Introduction

1. Brief description of the Tyumen State University of Architecture and Civil Engineering

1.1. Basic information about the object under study

1.2. The inner sphere of the object under study

2. Analysis of the balance sheet of the budget executor of the main manager, recipient of budget funds

2.1. General assessment of the structure of the organization's property and its sources according to the analytical balance sheet

2.2. Estimation of the property status of a budgetary institution according to the balance of budget execution using the main financial ratios

3. Analysis of the report on the financial results of the activities of the State Educational Institution of Higher Professional Education "Tyumen State University of Architecture and Civil Engineering

4. Analysis of the report on the execution of the budget of the main manager, recipient of funds

Conclusion

List of used literature

Applications

Introduction

Analysis literally means dismemberment, decomposition of the object under study into parts, elements, into components inherent in this object. In any branch of scientific knowledge, in any sphere of human activity, it is impossible to do without. But analysis has acquired special significance in economics. Analysis of the economy, analysis of economic activity and its final results (in all sectors, in all manifestations) is an area of exclusively economic analysis.

In the course of economic analysis, economic processes are studied in their interconnection, interdependence and interdependence. Establishing the relationship, interdependence and interdependence is the most important point in the analysis. Causality mediates all economic facts, phenomena, situations, processes. In the process of analysis, not only the main factors influencing economic activity are revealed and characterized, but also the degree of their action is measured.

This course work presents an analysis of the financial and economic activities of the GOU VPO "Tyumen State University of Architecture and Civil Engineering". In the course of the analysis, it is necessary to give a general description of the financial and economic activities of the enterprise.

The purpose of the course work is to analyze the financial statements of the State Educational Institution of Higher Professional Education "Tyumen State University of Architecture and Civil Engineering" for the period 2005-2007.

Objectives of the course work:

1) give a brief description of the Tyumen State University of Architecture and Civil Engineering;

2) evaluate the structure of the organization's property and its sources according to the analytical balance sheet;

3) assess the financial position of a budgetary institution according to the balance of budget execution using the main financial ratios;

4) to analyze the report on the financial results of the activities of the State Educational Institution of Higher Professional Education “Tyumen State University of Architecture and Civil Engineering;

5) analyze the report on the execution of the budget of the main manager, recipient of funds.

The sources of analysis are the forms of annual financial statements.

1. Brief description of the Tyumen State University of Architecture and Civil Engineering

1.1. Basic information about the object under study

Full name: State educational institution of higher professional education "Tyumen State University of Architecture and Civil Engineering".

Legal and actual address: Tyumen, st. Lunacharsky, d. 2.

The history of the Tyumen State University of Architecture and Civil Engineering, one of the largest universities in the region, begins in 1971, when the leadership of the Tyumen region came up with a proposal to create an independent university on the basis of the construction department of the Tyumen Industrial Institute - the Tyumen Civil Engineering Institute. In the same year, the first enrollment of students took place. A little more than a thousand people studied at the two faculties of the university in 4 specialties. The institute is located in one of the most beautiful buildings in the city - an architectural monument of the 10th and 9th centuries. Candidate of Technical Sciences, Associate Professor M.V.Maltsev was approved as the first rector of the university. He gathered a team of like-minded people, real devotees of higher education, talented scientists from Tomsk, Omsk, Novosibirsk, Leningrad, who managed to organize the work of the institute in a short time.

Since 1993, the rector has been a 1973 Tyumen Institute of Institute graduate, Doctor of Technical Sciences, Professor Viktor Mikhailovich Chikishev. Teachers and graduates of the university took part in the development of the West Siberian oil and gas complex: creating infrastructure for oil and gas fields, designing and building cities and towns, laying roads and oil and gas pipelines in the Tyumen region. The second step in the development of the university was the assignment of the status of an academy in 1995. For more than 20 years of development, a professional teaching staff has been formed, which has become the scientific center of the regional construction complex, capable of solving complex engineering problems. A rational management system, the rapid pace of development of the material and technical base, the opening of new specialties that are in demand by the time, determined the future prospects of the university. By order of the Federal Agency for Education on August 5, 2005, the Academy of Architecture and Civil Engineering was renamed into the Tyumen State University of Architecture and Civil Engineering.

At the disposal of students and teachers of the university - 6 educational and laboratory buildings; a scientific library with over 380 thousand copies of publications of scientific, normative-instructive and fiction literature; two gyms, a sports and recreation complex with an area of 14 thousand square meters. m with a unique for the region swimming pool that meets international standards, gyms and an assembly hall for 450 seats; canteen building; 3 hostels. Established 18 multimedia classes, two experimental laboratories.

The computer park of the university is almost a thousand units, of which 750 are connected to a local network and have the ability to access the Internet. The concept of building the potential of our own educational innovative resources in the form of automated electronic educational and methodological complexes for the disciplines of the curriculum is being implemented.

TyumGASU is one of the founders and publisher of the scientific and technical journal "Construction Bulletin of the Tyumen Region". The progressive development of the university became possible thanks to the attraction of investments. In 1995, in the most difficult period of "survival" of universities, the Board of Trustees (TyumGASU Development Fund) was created. Vladimir Nikolayevich Nikiforov, Director General of OAO ZapSibGazprom, was elected as the first chairman.

The Council assists in providing the educational process with the latest laboratory equipment, educational and methodological literature, video products, in the publication of books and monographs, solves the problems of scientific and technological research, and social issues. Significant financial resources are directed to capital construction, reconstruction and repair.

Trustees give students the opportunity to do work experience at enterprises and construction sites, provide jobs for young professionals, participate in the educational process, are part of the SAC and evaluate the knowledge of graduates by reviewing diploma projects. The Foundation annually allocates 30 nominal scholarships to the best students of the university. Currently, the Fund includes more than 100 large organizations and enterprises interested in improving the quality of training of young professionals.

The University of Architecture and Civil Engineering today is 12 thousand students, over 500 teachers, more than 60% of whom have academic degrees. The general management of the university is carried out by an elected representative body - the academic council, headed by the rector. TyumGASU is the only university in the Tyumen region that trains civil engineers with higher education.

There are 5 faculties, 33 departments in the structure of the university.

The road department trains engineers in the specialties "Automobile roads and airfields" (specializations "Automobile roads" and "Organization and management in the road sector"), "Urban cadastre", "Land cadastre", "Land management". The faculty has 7 departments: construction and operation, roads, road design, land management and cadastre, structural mechanics, geodesy and photogrammetry, humanities and social sciences, physical education.

The Faculty of Architecture and Construction provides training in the specialties "Industrial and civil construction", "Urban construction and economy", "Architecture", "Design of the architectural environment", "Production of building materials, products and structures", "Expertise and real estate management". The basic areas are supplemented by a number of specializations: “Examination of the technical condition, reconstruction, repair and operation of buildings and structures”, “Computer-aided design systems”, “Economics and management in construction”, “Agricultural and farm construction”, “Municipal economy”.

The Faculty of Engineering Networks and Structures graduates specialists in “Water supply and sanitation”, “Heat and gas supply and ventilation”, “Industrial thermal power engineering”, “Environmental protection and rational use of natural resources”, “Safety of technological processes and production”. In addition to the graduating departments, the faculty includes two general education departments: general and special physics and chemistry.

With the organization of the Faculty of Economics and Management at the university, work is underway to diversify economic education in the following specialties: "Accounting, analysis and audit", "Economics and management at an enterprise (in construction)", "Economics and management at an enterprise (in urban economy)" , "State and municipal administration", "Management of the organization", "Commerce (trade business)", "Personnel management", "Marketing", "Socio-cultural service and tourism", "Information systems and technologies".

The Faculty of Correspondence Education trains engineers in 13 specialties. In addition to the standard form of education for students with incomplete higher and secondary specialized education, an accelerated form is used.

The university has a number of self-supporting centers, whose activities are aimed at obtaining additional education for specialists in the construction industry, as well as for realizing the scientific and creative potential of university teachers and staff.

This is the Center for retraining, advanced training and consulting; Territorial expert base center; Institute for Professional Training of Municipal Personnel; Center for pre-university training; Industry regional base center for labor protection and environmental safety, etc. To provide the Siberian region with qualified personnel, 4 branches of TyumGASU were opened in the cities of Tobolsk, Nadym, Muravlenko, Labytnangi and 10 representative offices (Pokachi, Urai, Novy Urengoy, Noyabrsk, Nefteyugansk, Ishim, Lyantor , Surgut, Nizhnevartovsk, Kurgan). Branches of the university train specialists taking into account the needs for professionals, carry out retraining and advanced training of teachers and specialists employed in the construction, oil, gas and other industries. Graduate students and applicants are trained at the departments of the university.

10 doctoral dissertations have been prepared in the doctoral program, open in five main specialties. The works of dissertators are devoted to the study and solution of topical issues in the construction of buildings and structures in relation to the conditions of Western Siberia. Every year, the university holds scientific conferences for students, graduate students, young scientists and teachers. On the basis of the Department of Physical Education, a sports and recreation center was created, whose activities are aimed at improving the health of students, teachers and employees. The combined teams of the university in various sports successfully perform at regional and all-Russian competitions.

In March 2007, the Zodchiy sports complex opened its doors to everyone. Extracurricular and educational work at the university is complex. There are 9 student associations on a permanent basis: the trade union committee, the artistic council; hostel council; editorial office of the StroyAk magazine; intelligence club; rescue squad "Adrenaline"; command staff of the MTR headquarters, uniting students from 18 universities and colleges of the Tyumen region; law enforcement detachment, pedagogical detachment.

The holidays “Initiation into Students”, “Freshman Debut”, a rally of student activists, sports and tourist competitions, and the “Student Spring” festival have already become traditional. The Job Fair, which is held twice a year, has gained great popularity in construction organizations.

In the Tyumen region, the volume of industrial and civil construction is constantly growing. Civil engineers are in demand in design, construction and maintenance enterprises of the construction complex. The active participation of TyumGASU in the rapid development of the West Siberian region is determined by the need of the oil and gas industry for new technologies and innovative projects, due to harsh climatic conditions, the most difficult engineering and geological conditions, vast spaces and underdeveloped infrastructure. Therefore, scientific schools have been created and are successfully functioning at the university, solving a number of the most important problems of the region, namely:

– development of new, lightweight, prefabricated buildings with minimal weight, excellent transportability and high installation characteristics;

– research in the field of thermal physics of freezing soils, theoretical and experimental studies of the applicability of new soil models;

– development of new types of foundations aimed at the construction of various structures in complex engineering and geological conditions in the north of Western Siberia;

– development of resource-saving technologies for construction and operation, roads and airfields in Western Siberia;

– solving the problems of water treatment, wastewater treatment, laying and operation of engineering communications;

– a solution for the integrated use and environmental monitoring of natural resources in Western Siberia.

The main task of the university is to provide training and retraining of innovative-minded and highly qualified specialists. This is possible with the integration of education, science and production. For 37 years, the university has trained about 25 thousand specialists who work in all corners of our country.

More than 80% of graduates work in the Tyumen region. The University is rightly proud of its graduates. Within its walls, talented scientists have grown up who have earned the recognition of Russian and foreign colleagues; it has become a launching pad for highly qualified specialists, heads of enterprises and organizations of the Tyumen region, and representatives of various levels of government.

1.2. The inner sphere of the object under study

The internal environment of an educational institution consists of an educational structure.

Educational structure - in Figure 1.1.

2. Analysis of the balance sheet of the budget executor of the main manager, recipient of budget funds

2.1 General assessment of the structure of the organization's property and its sources according to the analytical balance sheet

Of all the forms of financial statements, the most important is the balance sheet. The balance sheet characterizes in monetary terms the financial position of the organization as of the reporting date. The balance characterizes the state of inventories, settlements, the availability of funds, investments.

The budget execution balance of the main manager (manager), recipient of budget funds (f. 0503130) is made up of recipients of budget funds:

Chief administrators;

Stewards;

Recipients.

The balance sheet consists of four sections:

Two sections of the asset (Non-financial assets and Financial assets);

Two sections of liability (Liabilities and Financial Result).

It is filled in according to the balances of funds in the budget accounting accounts in the context of budget funds (columns 3, 6), extra-budgetary funds (columns 4, 7) and the final indicator (columns 5, 8) at the beginning of the year and the end of the reporting period.

It is possible to study the structure and dynamics of the financial condition of an enterprise using a comparative analytical balance sheet. The comparative analytical balance sheet is obtained from the original balance sheet by supplementing it with indicators of the structure, dynamics and structural dynamics of investments and sources of funds of the enterprise for the reporting period.

The comparative analytical balance brings together and systematizes those calculations that any analyst performs during the initial acquaintance with the balance sheet. The comparative balance scheme covers many important indicators that characterize the statics and dynamics of the financial condition. The comparative balance actually includes indicators of horizontal and vertical analysis.

The analysis of assets, liabilities and capital of budgetary funds was carried out according to the Balance sheet of the budget executor of the main manager, recipient of budget funds (form No. 130) (Appendix No. 1-3) by compiling a comparative analytical balance sheet (Table 2.1.).

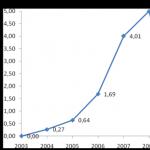

More clearly, the dynamics of assets and liabilities of the budgetary funds of GOU VPO TGASU for 2005-2007. shown in Figure 2.1.

|

||

|

||

|

|

|

|

The analysis of assets, liabilities and capital of non-budgetary funds of the Tyumen University of Architecture and Civil Engineering was carried out according to the Balance of the budget executor of the main manager, recipient of budget funds (form No. 130) (Appendix No. 1) by compiling a comparative analytical balance sheet (Table 2.2).

More clearly, the dynamics of assets and liabilities of non-budgetary funds of GOU VPO TGASU for 2005-2007. shown in Figure 2.8.

A more visual analysis of the structure of assets and liabilities of the budgetary funds of GOU VPO TGASU in 2005-2007. shown in figures 2.9, 2.10, 2.11, 2.12, 2.13, 2.14.

|

|

|

|

|

|

From the obtained table 2.1 and figure 2.1, the following changes are observed in the assets of the budgetary funds of the GOU VPO TGASU:

1) Non-financial assets of the institution in the period under review (2005-2007) in 2006 compared to 2007 increased by 15.36%, in 2007 compared to 2006. they increased by 94583231.32 rubles, which amounted to 128.67%.

The largest increase in non-financial assets in 2006 occurred in terms of the cost of investments in fixed assets: by 43,000,000.00 rubles. or by 70.15%, the cost of inventories, on the contrary, reduced the growth of non-financial assets by 1432.00 rubles. or 6.35%.

In 2007 non-financial assets increased in terms of the value of fixed assets (by 193890982.32 rubles or by 86.00%) and decreased in terms of investments in fixed assets (by 99300000.00 rubles, which amounted to 4.79%).

2) In general, the value of financial assets increased: in 2006 by 57,427.00 rubles, which amounted to 130.15%, mainly due to an increase in settlements on advances issued by 179,400.00 rubles, the cost of funds decreased by 121,973.00 rubles. (at 100%).

In 2007, the value of financial assets decreased by 131,909.86 rubles. or by 53.21%. The negative point is the increase in settlements for shortages: by 25,896.14 rubles, which amounted to 137.80%.

3) Liabilities of the institution in 2006 compared to 2005 increased by 4,425,840.95 rubles, which amounted to 221.88%. This growth was mainly due to the growth of arrears in payments to the budgets by 3,455,687.98 rubles. and reducing the debt of suppliers to the institution under study by 970152.98.

4) In 2007 liabilities decreased by 601,282.78 rubles. (or by 19.71%). This decrease was due to a decrease in debt to the budget by 957,664.00 rubles. (which amounted to 72.29%), and reducing the debt of suppliers to GOU VPO TGASU by 356,381.21 rubles, which indicates that the institution strictly implements financial and accounting discipline.

5) There is a positive trend in the change in the financial result: in 2006, an increase of 39,548,073.87 rubles. (or by 13.76%), in 2007 by 95052604.24 rubles. (or by 29.07%).

According to the results of the vertical analysis of the balance sheet in terms of budgetary funds (table 2.2 and figures 2.2 - 2.7), it can be said that in 2005 non-financial assets occupied the largest part in the structure of the asset balance throughout the analyzed period: in 2005 - 99.93 %, in 2006 - 99.92% and in 2007 - 99.97%. The largest share is occupied by the cost of fixed assets: in 2005 - 78.50%, in 2006 - 68.31% and in 2007 - 98.79%.

In the liabilities side of the balance sheet, a large share is occupied by the financial result: in 2005 - 100.48%, in 2006 - 99.08% and in 2007 - 99.42%.

From the obtained table 2.2 and figure 2.8, the following changes are observed in the assets of extrabudgetary funds of the GOU VPO TGASU:

1) Non-financial assets of the institution in the period under review (2005-2007) in 2006 compared to 2007 increased by 56.61% in 2007. compared to 2006 they increased by 180320083.58 rubles, which amounted to 143.22%.

The largest increase in non-financial assets in 2006 occurred in terms of the cost of investments in fixed assets: by 13,3099,195.44 rubles. or by 73.53%, inventories by 4770566.98 rubles. or by 42.66%.

In 2007 non-financial assets increased in terms of the value of fixed assets (by 379374421.95 rubles or 435.42%) and decreased in terms of investments in fixed assets (by 198041911.56 rubles, which amounted to 36.95%).

2) In general, the value of financial assets decreased: in 2006 by 22973055.01 rubles, or by 27.35%, mainly due to settlements with income debtors by 51685449.74 rubles, the value of cash increased by 26697872, 89 rub. (by 87.46%).

In 2007, the value of financial assets decreased by 10,259,475.99 rubles. or 9.59%. A positive aspect is the decrease in settlements for shortages: by 33,644.06 rubles, or by 13.62%.

3) Commitment of the institution in 2006 decreased by 100,998,598.70 rubles, or 364.33%, compared to 2005, mainly due to a decrease in debt on settlements with suppliers and contractors by 10,1160,674.79 rubles.

4) In 2007, liabilities increased by 139,104,326.23 rubles. (or 91.93%). This increase was due to the debt on settlements with suppliers and contractors by 144259040.73 rubles. (which amounted to 89.33%).

5) There is a positive trend in the change in the financial result: in 2006, an increase of 228830511.20 rubles. (or by 108.91%), in 2007 by 30956281.36 rubles. (or by 7.05%).

Based on the results of the vertical analysis of the balance sheet in terms of budgetary funds (table 2.1 and figures 2.2 - 2.7), it can be said that in 2005 non-financial assets occupied the largest part in the asset balance structure throughout the entire analyzed period: in 2005 - 146.05 %, in 2006 - 134.48% and in 2007 - 124.41%. The largest share is occupied by investments in non-financial assets: in 2005 - 99.24%, in 2006 - 101.25%.

In the liabilities side of the balance sheet, a large share is occupied by the financial result: in 2005. - 115.20%, in 2006 - 141.49% and in 2007 - 97.84%.

2.2 Estimation of the property status of a budgetary institution according to the balance sheet of budget execution using the main financial ratios

Budget reporting is a system of indicators reflecting the property and financial position of an institution as of the reporting date, as well as the financial results of the institution's activities and budget execution for the reporting period.

The main purpose of budgetary (financial) reporting is to control the use of budgetary allocations and the legality of the use of extrabudgetary funds.

The results of calculating the main financial ratios for assessing the property status of a budgetary institution according to the balance of budget execution (budgetary and extrabudgetary funds) are summarized in tables 2.3 and 2.4.

Table 2.3

Assessment of the property status of a budgetary institution according to the balance of budget execution (budgetary funds) using the main financial ratios

| Financial ratio | Calculation formula | 2005 year | 2006 | Absolute change | 2007 | Absolute change |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Property dynamics | 1,045 | 1,156 | 0,111 | 1,008 | - 0,148 | |

| 0,789 | 0,684 | - 0,105 | 0,988 | 0,305 | ||

| The share of fixed assets in the NFA | 0,789 | 0,684 | - 0,105 | 0,988 | 0,305 | |

| 0,00004 | 0,0001 | 0,00002 | 0,00003 | -0,00003 | ||

| 0,214 | 0,316 | 0,102 | 0,012 | - 0304 | ||

| 1 | 1 | 0 | 0,012 | - 0,988 | ||

| 0,640 | 0 | - 0,640 | 0 | 0 | ||

| 0,058 | 0,078 | 0,021 | 1 | 0,921 | ||

| Share of subsidiaries in financial assets | 0,360 | 1 | 0,640 | 1 | 0 | |

| Share of NFA in total assets | 0,786 | 0,684 | - 0,102 | 0,988 | 0,305 |

Table 2.4

Assessment of the property status of a budgetary institution according to the balance of budget execution (extrabudgetary funds) using the main financial ratios

| Financial ratio | Calculation formula | 2005 year | 2006 | Absolute change | 2007 | Absolute change |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Property dynamics | 1,365 | 1,566 | 0,201 | 1,372 | -0,194 | |

| The share of non-current non-current non-current assets in the composition of property | 0,290 | 0,209 | -0,081 | 0,781 | 0,572 | |

| The share of fixed assets in the NFA | 0,789 | 0,209 | -0,580 | 0,781 | 0,572 | |

| The share of current NFA in the composition of property | 0,031 | 0,038 | 0,008 | 0,025 | -0,013 | |

| Share of construction in progress in NFA | 0,420 | 0,578 | 0,158 | 0,028 | -0,550 | |

| Share of real NFAs in property | 1,000 | 1,000 | 0,000 | 1,000 | 0,000 | |

| Share of DC and financial investments in financial assets | 0,840 | 0,909 | 0,069 | 1,110 | 0,201 | |

| The share of inventories in current assets | 0,089 | 0,130 | 0,041 | 0,113 | -0,017 |

More clearly the dynamics of the main financial ratios for 2005-2007. shown in Figures 2.15, 2.16.

From the obtained table 2.3 and figure 2.15, the following changes are observed in the main financial ratios of the property status of the budgetary funds of the GOU VPO TGASU:

1) Financial ratio of property dynamics in the period under review (2005-2007) in 2006 compared to 2005 increased by 0.111; in 2007 compared to 2006 it decreased by 0.148.

2) In 2007 Compared to 2006, the share of non-current NFAs in property and the share of fixed assets in NFAs increased by 0.305.

3) Share of inventories in current assets in 2006 compared to 2005 increased by 0.021; in 2007 compared to 2006 they increased by 0.921. This increase was due to the growth of the material and technical base of the institution.

4) A positive moment is the increase in the share of NFA in 2007. compared to 2006 by 0.305.

Based on the results of the assessment of the property status in terms of budgetary funds (Table 2.3 and Figure 2.15), we can say that a stable financial ratio in 2005-2007. occupies the share of fixed assets in the NFA and the share of non-current NFA in the property: in 2005 - 0.789; in 2006 - 0.684, in 2007 - 0.988.

From the obtained table 2.4 and figure 2.16, the following changes in the main financial ratios of the property status for extra-budgetary funds of GOU VPO TGASU are observed:

1) Financial ratio of property dynamics in the period under review (2005-2007) in 2006 compared to 2005 increased by 0.201; in 2007 compared to 2006 it decreased by 0.194.

2) In 2007 Compared to 2006, the share of non-current NFA in the composition of property decreased by 0.081, in 2007 compared to 2006 it increased by 0.572.

3) The share of fixed assets in the NFA in 2006 compared to 2005 decreased by 0.580; in 2007 compared to 2006 they increased by 0.572.

4) A positive moment is the increase in the share of DS and financial investments in financial assets in 2006. compared to 2005 by 0.069 in 2007 compared to 2006 by 0.201, which indicates the financial stability of the institution.

There is an increase in the share of DE in financial assets in 2007 compared to 2006. by 0.574.

Based on the results of the assessment of the property status in terms of extrabudgetary funds (Table 2.4 and race 2.16), we can say that a stable financial ratio in 2005-2007. occupies the share of fixed assets in the NFA: in 2006 - 0.209; in 2007 - 0.781. The largest share is occupied by CA and financial investments: in 2005 - 0.840, in 2006 - 0.909, in 2007 - 1.110.

3. Analysis of the report on the financial results of the activities of the State Educational Institution of Higher Professional Education "Tyumen State University of Architecture and Civil Engineering"

Starting from 01.01.2006, the determination of the value of all income and expenses, including budgetary activities, is carried out on an accrual basis. Previously, all budgetary institutions worked on a cash basis. The transition to the accrual method is due to the Concept of reforming the budget process in the Russian Federation in 2004-2006, approved by the Decree of the Government of the Russian Federation of May 22, 2004 3249 "On measures to improve the effectiveness of budget expenditures."

The purpose of the adoption of the Concept is to create conditions and prerequisites for the most efficient management of public finances in accordance with the priorities of state policy and international experience. At the same time, the maximum effect of management is expressed in the effectiveness of budget expenditures.

To improve performance, it is necessary at least to have information about the magnitude of this performance, which is made up of the results of the activities of each of the budgetary institutions.

Therefore, budgetary institutions must quarterly determine the result of their financial activities and reflect in the reporting: in the Report on financial performance (form 0503121), which is formed in the context of budgetary and extrabudgetary activities.

The main sources of information in the analysis of income and expenses for budgetary and extrabudgetary activities of the State Educational Institution of Higher Professional Education "Tyumen State University of Architecture and Civil Engineering" are the Financial Performance Reports (form 0503121) for 2005-2007. (Appendices 4-6).

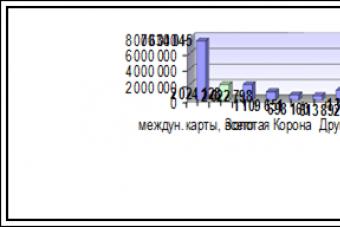

Analysis of the report on the financial results of the budgetary activities of the GOU VPO TGASU is presented in table 3.1. For clarity, the dynamics of the types of expenditures for budget activities is shown in Figure 3.1. Structure of expenditures on budgetary activities in 2005-2007 shown in Figures 3.2-3.4.

Analysis of the report on the financial results of extrabudgetary (entrepreneurial) activities of GOU VPO TGASU is presented in table 3.2. For clarity, the dynamics of types of income from extrabudgetary activities is shown in Figure 3.2, and expenditures from extrabudgetary activities are shown in Figure 3.5. Structure of expenses and incomes on extrabudgetary activities in 2005-2007 shown in Figures 3.6-3.11.

|

|

||

|

||

|

|

|

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

From the obtained table 3.1 and figure 3.1, the following changes are observed in the dynamics of expenditures on the budgetary activities of the GOU VPO TGASU:

1) Remuneration of labor and accruals for the payment of the institution in the period under review (2005-2007) in 2006 compared to 2005 increased by 14,048,459, which amounted to 26.024%; compared to 2006 they increased by 22486400 rubles, which amounted to 33.053%.

From the obtained table 3.1 and figure 3.2, the following changes are observed in the structure of expenditures on the budgetary activities of GOU VPO TGASU in 2005:

Payroll and payroll expenses account for 48.36%, other expenses - 26.36%, purchase of services - 17.68%, expenses for asset transactions - 6.31, social security - 1.29% in total cost structure.

From the obtained table 3.1 and figure 3.3, the following changes are observed in the structure of expenditures for the budgetary activities of the GOU VPO TGASU in 2006:

Labor costs and accruals for wages account for 48.92%, other expenses - 24.73%, purchase of services - 20.15%, expenses for operations with assets - 4.63, social security - 1.58% in total cost structure.

From the obtained table 3.1 and figure 3.4, the following changes are observed in the structure of expenditures for the budgetary activities of the GOU VPO TGASU in 2007:

Payroll and payroll expenses account for 55.10%, other expenses - 21.00%, purchase of services - 15.61%, expenses for asset transactions - 6.36, social security - 1.93% in total cost structure

From the obtained table 3.2 and figure 3.5, the following changes are observed in the dynamics of income and expenses for extrabudgetary activities of the GOU VPO TGASU:

2) There is a positive trend in income from market sales of goods, works, services: in 2006 growth by 58686287.43 rubles or (by 21.44%), in 2007 growth by 46891982.14 rubles or by (14.10%) .

From the obtained table 3.2 and figure 3.6, the following changes are observed in the structure of income from extrabudgetary activities of GOU VPO TGASU in 2005:

Income from market sales of goods, works, services is 69.20%, gratuitous and irrevocable receipts from budgets - 29.44%, other income - 0.91%, property income - 0.35%, income from operations with assets - 0.11% in the total income structure.

From the obtained table 3.2 and figure 3.7, the following structure of income from extrabudgetary activities of GOU VPO TGASU in 2006 is observed:

Incomes from market sales of goods, works, services account for 57.19%, gratuitous and irrevocable receipts from budgets - 41.69%, other income - 1.12 in the total income structure.

From the obtained table 3.2 and figure 3.8, the following structure of income from extrabudgetary activities of GOU VPO TGASU in 2007 is observed:

Incomes from market sales of goods, works, services account for 93.99%, gratuitous and irrevocable receipts from budgets - 1.51%, other income - 2.40%, property income - 2.09% in the total income structure.

From the obtained table 3.2 and figures 3.9-3.11, the following changes are observed in the structure of expenses for extrabudgetary activities of the GOU VPO TGASU in the period 2005-2007:

Growth rate of labor costs and payroll charges in 2007 compared to 2006 amounted to 20.62, for other expenses -86.00, purchase of services - 97.63, expenses for operations with assets - 19.06, in the general structure of expenses.

4. Analysis of the report on the execution of the budget of the main manager, recipient of funds

The budget execution report of the main manager (manager), recipient of budget funds (f. 0503127) (hereinafter referred to as the Budget execution report) for the quarterly and annual reporting dates is compiled separately for budgetary and extrabudgetary activities.

The budget execution report submitted by the administrators (recipients) of federal budget funds to the chief administrator of federal budget funds must be certified by the body providing cash services for budget execution.

The report on budget execution by the main administrators of the federal budget funds is compiled in the form of a summary form in the context of all detailed codes of the budget classification of the Russian Federation without reflecting the grouping codes.

The budget execution report (in terms of extrabudgetary activities) reflects transactions with funds from entrepreneurial and other income-generating activities, from profits remaining at the disposal of the institution, and from gratuitous receipts from individuals and legal entities.

The budget execution report (in terms of extrabudgetary activities) reflects transactions with funds from entrepreneurial and other income-generating activities, from profits remaining at the disposal of the institution, and from gratuitous receipts from individuals and legal entities.

In order to implement the provisions of Art. 25 of the Federal Law of December 23, 2004 No. 173-FZ “On the Federal Budget for 2005” and similar norms of federal laws on the federal budget for the corresponding financial year, the main managers of the federal budget funds quarterly submit a report on additional sources of budget financing of institutions located outside the Russian Federation. Federation, in the form of a report on the execution of the budget.

Analysis of the report on the execution of the budget of the main administrator (manager), recipient of the budget funds of TyumGASU (budgetary funds) for 2005-2007. presented in tables 4.1 - 4.2. The dynamics of budget spending is shown in Figure 4.1.

Analysis of the report on the execution of the budget of the chief administrator (manager), the recipient of the budget funds of TyumGASU (extrabudgetary funds) for 2005-2007. presented in tables 4.3 - 4.5. The dynamics of budget revenues is shown in Figure 4.2, budget expenditures - in Figure 4.3.

|

|

|

|

From the obtained table 4.1 and figure 4.1, the following dynamics of expenditures on the budgetary activities of GOU VPO TGASU in 2005-2007 is observed:

1) Wages in the period under review (2005-2007) in 2006 compared to 2005 increased by 11,197,500.00 rubles. or by 16.01% in 2007. compared to 2006 increased by 17848900.00 rubles, or by 50.76%.

From the obtained table 4.2 and figures 4.2-4.3, the following changes are observed in the dynamics of income and expenses for extrabudgetary activities of the State Educational Institution of Higher Professional Education TGASU in 2005-2007:

1) The largest increase in income from the sale of services in the period under review (2005-2007) in 2006 compared to 2005. increased by 51460886.58 rubles, which amounted to 15.85%, in 2007. compared to 2006, an increase of 33,019,489.39 rubles, which amounted to 8.78%.

2) Payroll expenses and accruals for the payroll of the institution in the period under review (2005-2007) in 2006 compared to 2005 increased by 37749564.01 rubles, which amounted to 34.73%. In 2007 compared to 2006 increased by 33259557.13 or (22.71%).

3) The largest increase in expenses for the receipt of non-financial assets in 2006 compared to 2005 by 18,9149,057.91 rubles, which amounted to 221.14%.

Conclusion

Analysis of financial statements is an integral part of most decisions regarding lending, investing, etc.

The purpose of the analysis is a detailed description of the property and financial potential of an economic entity, the results of its activities in the past reporting period, as well as the possibilities for developing the object in the future.

This course work presents an analysis of the financial statements of the State Educational Institution of Higher Professional Education "Tyumen State University of Architecture and Civil Engineering".

The first chapter of the work provides basic information about the object of study: the history of creation, the internal sphere and the external environment.

The second, third and fourth chapters contain an in-depth analysis of the financial condition of the Tyumen State University of Architecture and Civil Engineering for 2005-2007.

In the first part of the second chapter, a general assessment of the dynamics and structure of the balance sheet items was made, which showed:

1) The growth of the property of the enterprise in terms of budget funds for 3 years by 138425236.28 rubles, in terms of extra-budgetary funds - by 297892520.09 rubles;

2) The predominance of non-financial assets in the structure of assets of budgetary and extra-budgetary funds (from 99.93% in 2005 to 99.97% in 2007 - budgetary non-financial assets; from 146.05% in 2005 to 124.41% in 2007 - off-budget non-financial assets).

3) In the liabilities side of the balance sheet, a large share is occupied by the financial result: for budgetary funds in 2005 - 100.48%, in 2006 - 99.08% and in 2007 - 99.42%; extrabudgetary funds in 2005 - 115.20%, in 2006 - 141.49% and in 2007 - 97.84%.

In the second part of the second chapter of the course work, an assessment of the property status of a budgetary institution was carried out according to the balance of budget execution using the main financial ratios.

Based on the results of the assessment of the property status in terms of budgetary funds, it can be said that a stable financial ratio in 2005-2007. occupies the share of fixed assets in the NFA and the share of non-current NFA in the property: in 2005 - 0.789; in 2006 - 0.684, in 2007 - 0.988.

An assessment of the property status in terms of extra-budgetary funds showed that a stable financial ratio in 2005-2007. occupies the share of fixed assets in the NFA: in 2006 - 0.209; in 2007 - 0.781. The largest share is occupied by CA and financial investments: in 2005 - 0.840, in 2006 - 0.909, in 2007 - 1.110.

The third chapter contains an analysis of the report on the financial results of the GOU VPO "Tyumen State University of Architecture and Civil Engineering". The analysis performed shows the following changes in the dynamics and structure of expenditures on the budgetary activities of GOU VPO TGASU:

1) Remuneration of labor and accruals for the payment of the institution in the period under review in 2006 compared to 2005 increased by 14,048,459, which amounted to 26.024%; compared to 2006, they increased by 22,486,400 rubles, which amounted to 33.053%.

2) The largest increase in expenses on transactions with assets in 2007 occurred in terms of depreciation of fixed assets and intangible assets: by 4,013,285.10 rubles. or at 62.40.

3) The predominance of labor costs and accruals for wages in the structure of expenses: 48.36% - in 2005, 48.92% - in 2006. 55.10% - in 2007

The analysis also shows the following changes in the dynamics and structure of expenses and incomes for extrabudgetary activities of GOU VPO TSUAE:

1) The largest increase in income from gratuitous and irrevocable receipts from the budget in the period under review (2005-2007) in 2006 compared to 2005. increased by 12593733.50, which amounted to 108.09% in 2007. compared with 2006, there is a sharp decline in income by 236252657.80, which amounted to 2.52%.

2) There is a positive trend in income from market sales of goods, works, services: in 2006. growth by 58686287.43 rubles. or (by 21.44%), in 2007. growth by 46891982.14 rubles. or by (14.10%).

3) Payroll expenses and accruals for the payroll of the institution in the period under review (2005-2007) in 2007 compared to 2006 increased by 30575364.66 rubles, which amounted to 20.62%.

4) The largest increase in expenses on operations with assets in 2007 occurred in terms of depreciation of fixed assets and intangible assets: by 4,578,249.51 rubles. or at 20.82.

5) Predominance of income from market sales of goods, works, services in the structure of income: 69.20% - in 2005, 57.19% - in 2006. 93.99% - in 2007

6) The predominance of labor costs and accruals for wages in the structure of expenses: 50.20% - in 2005, 42.11% - in 2006. 46.38% - in 2007

In the fourth chapter of this course work, an analysis of the report on the execution of the budget of the main manager, the recipient of funds from the State Educational Institution of Higher Professional Education TyumGASU was carried out. The results of the analysis show the following dynamics of expenditures on budgetary and extrabudgetary activities of GOU VPO TGASU in 2005-2007:

1) Wages in the period under review in 2006 compared to 2005 increased by 11,197,500.00 rubles. or by 16.01% in 2007. compared to 2006 increased by 17848900.00 rubles, or by 50.76%.

2) Accruals for wages in 2006 in comparison with 2005 increased by 2869300.00 rubles, which amounted to 13.55%; compared to 2006 by 4,625,400.00 or 56.41%.

3) The largest increase in income from the sale of services in the period under review (2005-2007) in 2006. compared to 2005 increased by 51460886.58 rubles, which amounted to 15.85%, in 2007. compared to 2006, an increase of 33,019,489.39 rubles, which amounted to 8.78%.

4) Payroll expenses and accruals for the payroll of the institution in the period under review (2005-2007) in 2006 compared to 2005 increased by 37749564.01 rubles, which amounted to 34.73%. In 2007 compared to 2006 they increased by 33259557.13 or by (22.71%).

5) The largest increase in expenses for the receipt of non-financial assets in 2006 compared to 2005 by 18,9149,057.91 rubles, which amounted to 221.14%.

List of used literature

1) Analysis of financial statements: textbook / L.V. Dontsova. ON THE. Nikiforov. – 4th ed., revised. and additional - M .: Publishing house "Business and service", 2006.

2) Bakanov M.N., Sheremet A.D. Theory of economic analysis: Textbook. - M, 2003.

3) Bernstein L.A. Analysis of financial statements. - M., 2001.

4) Dybal S.V. Financial analysis: theory and practice: Proc. allowance. - St. Petersburg: Publishing House "Business Press", 2005.

5) Kovalev V.V. Financial analysis: Investment management. Choice of investments. Reporting analysis. - M, 2005.

6) Richard J. Audit and analysis of the economic activity of the enterprise. - M., 2004

7) Hendervik K. Financial and economic analysis of enterprises. - M., 2004.

8) Sherement A.D., Saifulin R.S. Methods of financial analysis. - M., 2004.

9) Shim J.K. etc. Cost management methods and cost analysis. - M., 2004.

10) Shmalen G. Fundamentals and problems of enterprise economics. - M., 2004.

Financial condition is a set of indicators reflecting the availability, placement and use of financial resources.

An analysis of the financial condition shows in which specific direction this work should be carried out, makes it possible to identify the most important aspects and the weakest positions in the financial condition of the enterprise.

The assessment of the financial condition can be performed with varying degrees of detail, depending on the purpose of the analysis, available information, software, technical and staffing. The most appropriate is the allocation of procedures for express analysis and in-depth analysis of the financial condition. Financial analysis makes it possible to evaluate:

property status of the enterprise;

the degree of entrepreneurial risk;

capital adequacy for current activities and long-term investments;

the need for additional sources of funding;

ability to increase capital;

rationality of attraction of borrowed funds;

soundness of the policy of distribution and use of profits.

The basis of information support for the analysis of the financial condition should be financial statements, which are the same for the organization of all industries and forms of ownership.

Non-profit organizations provide reporting established by law and regulations for legal entities to statistical authorities, state non-budgetary funds, and tax authorities.

Non-profit organizations must draw up financial statements based on synthetic and analytical accounting data (clause 1, article 13 of the Federal Law No. 129 FZ) and submit it to the tax authorities and statistics authorities. The annual financial statements consist of:

- · balance sheet (form No. 1);

- · Profit and loss statement (Form No. 2);

- capital flow statement (Form No. 3)

- cash flow statement (Form No. 4)

- appendices to the balance sheet (form No. 5)

- report on the intended use of the funds received (form No. 6)

- · explanatory note.

Sheet 10 "Report on the intended use of property (including cash) received as part of charitable activities" is provided as part of the income tax return

Non-profit organizations have the right not to provide Forms No. 3, 4 and No. 5 in the absence of relevant data.

In practice, budgetary institutions provide accounting reports that include not only the results of the activities of the organization, which is financed from budgetary funds allocated to it by higher organizations, but also indicators of extrabudgetary activities. Currently, the lack of state budget funds forces budgetary institutions to seek additional sources of funding, so most institutions, in addition to their main activities, are forced to provide paid services. The current legislation allows non-profit organizations to carry out entrepreneurial activities. However, entrepreneurial activity can be carried out only if it serves to achieve the goals for which the non-profit organization was created. At the same time, budgetary institutions are obliged to record income from such activities and property acquired at the expense of these incomes on a separate balance sheet. Order of the Ministry of Finance of the Russian Federation dated December 30, 1999 No. 107 n approved the Instruction on Accounting in Budgetary Organizations, which discloses the procedure for maintaining separate accounting for operations on budgetary funds and funds received from non-budgetary sources.

Based on the organizational and legal form, budgetary institutions have a number of features of accounting, which leaves its mark on the analysis of the financial condition of a budgetary institution:

the property reflected on the balance sheet of the institution is the property of the state;

as a non-profit organization, a budgetary institution does not set profit as the goal of its activities;

the activities of the institution are fully or partially financed from the budget.

Features of accounting for income, expenses and financial results from the provision of paid services are due to the following:

- 1. Budgetary institutions do not have an authorized fund and their own property. The property of budgetary institutions is assigned to them on the basis of the right of operational management.

- 2. Budgetary institutions draw up two balance sheets. If, in accordance with the constituent documents, the institution has been granted the right to carry out income-generating activities, then the income received from such activity and the property acquired at the expense of these incomes shall be at the independent disposal of the institution and recorded on a separate balance sheet. On a separate balance sheet, which takes into account income and property received from entrepreneurial activity and the provision of paid services, other extra-budgetary assets and liabilities are also reflected. It can be targeted funds and gratuitous receipts.

- 3. Budget institutions keep separate records for each of the three sources of funding, which means budget funding, income from the provision of paid services, targeted and gratuitous receipts.

- 4. Budget institutions, unlike other organizations in accounting, recognize income from the provision of paid services or the sale of manufactured products only after payment for these services or products by the customer or buyer.

- 5. The accounting of budgetary institutions does not provide for depreciation on fixed assets and intangible assets.

Along with commercial enterprises and organizations, budgetary institutions, based on the results of work for the reporting period, determine the economic or financial indicators of economic activity. They are used for the purpose of economic planning of the activities of the institution in the analysis of economic activities, as well as to determine the tax base.

The most important performance indicators of a budgetary institution include:

the amount of budget financing;

- budget expenses;

- The volume of sales of products (works, services);

- Expenditure at the expense of extrabudgetary sources;

- income from the provision of paid services;

- costs associated with the provision of paid services;

- Profit (loss) from the provision of paid services.

Thus, based on reporting, you can get an idea of the four aspects of the enterprise:

- · the property and financial position of the enterprise from a long-term perspective;

- financial results regularly generated by this enterprise;

- · changes in the capital of owners;

- the liquidity of the enterprise.

The first aspect of activity is reflected in the balance sheet: the active side of the balance sheet gives an idea of the property of the enterprise, the passive side - of the structure of the sources of its funds.

The second aspect is presented in the income statement - all income and expenses of the enterprise for the reporting period in certain groupings are given in this form. Considering the form in dynamics, one can understand how effectively a given institution works on average.

The third aspect is reflected in the statement of changes in equity, which gives the movement of all components of equity.

The fourth aspect is determined by the fact that profit and cash are not the same thing. For the rhythm of settlements with creditors, it is not profit that is important, but the availability of funds in the required amounts and at the right time. A certain characteristic of this aspect is given by the cash flow statement.

An analysis of the financial condition of an institution according to reporting data can be carried out with varying degrees of detail. There are 2 types of analysis: express analysis and in-depth analysis. In the first case, it is supposed to get only the most general idea of the enterprise, in the second - the ongoing analytical calculations and expected results are more detailed and detailed. If express analysis essentially boils down to reading the annual report, then in-depth analysis involves the calculation of a system of analytical coefficients that allows you to get an idea of the following aspects of the institution's activities:

- 1. Assessment of the property condition;

- 2. Assessment of business activity;

- 3. Assessment of financial activity;

- 4. Evaluation of the profile use of funds.

A preliminary assessment of the financial condition of a public educational institution can be made on the basis of a horizontal and vertical analysis of the balance of execution of the budgeted income and expenses for budget financing (form No. 1) and the balance of execution of the estimates of income and expenses from extrabudgetary sources (form No. 1-1)

The financial assessment of the property potential of the institution is presented in the asset balance, as well as in form No. 5. The indicators of this block allow you to get an idea of the "size" of the institution, the amount of funds under its control, and the structure of assets.

The financial condition of an institution from a short-term perspective is assessed by solvency indicators, in the most general form characterizing whether it can timely and in full make settlements on short-term and long-term obligations to counterparties.

Quantification and analysis of business activity can be done in the following three ways:

assessment of the degree of implementation of the plan according to the main indicators and analysis of deviations;

assessment of the level of efficiency in the use of material, labor and financial resources of a commercial organization.

The performance of an institution in the financial sense is characterized by profitability indicators

The analysis of the financial condition of the enterprise is completed by its comprehensive assessment. When analyzing the financial condition of their enterprise, after a comprehensive assessment, they develop measures to improve the financial condition, paying special attention to the development of the financial strategy of the enterprise for the future and in the coming periods.

Analysis of balance sheet indicators is carried out on the basis of information on the movement of non-financial assets (separately by types of fixed assets, intangible assets, non-produced assets, inventories). Information on the movement of non-financial assets must be provided in the annex to the explanatory note (f. 0503168).

In addition, it is necessary to disclose the technical condition, efficiency of use, provision of budgetary institutions and their structural divisions with fixed assets (correspondence of the size, composition and technical level of funds to the real need for them), the main measures to improve the condition and safety of fixed assets, the characteristics of completeness, as well as information about the timeliness of receipt of inventories.

Information on the status of settlements on receivables and payables as of January 1 of the reporting year and on the reporting date, with an explanation of the reasons for the formation of amounts of debt, is presented in the appendix to the explanatory note (f. 0503169).

Information on f. 0503169 are compiled separately for budgetary and extrabudgetary activities, as well as separately for receivables and payables. At the same time, tax payments are reflected by types of taxes to the corresponding levels of budgets.

In addition, information on the legal grounds for the presence of financial investments should be disclosed. Information on financial investments must be submitted in the annex to the explanatory note (f. 0503171).

Information on the state (municipal) debt is reflected in the context of debt instruments in the appendix to the explanatory note (f. 0503172).

When changing the balance sheet currency at the beginning of the financial year, information about the change in the balance of the balance sheet currency must be given in the appendix to the explanatory note (f. 0503173).

Other issues of the activity of a budgetary institution

Measures taken based on the results of control measures of the state financial control bodies must be presented in the form of table No. 7; information on the inventory (only at the end of the year) - in the form of table No. 6; information on shortages - in the annex to the explanatory note (f. 0503176), which are enshrined in the Instruction on the procedure for compiling and submitting annual, quarterly and monthly budget reports.

Information on the use of information technology in the activities of a budgetary institution (f. 0503177) reflects the costs of acquiring and upgrading computer equipment (personal computers, printing devices, servers of various performance, network equipment for local area networks, data storage systems), the costs of acquiring non-exclusive ( licensed) rights to software and databases, including copies of computer programs and databases on various media (CDs, CD-ROMs, etc.), the costs of creating software and databases (including for payment of a state contract for the performance of work on the creation of computer programs or databases), as well as for the acquisition of exclusive rights to them from copyright holders, as well as expenses for other activities in the field of information technology (connection to computer networks, creation and support of Internet sites and information systems, installation, adjustment of local computing overhead network, current repairs, maintenance, technical support and administration of computer equipment, systems for transmitting, displaying and protecting information, etc.), as well as justifying the expediency of the costs incurred (support for current activities, technical re-equipment, other purposes).

This section also discloses other issues that were not reflected in the previous sections, but had a significant impact on the activities of a budgetary institution in the reporting period.

Analysis of the financial performance of the state (municipal) budgetary and autonomous institution

The analysis of the financial results of the activities of a budgetary and autonomous institution is carried out on the basis of the data of form 0503721 “Report on the financial results of the activities of the institution”, where data on income (receipts) and expenses (payments) are reflected in the context of activities with targeted funds, activities for the provision of services (works) and temporary funds. Form 0503721 of a budgetary and autonomous institution contains both data on financial results (which are reflected on a cash basis) and data on cash flows from operations with financial and non-financial assets and liabilities of the institution.

The first step in the analysis of form 0503721 is an aggregate analysis of cash flows from operating activities, transactions with assets and liabilities of the institution, which considers the inflows and outflows of funds. To conduct an analysis for each type of activity (activities with targeted funds, for the provision of services (works), operations with funds in temporary disposal), a table is compiled in the form of table 5.

Table 5 - Assessment of the composition and dynamics of financial results and cash flows of an institution for income-generating activities

|

Indicators |

Calculation procedure |

Amount, thousand rubles |

||

|

Change |

||||

|

I. Operations |

||||

|

gr. 5 s. 010 form 0503721 |

||||

|

2. Costs |

gr. 5 s. 150 forms 0503721 |

|||

|

3. Operating result before tax |

gr. 5 s. 301 form 0503721 or p. 3 = s. 1 - p. 2 |

|||

|

4. Income tax |

gr. 5 s. 302 forms 0503721 |

|||

|

II. Transactions with non-financial assets |

||||

|

5. Increase in the value of non-financial assets |

sum of lines 321, 331, 351, 361, 371 gr. 5 forms 0503721 |

|||

|

6. Decrease in the value of non-financial assets |

sum of lines 322, 332, 352, 362, 372 gr. 5 forms 0503721 |

|||

|

07. Net result on operations with non-financial assets |

sum of lines 320, 330, 350, 360, 370 gr. 5 of form 0503721 or p. 7 = s. 5 - p. 6 |

|||

|

III. Transactions with financial assets and liabilities |

||||

|

8. Increase in the value of financial assets |

sum of lines 411, 421, 441, 461, 471, 481 gr. 5 forms 0503721 |

|||

|

9. Decrease in the value of financial assets |

sum of lines 412, 422, 442, 462, 472, 482 gr. 5 forms 0503721 |

|||

|

10. Net result on operations with financial assets |

sum of lines 410, 420, 440, 460, 470, 480 gr. 5 of form 0503721 or p. 10 = s. 8 - p. 9 |

|||

|

11. Increasing liabilities |

sum of lines 521, 531, 541 gr. 5 forms 0503721 |

|||

|

12. Reduction of liabilities |

sum of lines 522, 532, 542 gr. 5 forms 0503721 |

|||

|

13. Net result on operations with liabilities |

sum of lines 520, 530, 540 gr. 5 of form 0503721 or p. 13 = s. 11 - p. 12 |

|||

|

14. Net operating result |

gr. 5 s. 300 form 0503721 or p. 14 = s. 3 - p. 4 + p. 7 + p. 10 + p.13 |

When formulating conclusions, it is necessary to pay attention to the sufficiency of cash inflows to ensure payments for each group of operations of the institution, the nature of the operating result before and after taxation, the impact of the balance of each group of operations on the final (net) operating result of the institution.

After considering the composition and nature of cash flows for all types of activities and operations of the institution, a direct analysis of financial results is carried out - income, expenses and profits (operating result) for income-generating activities.

Table 6 - Analysis of the composition and structure of the institution's income by operating activities

|

Indicators |

Line number in the form 0503721 |

Meaning of indicators |

|||||

|

Change |

|||||||

|

1. Income from property |

|||||||

|

2. Income from the provision of paid services (works) |

|||||||

|

3. Fines, penalties, forfeits received |

|||||||

|

4. Donations |

|||||||

|

5. Income from operations with assets |

|||||||

|

6. Deferred income |

|||||||

|

7. Other income |

|||||||

Table 7 - Analysis of the composition and structure of the institution's operating expenses

|

Indicators |

Line number in the form 0503721 |

Meaning of indicators |

|||||

|

Change |

|||||||

|

1. Salary and other benefits |

gr. 5 s. 161 + p. 162 |

||||||

|

2. Accruals on payroll payments |

|||||||

|

3. Acquisition of works, services |

|||||||

|

including: |

|||||||

|

Communication services |

|||||||

|

Public utilities |

|||||||

|

Transport services |

|||||||

|

Rent |

|||||||

|

Works, property maintenance services |

|||||||

|

Other works (services) |

|||||||

|

4. Interest on debt obligations |

|||||||

|

5. Free transfers |

gr. 5 s. 210 + p. 230 |

||||||

|

6. Social Security Expenses |

|||||||

|

7. Asset transaction costs |

|||||||

|

8. Deferred expenses |

|||||||

|

9. Other expenses |

|||||||

Based on the results of the analysis, it is necessary to indicate which types of income and expenses prevail, how the structure of income and expenses of the institution develops, and to characterize the nature of the dynamics of absolute and relative changes.

In addition, relative indicators of financial results can be calculated for income-generating activities of a budgetary and autonomous institution: profitability of operating activities, profitability of paid works (services) and economic efficiency of income-generating activities.

The overall profitability of operating activities (rod) can be calculated as the ratio of the operating result before tax (OPto) and the institution's operating expenses (Po):

The profitability of paid works (services) (ru) is defined as the ratio of income from the provision of paid services (Du) and expenses, the implementation of which is directly related to the provision of paid services (Ru), namely, the costs of the institution for wages with accruals and the costs of acquiring works ( services):

The indicator of economic efficiency (Ee) can be defined as the ratio of the net operating result (OPh) and the total cost of the institution for operating activities:

Since these indicators are determined by the activities of an institution related to generating income, their economic meaning is close to the profitability indicators determined for commercial organizations and, therefore, the refinancing rate of the Bank of Russia can serve as a basis for assessing their level.

Calculation of relative indicators of financial results of a state (municipal) budgetary and autonomous institution can be presented in Table 8.

Table 8 - Calculation of relative indicators of financial performance of the state (municipal) budgetary and autonomous institutions

|

Indicators |

Designation |

Calculation procedure |

Change |

||

|

1. Income from the provision of paid works (services), thousand rubles. |

With. 040 f. 0503721 |

||||

|

2. Operating result before taxation, thousand rubles. |

With. 301 f. 0503721 |

||||

|

3. Net operating result, thousand rubles |

With. 300 f. 0503721 |

||||

|

4. Costs associated with the provision of paid services, thousand rubles. |

sum of lines 160, 170 f. 0503721 |

||||

|

5. Expenses of the institution for operating activities, thousand rubles. |

With. 150 f. 0503721 |

||||

|

6. Overall profitability of operating activities, % |

rod = OPdo / Po |

||||

|

7. Profitability of paid works (services), % |

ru = OPu / Ru |

||||

|

8. Economic efficiency of the institution, % |

Ue \u003d OPh / Po |

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Hosted at http://www.allbest.ru/

CONTENTS

Introduction

Chapter 1. Principles of organizing accounting in budgetary organizations of the Russian Federation

1.1 The budget system of the Russian Federation

Chapter 2

2.1 Brief description of the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 8 for the Perm Territory

Chapter 3

3.2 Budgeting for 2016 on the example of the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 8 for the Perm Territory

Conclusion

List of used literature

Applications

INTRODUCTION

The relevance of the topic is determined by the fact that the most important condition for the effective functioning of the national economy is the rational and economical use of state budget funds allocated for the maintenance of non-production sectors.

In the economic complex of the country there are a significant number of federal tax services that receive funds from the state budget.

Budgetary organizations are important subjects of the economy in any economic system and in any model of government.

The development of the economic and social sphere is also characterized by a significant increase in the role of budgetary institutions. The result of their activity characterizes the usefulness of the work they have done and represents the process of providing services to the general population.

A comprehensive analysis of the activities of budgetary organizations contributes to a more efficient use of funds allocated for the maintenance of the non-productive sphere. In this regard, the effective management of budgetary institutions and the rational use of both budgetary and extrabudgetary funds causes an objective need to organize an analysis of the indicators of their financial and economic activities.

The aim of the work is to analyze the financial statements of a budgetary organization for making management decisions and develop recommendations for improving the system for organizing the finances of the object under study.

The objectives of this final qualification work are:

1. Study of the theoretical and methodological basis for the functioning of a financial and budgetary organization.

2. Conducting an analysis of the effectiveness of making managerial decisions on managing the finances of a budgetary organization on the example of the Interdistrict Inspectorate of the Federal Tax Service No. 8 for the Perm Territory

3. Development of a direction for improving the adoption of managerial decisions by the Interdistrict Inspectorate of the Federal Tax Service No. 8 for the Perm Territory.

The object of the study is the financial management of a budgetary organization.

The research base for the final qualification work is the Interdistrict Inspectorate of the Federal Tax Service No. 8 for the Perm Territory.

The subject of the study is the cost and income estimates of the Interdistrict Federal Tax Service of Russia No. 8 for the Perm Territory.

The theoretical methodological basis of the study is:

1) Normative - legal and legislative acts regulating the activities of budgetary organizations.

2) Modern methodological techniques and methods for quantitative and qualitative analysis of financial and economic activities.

3) Monographic and educational literature on the issues under study.

4) Publications in specialized publications on this subject.

5) Accounting data of the Interdistrict Inspectorate of the Federal Tax Service No. 8 for the Perm Territory.

The second chapter analyzes the financial and economic activities of the Interdistrict Inspectorate of the Federal Tax Service No. 8 for the Perm Territory.

In the third chapter, the author develops a budget estimate for 2011-2013, presents calculations for the budget estimate for 2011, in the budgets of 2012-2013. calculations are made in a similar way, so they are omitted in the final qualifying work.

The structure of the final qualification work is represented by an introduction, three chapters, a conclusion, a list of references, twenty-nine tables, one figure.

CHAPTER 1

1.1 The budget system of the Russian Federation

Determining the essence, role and place of the budget in the reproduction system serves as the main methodological point in the development of the theory of budget planning and the use of its results in the creation and improvement of the budget system. The essence of the budget cannot be considered outside the specific economic conditions, since it depends on the system of production relations, one or another mode of production and is determined by it.

The budget represents, expressed in specific indicators, goals, alternatives for achieving goals, the consequences of the emergence of alternatives on goals, the actual results of the implementation of managerial decisions, deviations from planned results. It can also be defined as the decision-making process by which an entity evaluates the feasibility of inflows and outflows of assets. [8, 70s.]

In the Russian Federation, the budget period, that is, the time of the budget execution process, is set from January 1 to December 31, therefore, it coincides with the calendar year. The duration of the budget process is much longer than the budget period, since the budget process includes the time required for budget planning, subsequent budget control and other actions. At this level, the concept of "budget", as the Federal plan of the state, arises.

The main manager of budgetary funds is an executive body that has the right to distribute funds between managers and recipients of budgetary funds. He prepares a list of budget expenditures for budget managers and budget recipients, communicates notifications of budget assignments to them, approves income and expenditure estimates for them, changes, if necessary, the distribution of funds between the articles of the budget approved for them, monitors the rational, targeted use of budget funds by the budget recipient .

The manager of budgetary funds is an executive authority that distributes funds among budget recipients, it brings notifications of budget allocations to them, approves estimates of income and expenses of budget recipients, and controls the targeted use of budget funds by them.

A budget recipient (budgetary institution) is an organization created by an executive authority to carry out non-commercial functions (management, defense, social and cultural events, etc.) and financed in an estimated manner from the budget or extrabudgetary funds.

Control and Accounts Bodies (Accounts Chamber of the Russian Federation, Chambers of Control and Accounts of the constituent entities of the Russian Federation and municipalities) exercise control over the execution of the relevant extra-budgetary funds, conduct an external audit of reports on the execution of budgets and extra-budgetary funds.

All the authorities and institutions listed above are participants in the budget process.

Drawing up a draft budget is the prerogative of the Government of the Russian Federation, the executive authorities of the constituent entities of the Russian Federation and municipalities. On their instructions, the draft budget is developed by the Ministry of Finance of the Russian Federation and territorial financial authorities. Draft territorial budgets are drawn up by the financial authorities of the constituent entities of the Russian Federation and municipalities.

In the course of drafting the budget, in the event of an imbalance in revenues and the minimum necessary expenditures of territorial budgets, the territorial executive authority submits to the higher executive authority the necessary calculations to justify the size of the deductions from regulatory revenues, subsidies, subventions, the list of income and expenses subject to transfer from the higher budget, as well as data on changes in the composition of objects subject to budget financing.

The main planning document of the budgetary sphere is the estimate of income and expenses. Institutions financed in the budgetary order are called budgetary.

These are schools, kindergartens and nurseries, higher and secondary specialized educational institutions, vocational schools, research organizations, health care, social security, physical education institutions, etc.

The need for funds of a budgetary institution is reflected in the cost estimate, which is the main planned financial document. On the basis of the approved budget, budgetary institutions receive funds to carry out their activities.

Accounting in budgetary institutions provides a reflection of all operations related to the execution of budget expenditure estimates, estimates for special funds and generalization of accounting and reporting data.

1.2 Features of accounting of budgetary organizations