The mortgage market in any state is an integral part of its financial system. It is the purchase of housing with the help of borrowed funds for many people is the only option for solving the housing problem. In order to navigate the market indicators, the prospects for its development and, possibly, make forecasts, it is important to understand the key concepts. Let us consider in more detail what the mortgage market is like in 2019, how it was formed in the Russian Federation and what are the results of its activities at the moment.

The mortgage market is an interconnected system of three key components or elements:

- mortgage loans;

- commercial and residential real estate;

- mortgage securities.

The mortgage loans market is classified as a primary market, and mortgage-backed securities as a secondary market.

Let's analyze each concept in more detail.

The primary mortgage market implies the relationship between the borrower and the lender, the basis of which is the fulfillment of credit obligations.

Participants of the primary mortgage market:

- banks;

- individuals and legal entities (borrowers);

- financial companies that issue mortgage loans, but do not have the status of a banking structure.

Banks, in addition to extracting maximum profits, pursue the goal of the ongoing renewal of credit resources or funds that can be immediately directed to the issuance of new housing loans. This goal is realized through the functioning of the secondary mortgage market.

Secondary market

It trades mortgages on already issued loans. The bottom line is that the bank that issued the mortgage issues securities secured by mortgages and then sells them to other investors. It is the secondary market that makes it possible to accumulate considerable funds and channel them into the sphere of mortgage lending.

The market itself is also divided into primary and secondary. At the first stage, securities are initially placed among creditor participants, and at the second stage, their movement (turnover) begins. The cost of securities attracted to the secondary market does not change their value upwards, but only creates a mechanism for regulating their liquidity and demand.

The real estate market is the main reason for the existence of markets for mortgage loans and mortgage-backed securities. Here, transactions are carried out for the sale and purchase of real estate objects, the pledge of which to creditors allows the functioning of the secondary and primary mortgage markets.

The interaction of all three elements is quite simple:

- The future borrower submits an application to the selected bank.

- The Bank assesses the feasibility of issuing a loan based on an analysis of its solvency and compliance with the established list of requirements.

- The maximum loan amount and the repayment period of the debt are calculated.

- After the conclusion of a loan agreement, a mortgage agreement and a sale and purchase agreement with a real estate seller, the bank creates a primary securities market.

- By transferring the mortgage to other investors, the bank creates a secondary market for mortgage-backed securities.

After the issuance of new loans secured by real estate, the cycle will repeat itself.

The History of the Mortgage Market in Russia

The mortgage market of the Russian Federation in its modern format is relatively young, as it emerged in the 90s of the last century. The very first mortgage loans were issued during the reign of Elizabeth, when the banks of the Russian Empire lent money to the elite for the purchase of housing.

The scale of issuing housing loans in pre-revolutionary Russia was not massive, but this area of banking services was relevant until the Bolsheviks came to power.

During the Soviet period, for natural reasons, there were no mortgage loans in the country until 1995. It was 1995 that became the starting point for the emergence of the modern version of the mortgage, when Sberbank and DeltaCredit began issuing the first secured loans to the population.

After more than 20 years, it is quite logical that the mortgage market has changed, experienced more than one crisis and continues its path of formation to this day. For example, in the mid-90s, only those borrowers who were officially employed and could confirm their income with a 2-personal income tax certificate could receive a mortgage.

Today, banks offer many programs when providing only two documents, and also take into account the additional income of the client and his family members.

Also, earlier a mortgage was issued only for the purchase of a residential property with an already registered ownership right (in the secondary housing market). Now you can get a loan for the purchase of ready-made objects under construction, for the purchase of commercial real estate and even for the construction of a separate house.

All this has become stimulating factors for the development of the construction and related industries of our economy.

Statistics of the mortgage market of the Russian Federation and its main indicators

Mortgage statistics in Russia are collected and systematized by the Federal Statistics Service and the Central Bank. The most complete picture of the results of mortgage lending in our country consists of an analysis of such indicators as:

- market size (volume of mortgage loans);

- the number of credit institutions issuing mortgages;

- current types of mortgage products and conditions for them in banks.

Let's consider them in detail.

Market size and current results for issuance for 2017-2018

The volume of the mortgage market in the Russian Federation is characterized by the indicator "volume of issued housing loans". On a monthly basis for 2017-2018. visual information is presented below (according to the data of the Bank of Russia).

The diagram shows a steady growth trend in the volume of loans issued in the country (indicators are calculated on an accrual basis). For example, in March 2018, loans were issued by 172,813 million more compared to the same period last year (almost 2 times).

The weighted average loan term at the beginning of 2019 is 186.4 months, and the weighted average interest rate is 9.8% per annum (information as of 03/01/2018). At the same time, the debt under existing contracts as of March 1 is 5,300 billion rubles. The overdue debt of this figure is 60.8 billion rubles. Both of these parameters also tend to grow in dynamics.

Major Players

In the Russian mortgage market in 2019 (data at the beginning of the year), 561 credit organizations operate in the Russian Federation, of which 410 units issue mortgage housing loans. These are lenders with a high level of reliability and proven efficiency of their activities.

These include the largest banks in the country:

- Sberbank;

- Rosselkhozbank;

- Gazprombank;

- DeltaCredit;

- Raiffeisenbank and others.

Each of them offers potential customers at least several options for obtaining a mortgage to improve their living conditions.

Bank conditions

Lending conditions in Russian banks can vary significantly depending on the product chosen, the category of the client and the duration of his cooperation with the lender.

The parameters for obtaining a mortgage loan in the largest credit institutions of the Russian Federation in 2019 are given in the table below.

Mortgages in the secondary market:

| Bank | Base rate, % | PV, % | Experience, months | Age, years |

|---|---|---|---|---|

| Sberbank | 9,2 | 15 | 6 | 21-75 |

| VTB | 9,8 | 15 | 3 | 21-65 |

| Raiffeisenbank | 8,99 | 15 | 3 | 21-65 |

| Gazprombank | 9.2 | 20 | 6 | 21-60 |

| Rosbank | 10.74 | 15 | 2 | 20-65 |

| Rosselkhozbank | 9.1 | 15 | 6 | 21-65 |

| Absalut bank | 10.75 | 15 | 3 | 21-65 |

| Promsvyazbank | 9.8 | 20 | 4 | 21-65 |

| Dom.RF | 9.4 | 15 | 3 | 21-65 |

| Uralsib | 9.49 | 10 | 3 | 18-65 |

| AK Bars | 9.2 | 10 | 3 | 18-70 |

| Transcapitalbank | 9.49 | 20 | 3 | 21-75 |

| FC Otkritie | 9.2 | 15 | 3 | 18-65 |

| Sviaz-bank | 9.3 | 15 | 4 | 21-65 |

| Zapsibkombank | 9.8 | 10 | 6 | 21-65 |

| Metallinvestbank | 9 | 10 | 4 | 18-65 |

| Bank Zenith | 9,5 | 15 | 4 | 21-65 |

| SMP bank | 9,5 | 15 | 6 | 21-65 |

| UniCredit Bank | 9,4 | 20 | 6 | 21-65 |

| Alfa Bank | 9,19 | 15 | 6 | 20-64 |

Mortgages in the primary market:

| Bank | Bid, % | PV, % | Experience, years | Age, years |

|---|---|---|---|---|

| Sberbank | 9,3 | 15 | 6 | 21-75 |

| VTB | 9,8 | 15 | 3 | 21-65 |

| Raiffeisenbank | 8,99 | 15 | 3 | 21-65 |

| Gazprombank | 9,2 | 20 | 6 | 21-65 |

| Rosbank | 10,74 | 15 | 2 | 20-65 |

| Rosselkhozbank | 9 | 20 | 6 | 21-65 |

| Absalut bank | 10,75 | 15 | 3 | 21-65 |

| Promsvyazbank | 9,15 | 15 | 4 | 21-65 |

| DOM.RF | 8,9 | 15 | 3 | 21-65 |

| Uralsib | 9,49 | 10 | 3 | 18-65 |

| AK Bars | 9,2 | 10 | 3 | 18-70 |

| Transcapitalbank | 9,49 | 20 | 3 | 21-75 |

| FC Otkritie | 8,8 | 15 | 3 | 18-65 |

| Sviaz-bank | 9,2 | 15 | 4 | 21-65 |

| Zapsibkombank | 9,8 | 15 | 6 | 21-65 |

| Metallinvestbank | 9,1 | 10 | 4 | 18-65 |

| Bank Zenith | 9,5 | 20 | 4 | 21-65 |

| SMP bank | 10,99 | 15 | 6 | 21-65 |

| Alfa Bank | 9,29 | 15 | 6 | 20-64 |

| UniCredit Bank | 9,4 | 20 | 6 | 21-65 |

Types of mortgage loans in Russia and prospects for their development

All mortgage loans in Russia can be divided into the following types:

- Mortgage for housing under construction.

This type of mortgage allows you to purchase an apartment or house from the developer at the stage of its construction. The developer and the property must be accredited by the bank.

At the moment, there is a gradual change in the legislative framework in order to protect borrowers more. So soon the DDU will be canceled and apartments from developers will be issued after they are built.

- Mortgages for secondary housing.

With the help of this loan, you can buy housing with already registered ownership. This is a ready-made property that you can immediately move into. This type of mortgage lending is now the most common and convenient.

- Preferential mortgage programs.

This includes (for military personnel participating in the accumulative mortgage system), (for families with two or more children), housing loans for the poor and other socially unprotected citizens.

The conditions for such a loan are distinguished by a loyal attitude towards the borrower and a lower interest rate. Only certain properties can be purchased with the help of such programs from specific developers or sellers.

In 2018, a family and refinancing of such a loan was launched.

Also, social mortgage continues to develop in the regions, which allows state employees and other socially significant and not very protected categories of citizens to take mortgages at a preferential rate.

- Mortgage for the construction of a separate house.

Such a mortgage is issued for the construction and finishing of a private house on a land plot owned by the borrower. To approve the application, you will need to provide a project for future housing and estimate documentation from an approved contractor.

It was launched as an experiment in 2018, but so far it is very difficult because. banks were not ready for this program.

- Corporate mortgage.

Such loans are issued on preferential terms by employers. A striking example here is Russian Railways, where employees can get a loan for housing at 2-4% per year (a loan for a loaned property can be taken by company employees who have worked for more than 1 year).

- Real estate mortgage

This mortgage implies that the bank issues money in the amount of the assessed value of the property, which he receives as collateral. At the same time, in most cases, the bank does not care for what purposes the borrowed funds will be used.

With such a loan, you can buy non-standard real estate options: apartments, a house with land, a summer house, take money for repairs or purchase of foreign real estate.

- Refinancing

One of the most popular mortgage loans of 2019. Mortgage refinancing allows you to significantly reduce the interest rate on an existing loan due to the fact that mortgage debt and the right to claim collateral from one bank are transferred to another at a lower interest rate.

This type of lending will continue to grow. previously issued loans were issued at rates of more than 12%, and now they start from 9%, which can significantly reduce the debt burden.

It is worth remembering that and are two big differences. These two concepts are often confused. Also, refinancing is often confused with the usual reduction in mortgage interest on application.

Conclusion: Both areas of housing lending in the future have the same positive development prospects, as they are in demand among borrowers of various categories. Solving housing problems without the use of borrowed funds is simply impossible for most Russian families today.

Market forecast for 2019

Based on a detailed analysis of the mortgage lending market, specialists and experts in this field can make forecasts of its development.

Forecasting in the field of mortgage lending in the Russian Federation is only possible for several years ahead. This is due to the ongoing crisis in our country and strained political relations with other states.

For 2019, it is possible to determine the main trend in the development of mortgages - this is a consistent increase in the interest rate. The Central Bank has made several official statements that the key rate will continue its slight increase in the future, which will inevitably lead to an increase in lending rates on mortgages and other loans.

The second direction in the development of the mortgage market is an increase in demand for refinancing already issued housing loans. The reason for this is quite logical and is associated with a decrease in the purchasing power of the population. The growth of overdue debt is growing, forcing people to turn to banks for refinancing services.

The mortgage market in the Russian Federation is in the phase of its development and is characterized by dynamic growth. Today, a mortgage can be taken from any leading bank in the country: Sberbank, VTB, Russian Agricultural Bank, Gazprombank, Raiffeisen Bank, etc. Each of them offers a variety of home improvement programs with different terms, interest rates, and borrowing requirements.

We are waiting for your questions in the comments and our mortgage specialist in a special form.

Please rate our post and like it.

The growth and dynamics of the mortgage lending market depends on such indicators as:

current prices in the housing market;

Mortgage rates;

terms of the loan;

the amount of the initial deposit;

the income level of the population.

Over the past few years, as shown in Table 3, housing prices in our country have been steadily rising, which contributes to the development of the mortgage lending market. After all, only a small percentage of the country's population has enough money to purchase their own housing without resorting to a mortgage loan.

Table 2. Dynamics of prices in the housing market in the Russian Federation

|

Index |

||||

|

Prices for 1 sq. m in the primary market, rub. |

||||

|

Price index in the primary market, % to the previous year |

||||

|

Price 1 sq. m in the secondary market, rub. |

||||

|

Price index in the secondary market, % to the previous year |

However, mortgage lending also implies that the income of the bulk of the population should be sufficient to make monthly payments without significant harm to the individual. Based on the foregoing, we can conclude that mortgage lending is more accessible, the lower the monthly payments on it. This condition is achieved in various ways, such as extending the term of the loan or lowering the interest rate. Also in Russia, the availability of mortgage lending is based on a reduction in the risk premium to the loan rate, which is ensured by the fact that the state assumes the main risks in mortgage lending.

According to AHML statistics, the average monthly rate on ruble loans reached 12.4%. Interest rates on mortgage loans reached their peak in 2009, at the height of the economic crisis, and amounted to 14.6% for ruble loans and 13.5% per annum for loans issued in foreign currency. Reducing the interest rate contributes to an increase in mortgage lending.

Statistics show that at the moment the growth rate of mortgage lending is very high. However, the level of mortgage lending in Russia will not soon approach the level of the US or EU countries, where it is 50 and 30% of GDP, respectively, while in our country it is only 2-3% of GDP.

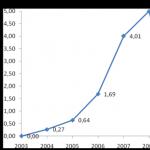

As shown in fig. 1, housing loans have already reached pre-crisis levels and even exceeded them.

Rice. 1. Dynamics of the volume of mortgage loans issued and the share of mortgage loans in rubles in 2007-2013 in RF.

The results of the development of the mortgage lending market in January-August 2013 testify to the continued growth in the issuance of loans, despite the suspension of economic growth.

In January - August 2013, 485,430 mortgage loans were issued for a total amount of 784.9 billion rubles, which is 1.16 times higher than the level of January - August 2012 in quantitative terms and 1.28 times in monetary terms.

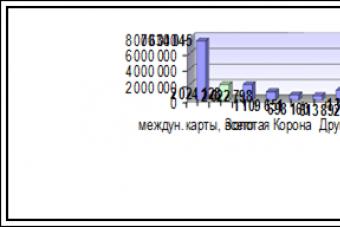

Such an increase in the volume of issuance was due to the introduction by the state of a sufficiently large number of social programs for the purchase of housing on preferential terms. The level of mortgage lending in different regions is quite different, and as shown in Fig. 2 leading positions are occupied by Moscow and the Moscow region, while other regions of our country are far behind.

Rice. 2 30 regions with the largest volume of mortgage loans issued in 2012-2013, million rubles

Also important is the income of the country's population, because the more people earn, the more the mortgage lending market develops. With real income growth, people are optimistic about the future, they can save more or save on credit. Also, according to the Federal State Statistics Service, over the past 5 years, the real incomes of the population have almost doubled, at the same time, the volume of mortgage lending has also grown.

In recent years, the number of overdue debts has decreased markedly, as shown in Figure 3, their volume has more than halved. This indicates an increase in the standard of living of the population and an effective state policy in the field of mortgage lending.

Rice.

At the end of 2012, the largest banks issuing mortgage loans raised interest rates, which was the first increase in the cost of mortgage lending in the last few years. However, only the main rates were raised, while the rates for preferential programs were reduced.

This trend was set by the country's largest banks, in which the state is also a participant. For example, Sberbank, which issues more than half of the total mortgage loans, was also followed by VTB24, Gazprom and other less significant banks.

During the crisis, banks stopped issuing mortgage loans without down payments, as the solvency of borrowers sharply decreased during this period. Also, a large number of apartments were put up for sale due to the lack of some financial discipline from the borrowers.

The remaining banks, which continued to issue loans without a down payment, sharply tightened the conditions in order to minimize the risk of losses. For example:

Sovetsky Bank offered to receive 0.5-5 million rubles, without a down payment for 1-15 years, at a rate of 16.9% with insurance or 19.9% without personal or property insurance. It was also necessary to provide an impressive amount of documents that would testify to the high level of income and its stability;

Sviaz-Bank demanded that the borrower issue a pledge of his housing, but the amount received was only 3 million, and the term ranged from 1 to 30 years, and the rate was calculated individually for each borrower.

You can also reduce mortgage costs during various mortgage sales and special price reductions, which are carried out by almost all banks. For example, UniCredit Bank in December last year offered its borrowers a discount on all mortgage loans in the amount of 0.5% per annum, which was a New Year's gift for all borrowers.

You can also get a mortgage loan not only during the period of various promotions, but with the help of state support. So in 2013, along with the already existing programs for the military and young families, a new program of state support for the purchase of housing on credit for young teachers was launched. This program consists in the fact that a teacher under 35 years of age must contribute at least 10% of the total cost of housing, while he must confirm his income with the necessary certificates in order to receive a mortgage loan at 8.5% per annum.

The most popular banks in the field of mortgage lending are Sberbank and VTB24, their offers are also the most attractive for borrowers.

So a mortgage loan from Sberbank of Russia in 2013 is issued on the following conditions:

1) The rate for a loan issued in rubles will be from 9 to 15% per annum, in foreign currency from 12 to 14%;

2) The down payment must be at least 15% of the total amount;

3) The period for which a mortgage loan is issued must be no more than 30 years;

It is also necessary to provide the bank with a package of documents that will confirm the stable financial position of the borrower.

VTB24 mortgage in 2013:

The rate on ruble loans is 10.9-14.9%, on loans in foreign currency - 8.9-11.2% per annum;

Down payment - from 10% of the cost of housing;

Term - up to 50 years.

It is desirable to obtain insurance (life and disability of the borrower, damage or damage to the apartment, termination of ownership of housing), without insurance, the rate increases by 3% per annum. Income certificates and proof of employment are required.

Over the past few years, the mortgage lending market in Russia has become more developed. Mortgage loans are very popular among the population and have a beneficial effect on the economy of our country. The development of this market is influenced by a large number of factors, such as incomes of the population, housing prices, payment terms, etc.

An important feature of 2013 was the noticeably increased influence of mortgage lending on the housing market in the country. This is evidenced by the growth in the share of mortgage transactions against the backdrop of a stable dynamics of housing transactions. According to Rosreestr, every fourth property right (24.6%) registered in housing transactions in 2013 was acquired using a mortgage loan.

This figure is a record for the entire observation period (since 2005). According to AHML estimates, in general, the share of mortgages in the sale of new housing is up to 40%, and for some objects, transactions with mortgages amount to more than 50% and reach 70-80% of sales.

In 2013, according to the Central Bank of the Russian Federation, the volume of mortgage loans issued continued to increase: 657 credit institutions provided 824,792 loans in the amount of 1.354 trillion. rubles, which is 19.24% more in terms of the number of loans and 31.17% more in monetary terms than in 2012.

Figure 2. Dynamics of the provision of mortgage housing loans on a cumulative basis since the beginning of the year

Debt on HML as of January 1, 2014 Amounted to 2.648 trillion. rub. The volume of issued housing loans (LC) in 2013 Reached 1.404 trillion. rub., or 880485 loans with a debt of 2.765 trillion. rub.

Overdue mortgage debt as of January 1, 2014 was at the level of 39.50 billion rubles, or 1.49% of the residual debt, which is 0.59 p.p. less than January 1, 2013 The share of overdue debt from the residual debt on mortgage housing loans in rubles as of January 1, 2014 decreased by 0.47 p.p. to 1.0% compared to January 1, 2013, and for loans in foreign currency compared to January 1, 2013, on the contrary, increased by 1.15 p.p. up to 12.57%.

Figure 3. Dynamics of the average value of HMLs for 6 groups of credit institutions, ranked by assets (in descending order)

In 2013, the share of HMLs in foreign currency in the volume of loans issued continued to decline: in monetary terms, by 0.3 p.p. up to 1.12%, and in quantitative terms - by 0.02 p.p. to 0.23% compared to 2012. As of January 1, 2014 the share of such loans in the outstanding debt decreased by 1.93 p.p. to 4.22%, and the share of overdue debt on HMLs in foreign currency in the total overdue debt increased by 1.84 p.p. and amounted to 35.59%.

According to the Central Bank of the Russian Federation, the share of debt on HMLs without overdue payments in the total amount of debt on HMLs as of January 1, 2014 increased by 0.12 p.p. compared to January 1, 2013 and reached 96.05%. The share of debt on defaulted loans (with overdue payments over 180 days) in the total amount of debt on HMLs decreased by 0.48 percentage points over the same period. and amounted to 1.78%.

According to the Central Bank of the Russian Federation, out of 6 groups of credit institutions ranked by assets (in descending order), the share of Group I of the five credit institutions with the largest assets in the total volume of loans provided in 2013 HML was at the level of 72.22% in monetary terms and 76.93% in quantitative terms, having added 6.23 percentage points, respectively. and 4.62 p.p. compared to 2012 Relative to 2011, the share of Group I in the volume of mortgage loans issued increased by 18.46 p.p. and by number - by 14.63 percentage points, which indicates the ongoing monopolization of the mortgage market. As of January 1, 2014 the first two groups (19 credit institutions) cover 80.13% of the HML market. Accordingly, the shares of other groups of credit institutions decreased.

With a decrease to 1.49% in 2013. the share of overdue debt in the total debt in the Russian Federation (RUB 39.50 billion) against 2.08% in 2012. The second group of credit institutions is “leading”, maintaining the largest value of the share of overdue debt in 2013 (3.04%), thus having the most risky HML portfolio. The quality of the group's loan portfolios, expressed as a percentage of the group's overdue debt of the group's residual debt, worsened in 2013 for groups III and V and improved for the rest.

The lowest value of the average HML in rubles for 2013 (1.31 million rubles) in Group V, and the highest value of the average value of HML in foreign currency (20.5 million rubles) - in Group VI.

Compared to 2012 average HML values in rubles for all groups increased. The largest increase in the average value of HMLs in foreign currency was in groups II and VI, and the largest decrease was noted in group IV (Fig. 3).

The data of the Bank of Russia as of 01.01.2014 indicate that the level of issuance rates on ruble mortgage loans extended during December amounted to 12.1%, which is 0.6 p.p. below December 2012 levels.

The dynamics of rates in 2013 was uneven - at the beginning of the year they grew dynamically, reaching a maximum value of 12.9% in March, but then there was a downward trend in rates, which peaked in November-December 2013.

The decrease in rates at the end of the year is explained by seasonal promotions of banks - in the third quarter of 2013, almost all leaders in the mortgage market launched special offers that allow a fairly wide range of borrowers to count on lower mortgage interest rates.

The weighted average mortgage lending rate in 2013 was 12.4% (cumulative), which is explained by the high level of rates in the first quarter of 2013.

Figure 4. Dynamics of the weighted average HML rate for 6 groups of credit institutions ranked by assets (in descending order)

An additional factor motivating major banks to intensify their efforts to increase mortgage portfolios was the policy of the Bank of Russia aimed at limiting the growth rate of unsecured lending, including an increase in the size of the minimum reserves for losses on unsecured consumer loans. In this regard, credit institutions that have the appropriate capabilities (primarily access to funding), depending on internal priorities, could focus on a more active development of mortgage lending. Thus, starting from the second quarter of 2013, the AHML Analytical Center recorded about 30 cases of interest rate cuts on a permanent or temporary basis among active market participants.

In 2013, the average weighted term of HML lending for all groups of credit institutions for HML in rubles was 14.7 years, and for loans in foreign currency 12.7 years. The longest weighted average lending period for credits in rubles in group III is 15.6 years, and for credits in foreign currency in group I - 21.2 years. Group VI has the smallest average weighted loan terms: 10.3 years for loans in rubles and 2.1 years for loans in foreign currency.

According to the Central Bank of the Russian Federation, in 2013. the acquisition by credit institutions of the rights of claim on mortgage housing loans increased by 5.17% compared to 2012 and amounted to 85.98 billion rubles. Acquisition of claims on loans in rubles decreased by 2.47% and reached 61.71 billion rubles, and on loans in foreign currency increased by 31.3% and amounted to 24.274 billion rubles. The largest volume of acquired rights of claim under HMLs in 2013 both in rubles and in foreign currency, as in 2012, was registered with credit institutions of the IV group.

According to AHML OJSC, in 2013 the volume of transactions in the primary housing market using mortgage lending increased by 10 p.p. compared to 2012 and amounted to 30%.

Table 3

Structure of mortgage loans

In 2013, the share of AHML OJSC in the mortgage market amounted to 8.2% in ruble terms (111.3 billion rubles), or about 10% of the total number of loans issued, including through work in the primary market (refinancing ) - 3.5% (48.0 billion rubles), in the secondary - 4.7% (63.3 billion rubles). According to AHML OJSC, the total volume of mortgage-backed securities issue in 2013 It amounted to 140.625 billion rubles, of which 55.5% (78.1 billion rubles) of securities were issued with the participation of the Agency itself.

In 2014 the size of the maternity capital of AHML OJSC has been increased and amounts to 429.4 thousand rubles. In 2014, indexed annual payments to military personnel participating in the accumulative mortgage system reached 233,000 rubles. The agency under the program "Military Mortgage" increased the maximum amount of a mortgage loan when buying an apartment in the primary market from 2 million to 2.2 million rubles. and reduced the minimum down payment from 30% to 20%.

In the past six months, many mortgage banks have loosened the requirements for borrowers: they reduced the minimum down payment (including to zero), increased the maximum loan amount and expanded the list of lending objects.

Despite some easing of requirements for borrowers, the quality of the mortgage portfolio accumulated on banks' balance sheets is at a high level. The share of overdue payments in the total volume of accumulated mortgage debt as of January 1, 2014 amounted to 1.49%, and the total volume of mortgage loans without a single overdue payment is more than 96%. However, it should be noted that in the event of a sharp deterioration in the economic situation and an increase in unemployment, the share of overdue payments may increase, and the quality of the mortgage portfolio may deteriorate rapidly.

The growth of the mortgage market has become one of the main drivers of housing construction. Sensing that banks have resumed lending to the construction industry and homebuyers, developers stepped up their activities. Thus, in 2013, 912.1 thousand apartments were built with a total area of 69.4 million square meters. meters (+5.6% compared to the corresponding period of the previous year). This figure is a record for the entire history of the Russian Federation since 1990.

It is important to note that the simultaneous increase in mortgage lending and housing construction keeps the housing market on a balanced development path - additional effective demand of the population, supported by mortgages, absorbs the primary housing market.

The growth in housing prices, according to Rosstat, in 2013 compared to 2012 averaged 7.2%, which, in the context of fixed annual inflation (6.8%), suggests that the real increase in housing prices, on average in Russia, did not exceed 0.5 p.p.

Taking into account the fact that real disposable incomes of the population increased by 3.3 percentage points, and mortgage rates decreased, we can say that at the end of 2013, an increase in the availability of housing for the population was recorded, both at the expense of own and and through borrowed funds.

The most "popular" way to buy real estate in the Russian Federation over the past 5-7 years is still a mortgage. Therefore, the country's authorities in their economic policy in every possible way contribute to banking programs aimed at lowering rates on this type of loan. This vital topic was raised in his speech on January 30, 2014 by Alexei Ulyukaev, who holds the post of Minister of the Ministry of Economic Development. President Vladimir Putin also supports this statement and believes that it is necessary to establish a "firm" mortgage interest rate, which would be close to the refinancing rate of the Bank of Russia. In turn, Igor Shuvalov, First Deputy Prime Minister of the Russian Federation, points to a steady increase in the number of loans issued in 2013 and January 2014, and believes that it is necessary to adhere to the direction chosen by the country's government and banking organizations in this segment.

The Ministry of Finance of the Russian Federation predicts a decrease in inflation in 2014 to 5%-6%. As a result, mortgages can fall in price up to 8% per annum.

At the same time, it should be noted that the number of Russians who plan to improve their living conditions continues to grow. Mortgage growth in 2014 is projected to be 20%-25%. Already, every fourth purchase of real estate is made on credit, because this is the most affordable way to solve problems with housing. The high quality of borrowers is also pleasing. The share of mortgage loans without debt for the six months of 2013 amounted to 96%.

State-owned banks are the most active in the mortgage market. Despite the active pace of issuing loans by private banks, Sberbank, VTB 24 and Gazprombank continue to be leaders. Their share in the total mortgage is 68%. In the second half of the year, the Bank of Moscow also began to actively increase its volumes.

|

Place in the ranking as of 07/01/2014 |

Place in the ranking as of 07/01/2013 |

Name of the bank |

The volume of issued mortgages. lived. loans, million rubles |

Growth rate (H1 2014/Hy 1 2013), % |

|||

|

1 half. 2014 |

1 half. 2013 |

||||||

|

OJSC "Sberbank of Russia" |

|||||||

|

VTB 24 (ZAO) |

|||||||

|

CJSC "CB Delta Credit" |

|||||||

|

JSC "Bank of Moscow" |

|||||||

|

JSCB "ROSBANK" |

|||||||

|

JSCB "Svyaz-Bank" |

|||||||

|

CJSC "Raiffeisenbank" |

|||||||

|

JSC "Bank "Saint-Petersburg" |

|||||||

|

Financial group "Opening"* |

It is the state-owned banks that influence the dynamics of the interest rate. Due to the fact that they lowered rates in the second half of 2013, other credit institutions also had to revise their lending conditions.

Among the latest plans of the Government is the creation in the near future of a single center for the issuance of social mortgage loans, which will allow further development of existing mortgage programs for low-income and vulnerable segments of the population (teachers, doctors, scientists, military, young families, etc.).

Analysts' forecasts for the development of mortgage programs in the Russian Federation in the first half of 2014. Taking into account the results of the total mortgage portfolio of Russian banks for 2013 as a whole, analysts make bold predictions about an increase in the volume of mortgage loans in the first half of 2014 by 16%. Moreover, arrears on mortgages should be sharply reduced, unless, of course, the economic situation in the country worsens even more. Speaking specifically about the results of January 2014, so far there has been some growth in the average cost of loans, although many Russian banks offer their customers a wide range of special mortgage programs with reduced rates. Apparently, the terms of the mortgage under such programs do not suit customers in some way.

Experts tend to explain this paradox as follows. First of all, at the end of last year and at the beginning of this year, banks increased the influx of customers who are ready to take out mortgages with a low down payment. Secondly, most of the clients of mortgage banks deliberately choose for themselves programs with an extended average payment period. Naturally, at the same time, the rates remain high, since they directly depend on the size of the borrower's own funds and the loan term.

Analysts also noted that in January 2014, Russian banks began to prepare new "flexible" requirements for their clients. They are willing to take risks in order to attract borrowers, even if they do not meet their basic initial requirements. In this way, the banks intend to make their mortgage borrowers the "primary breadwinners" who will bring them economic success in the future. Representatives of Rosselkhozbank and Sberbank are openly talking about this today, arguing that the Central Bank is pushing them to take such a step.

For example, quite recently Sberbank officially announced a 0.5 percentage point reduction in its basic mortgage rates. But this trend is alarming for some experts, because with “inadequate” mortgage offers, real estate prices can also rise sharply, especially in Moscow and other large cities of Russia.

Medium-term forecast for the development of the financial sector, mortgages and the Russian economy.

Their forecast, up to 2016, was recently presented by experts from the Institute for Economic Development. Gaidar. This document added nervousness to many leaders of mortgage banks. Experts believe that the income of the country's citizens in 2014 will grow quite a bit (by no more than 0.9%). For the perspective of 2015-2016 - even less (by 0.4%). This can only mean - the growth rate of mortgage lending will gradually decline. The debt burden on the population will grow rapidly, although banks offer profitable mortgage loans with a slowdown in their payments.

At the same time, the cost of servicing mortgage loans will begin to grow, which cannot but affect the financial development of many Russian banks, especially small ones. According to experts, it is necessary to look at the downward trend in the growth of consumer loans in 2013, and then it will not be difficult to compare the facts and draw conclusions by analogy regarding the development or “non-development” of mortgage programs.

Banks are betting on ruble mortgages.

Currency mortgage offers are not in great demand in our country. Their volume is no more than 1% of all issued mortgage loans. Today, banks are making their main bet on ruble mortgages. The situation for the first half of 2014 will not change significantly. But none of the owners of mortgage banks, experts or analysts wants to give forecasts until the end of the year. Everything will depend on the overall stability in the country.

Radical changes in mortgage rates are possible only if the economy is "desperately in a fever." Otherwise, one can hope for a smooth (gradual) decrease in average annual rates. The heads of major mortgage banks in the Russian Federation are inclined to hope that this spring the rates on mortgage ruble loans will remain at the level of the end of 2013 (about 12.4% per annum).

mortgage housing savings bank russia

Table 4

Comparative characteristics of the main conditions of mortgage lending in various banks

|

Sberbank |

||||||

|

Nordea Bank |

||||||

|

Raiffeisenbank |

||||||

|

UniCredit Bank |

||||||

|

Absolut Bank |

||||||

|

Credit Bank of Moscow |

||||||

|

Sobinbank |

||||||

|

Bank of Moscow |

||||||

|

Gazprombank |

||||||

|

Svyaz-Bank |

||||||

|

Alfa Bank |

||||||

|

Rosevrobank |

||||||

|

Promsvyazbank |

||||||

|

Transcapitalbank |

||||||

|

Tatfondbank |

||||||

|

Baltinvestbank |

||||||

|

Globexbank |

||||||

|

Credit Europe Bank |

||||||

|

Khanty-Mansiysk Bank |

||||||

|

Renaissance 2 3 1 2 1 9 |

Criteria for evaluation:

- 1. The value of the minimum down payment: 1 point - from 25%, 2 points - from 20%, 3 points - up to 20%.

- 2. Maximum loan term: 1 point - up to 20 years, 2 points - up to 25 years, 3 points - over 25 years.

- 3. Maximum loan amount: 0.5 points - up to 5 million, 1 point - up to 10 million, 2 points - up to 20 million, 3 points - over 20

- 4. The value of the interest rate: 1 point - above the average, 2 - 2.5 points - approximately equal to the average (depending on the upper limit of the rate), 3 points - below the average rate.

- 5. Forbes reliability rating: 1 point - 3 stars, 2 points - 4 stars, 3 points - 5 stars.

An analysis of the behavior of the main players in the mortgage market generally indicates a possible deterioration in the mortgage portfolio of banks in the medium term against the backdrop of weakening requirements for borrowers in previous periods. Also, according to the monitoring data of the AHML Analytical Center, in early July 2013, Soyuz Bank reduced the minimum down payment to 15%, and Svyaz-Bank - to 0% in mid-August (upon providing a certificate in the form 2-NDFL). In the event of a (significant) increase in arrears, an increase in interest rates cannot be ruled out. Thus, the market remains in a state of considerable uncertainty.

For the majority of citizens of the Russian Federation, mortgages have become the most affordable tool for acquiring their own housing. The decrease in mortgage rates in the context of stabilization of real estate prices attracts more and more people and provides an increase in the availability of this service for the population. Why is mortgage becoming an increasingly popular method of improving housing conditions? What trends are typical for the HML market? What is the dynamics of the mortgage market development? We will try to answer these and other questions in detail in this article.

Key market indicators for 2014-2017

According to the data of the Central Bank, on July 1, 2017, 589 credit institutions operated in the Russian Federation, 423 of which provided mortgage housing loans to citizens. For comparison, in 2014 there were 635 such organizations, in 2015 - 574, in 2016 - 499. Such a decrease in the number of organizations providing HMLs is explained not so much by the economic situation in the country or a decrease in demand for such services, but by the termination of activities credit institutions themselves as a result of bankruptcy or liquidation for another reason. It was in 2014 that the downward trend emerged precisely in 2014, since in previous periods the mortgage housing market was characterized by an increase in the number of such organizations - in 2009 there were 571 of them, and by 2013 this figure increased to 665. The table below shows the main indicators characterizing the dynamics of the mortgage market in last years.

Table - Trends specific to the HML market in 2014-2017

| Characteristics |

A period of time |

|||

|---|---|---|---|---|

| 1.01.2014 - 31.12.2014

|

1.01.2015 - 31.12.2015

|

1.01.2016 - 31.12.2016

|

1.01.2017 - 30.06.2017

|

|

| Number of HMLs, billion rubles |

1 012 800 pcs. in the amount of 1764.1 |

699 510 pcs. in the amount of 1161.7 |

856 461 pcs. in the amount of 1473.3 |

423 486 pcs. in the amount of 773.0 |

| Share of HMLs concluded in rubles |

1 012 064

|

699 419

|

856 427

|

423 482

|

| Debt, billion rubles |

In rubles - 3391.9; in foreign currency - 136.5 |

In rubles - 3851.2; in foreign currency - 131.1 |

In rubles - 4421.9; in foreign currency - 71.2 |

In rubles - 4616.3; in foreign currency - 54.6 |

| Amount of refinanced HMLs, billion rubles |

228,2

|

80,3

|

114,5

|

83,1

|

| The volume of early repaid mortgages, billion rubles |

530,6

|

477,1

|

611,4

|

347,3

|

Source: CBR

Thus, in the absence of growth in incomes of citizens and a reduction in investment demand in 2015, there has been a drop in the absolute indicators of HMLs. But already in 2016, the situation began to change and this indicator approached the level of 2014, despite the decrease in the number of banks. For the first 6 months of 2017, the indicator increased by 16.3% compared to the same time period in 2016. In 2014, there was an increase in the number of mortgage loans issued in rubles, and HMLs in foreign currency decreased by 2.5 times against the background of the weakening of the ruble. At the same time, in 2015, the number decreased by 1.4 times due to a reduction in lending by 34%. In 2016, there was a growth of 1.2 times against the backdrop of an increase in lending by 27.2%, while HMLs in foreign currency decreased again by 2.7 times. In 2017, the trends of the previous year continued. During the period under review, debt on housing mortgage loans in rubles increased significantly and decreased in foreign currency.

Dynamics of the weighted average rate in 2012-2017

The loan portfolio of any bank consists of several types of loans, which can be both long-term and short-term and others. The rates of such loans often differ from each other, and in order to know the total cost of all available loans, a special concept has been developed - the weighted average interest rate (ATR). It is a reflection of the average interest rate on all loans issued by banking organizations. Figure 1 shows the dynamics of ATP changes from 2012 to 2017 and gives a forecast for 2018.

Figure 1 - Weighted average interest rate on issued mortgage loans in 2012-2017 in foreign currency and rubles

Source: analytical materials of the Central Bank of the Russian Federation “On the state of the housing mortgage lending market” for 2014, 2015, 2016, the first half of 2017

As can be seen from the graph, in 2012 the ATP in rubles was 12.3% (which is 0.4 points higher than in 2011), and in foreign currency - 9.8% (an increase of 0.1%). In 2013, the ATP did not change significantly and amounted to 12.4% and 9.6% in rubles and foreign currency, respectively. In 2014, the changes were quite insignificant - 12.45 and 9.25%. In 2015, there was an increase in rates on provided HMLs - 13.35 and 9.82%. In 2016, there were downward trends, as ATP in rubles decreased by 0.87 percentage points, and in foreign currency - by 1.17 and amounted to 12.48 and 8.65%, respectively. In the first half of 2017, there was a significant decrease in interest rates on provided HMLs in rubles and foreign currency with an increase in lending terms - 11.5 and 6.75% in rubles and foreign currency. At the same time, already in November, the ruble indicator amounted to 10.9%. According to the forecast of T. Vlasova, Head of the Mortgage Department of the Ingrad Group of Companies, in 2018 the ATP may drop to a record 8-8.5%.

How many mortgages were issued in the regions of the Russian Federation?

The Volga Federal District occupies the leading position in obtaining mortgage loans, where 270,294 mortgage loans were concluded for 403,282,000 rubles. The second position among the districts is occupied by the Central Federal District, where 254,969 loan agreements were concluded out of 1,086,940 throughout the Russian Federation. At the same time, 62,505 HMLs are in Moscow, and 56,646 in the Moscow Region, which is a record among the constituent entities of the Russian Federation. The third place in the district is occupied by the Voronezh region, where 16,511 mortgage loans were issued. Least of all mortgage loans were issued in the North Caucasian Federal District - 24,281 units. Figure 2 shows the shares of mortgage loans issued in the primary market by federal districts of the Russian Federation in 2017.

Figure 2 - The share of issued mortgage loans by FD in 2017

Calculation of the "Insurance portal" according to the statistical data of the Central Bank of the Russian Federation

The weighted average interest rate varies slightly by county. Thus, in the Central Federal District it is 10.64%, in the Northwestern Federal District - 10.65%, in the Southern Federal District - 10.7%, in the North Caucasian Federal District - 10.72%, in the Volga Federal District - 10.6%, in the Urals - 10.65%, in the Siberian - 10.66%, in the Far East - 10.57%. Among the constituent entities of the Russian Federation, 2 regions can be distinguished with the highest and lowest interest rates on mortgages - these are the Republic of Crimea (11.24%) and Chuvashia (10.42%).

The cost of mortgages in new buildings and in the secondary market

According to the Agency for Housing Mortgage Lending, in 2017, the share of the population who have access to a mortgage increased by 6 percentage points and amounted to 43%. The main growth factors were the reduction in rates and real real estate prices after deducting inflation. By comparison, back in 2012, this share of the population was only 29%. The reduction in rates is attractive to citizens, since the amount of the monthly payment on the loan is also reduced, and savings over the entire period can reach 45%. In conditions of expensive housing (both in the primary and in the secondary market), this fact is one of the decisive factors in the choice of mortgage lending. Figure 3 shows the average prices per 1 sq. m. m. in the secondary market and in new buildings.

Figure 3 - Dynamics of prices in the real estate market of the Russian Federation in 2012-2017

Banki.ru calculations according to the Bank of Russia and Rosstat

The increase in real estate prices is due to the fact that the construction market has not yet recovered from the economic crisis. The dynamics of housing commissioning has been slowing down over the past few years, which can be explained both by a decline in sales in 2015 and a reduction in equity financing and lending to developers. The post-crisis period showed the worst performance in investing in residential real estate. So, in the first half of 2016, this figure was equal to 239 billion rubles, and for the same period in 2017 - only 194 billion rubles.

The volume of loans issued by leading banks in 2017

The share of mortgage loans in the total portfolio of Russian banks exceeds 11%. At the end of 2017, this figure was 10.6%. About 90% of the total portfolio is accounted for by loans (including retail loans) issued by 30 largest Russian banks. Mortgage lending is traditionally dominated by 2 banks - Sberbank and VTB. Moreover, the first in 2017 issued more than half of all mortgage loans for a total amount of more than 1 trillion rubles. Sberbank's mortgage portfolio grew by 17%.

VTB is relatively far behind its competitor - mortgage loans in 2017 were issued for more than 430 billion rubles, and the loan portfolio grew only by 11%. More than 70% of all mortgages are accounted for by these 2 banks, but there are other market players that are of no small importance for its development. The volumes of mortgage loans issued by them are shown in Figure 4.

Figure 4 - The volume of mortgage loans issued by the leading banks of the Russian Federation in 2017

According to the AHML survey “Results of the development of the mortgage and housing market in 2017”

As of January 1, 2018, the volume of the mortgage portfolio of banks reached 5.34 trillion rubles, of which 1.12 trillion are mortgage loans for the purchase of housing in the primary market (in new buildings). In 2017, citizens of the Russian Federation purchased 2.85 million apartments (or other residential premises), which corresponds to the demand for housing in 2016. The demand for new buildings also remained at the same level - 621 thousand contracts in 2017 against 620 thousand in 2016. About 2.23 million transactions were made in the secondary market. The share of mortgage transactions in the secondary market was 31%, in the primary market - 50%, in the first case the average size of a mortgage loan was 1.74 million rubles, in the second - 2.12 million.

Conclusion

At the end of 2017, a high concentration of supply and demand remains, this is especially noticeable in 10 regions of the Russian Federation: Moscow and the region, St. Petersburg, the Tyumen region, Tatarstan, the Sverdlovsk region, Bashkortostan, the Krasnodar Territory and other regions. The high volume of housing construction in these regions is supported by higher wages and the active development of mortgage lending. These regions account for 48% of all issued mortgages in 2017.