Practice shows that due attention is not always paid to the analysis of the wage fund, or it is performed very superficially. However, factor analysis of the wage fund is an effective analytical tool for analyzing the current situation and making decisions.

In the classical sense, factor analysis is used to establish the relationship between two or more variables. Accordingly, for the payroll, the first and most important variable is its actual absolute size.

The result of factor analysis should be the answer to the question: what factors had the greatest impact on its change?

In the future, such an analysis helps to timely identify undesirable trends in the use of funds for staff salaries and make high-quality management decisions. Allows you to more accurately plan the payroll and other personnel costs.

What factors should be used to analyze the payroll?

To properly analyze, you need to isolate all the components of the wage fund. First of all, there are components of a direct impact on the size of the payroll:

- Time payment at tariff rates

- Time-based payroll

- Piece-work payment

- Monthly bonuses

- Additional payments and allowances according to the labor code (specify when analyzing)

- Additional payments and allowances established by the employer (specify when analyzing)

- Vacation pay

- Compensation for unused vacation

The list of these factors can be continued, its size is limited only by the complexity of the payment system adopted in the company.

There are also so-called "variable" factors that affect the amount of payment of one kind or another. For example, the amount of piecework pay may depend on the piecework rate, production rates, and the number of pieceworkers. Accordingly, it is also possible to derive the degree of influence of these factors on the size of the payroll.

Some examples of such indicators (the list is not exhaustive):

- Average headcount

- average salary

- Average salary

- Average hourly rate

- % bonus to salary (tariff rate)

- Average piece rate

- The number of "timers"

- The number of "pieceworkers"

- Number of workers in hazardous working conditions

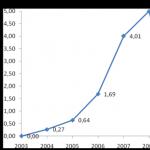

Here is a small illustration explaining the above:

Base period selection

To begin with, a base is selected to perform the analysis. As a rule, this is some kind of planning period. For example, we can compare Q1 2015 with Q1 2014. And then analyze what factors had the greatest impact on the change in the size of the salary fund.

Economists often suggest comparing comparable periods. For example, the first half of 2015 is compared with the first half of 2014. This is justified in most cases. But sometimes there is a need to compare, for example, the last quarter of last year with the 3rd quarter of this year. This option is also possible.

The main rule is that the comparison periods should be the same in time. Month to month, quarter to quarter.

Factor analysis example

The essence of the proposed method is quite simple. We must consider each factor separately in order to find out the degree of its influence on the overall result.

Please do not use this factor analysis in student work, this is a purely practical solution for HR managers or other managers of an enterprise or company.

Let's take an example. First, the source table for factor analysis is shown. The table is simplified, at any operating industrial enterprise it will contain approximately 2-3 times more factors.

| Payment types | 1 sq. 2014 | 1 sq. 2015 | Deviation, rub. | Deviation, % |

|---|---|---|---|---|

| Time payment | 4456778 | 4587226 | 130448 | 103 |

| Piece-work payment | 1456767 | 1674885 | 218118 | 115 |

| Vacation pay: | 571896 | 757149 | 185253 | 132 |

| a) basic | 547881 | 682145 | 134264 | 125 |

| b) educational | 24015 | 75004 | 50989 | 312 |

| Monthly premium | 2258404 | 1965874 | -292530 | 87 |

| One-time bonuses | 125000 | 77000 | -48000 | 62 |

| Night work allowance | 152447 | 174885 | 22438 | 115 |

| Overtime pay | 85077 | 225487 | 140410 | 265 |

| Weekend work pay | 14332 | 58441 | 44109 | 408 |

| TOTAL FOT | 9120701 | 9520947 | 400246 | 104 |

In relative terms, we see: Already the first reading of the information in this table shows an approximate picture of the reasons for the growth of the wage fund. Almost all types of payments have grown in absolute terms. But there is also a decrease in the amount of payments for the types of "Monthly premium" and "Lump-sum bonuses".

- a very significant increase in pay for work on weekends, more than 4 times;

- a threefold increase in student leave;

- overtime costs increased by 2.65 times

- payments of one-time bonuses decreased by 38%.

Already this information may be enough to make some managerial decisions regarding wages. Especially if such information is presented in the report in the form of infographics, for example:

However, the analysis does not end there. Often it is necessary to analyze in more depth the causes of certain deviations. That is, it is the turn to consider and analyze the impact of variables on each of the types of payments in the pay fund.

Let's say that we need to find out the detailed reasons for the significant increase in vacation pay (paragraph 3 of the table of initial data). How vacation pay is calculated (O): the average daily earnings are multiplied by the number of vacation days provided to the company's employees in the reporting period (simplified formula).

The average daily earnings (SDZ) are taken equal to 1678.45 rubles. in the 1st quarter of 2014 and 1835.54 in the 1st quarter of 2015.

Vacation days (D) provided to employees in the 1st quarter of 2014 340 days, in the 1st quarter of 2015 - 371 days.

For the calculation, we will use the method of chain substitutions.

OTP 0 \u003d SDZ 0 * D 0 \u003d 1678.45 * 340 \u003d 570673 rubles.

OTPusl 1 \u003d SDZ 1 * D 0 \u003d 1835.54 * 340 \u003d 624083.60 rubles.

OTP 1 \u003d SDZ 1 * D 1 \u003d 1835.54 * 371 \u003d 680985.34 rubles.

Then, in order to find out the influence of the growth factor of average daily earnings, we subtract OTP 0 from OTP condition 1 and get the difference of 53,410 rubles. It can be concluded that due to the increase in average daily earnings, the total amount of vacation pay increased by 53,410 rubles. The rest of the increase (56,902 rubles) occurred due to an increase in the number of days the employees were on vacation.

Using the same algorithm, you can analyze changes in all types of payments in the structure of the wage fund.

Thus, by measuring and analyzing the factors of change in the payroll, we obtain valuable information for making managerial decisions.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

FOTd \u003d Rf NDF ChNch.pl H ZPchas.pl (1.8)

FOTn \u003d Rf NDF ChNh.f NZPh.pl (1.9)

FOTzp.h \u003d Rf H Df ChNh.f NZPh.f (1.10)

FOTpl \u003d Rpl NZPgod.pl. (1.11)

FOTr \u003d Rf NZPgod.pl. (1.12)

FOTzp.year. = Rf NZPyear.f (1.13)

Figure 2.1 shows an approximate diagram of the income of employees of the enterprise, these elements mainly form the real wages paid to employees.

This analysis is aimed at studying the reasons for the change in the average salary of one employee by category and profession, as well as in the whole enterprise. At the same time, it should be taken into account that the average annual wage depends on the number of days worked by one worker per year (D), the duration of the work shift (Nh) and the average hourly wage (ZPh):

ZPyear \u003d D H Nh HZPh. (1.14)

In the process of analysis, we also take into account the correspondence between the growth rates of average wages and labor productivity. As already noted, for expanded reproduction, profit and profitability, it is necessary that the growth rate of labor productivity outstrip the growth rate of wages. If this principle is not observed, then there is an overspending of the salary fund, an increase in the cost of production and, accordingly, a decrease in the amount of profit.

The change in the average earnings of employees for a given period of time (year, month, day, hour) is characterized by its index (Iav), which is determined by the ratio of the average salary for the reporting period (SFOo) to the average salary in the base period (SFOB):

Rice. 2 . 1 Income structureenterprise employee.

The labor productivity index is calculated in a similar way:

Lead coefficient (Kop) is equal to:

To determine the amount of savings (- E) or overspending (+ E) of the wage fund due to a change in the ratio between the growth rates of labor productivity and its payment, you can use the following formula:

E \u003d FOTf (1.18)

2 . Analysis of the wage fund at the enterprise

2.1 The main technical and economic indicators of the work of the machine shop№ 5 JSC NKMZ»

The main technical and economic indicators of the work of the shop for the month are taken from the actual results of the work of the machine shop for 2003 and are given in Table. 2.1.

Table 2.1- Technical and economic indicators memechanical workshop

|

Indicators |

||||

|

Shipment of finished products, t. |

||||

|

Complete supply of blanks for mechanical products, t. UAH |

||||

|

Conditional fully shipped commercial products, t. UAH |

||||

|

Average monthly output per worker, t. |

||||

|

Average monthly output per machine operator, t. |

||||

|

Planned payroll, UAH |

||||

|

Planned cost of production volume, UAH |

||||

|

Gross volume Including machine tool n-hour. Including labor hours. |

||||

|

Total production by font 10 (export) |

||||

|

Galvanization area |

||||

|

General payroll fund, UAH including - production workers support workers leaders specialists employees |

||||

|

The average number of industrial and production personnel |

||||

|

including workers auxiliary production machinists second workers |

||||

|

Production time workers Leaders Specialists Employees |

||||

|

Total overhead costs, UAH including - variables Permanent |

||||

|

Basic salary of production workers, UAH |

||||

|

Percentage of general production costs to the basic salary of production workers |

As can be seen from Table 2.1, the stability in the workload of the workshop makes it possible to practically fulfill the planned level of commercial output of mechanical products, to achieve an increase in gross volume in standard hours by 113.7% and in machine standard hours by 114.6%, as well as to increase production for one worker up to 105.0% and for one machine operator up to 106.7%.

The planned production cost was exceeded by 19.1%, the planned wage fund - by 17%.

It should be noted as a positive factor a decrease in overhead costs in the workshop by 15.7%

For the purpose of efficient operation of the workshop, it is proposed:

improving the quality of equipment repair;

control over compliance with planned costs for cost items;

activation of the work of all departments of the shop, aimed at increasing the efficiency of production and reducing the cost of production.

Table 2.2- Number of shop workers by years and categoriesemountains

From table 2.2 it can be seen that most of the workers are employed by the main production workers, half of which are pieceworkers. Over the two proposed periods, the number of employees increased by only 11 people, of which the number of main production workers increased by 13 people.

2.2 Payroll analysis

Starting to analyze the use of the wage fund, first of all, we calculate the absolute and relative deviation of the reporting value of 2003 from the reporting value of 2002.

Preliminarily, we perform a structural analysis of the data we have, and we enter all the calculated values in the corresponding columns of Appendix A. The first two columns are the data we have for the enterprise division, and we calculate the remaining columns.

According to preliminary calculations of the analysis of the structure of the payroll fund of the unit, the following conclusions can be drawn:

Firstly, there is an overspending of the entire wage fund by UAH 508,103, and secondly, compared to the previous year, the wage fund increased by 16.97%, of which incentive and compensation payments increased the most in percentage terms. Structurally, incentive and compensation payments also deviated the most in the wage fund. These changes are related to the unexpected costs of these payments. Other structural elements have not changed significantly.

Based on Appendix A, we will distribute the data in the form we need and present it in Appendix B.

The absolute deviation (AFOTabs) is determined by comparing the actually used funds for wages in 2003 (FOTnast.) with the wage fund for 2002 (FOTprev.) as a whole for the enterprise, production units and categories of workers, according to the formula (1.1):

DFOTabs = PHOTset. - FOTpred. = 3502597-2994494=+508103 UAH

As a result of the analysis, there is an increase in labor costs in the amount of UAH 508,103. The increase was mainly due to an increase in workers' wages. In the constant part of labor costs, the largest share is the growth of various additional payments, such as for overtime work, higher RCC salaries, and higher rates based on the increase in the minimum wage. A slight change in the variable part of workers' wages was caused by structural shifts in output. In the variable part, there was a slight decrease in almost all cost elements due to a decrease in the labor intensity of products. In our case, a negative impact on the wage fund was caused by an increase in RCC wages by UAH 101,955, which occurred due to an increase in salaries.

However, it should be borne in mind that the absolute deviation in itself does not characterize the use of the wage fund, since this indicator is determined without taking into account the degree of fulfillment of the production plan.

The relative deviation is calculated as the difference between the actually accrued amount of costs and the planned fund, adjusted for the coefficient of fulfillment of the production plan. The percentage of the ratio of the fact of 2003 to 2002 in terms of production is 115.1%. However, it must be taken into account that only the variable part of the wage fund is adjusted, which changes in proportion to the volume of production.

Based on the data, we determine the relative deviation in the wage fund, taking into account the ratio of 2003. by 2002 for production, according to the formula (1.2):

D PHOTO \u003d 3502597 - (869370.7 × 1.151 + 2125123.3) \u003d + 376828 UAH.

When calculating the relative deviation in the wage fund, you can use the so-called correction factor (Kp), which reflects the share of the wage variable in the total fund. It shows by what fraction of a percentage the wage fund of the previous period should be increased for each percentage of overfulfillment of the plan for output (P %). Let's perform the calculation according to the formula (1.3):

DPHot. = 3502597 - (2994494) = +376974.1 UAH

The calculation shows that this enterprise also has a relative overspending in the use of the wage fund in the amount of UAH 376,974.1.

The next step in our analysis is to determine the factors of absolute and relative deviations in the wage fund.

The variable part of the wage fund depends on the volume of production, its structure, specific labor intensity and the level of average hourly wages.

To calculate the influence of these factors on the absolute and relative deviation of the wage fund, it is necessary to have the calculated data given in Table. 2.3

tablesa 2.3 - Calculation of the influence of factors

to the variable payroll

|

Result, UAH |

||

|

payroll fund: actually 2002. |

||

|

on the fact of 2002, recalculated to the actual the volume of production in 2003 with the actual structure 2002 (1950338.1 * 115.1% / 100) |

||

|

on the fact of 2002, recalculated to the actual production volume in 2003 and actual structure 2003 |

||

|

actually for 2003 with the actual specific labor intensity in 2003 and at the level of payment in 2002 |

||

|

Actually for 2003 |

||

|

Deviation from the fact of 2002: absolute (1366315.4 - 869370.7) relative (1366315.4 - 1000645) |

The calculation results in table 2.4 indicate that this enterprise has a relative overspending of variable wages. It occurred due to the fact that the rate of growth in the productivity of piecework workers was lower than the rate of growth in their wages. The overspending is caused, in particular, by an increase in wage rates for all categories of workers, as well as an increase in hourly rates and wages.

Table 2.4 - Calculation of the influence of factors on the change in the variable part of the payroll

The permanent part of the wage fund. The permanent part of the remuneration includes the salary of time workers, employees, employees of kindergartens, clubs, sanatoriums, dispensaries, etc., as well as all types of additional payments. The salary fund of these categories of workers depends on their average number and average earnings for the corresponding period of time. The average annual salary of time workers, in addition, also depends on the number of days worked on average by one worker per year, the average length of a work shift and average hourly earnings. The initial data for the analysis are given in table 2.5.

tablica 2.5 - Initial data for the analysis of the time wage fundAYou

The calculation of the influence of these factors can be made by the method of complete chain substitutions, using the data of Table 2.5, we will calculate according to the formulas (1.4,1.5,1.6,1.7,1.8,1.9,1.10), respectively:

FOT = 79 CH6672.4 = 527121 (UAH)

FOTr \u003d 84 H 6672.4 \u003d 560481.6 (UAH)

FOTzp.year = 84 CH6038 = 507196 (UAH)

Now let's calculate the deviation:

D FOTr \u003d 560481.6 - 527121 \u003d +33360.6 UAH;

DFOTzp.year \u003d 507196 - 560481.6 \u003d -53285.6 UAH

Total: -19925 UAH.

Including:

FOTr \u003d 84 H 252 H 8.0 H3.3 \u003d 558835.2 UAH.

FOTd \u003d 84 CH240H 8.0H 3.3 \u003d 532224 UAH.

PHOTn = 84 × 240 × 7.9 × 3.3 = UAH 525,571.2

FOTzp.h \u003d 84 H 240 H 7.9 H3.14 \u003d 507196 UAH.

Now let's calculate the difference:

DFOTr = 558835.2 - 527121 = +31714.2 UAH;

D FOTd \u003d 532224 - 558835.2 \u003d -26611.2 UAH.

DFOTn = 110157.6 - 111552 = -6652.8 UAH.

DFOTzp.h = 134400 - 110157.6 = -18375.2 UAH

Total -19925 UAH.

Thus, savings in the time wage fund occurred mainly due to an increase in the number of employees. The increase in the average hourly wage occurred as a result of an increase in tariff rates due to inflation, as well as the company's policy in the field of improving the well-being of employees.

The wage fund of the RCC may also change due to its number and average annual earnings.

At this enterprise, there was a slight reduction in the management apparatus from 38 to 36 people. However, their payment fund has increased. Calculation by formulas (1.11,1.12,1.13):

FOTpl \u003d 38H 17852.5 \u003d 678394 (UAH)

FOTR \u003d 36H 17852.5 \u003d 642689 (UAH)

FOTzp.year. = 36 H 21676.4 = 780349 (UAH)

Let's calculate the deviations at each stage:

D FOTr = 642689 - 678394 = -35705 (UAH);

D FOTzp.year. = 780349 - 642689 = 137660 (UAH).

Total +101955 UAH.

The next stage of our work is the study of the average earnings of employees of the enterprise, its change, as well as the factors that determine its level.

The calculation of the influence of these factors on the change in the level of the average annual salary by categories of workers will be made by taking absolute differences according to the formula (1.14), all calculations are summarized in table 2.6.

Table 2.6 - Analysis of the average earnings of a workerAndka

|

Pieceworkers |

Time workers |

||||

|

fact 2002 |

fact 2003 |

fact 2002 |

Fact 2003 |

||

|

Number of days worked. 1 working (D) |

|||||

|

Medium continues. shifts, h (Nh) |

|||||

|

Average hourly salary (ZPhour) |

|||||

|

Average annual salary, UAH |

|||||

|

Deviation from the fact 2002 average annual salary of an employee: |

|||||

|

Incl. by changing: Number of days worked Shift duration Average hourly wage |

Table 2.6 shows that the growth in the average annual wage is mainly due to an increase in the average hourly wage of piecework workers, which in turn depends on the level of qualification of workers, revision of production standards and prices, changes in work categories and tariff rates, various additional payments and bonuses. In the process of analysis, it is necessary to study the implementation of the action plan to reduce the labor intensity of products, the timeliness of revision of production rates and prices, the correctness of payment according to tariffs, the correctness of accrual of additional payments for work experience, overtime, downtime due to the fault of the enterprise, etc.

The change in the average earnings of employees for a given period of time (year, month, day, hour) is characterized by its index (Iav), which is determined by the ratio of the average salary for the reporting period (SFOo) to the average salary in the base period (SFOB) according to the formula (1.15 ):

The labor productivity index is calculated in a similar way, formula (1.16):

The given data show that at the analyzed enterprise, the growth rate of labor productivity outstrips the growth rate of wages.

The advance coefficient (Kop) according to the formula (1.17) is equal to:

To determine the amount of savings (- E) or overspending (+ E) of the wage fund due to a change in the ratio between the growth rates of labor productivity and its payment, you can use the calculation according to the formula (1.18):

E \u003d 3502597 \u003d +895664.1 UAH.

In the process of analysis, we see that the lower growth rate of labor productivity compared to the growth rate of wages led to an overspending of the wage fund in the amount of UAH 895,664.1. But this does not mean that the enterprise worked badly. In this case, such a difference arose due to an increase in hourly rates. And during this period, the company simply had a temporary decline in production.

2.3 Methods of remuneration used in NKMZ JSCTnicknames

The structure of the system for the formation of the fund for remuneration and labor incentives for employees of NKMZ JSC:

Salary: Tariff, salary, piece rates

Floating odds system

Bonuses and additional payments: for professional skills, for multi-shift work, for deviation from normal working conditions, for class, for leading a team, for working with a smaller number, for knowledge of a foreign language.

Bonus systems: For the main results of economic activity, for saving materials and fuel and energy resources, for the implementation of creative ideas and the conclusion of profitable contracts, based on the results of labor rivalry, for the performance of especially important work.

One-time remuneration: For length of service, for the overall results of the plant for a certain period (bonuses)

Profit Sharing: Dividends

Equity participation: Purchase of shares

The main conditions for the payment of bonuses and other additional payments to the basic payroll are set out below.

Remuneration of managers, specialists and employees for the main results of economic activity.

Indicators and conditions of bonuses:

1) Bonuses for plant employees are made in the following order:

a) managers, specialists and employees of production shops for the results of the work of the shop and the results of production activities;

b) managers, specialists and employees of departments, design, technological and other departments, services that are not part of the production; auxiliary workshops - for the results of the work of the plant as a whole and the results of the activities of each structural unit;

c) managers, specialists and employees of the structural divisions included in the production - for the results of the production work and the results of the activities of each structural division;

2) A prerequisite for the payment of bonuses is:

a) fulfillment of terms of contractual obligations for the supply of products for structural divisions;

b) fulfillment of tasks to reduce labor intensity;

c) providing the production plan with purchased scrap metal in the amount of the approved need;

d) ensuring the planned number of personnel in the main production shops.

3) The rate of deductions to the incentive fund for executives, specialists and employees of the main production shops for the main results of economic activity.

Estimated indicators of the effectiveness of the work of teams for the formation of the incentive fund for structural divisions (Mechanical Assembly Shop No. 5) and the size of the standards as a percentage of the wage fund for managers, specialists and employees of the structural division calculated according to official salaries according to the staffing table:

a) fulfillment of the plan for the volume of commercial output in compliance with the terms of contractual obligations for the supply of products - 15%;

b) implementation of the plan at the cost of the workshop - 15%;

c) fulfillment of the plan for the volume of production sales - 10%.

The basis for the formation of the incentive fund is the PES report.

In case of non-fulfillment of the estimated indicators of the effectiveness of the work of teams on a cumulative basis from the beginning of the year, but the fulfillment of these indicators for the reporting month, the teams of departments are rewarded in the amount of 50% of the amount of incentive funds.

If in subsequent periods of the calendar year the indicated underfulfillment of the estimated indicators is replenished, then the General Director may decide to pay up to 100% of the part of the amount of bonuses that was accrued, but not fulfilled according to the results of the previous periods of the current year, subject to the plan for the gross volume of machine tools standard hour, calculated on an accrual basis.

Encouragement of employees for the implementation of creative ideas, initiatives and the conclusion of profitable contracts.

It is possible to ensure the competitiveness of an enterprise in modern conditions by:

A clear focus on the creation and production of new machines and equipment that meets the needs of consumers, improving previously mastered technology through the development and implementation of new technical solutions, developing cooperation on mutually beneficial terms with leading companies in the manufacture and sale of unique science-intensive and high-quality engineering products on world markets;

Development of a progressive technological base, which provides for the development and implementation of science-intensive resource-saving technologies that surpass traditional ones in their technical and economic parameters. To maintain a competitive advantage, it is necessary to ensure a technological separation from competitors, that is, to constantly create and master new technologies and products.

In order to stimulate creativity, increase the interest of staff in expanding sales markets and attracting new customers, this provision is introduced:

1) Bonus from funds generated by contributions to the incentive fund in the amount of:

Up to 1.5% of the funds received for the development, manufacture and sale of new high-performance products;

Up to 1% of the funds received for the initiative to conclude profitable contracts that bring profit and increase production volumes.

Table 2.7 - Scheme of distribution of the total amount of the incentive fund

|

Developers |

Initiative group |

Design work |

Technological work |

Pre-production work and assistance to other services |

Work on the development and organization of production |

reserve fund |

||

|

Basic |

||||||||

|

No design work |

||||||||

|

There are no technological works |

||||||||

|

No pre-production |

||||||||

|

There are no pre-production and manufacturing works |

The basis for awarding bonuses is:

Invoice on the amount of material handed over to the warehouse, signed by the head of the warehouse OMTS and the head. Accounting;

Economic calculation and information about incentives.

The amount of bonuses paid to one employee depends on the personal contribution to the achievement of savings and is not limited to limits.

Employees are completely deprived of the accrued bonus:

Those who have made absenteeism;

Part-time workers due to arrest for hooliganism and drunkenness;

Convicted of theft;

30% of the total amount of the bonus fund for bonuses for managers and specialists and employees;

20% - for bonuses to workers from the total amount for bonuses to workers;

25% - for bonuses for managers, specialists and employees of the total amount for RCC bonuses.

Encouragement of personnel employees of NKMZ JSC.

Gratitude can be declared or monetary rewards can be given to personnel employees who have worked continuously at the enterprise for more than 20 years and have achieved: - 50th anniversary date (impeccable reputation and long-term labor merits); - retirement age and voluntary dismissal in connection with retirement, having worked at the enterprise conscientiously and flawlessly.

Payment and encouragement of students of the MK DSMA and DSMA, 2 working machine operators and basic machine operators on CNC machines, who are studying or trained in accordance with the “Program for the Professional Development of Young Specialists at NKMZ CJSC”. (temporarily)

At present, to ensure the life of the plant, a comprehensive program of technical re-equipment and modernization of production has been developed and is being implemented, it is planned to update the existing technological base, introduce high technologies, modernize the production facility, and train highly qualified personnel.

The current regulation applies to:

Students of the 4th and 5th courses of full-time and part-time education and graduates of the DSEA, undergoing training on a credit-modular system and practice at CJSC "NKMZ";

Students and graduates of the MK DSMA, undergoing training and practice at NKMZ CJSC, who have concluded an agreement in accordance with the Professional Development Program for Young Professionals at NKMZ CJSC.

Compensation for the work of students who have concluded an agreement in accordance with the "Program for the professional development of young specialists at CJSC NKMZ"

Preparation of full-time students of the DSEA, studying on a credit-modular system, consists of 4 stages:

1st stage: training of 4th year students in the form of "3-2-1";

2nd stage: internship in the workshops of the main production as 2 working machine operators on CNC machines;

3rd stage: training of 5th year students in the form of "3-2-1";

Stage 4: practical training in the main production shops as 2 working machine operators on CNC machines during pre-diploma practice.

At the end - employment.

Remuneration of students: 1-3 stages - 220 UAH / month, subject to 100% attendance of theoretical and practical classes.

Adjustment of the amount by points: 4.5 b. and above - 1;

4-4.5 b. - 0.75; below 4 - 0.5.

If "failed" is not paid.

Payments to NKMZ employees of bonuses for the general results of the plant's work for a certain period (payment of bonuses)

The system of measures for solving problems in the field of work with personnel includes the formation of a strong workforce and ensuring the high quality of human resources and as decisive factors in production efficiency and competitiveness. There is an expansion and deepening of the functions of managing workers of all categories. Of particular importance are the strategic issues of personnel management, the stability of the workforce. Stability serves as an incentive for the production and business activity of workers and employees, strengthens the sense of corporate community, and forms a corporate culture of relations.

In order to achieve better results in the context of constantly developing scientific and technological progress and intensifying competition in the world market, the motivational mechanism of salary management is expanding and for this purpose a provision is put into effect on the payment of bonuses for overall performance for a certain period (payment of bonuses).

1) The procedure for paying bonuses for overall performance (bonus)

1.1) The bonus for the overall results of work is paid to workers, managers, specialists, employees and other categories who are on the staff (listed composition) of the plant, as well as employees of the trade union committee, the board of the youth association, cultural centers, medical and sanitary unit, sanatorium and dispensary.

1.2) The payment of bonuses for the general results of work is paid from the funds of the wage fund, subject to the accumulation of funds earmarked for these purposes.

1.3) The amount of the bonus is accrued to each employee on a scale of coefficients in accordance with the salary received by the employees, taking into account the length of service and the effectiveness of work at the plant (Appendix No. 1). The amount of the bonus is indicated in the application, adjusted for the coefficient of accumulation of funds in a certain period.

1.4) Employees who have achieved high results in labor, who have shown initiative and creativity in finding internal reserves for the growth of production and labor productivity, in finding and expanding markets for their products, and who are marked by various forms of moral encouragement, the bonus grows in the following amounts:

Awarded with orders and medals - 40%;

Those who received the title of "Honorary Novokramatorets" - 30%;

Those who received the title of "NKMZ Labor Veteran" - 20%;

Awarded with the diploma of the President - 20%;

Awarded with diplomas, extracts, signs, certificates .... - 15 %.

1.5) Employees who are awarded titles and incentives under clause 1.4 receive an increase in the due amount of the bonus once a year in the year of awarding.

In the case of awarding an employee with several incentives, the increase in the bonus is made at the highest percentage.

1.6) When an employee receives, along with moral incentives, cash bonuses or gifts, the bonus is not increased.

1.7) Employees who committed the following violations of labor discipline are deprived of the accrued bonuses:

Absence from work for more than 3 hours without the permission of the administration

Appearance at work in a state of intoxication, narcotic or toxic intoxication;

Theft (including petty) of secret or other property;

Worked part-time in connection with bringing to criminal responsibility;

Factory reprimand.

1.8) The bonus is paid for the time actually worked in the reporting period, taking into account the time of business trips related to the implementation of the production plan, based on the average salary of workers, managers, specialists and employees, employees of the trade union committee and the board of the youth association, cultural and educational institutions, the medical unit, the sanatorium -dispensary.

1.9) When a worker is transferred from one unit to another where different scales apply, bonuses are paid at a fixed percentage, based on the last place of work at the end of the reporting period.

1.10) For workers temporarily transferred to another job on the basis of a certificate from the medical commission, as well as women transferred to another job due to pregnancy and in connection with breastfeeding, the bonus is accrued for the main job that they performed before the transfer.

The procedure for calculating the length of service, giving the right to receive a bonus for the overall results of the plant:

2.1) The length of service giving the right to receive a bonus includes:

Time of continuous work at the plant, in the trade union committee, youth associations, in sports clubs, cultural centers, medical and sanitary units, sanatoriums and dispensaries;

Time spent abroad, when returning to work on time;

The time of service in the army, or the worker worked at the factory and, after returning from the army, works as a machine operator in the main workshops of the factory, provided that he enters the factory no later than 3 months from the date of return from the army (excluding travel time);

Time of leave for women to care for a child in accordance with applicable law;

2.2) The main document for determining the length of service is the work book.

3) The procedure for determining earnings for the payment of bonuses for overall performance

The composition of actual earnings, on which the bonus is calculated, includes:

Payments from the payroll fund accrued for the time actually worked, taking into account the time of business trips related to the implementation of the production plan;

Additional payments from the wage fund (except for long service payments, one-time bonuses, bonuses paid in honor of holidays and anniversaries, material assistance).

Table 2.7 - Amount of bonus (bonus) for overall performance

(in wage ratios)

|

Work experience |

Machine operators engaged in processing Measuring, prod. sites, workshops that are part of the production, RMC, tools. workshops, TsSO, TsTNP |

Management Board, executives of workshops, departments, services, employees of all divisions of the plant |

Employees of the medical and sanitary unit and dental offices located on the territory. Factory |

|||

|

Highly qualified (4,5,6 category) |

Machine operators 1,2,3 categories |

Managers, leading specialists, categorical specialists, Art. dispatcher, chief plots, craftsmen, workers 4,5,6,7,8 times., Drivers of the 1st class, trimmers 3 grades, pilers 3 rubles, casters 3 rubles. |

Workers 1,2,3,4 rated, distribution, works, pickers, transporters and operators of the centralization post, special. b / c., technicians, supply managers, employees, pom. craftsmen, 2 workers of machine operators |

|||

For a more illustrative example of accruing bonuses for employees of an enterprise, a table of accruing bonuses in Appendix C and D is proposed below.

The existing methods of basic and additional remuneration of employees at this enterprise can be considered quite satisfactory, since the motivational mechanism is fully involved in determining wages for each employee. It also includes the basic wage accrued at piecework and time rates, salaries. To further encourage employees, the enterprise has an extensive system of various allowances and additional payments, there are several types of bonus systems that cover various areas of application of the efforts of employees in the performance of their duties, as well as incentives to strive to improve their qualification level and perform their duties with less labor costs and working hours, resulting in cost savings and reduced contract lead times.

For greater interest of employees in working at this particular enterprise and with greater impact, awards are provided for the overall results of work for a certain period, as well as participation in profits in the form of dividends.

Thus, we can say that the existing methods of remuneration of employees at this point in time are fully consistent with the needs of the enterprise and employees. However, it is still necessary to reform this reward system due to its cumbersomeness.

3. DIRECTIONS TO IMPROVE THE SYSTEMSSABOUTPARMOR OF LABOR

3.1 Efficient wage systems in market conditions on the example of economicOmedically developed countries

In countries with developed market economies, great importance is attached to strengthening the stimulating role of tariff wages. It is based on the concept of a flexible tariff, the essence of which is that tariff wages, along with the main task of motivating workers to improve their working skills, should encourage the individual results of their work, primarily the production and quality of products.

In accordance with the concept of a flexible tariff, a wage model has been developed, in which the size of the tariff is made dependent on labor productivity. So, within each qualification category, three tariff rates are set depending on the output of the worker: "low" - when performing less than 95% of the norm; "normal", characterizing the average level of labor intensity; "high" - when more than 105% of the norm is fulfilled. In the event that the output systematically exceeds 105% of the norm, the worker receives a rate 5% higher than the rate for qualification.

The tariff rate is set for 3-6 months. After the specified period, it is reviewed and adjusted taking into account the increase in labor productivity of the worker in the past quarter or six months. Such a system of remuneration is called "compromise". It contains elements of two main forms of wages: time and piecework, while the income of workers is guaranteed, and this brings them closer to the status of employees, the differences between which cause numerous labor disputes. This allows entrepreneurs to stimulate higher output and at the same time control wages by linking them to changes in labor productivity.

The “compromise” wage system is used to stimulate time workers and only in those areas where productivity can be measured and the worker can influence it.

Merits are most often assessed by such indicators: product quality and amount of work, independence in work, professional skills and initiative, relationships with colleagues, need for leadership.

If the assessment of work by complexity determines the differentiation of tariff rates along the vertical, then the assessment of the effectiveness of its performers determines the differentiation of rates along the horizontal. If such an assessment is used for the purpose of material incentives, the tariff scale provides for a number of incentive elements. This is either a fork with limiting maximum and minimum rates, or fractional rates for each or at least for most of the categories. The range of tariff rates is 8-15% depending on the category.

Incentives under the "merit evaluation system" are applied in case of large differences in the qualification level and practical experience of workers, and the worker can prove himself by deepening his knowledge, improving professional skills, influencing the quantity and quality of products.

The "merit evaluation system" has become the most important practical tool for personnel policy pursued by private enterprises in order to increase the intensity of labor in every possible way. The results of such an assessment are used not only to determine the amount of incentives, but are also taken into account when selecting candidates for dismissal during the period of technical re-equipment of production.

In the context of intensifying competition, bonuses for saving resources, which help to reduce production costs, become important. Such bonuses are collective in nature, have many varieties (Scanlon, Rucker, Kaiser, etc.).

The most common among collective incentive methods is the “Scanlon system”, named after the trade union leader of one of the American steel corporations, who proposed in the 1930s the principle of stimulating all personnel based on the wage cost standard in the cost of finished products.

Varieties of the “Scanlon system” used in the USA, Great Britain and other countries differ in the technique for calculating the standard, the contingent of employees covered by the system, and the proportion of distribution of savings between administration and staff.

It should be noted that bonus systems based on cost standards have a significant drawback. The bonus fund is calculated on the basis of cost indicators that are influenced by many factors. In order to increase the effectiveness of the collective incentive mechanism, in recent years, systems based on the general indicators of productivity improvement in the enterprise in kind have been applied. They are calculated as the volume of production in physical terms, divided by the total number of man-hours worked. Depending on changes in labor productivity, workers are charged a tariff rate multiplied by the corresponding rate of growth in labor productivity. The advantage of these systems is that they make it possible to reward employees in accordance with the actual increase in labor productivity.

The most common method of stimulating product quality improvement is the "individual bonus system" depending on the percentage of defects. At the same time, the normative value of defects in the area is preliminarily set at the level of approximately 10% of the volume of production, for which the worker is charged a bonus in the amount of 3% of the tariff rate. As marriage increases to 15%, the premium decreases to zero. In the event of a decrease in marriage to 5%, the amount of the bonus increases to 8% of the worker's wage rate.

In addition, at the enterprises of countries with developed market economies there are special bonus systems for collective rationalization proposals. The source of bonuses is usually the funds saved from the implementation of rationalization proposals. The percentage allocated to the bonus fund at each enterprise is different.

Many firms are now abandoning ineffective coercive measures and are focusing on increasing the personal responsibility of each for the quality of manufactured products. Thus, new forms of quality promotion have arisen, based on a close combination of material and moral principles, in particular, a system of self-control and quality circles.

The transfer of workers to self-control pursues two goals - improving the quality of products and the cost of technical control. The interest of workers is achieved, on the one hand, by expanding labor functions, increasing the independence and responsibility of each worker, and, on the other hand, by appropriately linking wages with changes in the content of labor and improving the quality of products. Moreover, the incentive is carried out within the payroll on the basis of a reduction in the number of supervisory personnel.

Quality circles are one of the forms of participation of workers in improving production efficiency. Groups of 5 to 10 workers or more unite, as a rule, under the supervision of their immediate supervisor to discuss and make decisions directly or indirectly related to product quality. Members of the circles identify the causes of marriage, develop recommendations for their elimination, make proposals for improving technology, methods of organizing labor, improving the skills of workers, and labor discipline.

Popularity, especially in Western Europe, won the so-called bonuses for attendance, paid to qualified employees in which the company is interested.

Attendance incentives can take the form of individual, collective and individual-collective bonuses. In the first case, the indicator is the attendance of an individual employee. For example, for a fully worked week, a bonus is paid in the amount of 5-8% of the weekly wage rate. An indicator of the effectiveness of collective bonuses is a decrease in the total number of absenteeism in a workshop, division or company as a whole. One of the common methods of stimulating a decrease in the number of absenteeism and lateness is various competitions between employees, which identify the most disciplined of them. At the end of the year, lists of employees are compiled at the enterprise, starting with the one with the least and ending with the one with the greatest number of absenteeism. The bonus fund allocated for these purposes is distributed as follows: having the least number of absenteeism receives 10% of the total amount of the fund, each subsequent - 10% of the remaining amount.

Another way to reward high levels of absenteeism is to provide workers with additional leave.

Consider some features of wages in some developed countries of the world:

1) Wages at Japanese enterprises

Since Japan industrialized much more slowly than most Western countries, the country has historically experienced a shortage of skilled workers.

Availability of lifetime employment, in which the relationship between the employer and the employee, including economic and social aspects, is fixed for a long time.

The organization of labor in Japanese enterprises differs significantly from that adopted in developed capitalist countries. Most large Japanese firms tend to invest in employee training. This is due to the likelihood that the net economic return will exceed the cost of training, and reduce the risk that a trained person will look for work outside the firm. The management strategy is based on the fact that a person trained by the company will connect his future career with this particular company.

An age-based wage growth curve constructed using data from the average Japanese firm peaks at 48-53-year-old workers and then falls off fairly quickly. The earnings of most Japanese workers after they reach 55 years of age hover around 80% of the level they reached during their professional maturity.

The main components of earnings are approximately the same as in Ukraine. The permanent part of the salary (about 65%) is guaranteed by the firm. It is supplemented by various surcharges, allowances, bonuses. Allowances are divided from the period of validity into annual and mobile, acting for a certain, sometimes long time. The allowances are divided: the first type - for professional excellence - is annually set by the heads of companies together with trade union organizations on the basis of periodically conducted certification. The second type of allowance is caused by the need to compensate for the increase in the cost of living. Their value is adjusted with a change in the price index in the country once a year, does not depend on personal labor contribution and applies to all employees of the company.

Wage issues in Japan are an integral element of the system of so-called lifetime employment, as well as the main subject of negotiations in the collective bargaining regulation of labor. The system of lifelong employment corresponds to a special system of remuneration, according to which the amount of monetary remuneration depends on the length of service at a given enterprise and merit in front of it, i.e. ultimately on the age of the worker. Being an integral part of the lifetime employment system, it provides for an annual automatic increase in the employee's earnings throughout his entire career, as well as career advancement according to the seniority status of the next applicant.

In the current conditions of the development of the capitalist cycle, the status of a permanent and temporary worker plays the role of a kind of labor pass to the labor market: during the period of decline and stagnation of production, temporary workers leave (mainly from large enterprises) and replenish the army of the unemployed, in the recovery phase they are “absorbed” into production again. Consequently, the status of a permanent or temporary worker is the most important stimulating factor in increasing labor productivity for workers of both categories, because the danger of losing the status of a permanent worker makes one who has to scrupulously follow the internal regulations, established labor standards, all instructions from the enterprise administration, and improve their skills. Temporary workers are only nominally such, in fact they work for many years in the same enterprise and do the same work as permanent ones. Their wages are approximately 40-50% of the wages of permanent workers.

The personal tariff rate as one of the components of the synthesized system is based on a combination of two parameters: the age and length of service of the employee. It is believed that the qualification of an employee increases with the accumulation of experience evenly throughout his working life. Therefore, the increase for seniority is the same throughout the entire age scale.

Age is measured differently. The entire age scale is divided into unequal intervals, which, according to Japanese experts, correspond to the needs of the worker at different periods of his life.

It has been proved that individual forms of remuneration, including piecework and piecework-time, are not combined with the use of new technology, since the final result of labor depends on the combined efforts of a group of workers. Therefore, in most industrial enterprises, a brigade form of labor organization is used, but the degree of autonomy of the teams and their structure in Japanese enterprises are different.

2) The practice of remuneration in Swedish enterprises

According to rough estimates, there are about a thousand different incentive systems in Swedish enterprises that provide for the participation of employees in the profits of the enterprise, up to 200 thousand employees are covered by such systems, but only 20% of Swedish enterprises have introduced a unified bonus procedure that involves remuneration of all employees. Other enterprises have developed such systems only for certain groups of personnel, usually representatives of management.

In Sweden, the operation of profit sharing systems is not determined by law, as in other countries, but by the regulation on taxation. The regulation provides for two types of bonus payments from profits: issued annually and "deferred", transferred to a bank account no earlier than five years later. Bonus deductions from profits are treated as part of income and are taxed.

In the second case, when the money is transferred to a bank account, they form a credit fund, which is put into circulation, most often to buy shares in the company itself. Thus, employees become its shareholders. Most Swedish companies prefer the system of deferred remuneration, because: a) in comparison with the annual bonus payments in this case, the tax is reduced by 10%; b) the system stimulates the constant interest of employees in the successful operation of the enterprise.

The remuneration of workers engaged in both manual and mechanized labor is made monthly. Bonuses are also paid for improving labor productivity and for individual achievements. Overtime at enterprises is paid as follows (SKF - the world's largest manufacturer of ball bearings - a multinational company): 25% surcharge - for the first 6 additional hours of work and 50% surcharge - for each subsequent hour. Also, at the enterprises of this company and some others, bonuses are paid in the form of compensation for excessive production noise in the shops and harmful working conditions.

3) Organization of wages in Italian enterprises

The state-monopoly policy of income and the strategy of the trade unions determine the general trends in the differentiation of wages and incomes in Italy.

The structure of wages in Italian enterprises is exceptionally fragmented. Salary includes, in addition to the industry wage rate, personal and collective bonuses to the rate, allowances in connection with the increase in the cost of living and for seniority, regular and irregular bonuses, piecework, “Christmas bonuses”, etc.

In official Italian statistics, the concepts of direct and indirect wages are used. The share of direct wages is 70-73%. Direct payment, in addition to permanent elements, includes temporary ones (bonuses and individual payments). Indirect wages consist of payments related to the result of work (annual bonuses) and elements that are part of "social payments".

Payments included in the salary structure are divided into contractual and non-contractual. Contractual payments are understood as all earnings fixed in collective agreements. Non-contractual payments (in the context of curbing the growth of contractual payments) will allow employers to withdraw wages from the control of trade unions. Largely due to non-contractual payments, the actual differentiation of wages is established, some advantages are provided to certain categories of workers.

Similar Documents

The essence and principles of wages in a market economy. Modern forms and systems of remuneration. Analysis of wages in LLC "Sigma", Kostroma. Analysis of the system of remuneration of workers. Improving the system of remuneration at the enterprise under study.

thesis, added 04/11/2012

Principles and methods of organizing wages at the enterprise, its forms and systems. Analysis of the wage fund and factors influencing the indicators of its effective use. Foreign experience in the organization of payment and material incentives for labor.

thesis, added 11/24/2010

Forms of remuneration and regulation of the system in the Republic of Belarus. Analysis of the level, trends and factors of growth in wages for workers of the SPK "Lyakhovichsky". Organization and ways to increase the stimulating role of wages in an agricultural enterprise.

thesis, added 15.02.2008

Theoretical foundations of personnel remuneration. Compensation of employees in the management system. Objective prerequisites for the creation of a wage system and the organization of wages at the enterprise. Improving the organization of wages in OJSC "OTP Bank".

thesis, added 06/17/2009

Analysis of activities of LLC UMTS "Splav", characteristics of the system for organizing the accounting of wages. The wage system as a necessary element of the organization of wages. Features of the methods of motivation of workers, the structure of the wage fund.

term paper, added 09/01/2012

Essence, forms and systems of remuneration. Problems of labor motivation in a market economy. Analysis of technical and economic indicators and analysis of the payroll fund and wages of CJSC "RMM". Proposals for improving wages in CJSC "RMM".

thesis, added 05/25/2010

Remuneration of personnel as an economic category. The main types of organization of remuneration at the enterprise: forms and systems. Directions for improving wages on the example of OOO "Lenat". Evaluation of the professional and qualification level of employees.

term paper, added 11/16/2010

The essence of the concepts of wages, wages as socio-economic categories. Analysis of the formation of the wage fund and the system of labor incentives at the enterprise, directions for their improvement. Foreign experience of wages and employment.

thesis, added 06/02/2015

Economic essence and forms of remuneration, foreign experience of its organization at the enterprise. Analysis of the use of the wage fund, factor analysis, analysis of the relationship between the growth rate of labor productivity and average wages.

thesis, added 11/17/2010

Economic nature and essence of wages. Functions and principles of organization of remuneration and labor incentives. Analysis of the structure, composition and use of the wage fund, the relationship between changes in average wages and labor productivity.

The analysis of the payroll fund is carried out according to the same plan as the analysis of other types of expenses: in comparison with the standard or planned value, or in comparison with the previous reporting or base period. With a pronounced seasonality in the activities of the enterprise, it will be useful to compare with the same period of previous years. In the analysis of data relating to the payroll and the use of working time, various index indicators are widely used.

The sources of information for analysis are the Plan for the economic and social development of the enterprise, statistical reporting on labor f.N1-T “Report on labor”, an appendix to f.N1-T “Report on the movement of labor force, jobs”, data from the time sheet and department frames.

Labor costs occupy a significant share in the cost of services rendered.

The formation of labor costs depends on the categories of workers, since the remuneration of workers is more influenced by the volume of services rendered (in case of piecework wages), or hours worked (in case of hourly wages). Employees are paid according to the established official salaries, that is, it is directly related to the volume of production.

In accordance with Table 4, we see that labor costs for LLCs are 26.7%.

Table 4 - Structure of costs in the cost price in%

The analysis of the use of the salary fund should be carried out according to a predetermined system. Its main stages in the enterprise are the following:

- - Selection, processing and systematization of the necessary reporting data and operational observation materials.

- - Analysis of accumulated materials.

- - Using the results of the analysis to develop and implement measures of operational impact on the practice of the enterprise and improve production efficiency.

- - The rational use of the wage fund is closely related to the correct organization of wages at the enterprise, depends on the degree of implementation of the production program and the state of the organization of production and labor, therefore, it is necessary that the analysis provides:

- - Verification of the compliance of the size of the use of the wage fund with the volume of the completed production program.

- - Checking the calculation of the implementation of the plan in terms of production volume as the basis for regulating the spending of the salary fund.

- - Determining the amount of savings or allowed overspending of this fund and the main areas of overspending.

- - A grouping of factors that determine the actual relationship between the growth of labor productivity and the growth of wages.

- - Development of specific organizational and technical measures arising from the entire material of the analysis.

For the purposes of analysis, it is necessary to select, process and systematize only such materials and data that make it possible to identify the degree of influence of certain factors (positive or negative) on the expenditure of the wage fund.

For a successful analysis, you need to have the following materials:

- - Reporting data (in comparison with the plan) on the volume of production, number of employees, labor productivity, average monthly (quarterly, annual) salary, payroll.

- - Reporting data (in comparison with the plan) on the use of the payroll fund for its constituent (structural) elements.

- - Data on the state of technical regulation at the enterprise.

- - Data on surcharges for deviation from normal working conditions for reasons.

- - Operational control materials characterizing the state of tariff discipline at the enterprise, and the correctness of the tariffing of works and workers.

- - Materials characterizing the legality of a number of payments and additional payments made during the reporting period.

- - Materials of operational control concerning the correctness of accounting for the production of workers, and so on.

- - The correctness of the conclusions of the analysis and its effectiveness depend on the comparability of the analyzed data.

Comparability of indicators in the analysis is especially important in the following cases:

- - When the actual implementation of the production program deviates from the plan for the assortment (by nomenclature), that is, when assortment shifts and the labor intensity associated with these changes are observed in the analyzed reporting period.

- - With the wrong method of wage planning in the enterprise.

- - When in the reporting period there is a significant revision of the norms, not reflected in the planned labor limits, or the calculated (tariff) rates have changed, etc.

On average in Russia, wages account for 25-30% of costs, and such a significant amount requires careful planning and performance monitoring.

It is not surprising that the question often arises: how to calculate? This article will discuss the methodology for calculating the wage fund.

Who calculates and how?

Responsibilities for the planning and control of the Wage Fund may be entrusted to different persons, depending on the size and organizational structure of the enterprise.

In small firms, this may be managed directly by the head or chief accountant.

With the expansion of production, it can go to the planning and economic department with the participation of a personnel specialist, control and execution will remain with the accounting department. How to calculate the wage fund correctly? Methods for calculating the wage fund may be different.

Analysis of the payroll should begin with determining its actual size. This can be done by calculating the fund for the past period. To do this, you need to summarize all its components, reflected in the financial statements.

The Labor Code of Russia assigns four components to the Payroll Fund: pay for hours worked, pay for time not worked, one-time incentive payments and payments for food, housing, fuel (read more about what is included in the payroll).

The pay for hours worked includes wages at time and piece rates, the cost of products issued as payment in kind, additional payments and allowances associated with processing, harmful working conditions. This also includes bonuses and other motivational payments of a regular nature.

Pay for hours not worked consists mainly of from payment for annual and additional holidays, study holidays, preferential hours for teenagers, payment for employee training, remuneration for employees involved in state or public duties. This also includes payments for forced downtime and absenteeism.

All payments of an irregular nature, such as compensation for unused vacation, additional vacation pay, material assistance, annual bonus and others, are taken into account as lump-sum incentive payments.

Payments for food, housing, fuel are the costs that the company incurs for arranging the life of employees: providing them with housing or rent compensation, reducing prices in the canteen, paying for gasoline.

All payments included in the Wage Fund, on account 70, the balance of which is reflected in the order journal No. 10. The wage fund for the past period is a debit turnover on account 70 for the same period.

To analyze the payroll, information can also be taken from statistical reporting forms No. P-4 “Information on the number, wages and movement of employees”, No. 1-T “Information on the number and wages of employees by type of activity”.

To simplify the analytical work at the enterprise, operations on account 70 can be summarized in a summary sheet.

What factors need to be considered?

When analyzing the payroll for periods affected by one of these factors, the estimates must be adjusted in accordance with them.

If the payroll is calculated for a period when changes in one of these factors are planned, it is also necessary to make adjustments to the calculations. And now let's try to figure out in more detail how to find the wage fund and how to calculate it

The types of wage fund and wages are described in.

Planned payroll

The planned payroll at the enterprise can be calculated in general or in detail. It depends on the planning horizon, the depth of the analytical material and the planning stages.

The planned payroll at the enterprise can be calculated in general or in detail. It depends on the planning horizon, the depth of the analytical material and the planning stages.

In a generalized form, the payroll can be calculated based on several approaches.

Wage Fund, the calculation formula based on the wage rate per unit of output The payroll is calculated, according to the production plan.

Calculation of the planned payroll fund:

FOTpl \u003d Q x Nz.pl.,

Where Q is the planned volume of production,

Nz.pl. - The rate of wages per unit of output.

In the production of products with different Nz.pl. this indicator can be taken on average, or the payroll can be calculated for the production of each item, and then add up the results. The higher the share of piecework workers in the enterprise, the more accurate this forecast will be.

Payroll index, formula: based on the indices of changes in wages and labor productivity, the payroll is calculated, based on their ratio:

FOTpl \u003d FOTbase x (Iz.pl. / Ip.tr.),

Where FOTbase is the actual payroll in the past period,

Iz.pl. - the planned increase in the average salary for the enterprise in fractions of a unit,

Ip.tr. - the planned growth of labor productivity in fractions of a unit.

Based on the payroll growth rate for each percentage of production growth. In terms of economic meaning, this calculation of the payroll fund at the enterprise is close to the first method, but here the features of the change in the payroll at the enterprise are taken into account, because. not all payments depend on the volume of production:

FOTpl \u003d FOTbase + FOTbase x (Np.z.pl x Iq),

where Np.z.pl. is the rate of increase in wages for each percentage increase in output,

Iq - coefficient of increase in production volumes, taken in percentage points.

Based on the projected number of workers and the level of their wages, it is effective for enterprises with a large share of temporary or fixed salary workers. The payroll level formula in this case is:

FOTpl \u003d Chsp x ZP,

Where Nsp is the planned number of employees,

ZP - the planned level of wages for the period.

After a generalized calculation of the payroll, a more accurate forecast can be made by calculating it by elements. For this, the tariff fund is calculated, which is enlarged to an hourly (daily, monthly,). The general and additional payroll are considered separately.

Tariff

How to determine the wage fund by the element-by-element method? The method is fundamental here: the payroll is calculated separately for hours worked for workers with piecework and hourly wages.

Initially, the tariff payroll is calculated - this is the amount of payments for work within an hour, excluding additional payments.

For employees whose pay depends on the amount of work performed (the so-called pieceworkers), the tariff payroll may be determined on the basis of standard output or on the basis of a production plan.

If this is how the labor of workers employed in different industries is paid, the payroll is considered for each type of work separately(you can combine works with the same cost). Tariff wage fund, formula:

FOTsd \u003d Tst x Fv x Chsd x Knv,

where Tst is the rate at the rate per unit of work

Frv - working time fund for the period

Chsd - the number of piecework workers

Knv - output coefficient

Based on the fact that the existing employees in the allotted time in the normative labor productivity must complete the planned amount of work, simplify the formula:

FOTsd \u003d Tst x Qplan,

where Qplan is the planned scope of work.

This formula has something in common with the generalized calculation form, however, with an accurate calculation, it applies only to workers with piecework wages. The tariff payroll acts as an integral indicator, which sums up the planned payments to all employees.

Employees with hourly wages receive wages in accordance with the tariff rates established by the enterprise. It is easy to calculate payroll for employees with the same wage rate according to the general formula:

FOTpv \u003d Tst x Fv x Chpv,

Here Tst means the hourly rate,

NPV is the number of employees with this rate.

The planned payroll for workers consists not only of the tariff fund, it includes various additional payments to the payroll, depending on its scale. Their volumes depend on the characteristics of a particular production.

The payroll fund for engineers, specialists, managers and security personnel who receive fixed salaries is the sum of the products of the average salary for the group and the number of employees.

Hourly

The hourly payroll is not limited to the tariff fund. To encourage employees for high performance, or by virtue of legislation, an enterprise may increase payments compared to tariffs.

In addition to the tariff, the hourly pay includes all additional payments for hours worked. They include surcharges for night work, work on weekends and holidays, as well as hazardous production, these requirements are established by the Labor Code of the Russian Federation. Most often, such payments are predictable.

It also includes payments related to the form of remuneration. The bonus payment system can be applied to both “piecework” and “time-workers”: for quality work, they are given a bonus as a percentage of their salary or a fixed amount.

Piecework workers can also be on piecework-progressive pay, when results are additionally paid in excess of the norm. Such results can be predicted based on the statistics of past periods, their planned payment is included in the hourly payroll.

General

The general payroll, or wages, is the full amount of payments to employees for hours worked.

The total Wage Fund will be equal to the sum of the tariff funds and all allowances and payments, it, of course, includes the payroll of employees who receive a salary.

Basic payroll formula:

PHOT = PHOTsr + PHOTpv + PHOTokl + Allowances

Additional

Analyzing the structure of payments, already at the level of one day, you can notice payments for the time that the employee does not work.

Analyzing the structure of payments, already at the level of one day, you can notice payments for the time that the employee does not work.

Within a shift, these breaks include breastfeeding breaks for mothers, as well as work-related grace hours for teens.

The most notable example of such payments would be vacation pay., which clearly stand out at the level of the average monthly and annual Wage Fund.

In addition to the next vacation and additional vacation, they include non-outputs related to the training of the employee, the fulfillment of “third-party” duties, for example, state ones. This also includes severance pay.

Payment for hours not worked forms an additional wage fund. Currently, its planning is often neglected, setting it conditionally in the amount of a certain share of the total payroll. Although, payroll planning is important, so you need to know how to calculate it.

In the literature, it is often planned to accept an additional payroll from 13% to 20% of the main one.

During the Soviet planned economy, a methodology was developed for calculating the additional wage fund, based on the calculation of the percentage of additional wages (%zp). Additional Wage Fund, formula:

%dp = (1 + D/100) x (b - bbol) / (100 - b)

where D - additional payments for deviation from normal working conditions (work on weekends, at night, harmful conditions),

b is the predicted percentage of absenteeism,

bbol is the percentage of absenteeism due to illness.

Sick leave is subtracted from this formula because it is paid by the Social Security Fund and does not fall into the cost structure of the business.

Taking into account the additional Wage Fund, all costs for payments to employees of the enterprise will amount to:

PHOT \u003d (PHOTav + PHOTpv + PHOTokl + Surcharges) x (1 +% dzp / 100%).

How are savings and overruns calculated?

At the end of the period, the economist has the opportunity to compare the planned size of the payroll with real payments. This must be done to assess the quality of planning, management, the economic condition of the enterprise, as well as to correct new forecasts and. Therefore, the calculation of savings in the wage fund is carried out.

Payroll savings formula:

The absolute deviation of payroll is an arithmetic comparison of two values, actual and planned:

∆FOTabs = FOTpl – FOTfact,

Where ∆FOTabs is the absolute deviation of the dimensions of the FOT,

FOTpl is the forecast volume of the FOT, calculated by one of the methods presented above

Payroll fact - the actual amount of payroll arising from management reporting.

A positive value of the deviation is called savings, a negative value is called overspending. But these values may indicate a failure to fulfill the production plan, so absolute savings will not always be an indicator that positively characterizes the work of the enterprise.

How to find out the relative deviation of the dimensions?

The relative deviation of the size of the Wage Fund makes it possible to assess the impact of savings or overspending on the payroll on the activities of the enterprise due to the connection with the production plan.

The relative deviation of the payroll, the formula is calculated in a similar way to adjusting the actual figure for the production plan performance ratio. But only part of the payroll associated with variable wages is adjusted.

∆PHOTotn \u003d PHOTOplan - (PHOTOsd.fact x Ipr.plan + FOTpv.fact),

where payroll pv.fact includes payment funds for both time workers and salaried workers.

The new value shows the relative savings or relative overspending of the Payroll.

How to calculate profitability?