thus, according to available data, the percentage of products paid for in the month of shipment ranged from 10 to 13%, in the second month - from 34 to 38%, in the third month - from 30 to 40%. As a result, the percentage of products that remained unpaid in the analyzed period ranged from 13 to 20%.

In this case, the shipment was understood as the volume of sales of products on credit, i.e., only a part of the credit turnover of the account "Sales of products, works, services." Advance payments are not included in the calculation.

In the above simplified example, one quarter was considered as the analyzed period. Based on the dynamics of indicators of the shipment of products and their payment, conclusions were drawn about the percentage of shipped products that remain unpaid. Obviously, the longer the time period used to determine the average percentage of receivables outstanding, the more reliable the results will be.

With no data other than those given, we will assume that the average percentage of outstanding receivables for the period is 16%. Then, when assessing the "quality" of receivables and identifying difficult-to-sell in its composition, the balance sheet value of buyers' debt is multiplied by the average percentage of unpaid products. If, for example, the value of "receivables on the balance sheet is 50,000,000 thousand rubles, then the calculation of liquidity ratios when conducting an internal solvency analysis will include the value of 42,000,000 thousand rubles (50,000,000 - 50,000,000 0.16) .

Note that this method of establishing the amount of doubtful receivables is widely used in foreign practice. For this purpose, data from a statistical analysis of accounts receivable from past periods are used.

In this case, two main approaches are used: either the percentage of the ratio of doubtful debts in the past periods and the total amount of receivables is established, or the ratio of unpaid doubtful debts and total sales is calculated. This or that method of calculating the amount of doubtful receivables is determined by the professional judgment of an accountant (financial manager) and is one of the aspects of accounting policy.

It is believed that the estimate of the allowance for doubtful debts will be most accurate if it is based on data on the time of delay in payments at the balance sheet date and probabilistic forecasts of repayment of receivables.

The use of an approach based on establishing the percentage of doubtful debts from sales volume is explained by the fact that losses from writing off bad debts are involved in the formation of the financial result and the determination of this indicator is an element of the structural analysis of the income statement.

A separate problem for the analysis of accounts receivable is the procedure for its write-off. It is known that the accounts receivable of Russian enterprises include that part of it that can be characterized as a debt that is unrealistic to collect. At the same time, it is not uncommon for cases when the period of delay in payment is more than 3 years, i.e., more than the limitation period specified by law (the law also provides for other, other than general, limitation periods or special periods).

According to the Regulations on Accounting and Accounting in the Russian Federation, receivables for which the limitation period has expired, other debts that are unrealistic to collect, are written off for each obligation based on the inventory data, written justification and order (instruction) of the head of the organization and include respectively, to the account of the reserve for doubtful debts or to the financial results of a commercial organization, if in the period preceding the reporting period, the amount of debts was not reserved.

In civil law, the limitation period is the period of time established by law for the judicial protection of a person whose right has been violated. The correct establishment of the initial moment of the limitation period is fundamental. According to Article 200 of the Civil Code of the Russian Federation, the limitation period begins from the day when the person knew or should have known about the violation of his right. For obligations with a certain performance period, the limitation period begins at the end of the performance period. At this point, the creditor company already knows that the obligation has not been fulfilled.

The expiration of the limitation period terminates the existence of objective civil rights. Consequently, the preservation of the amounts of this unclaimed debt as part of the balance sheet asset leads to a distortion of information about the actual volume of claims that the company can present to its debtors, reporting data, an overestimation of the real value of receivables and net assets.

The next problem is related to determining the consequences of writing off uncollected receivables. Clause 15 of section 2 of the Regulations on the composition of costs for the production and sale of products (works, services) included in the cost of products (works, services), and on the procedure for the formation of financial results taken into account when taxing profits, provides that non-operating expenses include losses from the write-off of receivables for which the limitation period has expired.

At the same time, it is noted that the write-off of receivables after the expiration of the limitation period must be preceded by the fulfillment of a number of conditions: the creditor's appeal to the arbitration court and the court's decision to refuse to award the amount of the debt to the creditor; the creditor taking measures to collect the debt from the debtor (correspondence with the debtor to pay off the debt, correspondence with the registration and tax authorities to identify the actual location of the debtor).

Only if the above conditions are observed, indicating that the company has exercised its right to receive debt from the debtor, the write-off of receivables for which the limitation period has expired will be taken into account in taxation. In this regard, there is a misconception that failure to meet these requirements makes it impossible to write off accounts receivable, which as a result becomes a "permanent item" of the balance sheet.

This common misconception is associated with the identification of the formation of financial results for tax purposes and for the purposes of presenting information in financial statements. The fact that the specified accounts receivable cannot be included in the calculation of the taxable base does not mean that it can remain as part of the assets (property) of the enterprise. Otherwise, the company's actions to reflect receivables are in conflict with the Federal Law "On Accounting" and the Regulation on Accounting and Accounting in the Russian Federation, according to which the financial statements should give a reliable and complete picture of the property and financial position of the organization. If unclaimed receivables remain, there is a distortion of reporting data associated with an overestimation of net assets and financial results.

To assess the turnover of accounts receivable, the following group of indicators is used.

1. Accounts receivable turnover

If during the year the amount of proceeds from sales changed significantly by months, then an updated method for calculating the average amount of receivables based on monthly data is used. Then

Where ODZn- amount of accounts receivable at the end n th month.

2 . Period of repayment of receivables

. Period of repayment of receivables

It should be borne in mind that the longer the period of delay in debt, the higher the risk of non-payment.

3. The share of receivables in the total volume of current assets

4. Share of doubtful debts in accounts receivable

This indicator characterizes the "quality" of receivables. The trend towards its growth indicates a decrease in liquidity.

The calculation of indicators of turnover of receivables is given in table. 31

Table 31

Accounts receivable turnover analysis

|

Indicators |

Last year |

Reporting year |

Changes |

|

Accounts receivable turnover, number of times |

| ||

|

Receivables repayment period, days |

|

| |

|

The share of receivables from buyers and customers in the total volume of current assets, % |

|

| |

|

Share of doubtful accounts receivable in total debt, %** |

|

|

* The indicators are transferred from a similar table compiled based on the results of the past year,

** Data on doubtful receivables are taken from the accounting department's certificate on the state of assets.

As follows from Table. 31, the state of settlements with buyers has worsened compared to last year. The average maturity of receivables increased by 5.4 days, which amounted to 89.9 days. Particular attention should be paid to declining debt quality. Compared to the previous year, the share of doubtful receivables increased by 8.0% and amounted to 21.0% of the total receivables. Bearing in mind that the share of accounts receivable by the end of the year was 45.5% of the total current assets, we can conclude that the liquidity of current assets in general has decreased and, consequently, the financial position of the enterprise has worsened.

Monitor the status of settlements with buyers for deferred (overdue) debts;

Target as many buyers as possible to reduce the risk of non-payment by one or more large buyers;

Monitor the ratio of receivables and payables: a significant predominance of receivables poses a threat to the financial stability of the enterprise and makes it necessary to attract additional (usually expensive) funds; the excess of accounts payable over accounts receivable can lead to the insolvency of the enterprise;

Provide discounts for early payment.

Payment terms can be chosen in such a way as to make early payment more attractive to buyers.

In the conditions of inflation, any deferred payment leads to the fact that the manufacturing enterprise (seller) actually receives only a part of the cost of the sold products. Therefore, it becomes necessary to evaluate the possibility of providing a discount for early payment. The analysis technique will be as follows.

The fall in the purchasing power of money over a period is characterized by the coefficient Ku, which is inverse to the price index. If the contractual amount to be received is S, and the price dynamics is characterized by the index Iц, then the real amount of money, taking into account their purchasing power at the time of payment, will be S: Iц . Assume that prices have increased by 5.0% over the period, then / = 1.05. Accordingly, the payment of 1000 rubles. at this point is equivalent to the payment of 952 RUB. (1000: 1.05) in real measurement. Then the real loss of revenue due to inflation will be 48 rubles. (1000 - 952); Within this value, the discount from the contract price, provided on condition of early payment, would reduce the losses of the enterprise from the depreciation of money.

For the analyzed enterprise, annual revenue, according to f. No. 2 amounted to 12,453,260 thousand rubles. It is known that in the analyzed period, 95% (11,830,600 thousand rubles) of the proceeds from the sale of products was received on the terms of subsequent payment (with the formation of receivables). According to Table. 31, we determined that the average repayment period for receivables at the enterprise in the reporting year was 89.9 days. Assuming (conditionally) the monthly inflation rate equal to 3%, we obtain that the price index Iц = 1.03. Thus, as a result of a monthly deferred payment, the company will actually receive only 97.1% (1: 1.03 100) of the contractual cost of production. For the period of repayment of receivables established at the enterprise of 89.9 days, the price index will average 1.093 (1.03 1.03 1.03). Then the coefficient of fall in the purchasing power of money will be equal to 0.915 (1: 1.093). In other words, with an average receivables return period of 89.9 days, the enterprise actually receives only 91.5% of the contract value, losing 85 rubles from every thousand rubles. (or 8.5%).

In this regard, we can say that the company actually received only 10,824,999 thousand rubles from the annual revenue of products sold on the terms of subsequent payment. (11,830,600 x 0.915). Therefore, 1,005,601 thousand rubles. (11,830,600 - 10,824,999) are hidden losses from inflation. In this regard, it may be appropriate for the enterprise to establish some discount from the contract price, subject to early payment under the contract.

The next argument in favor of providing discounts to buyers in case of early payment is the fact that in this case the company gets the opportunity to reduce not only the amount of receivables, but also the amount of financing, in other words, the amount of capital required. The fact is that in addition to the actual losses from inflation arising from the delay in settlements with buyers, the supplier company incurs losses associated with the need to service the debt, as well as with the lost profit of the possible use of temporarily free cash.

If the average receivables payment term is 60 days, and the company provides customers with a 2% discount for payment within 14 days, then such a discount for the company will be comparable to obtaining a loan at a rate of 15.7%. If an enterprise attracts borrowed funds at 24% per annum, then such conditions will be beneficial for it.

At the same time, for a buyer placing funds in deposits at 14% per annum, such a discount will also be attractive. If the buyer is informed in advance about how much he will receive from early payment, it is likely that the result of his decision will be faster settlements.

Variants of settlement methods with buyers and customers are analyzed in Table. 32.

Table 32

Analysis of the choice of the method of settlements with buyers and customers

|

Line number |

Indicators |

Option 1 (payment term 30 days subject to 3% discount) |

Option 2 (payment term 89.9 days) |

Deviations (gr. 2 - gr. 1) |

|

Price index (Ic) |

1.03*1.03x1.03= | |||

|

Purchasing power decline ratio of money (Ci) | ||||

|

Losses from inflation from each thousand rubles of the contract price, rub. | ||||

|

Losses from payment of interest for the use of loans at a rate of 24% per annum, rub. | ||||

|

Losses from the provision of a 3% discount from each thousand rubles of the contract price, rub. | ||||

|

Result of the price discount policy for shortening the payment term (p. 3 + p. 4 + p. 5) |

*

Thus, the provision of a 3% discount from the contract price, subject to a reduction in the payment period, allows the enterprise to reduce losses from inflation, as well as the costs associated with attracting financial resources, in the amount of 66 rubles. from every thousand rubles of the contractual price.

Note that for the enterprise, the reduction of the payment period from 3 to 1 month V in the case of a 3% discount, it is equivalent to obtaining a loan for 2 months at a rate of 18% per annum.

For the buyer, such conditions should be compared with the possibility of placing temporarily free funds. With an alternative possibility of placing funds in deposits at 14-16%, this option (reducing the settlement period) is appropriate.

In the situation under consideration, the decision-making period corresponded to 1 and 3 months. If it becomes necessary to evaluate changes in the purchasing power of money for a period that does not correspond to a whole month, for example, 15, 40, 70, etc. days, use the compound interest formula

(68)

(68)

where T is the monthly inflation rate (0.03 in our example);

P - the number of days in the decision period.

So, when assessing the fall in the purchasing power of money over a period equal, for example, to 45 days, we get the value

Similarly, options for granting discounts of other sizes and other terms of repayment of receivables that satisfy both the seller and the buyer of products 2 can be considered.

It should be borne in mind that a more accurate calculation of the expediency of providing discounts to buyers will be obtained when it is based not on a price index, which is essentially a macroeconomic indicator, but on the weighted average cost of capital of a given enterprise, characterizing the price of its financial resources.

The final step in the analysis of receivables turnover should be the assessment of the compliance with the conditions for obtaining and providing a loan. As it was found out earlier, the activity of any enterprise is associated with the acquisition of materials, products, and the consumption of various kinds of services. If payments for products or services rendered are made on the terms of subsequent payment, we can talk about the receipt of a loan by the enterprise from its suppliers and contractors. The enterprise itself acts as a creditor of its buyers and customers, as well as suppliers in terms of advances issued to them for the upcoming delivery of products. Therefore, the extent to which the terms of the loan granted to the enterprise correspond to the general conditions of its production and financial activities (the duration of the materials in stocks, the period of their transformation into finished products, the maturity of receivables) depends on the financial well-being of the enterprise. To compare the conditions for obtaining and granting a loan, a table can be compiled. 33.

Table 33

Comparative assessment of the conditions for granting and obtaining a loan

at the enterprise

|

Accounts receivable |

Average maturity, days |

Accounts payable |

Average maturity, days |

||

|

past period |

reporting period |

past period |

reporting period |

||

|

Indebtedness of buyers for products, goods and services |

Debt to suppliers for products, goods and services | ||||

|

Indebtedness of suppliers on advances issued* |

Debt to buyers on advances received* | ||||

*The values of the indicators are adjusted according to the conditions of the movement of material assets

As follows from the data in Table 33, the changes in the duration of the period for providing and receiving a loan had a multidirectional character: the period for lending to an enterprise by its suppliers was reduced by 3.5 days, the period for paying off receivables from buyers and customers increased by 5.4 days. Changes in terms of advances received and issued were characterized by a general reduction in the length of the loan period. However, since the time spent by funds in advances issued to suppliers increases the duration of the operating cycle, and the time spent using buyers' funds reduces the total turnover period, it can be concluded that the changes were not in favor of the enterprise in terms of prepayments. There is no need to say that all this is evidence of the deterioration of the financial conditions of the enterprise.

It should be borne in mind that the duration of the period of repayment of receivables and payables cannot be evaluated equally. The period from the receipt of products (services) from suppliers to the transfer of funds to them should be compared with the total time required for a single turnover of funds at the enterprise, i.e., the duration of the operating cycle.

In our example, the duration of the operating cycle was 162 days with a commodity loan repayment period of 61.5 days. Interpreting the calculation results, we can conclude that, receiving a loan from suppliers for 61.5 days, the company uses it in such a way that it is able to repay the debt at its own expense only after 162 days. The fact that the accounts payable at the enterprise is repaid earlier than the specified period indicates additional attraction of financial resources from outside. As explained earlier, such funds are short-term bank loans.

The state of receivables, its size and quality have a strong impact on the financial condition of the organization.

To improve the financial position of any organization, it is necessary:

Monitor the balance between accounts receivable and accounts payable. Significant excess of accounts receivable over

accounts payable creates a threat to the financial stability of the organization, leads to the need to attract additional sources of financing;

- - control the status of settlements on overdue debts;

- - focus on increasing the number of customers in order to reduce the risk of non-payment to monopoly customers.

In accordance with the current legislation of the Russian Federation, all mutual settlements between the manufacturer and the consumer must be carried out within a three-month period from the date of actual receipt of the goods by the debtor. Otherwise, the debt is considered overdue.

To assess the composition and movement of receivables on the basis of financial statements, we will compile an analytical table on the receivables of Askona-mebel LLC for 2012 (Table 8).

Table 8. Analysis of the movement of receivables for 2011-2012.

|

Indicators |

Movement of accounts receivable |

The growth rate of the remainder, |

|||||||

|

Balance at the beginning of the year |

arose |

Redeemed |

Balance at the end of the year |

||||||

|

Amount, thousand rubles |

Amount, thousand rubles |

Amount, thousand rubles |

Amount, thousand rubles |

||||||

|

Accounts receivable, total |

|||||||||

|

Short-term accounts receivable |

|||||||||

|

including overdue |

|||||||||

|

Long-term accounts receivable |

|||||||||

|

including overdue |

|||||||||

|

of which lasting more than 3 months |

|||||||||

|

accounts payable more than 12 months after the reporting date |

Conclusions: the data given in Table 8 show that over the year the amount of receivables increased by 2.9%, which, in general, entails negative consequences, since the company extracts funds from turnover in the form of receivables, which can lead to an increase in accounts payable to maintain the continuity of the production cycle. The structure of receivables is dominated by short-term receivables, which account for 99.3% of the total debt. Its value for the year increased by 2.6%: from 61,151 thousand rubles at the beginning of the year to 62,731 thousand rubles at the end of the year. At the same time, its share in the total amount of receivables decreased by 0.4 percentage points and amounted to 99.3%, which was affected by a 2.2-fold increase in long-term receivables (from 201 thousand rubles to 443 thousand rubles ). As a result, the share of long-term accounts receivable increased from 0.3% to 0.7% at the end of the year.

Despite the fact that the company managed to increase revenue from 99,017 thousand rubles. in 2011 to 156,969 thousand rubles. in 2012, short-term accounts receivable increased by 2.6%. This may indicate that in order to maintain revenue, the company had to change its credit policy in the direction of increasing the number of days of delay in paying for goods sold. Thus, the analysis of the movement of accounts receivable indicates its increase, which could be caused by:

- - imprudent credit policy in relation to buyers, indiscriminate choice of partners;

- - the onset of insolvency or bankruptcy of some consumers.

In order to improve the management of receivables in Askona-mebel LLC, it is necessary to recommend:

- - application of factoring in order to optimize receivables;

- - develop certain conditions for crediting debtors, among which may be: discounts for buyers in case of payment for the goods received within 10 days from the date of receipt of the goods; payment by the buyer of the full cost of the goods, if he purchases the goods from the 11th to the 30th day of the credit period; payment by the buyer of a fine in case of non-payment for the goods within a month and so on;

- - focus on a large number of buyers to reduce the risk of non-payment by one or more buyers;

- - track the ratio of receivables and payables;

- - carry out regular analysis of the financial statements of clients in comparison with the data of previous years;

- - to form a kind of dossier on buyers, both existing and potential;

- - develop an effective differentiated policy of work with buyers;

- - pursue a policy of attracting bona fide customers, offering them new approaches to service;

- - to carry out activities, including with the involvement of authorities to collect overdue receivables.

In the general structure of accounts receivable of Askona-mebel LLC, overdue debts account for 35.5%. During the year, this share increased by 5.6 percentage points, or by 4,058 thousand rubles. Consequently, the company failed to achieve the repayment of part of the overdue debts. At the same time, it should be noted that the balance of receivables with a maturity of more than 3 months increased by 2270 thousand rubles, or by 18.8%.

The average turnover of accounts receivable of the enterprise in 2012 was:

where About DZ - receivables turnover;

Вр - proceeds from sales;

DZ1, DZ2 - accounts receivable of the enterprise at the beginning and end of the analyzed period.

Thus, the average turnover of receivables in 2012 amounted to 2.52 turnovers (156969 / ((61352 + 63174) / 2).

Then, the average maturity of receivables will be: 360 days / 2.52 = 143 days. Considering that in 2011 the average repayment period of accounts receivable was 226 days, we can say that in 2012 there was an acceleration in the turnover of accounts receivable of Askona-Mebel LLC, therefore, the company reduces the loan provided to customers and, accordingly, this indicates a rapid the release of monetary resources from the turnover process and their use for the acquisition of additional property.

For a more complete analysis of receivables, we calculate the indicators of the share of receivables in the total volume of current assets, current assets, the share of doubtful receivables (an indicator of the "quality" of receivables) and their relationship to sales volume.

In doing so, we use the following formulas:

Share of accounts receivable in total current assets:

where Y dz - the share of receivables in the total volume of current stocks;

DZ - accounts receivable;

ActTech - current assets;

The share of doubtful debts in accounts receivable:

U sdz = * 100%,

where U sdz - the proportion of doubtful receivables in the total volume of receivables;

DZ doubt - doubtful accounts receivable;

DZ - accounts receivable.

The share of doubtful receivables characterizes the "quality" of receivables. Its increase indicates a decrease in liquidity. The obtained data will be summarized in the analytical table 9.

Table 9

|

Indicators |

Absolute change |

||

|

Revenue from the sale of goods, products, works, services, thousand rubles |

|||

|

Current assets, thousand rubles |

|||

|

Accounts receivable, thousand rubles |

|||

|

of which: short-term |

|||

|

long-term |

|||

|

of the total amount of accounts receivable doubtful accounts receivable |

|||

|

Accounts receivable turnover, turnover |

|||

|

including short term |

|||

|

Receivables repayment period, days |

|||

|

The ratio of accounts receivable to the volume of proceeds from the sale of goods, products, works, services |

|||

|

Share of accounts receivable in total current assets, % |

|||

|

including the share of receivables from buyers and customers in the volume of current assets, % |

|||

|

Share of doubtful accounts receivable in total accounts receivable, % |

|||

|

The ratio of doubtful receivables to the volume of proceeds from the sale of goods, products, works, services |

Conclusions: the data in Table 9 show that the state of settlements with buyers and customers in 2012 compared to 2011 improved by almost 2 times: the receivables turnover increased from 1.59 to 2.52 turnovers. The average period of repayment of receivables decreased by 83 days, which was primarily affected by the improvement in the state of settlements on short-term receivables, which occupies the largest share in the total volume of accounts receivable of Askona-mebel LLC. The share of receivables in total revenue from the sale of goods decreased from 61.9% to 40.2%.

Meanwhile, the above figures indicate a decrease in the quality of receivables. In 2012, compared to 2011, the share of doubtful receivables in the total volume of receivables increased by 0.6 percentage points and amounted to 9%. Considering that the share of receivables in the total volume of current assets is 32.7%, and the share of debt of buyers and customers in the total volume of current assets accounts for 26.1%, we can conclude that the liquidity of current assets has decreased due to the deterioration in the quality of receivables. debt. The reasons for the increase in the duration of the period of holding funds in receivables may be: an inefficient settlement system, financial difficulties for buyers, a long cycle of banking documents, etc. In this regard, the following measures can be proposed to resolve the current situation:

- - Creation of conditions for settlements with buyers and customers. The more favorable settlement terms are provided to buyers (increased terms, reduced requirements for assessing the reliability of debtors), the higher the balance of receivables;

- - development and implementation of a policy for the collection of receivables. The more active the company in collecting receivables, the smaller its balances and the higher the "quality" of receivables;

- - improving the quality of analysis of receivables and consistency in the use of its results. With a satisfactory state of analytical work at the enterprise, information should be generated on the size and age structure of receivables, the presence and volume of overdue debts, as well as on specific debtors, the delay in settlements with which creates problems with the current solvency of the enterprise.

Table 10. Analysis of the structure and condition of receivables, depending on the timing of its formation for LLC "Ascona-mebel" for 2011-2012

|

Indicators |

Total at the end of the year, thousand rubles |

including the terms of education |

|||||

|

from 1 to 3 months |

from 3 to 6 months |

from 6 to 12 months |

over 12 months |

||||

|

Accounts receivable from buyers and customers |

|||||||

|

Bills receivable |

|||||||

|

Debt of subsidiaries and affiliates |

|||||||

|

Advances issued |

|||||||

|

Other debtors |

|||||||

|

Total accounts receivable |

|||||||

|

As a percentage of the total amount of receivables, % |

Conclusions: analysis of the data in the table shows that the main share of receivables falls on the debt of buyers and customers - 79.8%, or 50448 thousand rubles, 10.5% of the total receivables falls on other debtors, 8.1% - on advances issued.

The largest volume of receivables falls on debts with a maturity of up to 3 months - 63.8%. Including 34.9% of the total accounts receivable (or 22,064 thousand rubles) is a debt with a formation period of 1 to 3 months.

At the same time, Ascona-mebel LLC, as part of receivables, has a rather high amount of debt (22,408 thousand rubles) with a long formation period - over 3 months, which is an overdue debt. Therefore, Askona-mebel LLC needs to make every effort to collect overdue debts in the near future, since otherwise it is possible to write off overdue debts to reduce the financial results of the organization. Effective measures to reduce overdue receivables can be: debt restructuring, the mandatory imposition of sanctions on non-paying consumers in case of non-fulfillment of the terms of agreements, both in terms of terms and types of payments, as well as working with non-paying enterprises to provide new, more stringent financial guarantees performance of their obligations, in case of failure to provide

guarantees - termination of concluded agreements.

Thus, the analysis of the accounts receivable of Askona-Mebel LLC for 2012 revealed a number of shortcomings that could directly affect the financial results of the enterprise, including:

- - growth of long-term receivables by 2.2 times;

- - increase in overdue accounts receivable by 4,058 thousand rubles (5.6 percentage points);

- - growth of accounts receivable with a maturity of more than 3 months by 18.8% (by 2,270 thousand rubles);

- - decrease in the quality of receivables: growth of doubtful receivables in the total volume of receivables by 0.6 percentage points - up to 9% and, as a result, a decrease in the liquidity of current assets.

Also, the presence of overdue receivables in the amount of 22,408 thousand rubles, doubtful receivables in the amount of 5,686 thousand rubles, if recognized as uncollectible, may lead to the write-off of debt to reduce the financial result of 28,094 thousand rubles. This amount will subsequently be reflected in the line "Other expenses" in Form No. 2 "Profit and Loss Statement" and form a negative financial result.

Enterprises engaged in economic and financial activities carry out settlements with counterparties. If the company has shipped products or performed work and services before the receipt of funds (payments) on the current account, then a receivable arises.

Accounts receivable- this is the debt of suppliers and contractors, employees of the enterprise, counterparties-customers who owe this enterprise for goods, works, services sold. Debtors can be both legal entities and individuals.

essence receivables lies in the fact that in accounting these debts are considered as part of an asset, that is, in fact, they have not yet been paid, but are included in profit. Consequently, the state of receivables affects the financial position of the enterprise.

The task of any enterprise is constant monitoring and analysis of receivables. To solve this problem, it is necessary to generate reports on the state of debts, their size and composition.

Composition of accounts receivable:

- debt on advances issued to suppliers on account of upcoming deliveries;

- debt on settlements with accountable persons;

- debt of counterparties-buyers for settlements for goods, work performed, services rendered;

- overpayment of taxes to the budget;

- calculations for "input" VAT;

- arrears of insurance premiums from the social insurance fund (FSS), if the amount of sick leave and maternity benefits exceeds the accrued insurance premiums;

- outstanding loans;

- arrears in settlements with persons who must compensate for the damage;

- other debt to the company.

EXAMPLE OF ANALYSIS OF RECEIVABLES

The analysis of receivables can be carried out in the following sequence:

- Analysis of the structure, movement and condition of receivables.

- Analysis of accounts receivable by maturity.

- Determination of the share of accounts receivable in the total volume of current assets, calculation of turnover ratios, assessment of the ratio of the growth rate of accounts receivable to the growth rate of sales proceeds.

- Analysis of the ratio of receivables and payables.

Analysis of the structure, movement and state of receivables

Let us consider the structure of short-term receivables of a healthcare institution in dynamics for one financial reporting year (Table 1).

From table 1 it follows that short-term receivables at the end of 2018 decreased by 412,852 rubles. compared to its beginning.

Accounts receivable for completed work and services to customers-buyers account for the largest share in the total debt of the organization: 60.74% at the beginning of the year and 58.81% at the end.

The debt on advances given to suppliers had a positive trend and decreased by the end of the year by 73,194 rubles.

Value added tax calculations at the end of 2018 amounted to RUB 206,038. against 294,582 rubles. at the beginning of the year, reducing accounts receivable by 88,544 rubles.

The amount of accounts receivable for social insurance at the end of the year is 126,782 rubles. The debt was formed due to the excess of the amount of accrued temporary disability benefits over the amount of insurance premiums to the FSS.

All indicators on accounts receivable at the end of the year had a positive trend.

Accounts receivable from suppliers

Consider the accounts receivable of suppliers in the context of each contract in terms of amount and timing of occurrence, find out the reasons for its formation.

In the period between payment to the supplier and the shipment of goods to him, the performance of work or the provision of services, a receivable is formed and a financial obligation arises for the counterparty to repay this debt. This period can last several days or months, depending on the conditions agreed by the parties in the contract.

Settlements on issued advances with debtors and settlements with suppliers are connected. If an advance payment for the forthcoming delivery of goods (performance of work, provision of services) is transferred to the supplier, then the supplier's receivables to the organization are formed in the balance sheet before the date of delivery of the goods.

If the supplier first supplied material values (performed work, provided services), then the organization has an accounts payable until payment is made.

Let's define the sums and terms of debt by means of tab. 2.

According to the data in Table. 2 accounts receivable at the end of 2018 amounted to 174,530 rubles. Debt by deadline:

- up to 30 days— 58 179 rubles. It is explained by the fact that under the contract, communication services and utilities are provided in the next month after prepayment. Accounts receivable for materials - 24,755.66 rubles, deliveries are made within 30 days after prepayment;

- from 31 to 60 days- 27,751 rubles;

- from 61 to 180 days— 88 600 rubles. (for a laboratory device, which, according to the supply agreement, Medtekhnika LLC must ship and deliver at the end of the first quarter of 2019).

There is no overdue debt.

Accounts receivable for completed works and services to customers-buyers

According to Table. Table 1 shows that in the structure of receivables, the largest share is indebtedness associated with the sale of material assets, the performance of work, the provision of services.

The debt arises at the time of shipment of goods, performance of work, provision of services and is repaid at the time of payment by the customer-buyer. The supporting document is certificate of completion (services), when goods are released - consignment note. Payment terms are regulated by a bilateral agreement and calendar plan.

To analyze accounts receivable for work performed, we will form a table. 3 and evaluate the state of "receivables" in terms of size and timing of occurrence.

As can be seen from Table. 3, receivables at the end of the first half of 2019 amounted to 809,773 rubles.