The article presents a stochastic simulation model for calculating the reserve of incurred but not declared losses in the form of a single-channel queuing system, described in semimartingale terms. Estimates of the number of insured events and distribution functions of the amount of insured damage for insurance of means of land and air transport are constructed using the example of statistical data of an insurance company. Simulation stochastic modeling was carried out in the high-level software environment Microsoft Visual Studio in C#, the evaluation of distribution functions for an empirical sample of insurance claims was carried out in Excel and Statistica. The graphs for calculating the simulation model of RPNU are presented. The advantage of using this model is that there is no requirement to accumulate and segment insurance claims data as required by other actuarial methods.

simulation modeling

queuing system

insurance compensation distribution function

1. Borovikov V. STATISTICA. The art of computer data analysis: for professionals. - 2nd ed. (+CD). - St. Petersburg: Peter, 2003. - 688 p.: ill.

2. Butov A.A., Ravodin K.O. Theory of random processes: teaching aid. - Ulyanovsk: UlGU, 2009. - 62 p.

3. Ivanov S.S., Golubev S.D., Chernaya L.A., Sharafutdinova N.E. Theory and practice of risk insurance. - M.: ROSNO: Ankil, 2007. - 480 p.

4. Clark S.M., Hardy M.R. and etc.; educational materials. - M., 2008. - 438 p.

5. Mack T., Mathematics of risk insurance / per. with him. - M .: CJSC "Olimp-Business", 2005. - 432 p.: ill.

6. Order of the Ministry of Finance of the Russian Federation dated June 11, 2002 No. 51n “On approval of the rules for the formation of insurance reserves for insurance other than life insurance”. – URL: http://base.garant.ru/12127460/ (date of access: 06/13/2016).

7. Federal Law No. 4015-1 dated November 27, 1992 N4015-1 (as amended on May 23, 2016) “On the Organization of the Insurance Business in the Russian Federation” – URL: http://base.garant.ru/10100758/1 / (date of access: 06/13/2016)

8. Friedland J. Estimation unpaid claims using basic techniques March 2009. URL: https://www.casact.org/library/studynotes/Friedland_estimating.pdf (Accessed June 13, 2016).

9. StatSoft Russia. – URL: http://www.statsoft.ru (date of access: 06/13/2016).

One of the important conditions when concluding an insurance contract is the timely notification of the client of the insurance company about the insured event. However, the period of time from the occurrence of an insured event to reporting it to the insurer during the period specified in the contract may exceed the reporting period. In this regard, in order to fulfill obligations under such claims, the insurer, along with the reserves of unearned premium, reported but unsettled losses and the stabilization reserve, forms a reserve for occurred but unreported insurance losses (hereinafter - IBNR) .

According to IBNR, it is an assessment of the insurer's obligations to make insurance payments that arose in connection with insured events that occurred in the reporting or previous periods, the occurrence of which was not announced to the insurer in the reporting or previous periods in accordance with the law or contractual procedure. The obligation to form and the methodology for calculating IBNR are provided for by the insurance legislation.

In the balance sheet of an insurance company, IBNR as an obligation of the insurer to customers is included in liabilities and affects the taxable base, the amount of assets required to ensure IBNR obligations, settlements with reinsurance companies, tariff policy, settlements with shareholders, solvency, financial stability, unprofitability and etc. In this regard, the correctness and accuracy of the IBNR assessment is essential for the insurer. On the one hand, an overvaluation requires an adequate amount of the asset to cover the reserve, on the other hand, an undervaluation can lead to a shortage of funds for insurance payments and, consequently, the insolvency of the insurance company.

To calculate IBNR, methods based on the use of loss development triangles (paid or held) are most widely used - chain ladder methods, Bornhütter-Ferguson, Berquist-Sherman, as well as methods based on expected loss.

This article considers a stochastic simulation model for estimating the reserve of incurred but not reported losses in the form of a single-channel queuing system (on the example of aviation insurance and land transport insurance), described in semimartingale terms. The data of NIK Insurance Company (hereinafter referred to as the Company) for the period 2010-2015 were used as statistical data on the number and amount of losses incurred.

Stochastic modeling of the queuing system was carried out in the high-level software environment Microsoft Visual Studio 2010 in C#, the distribution functions were evaluated by an empirical sample of insurance claims - in Microsoft Excel 2010 and Statistica 10.0.

Formulation of the problem

Consider a single-channel queuing system in terms of point processes. Let the process (At)t≥0 be a point counting process of the number of losses incurred at time t ≥ 0, (Dt)t≥0 be a point counting process of the number of reported but unsettled losses (losses known to the company at time t) , (Qt)t≥0 - the number of incurred but undeclared losses. The relationship of these processes is presented in the form of a queuing system (hereinafter referred to as QS), in which the role of claims is played by the occurrence of insured events, the queue length is the process (Qt)t≥0, and the number of serviced claims is the process (Dt)t≥0 (Fig. 1). Then the balance equation can be written in the form

Qt = Q0 + At - Dt, (1)

where A0 = 0; B0 = 0; D0 = 0.

Rice. 1. General scheme of QS operation

The processes At, Dt, Qt are considered on the stochastic basis B(Ω, F, ? = (Ft)t≥0, P), where At, Dt are independent Poisson processes with intensity λ > 0 and δ > 0, respectively. In accordance with the Doob-Meyer decomposition for submartingales, the processes At, Dt can be represented as

where and are square-integrable martingales on B, and , are compensators of the processes

At, Dt of the form

A stochastic simulation model for calculating RPNU can be built as follows.

Let ηt - the amount of loss declared by the client at time t be a random variable with the distribution function F(η ≤ x), then It - the amount of IBNR at time t - can be defined as

![]() (4)

(4)

Numerical calculation of the number of incurred but unreported losses

To evaluate the parameters, we introduce the following parameters: - date of the i-th insured event, - date of notification of the i-th insured event to the insurer, - number of days calculated from the date of the insured event to the date of notification, , i = 1...N, where N - the number of insured events for the period under review.

Since the time between occurrences of insured events has an exponential distribution, the value can be calculated by the maximum likelihood method as

Similarly, the service intensity value is calculated as the average number of days between the dates of the insured event and the date of the claim:

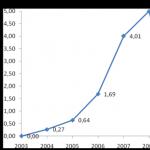

On fig. Figures 2-3 show illustrative examples of modeling the At process - the number of losses incurred for the period (0, T) according to the Company's statistical data for air transport insurance (AC CASCO, N1 = 40) with estimated parameters and for land transport insurance (AM CASCO, N1 = 316) with parameters .

Rice. 2. Schedule of processes At (CASCO VS), discreteness t = 1 month, T = 63 months.

Rice. 3. Graph of processes At (CASCO AM), discreteness t = 1 month, T = 40 months.

Mathematical model of the amount of insurance loss

Based on the empirical sample η1, η2, ..., ηN of insurance claims, we determine the distribution function of the random variable η under the assumption that for each type of insurance the sample of insurance claims is random and homogeneous.

Using the classical apparatus for fitting the distribution function according to empirical observations of insurance claims, presented in , we establish that the most appropriate distribution function for the insurance claim for CASCO VS and CASCO AM (in terms of the Kolmogorov-Smirnov criterion) is a lognormal distribution with parameters μ > 0, σ2 > 0 and the density of the form

x > 0. (7)

x > 0. (7)

The parameters of the log-normal distribution for the empirical sample were estimated using the maximum likelihood method:

(8)

(8)

The main parameters for estimating the distribution function, the Kolmogorov-Smirnov criterion

Rice. 4. Graph of EIt, (in USD) for CASCO aircraft, t = 1 month, T = 5000

Rice. 5. Graph of EIt, (in thousand rubles) for CASCO AM, t = 1 month, T = 1000

An example of fitting the empirical distribution function to the theoretical one is shown in fig. 4.

Assuming the stationarity of the parameters λ, δ, μ, σ, we determine the average value of EIt at T → ∞ (simulation time) by the formula

Conclusion

In this article, a stochastic simulation model of the reserve of occurred but undeclared losses was considered, built in terms of queuing systems. For the types of insurance CASCO AM and CASCO VS, a model of the number of incurred but undeclared losses is separately constructed, and the function of distribution of insurance compensation at time t is determined.

The advantage of using this simulation model for calculating IBNR is a high degree of adequacy of real data, which is confirmed by graphs 2-6. In addition, the application of this model does not require a preliminary long process of accumulating data on losses and discretizing insurance payments (for a quarter, half a year, a year) as required by chain-ladder methods.

Stochastic modeling of the RPNU queuing system is implemented in the Microsoft Visual Studio 2010 environment in C#. The fitting of the distribution function according to the empirical data of insurance claims is implemented in the Statistica 10.0 package.

This simulation model for calculating IBNR can be improved if the processes At, Dt are represented as multivariate processes.

Bibliographic link

Butov A.A., Galimov L.A. STOCHASTIC SIMULATION MODEL FOR ASSESSING THE RESERVE OF OCCURRED BUT NOT DECLARED INSURANCE LOSSES IN TERMS OF SMO // Fundamental research. - 2016. - No. 8-2. – S. 234-238;URL: http://fundamental-research.ru/ru/article/view?id=40647 (date of access: 01/04/2020). We bring to your attention the journals published by the publishing house "Academy of Natural History"

Usova E.Yu., Filatov A.Yu. Irkutsk State University Empirical study of OSAGO on the example of the insurance company "RESO-Garantiya"

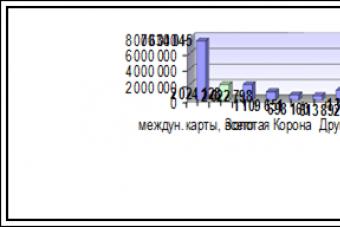

Insurance in Russia and other countries Insurance is a relationship to protect the property interests of individuals and legal entities in the event of insured events at the expense of monetary funds formed from insurance premiums. Share of insurance premium in GDP Russia - 2.5%, USA - 9%, France - 11%, UK - 16%. Insurance premium per capita Russia - $250, USA, France - $4 thousand, Great Britain - $6.5 thousand. The volume of the insurance market is ~ 1 trillion rubles. The growth rate is greater than that of GDP; in 2009 the fall (even excluding CHI) is smaller than that of GDP.

Insurance premiums and payments by types of insurance in 2008 Name of indicator Insurance premiumsInsurance payments Share of payments in premiums billion rubles % % Voluntary insurance Life insurance194.0263.070.32 Personal insurance10823.176131.520.56 Property insurance31667.030.40 Liability insurance234,8631,380.13 Total: .42 Compulsory OSAGO insurance8016,594811,130.60 OMS39481,420.95 Other81,5861,450.75 Total: .89

Insurance tariffs for OSAGO Increasing and decreasing coefficients: 1. Features of the territory where vehicles are used. 2.The nature of the use of the car 3.Power of the vehicle. 4. The presence or absence of insurance payments in previous periods. 5. Driving experience and age of car users. 6. The period of seasonal use of the car. Base rates are differentiated depending on the technical characteristics and design features of vehicles that affect the likelihood of harm when using the vehicle, as well as the potential amount of this harm. Since March 25, 2009, new OSAGO tariffs have been introduced! Analysis of tariff adjustments based on statistics for 20,000 contracts of IC RESO-Garantiya concluded in 2007 (all payments made).

Basic tariffs for various types of vehicles Vehicle type Effective tariffs, rub. Estimated tariffs, rub. Profit at the current tariff Trailers for passenger cars39513.782767.20% Trailers for trucks810225.36259.43% Tractors,89267.20% Buses, trolleybuses,2632.87% (legal entities) ,33–1.10% Taxi, 69–67.25% Trucks (up to 16 tons) .52–17.13% Trucks (over 16 tons) .03121.01% 1. Taxi - the rate is significantly underestimated, the losses of the UK, the unwillingness to insure. 2. Trailers for passenger cars (432 contracts) - the rate is too high, compulsory insurance has been cancelled.

Engine power factor By individual groups Based on regression engine, hp Calculation. net premium to Coef. with Calc. coefficient Actual / Calc. to Actual/calc. with Calc. coefficient Actual / Calc. to Actual/calc. s.731.71.60.9970.99%60.93% 1.4219.78%12.74% 2. Powerful cars - overpriced. 3. The discrepancy between the effective and calculated coefficients has decreased.

Age and experience coefficient Age and experience of the driver Freq. cases Calc. coefficient Coef. to Coef. with Act./ Calc. to Actual/calc. with no restrictions 0.07632.041.51.7–26.55%–16.76% up to 22 years with experience up to 3 years 0.06741.801.31.7–27.92%–5.75% up to 22 years with experience over 3 years0.03891.041.21.315.27%24.88% from 22 years with experience up to 3 years0.07231.931.151.5–40.56%–22.47% from 22 years with experience over 3 years0 , Simplification: we consider that the size of the average insurance payment does not depend on the age and experience of the driver (only the frequency is important). This is acceptable, unlike base rates, engine power factors and territory. 1. From experience and age - a significant component is experience. 2.Inexperienced drivers - the coefficient is underestimated (despite the increase). 3. Without restrictions - the coefficient is underestimated (despite the increase). 4.Experienced young drivers – the coefficient is overestimated (with the discrepancy even slightly increased). 5. Gender affects unprofitability more than age. The indicators are interconnected.

Bonus-malus coefficient bonus-malus Insurance premium Insurance premium without coef. Insurance payments Share of payments in premium Share adjusted for regression Calculation. coefficient 0.42010.38820.48 0.44820.49400.61 0.58280.59970.74 0.74870.70550.79870 The company is most profitable to work with clients who have not been involved in an accident in previous years and who have a reduction coefficient . 2. There is a reserve for reducing the bonus-malus coefficient for these categories of drivers.

Construction of the theoretical law of the distribution of payments Lognorm.distribution. Exponential Gamma Fear. payments, thousand rubles The number of fear. cases share fear. cases Theoret. prob. Calculation by crit. Pearson Theoret. prob. Calculation by crit. Pearson Theoret. prob. Calculation by crit. Pearson 0– .3250.2210.049 0.3590.003 0.3370.000 10– .2970.4030.028 0.2300.020 0.2420.013 20– .1520.2050.013 0.1480.000 0.1570.000 30– .0650.0900.007 0.0950.009 0.0990.012 40– .0520.0410.003 0.0610.001 0.0620.002 50–6036 0.0400.0190, 022 0.0390.000 0.0390.000 60–7017 0.0190.0100.009 0.0250.002 0.0240.001 70–8015 0.0170.0050.027 0.0160.000 0.0150, 000 80–908 0.0090.0030.014 0.0100.000 0.0090.000 90– .0140.0020.109 0.0070.009 0.0060, –1106 0.0070.0010.038 0.0040 .001 0.0040, –1203 0.0030.0010.015 0.0030.000 0.0020, =0.333 =0.046 =0.045

Application of the theoretical law of distribution of payments Finding the probability of payments of an arbitrary given amount: 1. Calculation of the tariff for DSAGO (expansion of the liability limit to 420 thousand rubles). Taking into account the load of 20%, the estimated premium for the gamma distribution is ~ 90 rubles. 2. Calculation of correction factors for the franchise (exemption of the insurance company from compensation for losses not exceeding a given value). Franchise, rubles Discount, %1,987,3014,6723,06 3. Formation of insurance tariffs for voluntary types of insurance, in particular, for CASCO.

Pluses and minuses of the state establishment of tariffs for OSAGO Pluses: 1. Unification of insurance conditions and simplification of the policyholder's decision when choosing an insurance company. 2. The impossibility of dumping by insurance companies in order to attract customers and subsequent failure to fulfill obligations. Cons: 1. Possible inconsistency of insurance rates with economic realities and a wide spread of unprofitability. 2. Slow response of tariff rates to changes in market conditions. 3. Insufficient differentiation of risks and poor consideration of the peculiarities of local insurance markets in tariffs. 4. The impossibility of attracting less unprofitable clients by the insurance company on special terms.

Thank you for your attention!

480 rub. | 150 UAH | $7.5 ", MOUSEOFF, FGCOLOR, "#FFFFCC",BGCOLOR, "#393939");" onMouseOut="return nd();"> Thesis - 480 rubles, shipping 10 minutes 24 hours a day, seven days a week and holidays

Yarkova Olga Nikolaevna Models and methods for assessing the solvency of an insurance company, taking into account investment and reinsurance (on the example of CASCO): dissertation ... candidate of economic sciences: 08.00.13 / Yarkova Olga Nikolaevna; [Place of protection: GOUVPO "Samara State Aerospace University"].- Samara, 2010.- 183 p.: ill.

Introduction

Chapter 1 Risk Models in Insurance and Methods for Increasing the Solvency of Insurance Companies 8

1.1 Risks in insurance 8

1.2 Methods for assessing solvency 16

1.3 Models for assessing solvency and approaches to improve it.29

Chapter 2 Study of the influence of the characteristics of the risk process and assets on the probability of non-ruin 38

2.1 Study of the dependence of the probability of non-ruin on the initial capital 38

2.2 Study of the impact of asset characteristics on the solvency of an insurance company 51

2.3 Analysis of the impact of initial capital on the strategy of investing in risky or risk-free assets 57

Chapter 3 Formation of an investment and reinsurance strategy 66

3.1 Analysis of the impact of diversification of investments in risky and risk-free assets on solvency 66

3.2 Forming an investment strategy 75

3.3 Impact of reinsurance on solvency 82

Conclusion 96

List of sources used 98

Applications 106

Introduction to work

Relevance of the research topic. Increasing competition, as evidenced by the decrease in the share of leading insurance companies in the total volume of collected premiums (according to the Expert RA Rating Agency), and the increase in risks caused by the global financial crisis, give rise to high requirements for an objective assessment of not only the solvency of insurance companies, under which we will understand the positivity of the risk process, but also the instruments that influence it. One of the instruments of influence on solvency is the equity capital of an insurance company, the increase of which is possible through investment. The influence of equity capital on such a characteristic of solvency as the probability of non-ruin is devoted to the works of foreign and domestic authors F. Lundberg, G. Grandell, F. de Vildera, T. Anderson, X. Cramer, G.Sh. Tsitsiashvili. K. Segerdahl, J. Paulsen and H. Gjessing investigated the dependence of solvency on the initial capital of an insurance company, taking into account the investment of free funds in risk-free assets. In the works of S. Brown, A.V. Melnikov and S. Asmussen analyzed the impact of initial capital on the probability of non-ruin of an insurance company, taking into account the investment of free funds in risky assets.

Another possibility to increase the probability of non-ruin is reinsurance. In the works of H. Schmidli and K. Hipp, an estimate was obtained of the dependence of the probability of non-ruin of an insurance company on the initial capital, taking into account reinsurance and investing in risky assets, but with strict assumptions about the nature of the distribution of payments and large values of initial capital.

Thus, it can be stated that in the works of domestic and foreign authors no attention is paid to modeling the dependencies of the probability of non-ruin of insurance companies on such characteristics of the risk process and assets as the relative risk premium, the profitability of risky and risk-free assets, the volatility of prices of a risky asset, the share of investment in risky (risk-free) assets, the amount of own retention in reinsurance, etc. The scientific and practical significance and insufficient development of these issues for assessing the solvency of insurance companies determined the choice of the topic and the structure of the study.

The purpose of the study is to improve methods for assessing the probability of non-ruin in terms of investment and reinsurance in solving the problem of increasing the solvency of an insurance company.

To achieve this goal, the following tasks were set and solved:

analysis of existing methods and models for assessing the solvency of insurance companies;

Modeling the relationship between the probability of non-ruin and the characteristics of the risk process, assets, the volume of investment and reinsurance;

Development of a methodology for the formation of investment strategies

In risk-free assets;

In risky assets;

In risky and risk-free assets;

Development of a methodology for the formation of reinsurance strategies in various investment conditions.

The object of research is the probability of non-ruin, as a characteristic of the solvency of an insurance company.

The subject of the study is methods and models for assessing the probability of non-ruin of an insurance company. Research area - 1.6. Mathematical analysis and modeling of processes in the financial sector of the economy, development of the method of financial mathematics and actuarial calculations.

Theoretical and methodological base of the research Works of domestic and foreign authors on insurance and actuarial mathematics, probability theory, random processes, mathematical statistics, numerical analysis were used as the theoretical basis of the dissertation work. Numerical simulation is implemented using the Delphi 7.0 software development environment.

The data of the insurance company RESO-Garantia were used as the information base of the study.

The scientific novelty lies in modeling the dependencies of the probability of non-ruin on the characteristics of the risk process, risky and risk-free assets, which make it possible to form investment and reinsurance strategies to increase the solvency of an insurance company.

The most significant scientific results:

proposed and implemented a procedure for mathematical modeling of the relationship between the probability of non-ruin and the relative risk premium, the relative risk premium and initial capital, the probability of non-ruin and the profitability of risky and risk-free assets, the probability of non-ruin and the volatility of prices of a risky asset, etc. assets on the solvency characteristics of the insurance company;

A methodology has been developed for the formation of strategies for investing in risky and / or risk-free assets based on the constructed models that characterize the relationship between the probability of non-ruin and the volume of investment; the volume of investment and initial capital, the use of which allows to increase the solvency of the insurance company;

A methodology for the formation of reinsurance strategies in various investment conditions is proposed based on the constructed models that describe the relationship between the characteristics of solvency and the volume of own retention, the implementation of which allows increasing the probability of non-ruin of an insurance company.

Practical significance The results of the study were accepted for implementation in the RESO-Garantiya insurance company (Orenburg branch), and are used when considering issues related to ensuring a high level of non-ruin. Theoretical and practical results obtained in the course of the study are used in the course of the academic discipline "Insurance and Actuarial Calculations".

Approbation of the work The main theoretical and practical provisions of the dissertation work were reported and discussed at conferences:

All-Russian scientific and practical conference "Interaction between the real and financial sectors in the transformational economy" (Orenburg, OSU, 2008);

All-Russian Scientific and Practical Conference "Financial and Actuarial Mathematics" (Neftekamsk, NFBashGU, 2009);

All-Russian scientific-practical conference "Multi-profile university as a regional center of education and science" (Orenburg, OGU, 2009).

Structure and scope of work The dissertation consists of an introduction, three chapters, a conclusion, a list of references and appendices. The appendices contain information and reference materials illustrating and supplementing the main content of the study. The dissertation work is presented on 212 pages of typewritten text, contains 84 tables and 56 figures. The list of references includes 93 titles of works by domestic and foreign authors. Applications are presented on 107 pages.

The first chapter "Risk Models in Insurance and Methods for Increasing the Solvency of Insurance Companies" reveals the economic essence of insurance as one of the risk management methods, describes models and methods for assessing the probability of non-ruin, and considers approaches to increasing the solvency of an insurance company.

In the second chapter, "Investigation of the influence of the characteristics of the risk process and assets on the probability of non-ruin," the dependencies of the probability of non-ruin of an insurance company on the initial capital are constructed in the Poisson model of collective risk, taking into account investment in either risky or risk-free assets. A procedure for modeling the relationship between the probability of non-ruin and the relative risk premium, the relative risk premium and initial capital, the probability of non-ruin and the profitability of risky and risk-free assets, the probability of non-ruin and the volatility of prices of a risky asset is proposed and implemented. A technique for forming an investment strategy in risky or risk-free assets has been developed.

In the third chapter “Formation of investment and reinsurance strategies”, the dependence of the probability of non-ruin on the initial capital is built in terms of investing in risky and risk-free assets. Modeling of the relationship between the probability of non-ruin and the volume of investment in risky and risk-free assets was carried out; volume of investment and initial capital of the insurance company. The method of formation of reinsurance strategies in various investment conditions is proposed.

Models for assessing solvency and approaches to its improvement

To implement its main function - making payments in the event of insured events - the insurance company must have special financial resources that determine its capital. The capital (reserve) of an insurance organization consists of two main parts - equity capital and borrowed capital, and the attracted part of the capital largely prevails over its own. This is due to the industry specifics of insurance. The activity of an insurance company is based on the creation of monetary funds, the source of which is the funds of policyholders received in the form of insurance premiums (premiums). They do not belong to the insurer. These funds are only temporarily, for the period of validity of the insurance contracts, at the disposal of the insurance company, after which they are used to pay the sum insured or converted into a revenue base (subject to the break-even passage of the contract), or returned to the policyholders in the part stipulated by the terms of the contract (bonus). Thus, the capital of the insurance company Y, at time t is equal to S(t) - the sum of payments made by the insurance company at time /; n(t) - premiums collected by time t. Process (1.1) is also called the risk process of an insurance company.

The formation and use of capital is one of the main aspects of the activities of insurance companies, aimed at ensuring solvency. An additional source of income for the insurer, in addition to income from insurance operations, is investment income. Profitable investment activity allows the insurer to reduce the tariff, in which both insurers and policyholders are interested. Not only the income of the insurer, but also its solvency depends on the efficiency and reliability of the placement of temporarily free funds. Thus, until 2005, the average return on investment of insurance companies lagged behind the rate of inflation and there was an increase in the number of insolvent insurers. In 2006, as of January 1, 2007, licenses were revoked from 14% of the total number of registered insurers. The inclusion of Russia in the global integration processes is forcing insurance companies to approach the conditions of world standards, and the increase in financial risks, in a crisis, and intensifying competition, as evidenced by the data of the Expert RA agency, give rise to high requirements for an objective assessment of the solvency of insurance companies.

A number of indicators are used to study the solvency of insurance companies. Some of these indicators are of a normative nature and are established and controlled by state bodies, while others are advisory. In Russia, the following indicators are used: the minimum level of authorized capital; normative solvency margin; the amount of necessary insurance reserves; standards for investment activities, etc. All these indicators reflect only certain aspects of the activities of insurance companies and are not quantitative characteristics of the company's solvency. In the works, as a measure of the solvency of an insurance company, the probability of non-ruin p(ii) = P \ Yl 0), or, the probability of ruin y / (u) = l-P (Yt 0), as a characteristic of the opposite event, which are a measure of the risk of the insurance company functioning, is used , characterizing the properties of the solvency of the company as a whole or individual portfolios of contracts. The concept of "ruin" means the excess of payments over receipts and reserves. However, the deficit of the latter does not mean the bankruptcy of the insurance company, since the company can use other sources of repayment of the deficit, for example, a loan. In risk theory, ruin (assets falling to zero) should be understood as some kind of indicator signaling financial trouble. Sometimes ruin is understood as the reduction of capital to a certain positive minimum - the minimum regulatory level (if the capital is less than the regulatory level, the activities of the insurer are suspended by the regulatory authorities). This approach is typical for EU countries. That is, the probability of ruin (or the probability of non-ruin) is a deterministic characteristic of solvency.

We will be interested in the dependence of the probability of ruin on the initial capital, the relative risk premium, etc. Calculation of the probability of ruin involves building models of individual or collective risk for the company as a whole or for individual portfolios of contracts. An individual risk model is characterized by the fact that all insured objects have the same characteristics, such as the probability of an insured event, the distribution of a possible insurance loss, the terms and conditions of insurance. The insurance company indemnifies the damage only from the funds received as insurance premiums. The individual risk model assumes that losses for each risk unit are independent and equally distributed. Such an assumption can be made in the case when insured losses for each insurance object are due to various, unrelated reasons. This is a natural requirement in life insurance, however, it is not typical for other types of insurance. The information content of such a model is low, since factors that can simultaneously affect many risks in the group are not taken into account. In addition, the individual risk model is a static insurance risk model, where the risk is modeled by only one random variable, namely, the total insurance loss for the risk group, and static models give a limited idea of the risk. Modification of the individual risk model is recommended by Rosstrakhnadzor when calculating tariff rates for risky types of insurance, due to the fact that it is the only analysis tool if statistical data is presented in aggregated form. The model of collective risk reflects the real phenomena in insurance most fully. With its help, you can achieve greater dynamics in managing the risk of the company.

Study of the influence of asset characteristics on the solvency of an insurance company

In our example, an insurance company that invests all free funds in a risk-free asset with a return of 0.13, with R = 3.82 claims / day, 0 = 60% and = 65%, to achieve a non-ruin probability of 0.95, it is necessary to have an initial capital of 320 thousand rubles. and give 20% of risks for reinsurance. Similar calculations can be made for other model parameters.

The dependences between the probability of non-ruin of the insurance company and the volume of own retention, calculated similarly, in the case of investing 50% of free funds in risky assets with a yield of 0.4 and price volatility of 0.25 and 50% of free funds in risk-free assets with a yield of 0.13, are presented in Table I. 14 of the appendix And (a family of solutions to problem (3.15) in tables Zh.30-Zh.32 of Appendix G, interpolation splines in Table K.20 of Appendix K). Dependency graphs constructed for different values of the reinsurer's relative risk premium a) = 65%; b) = 75%; c) , = 85% are presented in Figure 3.15, and the LSLS approximations are given below:

For the given characteristics of the risk process, an insurance company with an initial capital of 350 thousand rubles. and strategies for investing in risky (// = 0.4, st = 0.25) and risk-free (r = 0.13) assets (0.5, 0.5), respectively, to achieve a non-ruin probability of 0.95, it is necessary to reinsure 7.5% of risks if the relative risk premium of the assignor is 60%, and the relative risk premium of the reinsurer is 85%), or 5% of risks if the relative risk premium of the reinsurer is 65%. Dependencies between the initial capital of an insurance company and the volume of own retention are calculated similarly for p = 0.95, in the case of investing 50% of free funds in risky assets with a yield of 0.4 and price volatility of 0.25 and 50% of free funds in risk-free assets with a yield of 0.13. Graphs of calculated values (table I. 15) and interpolation splines, for the given parameters of the risk process (/3 = 0.5, r = 0.13, a = 0.5, // = 0.4, cr = 0.25, R = 3.82 claims / day, 0 = 60%, and = 350 thousand rubles), (Appendix K, Table K.21) are shown in Figure 3.16. own retention, p = 0.5, r = 0.13, a = 0.5, /l = 0.4, a = 0.25, A = 3.82 ISK/day, c = 60%, p = 0.95, for a) = 65%; b) = 75%; c) = 85%. Such dependencies will allow the insurance company to form a reinsurance strategy taking into account the characteristics of the assets. For example, to ensure the probability of non-ruin of 0.95 for an insurance company with an initial capital of 320 thousand rubles. it is necessary to invest 50% of free funds in risky assets with a return of 0.4 and price volatility of 0.25, 50% of free funds - in risk-free assets with a return of 0.13 and give 15% of risks for reinsurance if the relative risk premium of the reinsurer is 0.65. Thus, we quantified the impact on the probability of non-ruin of the characteristics of assets, the volume of investment in risky and risk-free assets, which will allow us to form an investment strategy in risky and risk-free assets, depending on the size of the initial capital. In addition, a methodology for the formation of a reinsurance strategy in various investment conditions is proposed and demonstrated using the example of CASCO. All calculations presented in the paper were obtained numerically using the automated software package "Analysis of the solvency of an insurance company" (Appendix L). Conclusion The analysis of models and methods for assessing the solvency of an insurance company led to the conclusion that the quantitative assessment of the impact on the probability of not ruining such characteristics as the relative risk premium, the profitability of risky and risk-free assets, the volatility of prices of a risky asset, the share of investment in risky and risk-free assets, the volume of equity reinsurance deductions. The paper proposes and implements a procedure for modeling the relationship between the characteristics of the solvency of an insurance company and the characteristics of the risk process, assets, volume of investment and reinsurance, allowing: - to quantify the size of the relative risk premium that provides a given probability of non-ruin with a fixed initial capital in various investment conditions; - quantify the size of the relative risk premium depending on the size of the initial capital, which guarantees a fixed level of the probability of non-ruin in various investment conditions; - quantify the impact of risk-free asset return, risk asset return, risk asset price volatility on the probability of non-ruin of the insurance company. Developed and implemented a methodology for the formation of strategies for investing in risky assets; into risk-free assets; into risky and risk-free assets that provide the required level of probability of non-ruin, depending on the ratio between the characteristics of the assets and the characteristics of the risk process.

Analysis of the impact of initial capital on the strategy of investing in risky or risk-free assets

There are three main ways to influence risk - reduction, retention and transfer. Risk reduction refers to the reduction of either the amount of possible damage or the likelihood of adverse events occurring. The conservation group includes self-insurance, i.e. creation of special reserve funds (self-insurance funds or risk fund) from which losses will be compensated in the event of adverse situations. The transfer of risk means the transfer of responsibility for the risk to third parties, while maintaining the level of risk. This group includes insurance, which involves the transfer of risk to an insurance company for a fee, as well as various types of guarantees, financial guarantees, etc.

Let's define insurance as - "a set of social relations associated with the formation of an insurance fund at the expense of contributions made by participants in its creation, with its centralization in organizations engaged in insurance operations and using it to cover damages or make other payments to persons in respect of whom insurance is carried out , in the event of the occurrence of predetermined random events. An insurance contract is called a policy. If the policy was made available for payment, then the insurer is said to have received the claim; if the insurance situation does not arise, then the policyholder loses the premium. The insurance company has numerous obligations and rights under the insurance contract. The obligations of the insurer are divided into obligations to bear the risk and to pay insurance compensation (sum insured).

To implement its main function - making payments in the event of insured events - the insurance company must have special financial resources that determine its capital. The capital (reserve) of an insurance organization consists of two main parts - equity capital and borrowed capital, and the attracted part of the capital largely prevails over its own. This is due to the industry specifics of insurance. The activity of an insurance company is based on the creation of monetary funds, the source of which is the funds of policyholders received in the form of insurance premiums (premiums). They do not belong to the insurer. These funds are only temporarily, for the period of validity of the insurance contracts, at the disposal of the insurance company, after which they are used to pay the sum insured or converted into a revenue base (subject to the break-even passage of the contract), or returned to the policyholders in the part stipulated by the terms of the contract (bonus). Thus, the capital of the insurance company Y, at time t is equal to

Thus, studies of the solvency of insurance companies, taking into account investment in risky and risk-free assets, are characterized by both assumptions about the nature of the distribution of payments, and the lack of study of the impact on solvency of such characteristics of assets as the profitability of a risky and risk-free asset and the volatility of prices of a risky asset.

If the investment activity and financial capabilities of the insurer do not allow achieving the desired level of solvency, insurance companies resort to risk redistribution. Reinsurance is an important link in ensuring the solvency of the insurer. The need for reinsurance is due to the fact that: 1) small insurance companies do not have enough own funds to ensure a high level of non-ruin; 2) insurance companies do not always have the opportunity to create a perfectly balanced portfolio, due to the small number of insurance objects or the presence of large risks in the portfolio; 3) even with a careful choice of risks accepted for insurance, the insurer cannot create a portfolio of completely independent insurance objects, since insurance compensates for losses arising from various kinds of hazards that the insured objects may be exposed to simultaneously when catastrophes occur; 4) the development of the economy and scientific and technological progress lead to a high concentration of material values and, as a result, to an increase in insurance amounts for a large number of insurance objects (the cost of transported goods increases, the cost of aircraft, ships, etc. increases). Insurance companies cannot accept such large risks for insurance without having reinsurance coverage. In some cases, insurance costs are so high (or dangerous) that the reserves of individual insurance companies are not enough to provide insurance in full. Reinsurance contract - an agreement according to which one party (assignor) transfers in full or in part the insurance risk (group of risks) to the other party - the reinsurer. The insurer that transfers the risk is called the assignor. The reinsurer assumes an obligation to compensate the assignor for the corresponding part of the insurance indemnity. Reinsurance provides a secondary redistribution of risk, thereby contributing to the quantitative and qualitative alignment of the insurance portfolio, which, in turn, allows you to take unique and expensive risks for insurance. Consider a special case of reinsurance - proportional, in which the reinsurer's payments depend on the insurance payments for each claim, i.e. One way to determine the optimal, from the point of view of the insurer, reinsurance volumes is based on making a decision based on a trade-off between expected income and security. The reinsurer, when accepting the risk, collects a premium from the assignor. The rate of receipt of the reinsurer's premiums is related to the relative risk premium by the ratio: where is the relative risk premium of the reinsurer. Then, the rate of receipt of premiums received by the cedant after reinsurance can be written as follows: In the works, it is proposed to use the Lundberg coefficient as an indicator of the reliability of an insurance company. If reinsurance premiums are paid continuously, with an intensity c "ep, then the Lundberg coefficient Rh for a direct insurer that has entered into a proportional reinsurance contract is the smallest positive root of the equation risk transferred for reinsurance Preference is given to such a volume of risk that will provide the insurance company with the maximum value of Rh and the greatest income for the assignor In the works of X. Schmidli and Z. Hipp, the estimate of the probability of ruin, taking into account investment and reinsurance, is sought as a solution to the following Cauchy problem: Based on (1.41), it is possible to determine the behavioral strategy of an insurance company that provides the optimal combination of income and the probability of ruin.As in the case of applying formula (1.10) to assess the probability of ruin, the described methods can be applied only when the The distribution of payouts is a light-tailed distribution. Models (1.39), (1.41) give exact solutions only in cases with payout distributions close to exponential.

Analysis of the impact of diversification of investments in risky and risk-free assets on solvency

Graphs of the dependence of the probability of non-ruin on the initial capital for the cases: a) without investment; b) with investment in risk-free assets g-0.13; c) with investment in risky assets /l = 0.4, a - 0.25, with and e thousand rubles,

I - 3.82 claims / day, c = 196.5 thousand rubles / day, I = 0.1 thousand rubles. Thus, we got the opportunity to form an investment strategy, depending on the size of the initial capital, with fixed parameters of the risk process, providing a higher level of non-ruin probability. So, for example, investing in risky assets (// = 0.4; a = 0.25) makes it possible to achieve a non-ruin probability of 0.95 with an initial capital value of 386.4 thousand rubles, while investing in risk-free assets (r = 0.13) capital is 391.8 thousand rubles, and in the absence of investment, 447.3 thousand rubles are required. In the above case, with values of initial capital less than 444 thousand rubles. a higher probability of non-ruin is provided by risky assets, with initial capital values of more than 444 thousand rubles - risk-free.

In addition to the problem of assessing the dependence of the probability of non-ruin on the initial capital for fixed values of the parameters of the collective risk model, it is of interest to evaluate the dependence of the relative risk premium that provides a given level of probability of non-ruin on the size of the initial capital. Given the ratio

Problem (2.6) is solved numerically for various values in (Appendix G, Table G.2 - G.4), and from the numerical solution of the equations (p(u 19) = p, where cp is a given level of non-ruin probability, we obtained the values of the initial capital and, which are presented in Appendix I (Table IL) for cp = 0.95.The dependencies presented in Figure 2.4 were approximated by 3rd order splines (Appendix K, Table K.1).We, for clarity, approximated them with generalized polynomials in the system functions (n / 100)1 ", / = 0.1..5 using the recurrent method of least squares. In the illustrated case (R = 3.82 claims / day, Ф = 0.95) allowance and initial capital for the cases: a) without investment, b) with investment in risk-free assets with a return of 0.13, c) with investment in risky assets /l = 0L, a = 0.25, with R = 3.82 claims / day, (p = 0.95 Such dependencies make it possible to determine the value of the relative risk premium and, which will provide a given level of probability of non-ruin, depending on the size of the initial capital. So, for example: an insurance company with an initial capital of 400 thousand rubles. to ensure a non-ruin probability of 0.95, a relative risk premium of 71% is required in the absence of investment. Investing in risk-free assets with a return of 0.13 allows you to reduce the risk premium to 57.5%, with the same probability of non-ruin. Investing in risky assets with a return of 0.4 and a volatility of 0.25 allows you to reduce the relative risk premium to 55.5%. Suppose an insurance company has initial capital and wishes to increase the probability of non-ruin through a relative risk premium. For various values of v, using the family of solutions to problem (2.6), we found p(u /v) (Appendix G, tables G.2 - G.4) and built the dependence of the probability of non-ruin on the relative risk premium for a fixed value of initial capital. The dependence of the probability of non-ruin on the relative risk premium for a fixed amount of initial capital and = 350 thousand rubles. in various investment conditions are presented in Table I.2 (Appendix I; in the form of 3rd order splines in Appendix K, Table K.2). Approximations of the dependences of the probability of non-ruin on the relative risk premium, constructed for the given parameters of the risk process (R = 3.82 claims / day, m = 350 thousand rubles) by the recurrent least squares method, are presented below (2. 8), and the corresponding graphs in Figure 2.5.

Publication date: 28.10.2017 11:37

The first part of the WRC in psychology is a theoretical study. It involves the study of literature on the topic of research, generalization of the material, its analysis and structured presentation.

Graduation papers in many humanities contain only empirical research. But in psychology, researchers seek to test their theories in practice. Therefore, the second part of the course, diploma and master's work in psychology is an empirical study.

What is empirical research in psychology

The term "empirical" is synonymous with the word practical, associated with experience. Therefore, the second chapter of a diploma or term paper in psychology is also called the “Practical Chapter” or “Experimental-Experimental Chapter”.

The logic of the graduate work in psychology is as follows:

- First, the student studies what other researchers have done within the framework of their chosen topic. Gets acquainted with theoretical models of psychological phenomena, as well as with the results of empirical research.

- Based on a theoretical analysis of other people's work and their own ideas, the student develops a plan for his own empirical research.

- Next, a student-psychologist conducts an empirical study, analyzes its results and draws conclusions.

What is the essence of empirical research in psychology?

Its main feature is that it allows you to study the laws of the human psyche, the laws of thinking, emotional life, behavior, etc.

The main instrument of empirical research in psychology is the tools of psychological diagnostics - tests, questionnaires, questionnaires, etc. With their help, the psychologist-researcher receives empirical data, subjects them to mathematical analysis and, on its basis, draws conclusions about psychological patterns.

The results of empirical research in psychology claim the status of a psychological law or regularity. This brings psychology closer to the exact sciences, such as physics.

However, in psychology there are many theories and models that are actively used in the practice of psychotherapy and counseling. But these models have not been empirically tested. However, the lack of empirical validity does not make these theories less valuable. This fact reflects the belonging of psychology to the humanities, where it is impossible to obtain accurate knowledge about the object.

Structure of the empirical study

The structure of the empirical research is reflected in the first paragraph of the second (practical) chapter of the course, diploma or master's work in psychology and includes the following elements.

Purpose of empirical research, as a rule, coincides with the purpose of the whole work. Most often, this goal can be associated either with identifying relationships between psychological indicators, or with identifying differences in the severity of psychological parameters in two groups of subjects, divided by some criterion.

Tasks of empirical research reflect the sequence of steps that must be taken to achieve the goal of empirical research. For example, they may include:

- Selection of psychodiagnostic methods.

- Formation of a sample of an empirical study.

- Conducting psychodiagnostics and compiling a summary table of the results of psychological testing.

- Qualitative analysis of the obtained data.

- Statistical processing of the results of psychodiagnostics.

- Interpretation of the results of mathematical processing.

- Formulation of conclusions.

Empirical Research Hypothesis, as a rule, coincides with the hypothesis of the entire work and reflects the assumption about the relationship of indicators or their differences. There may be several hypotheses if the study uses many psychological indicators. Sometimes it is appropriate to formulate a general hypothesis, and then specify it in several particular ones. For example:

General hypothesis: there are differences in motivation among employees of the organization of different sexes.

Particular hypotheses: 1) men are distinguished by a greater degree of motivation to achieve success; 2) women are distinguished by a greater degree of approval motivation.

Empirical Study Sample- these are the subjects or respondents who will participate in the testing. When forming a sample, it is important that all subjects have similar socio-demographic characteristics. The work usually indicates the gender, age, education of the respondents. If necessary, you can specify marital status, professional experience. The choice of characteristics is determined by the purpose and objectives of the study. For example, if the personal factors of professional burnout of teachers are studied, then it is hardly necessary to indicate the number of children when describing the sample.

Methods of empirical research- these are the tools that a psychologist uses to obtain empirical data about the psychological characteristics of the subjects. There are the following types of methods used in the WRC in psychology:

- Questionnaires. This type of method involves asking subjects about their socio-demographic characteristics, as well as some psychological characteristics. Questionnaires are not strictly reliable and valid psychological tools. Therefore, their data are of a reference and auxiliary nature.

- Questionnaires and tests are psychological tools standardized according to certain rules. With their help, you can get data about the psychological characteristics of the subjects. These data are considered valid and reliable, that is, reliable. This type of empirical research methods is most often used in term papers, diploma and master's programs in psychology.

- Projective methods also allow obtaining data on the psychological characteristics of the subjects, like questionnaires, but they are less standardized. Projective tests are rarely used in psychology WRCs, as their results are difficult to translate into numerical indicators. Projective methods are more appropriate in clinical and psychotherapeutic practice for individual work.

The next important element of empirical research is the results of empirical research and their analysis. Considering its importance, let's dwell on it in more detail.

Results of empirical research and their analysis

The meaning of empirical research in psychology is to obtain results and, after analyzing them, to formulate a conclusion about certain psychological patterns.

There are several types of results of empirical research, reflecting the successive stages of their processing.

- The first type of empirical research results are test results. The answers of the subjects to psychological questionnaires are processed by keys and entered into a summary table of results (it is usually placed in the application).

- The second type of empirical research results are the results of statistical data processing. For example, a summary table of the results of psychodiagnostics is entered into a statistical program (for example, STATISTICA or SPSS) and correlations are calculated or differences are analyzed. These results are given in the text of the work and are accompanied by a description and interpretation.

Usually, the analysis of the results of an empirical study is carried out in two stages:

- The first stage is a qualitative analysis of the data obtained by all psychodiagnostic methods. It involves the construction of histograms or tables with distributions of indicators, as well as charts of average values.

- The second stage is the statistical analysis of the data. This stage involves the presentation of the results of statistical calculations in the form of tables. Below the tables is a description of the results and their interpretation.

Let's take an example of the analysis of the results of an empirical study, the purpose of which was to compare the coping strategies of young people from Russia and the United States.

Let only one method be used - the Questionnaire "Methods of Coping Behavior" by R. Lazarus and S. Folkman (adapted by T.L. Kryukov, E.V. Kuftyak, M.S. Zamyshlyaev).

The sample included two groups of subjects: Group 1. Young people, citizens of Russia, 60 people (30 boys and 30 girls), age - from 20 to 25 years; live in Moscow; Group 2. Young people, US citizens, 60 people (30 boys and 30 girls), age - from 20 to 25 years; reside in New York.

At the stage of qualitative analysis, we compare the structure of coping strategies in groups, presenting them in the form of a graph.

On fig. 1 shows the structures of coping strategies of young people from Russia and the USA.

An analysis of the data shown in Fig. 1 shows that in the group of subjects from Russia, such coping strategies as the search for social support and distancing are most pronounced. The least expressed are flight-avoidance and self-control.

In the group of subjects from the United States, such coping strategies as planning a solution to a problem and taking responsibility are most pronounced. The least expressed are flight-avoidance and confrontational coping.

Some common features of the structure of coping strategies in groups of subjects can be noted. Escape-avoidance coping is the least pronounced among young people from Russia and the United States, that is, regardless of citizenship, young residents of megacities are not inclined to overcome negative experiences due to difficulties by responding by the type of evasion: denying the problem, fantasizing, unjustified expectations, distraction and so on. Such a result may reflect the specifics of life in a metropolis, where infantile forms of behavior in DLS do not allow one to achieve success.

We can also note equally low values for confrontational coping, which means that young people from Russia and the United States are equally not inclined to resolve problems through conflict behavior and emotional outbursts.

At the second stage of the analysis of the results of the empirical study, we carry out a statistical analysis of the data using the Mann-Whitney U-test, which allows us to identify statistically significant differences in the severity of coping strategies in the two groups.

The results of the calculation of significant differences in the indicators of coping strategies of young people from Russia and the United States are shown in Table 1.

Table 1. The results of the calculation of statistically significant differences in coping strategies and resilience of young people from Russia and the United States.

|

Averages |

Mann-Whitney U test |

Level of statistical significance (p) |

||

|

Russia |

USA |

|||

|

Confrontational coping |

43,6 |

44,3 |

1777 |

0,904 |

|

distancing |

62,1 |

49,0 |

1136 |

0,000* |

|

self control |

45,3 |

50,8 |

1348,5 |

0,018* |

|

Seeking social support |

65,7 |

49,3 |

0,000* |

|

|

Taking responsibility |

54,9 |

54,0 |

1690,5 |

0,565 |

|

escape-avoidance |

41,8 |

41,4 |

1718 |

0,667 |

|

Problem solving planning |

50,4 |

56,4 |

1293,5 |

0,008* |

|

Positive revaluation |

45,3 |

45,2 |

1760 |

0,834 |

* - differences are statistically significant (р≤0.05)

Analysis of the data given in Table 1 allows us to draw the following conclusions:

The level of the coping strategy "distancing" is statistically significantly higher in the group of young people from Russia. This means that, compared with Americans, Russian subjects tend to overcome difficult life situations due to the subjective decrease in its significance and the degree of emotional involvement in it; they are more characterized by the use of intellectual methods of rationalization, switching attention, detachment, humor, depreciation, etc.

The level of the coping strategy "search for social support" is statistically significantly higher in the group of young people from Russia. This means that, compared with Americans, Russian subjects tend to solve problems by attracting external (social) resources, seeking informational, emotional, and effective support; they are characterized by a focus on interacting with other people, expecting support, attention, advice, sympathy, specific effective help.

The level of the “self-control” coping strategy is statistically significantly higher in the group of young people from the USA. This means that, compared with Russians, American subjects tend to overcome difficult life situations by purposefully suppressing and restraining emotions, minimizing their influence on the perception of the situation and choosing a behavior strategy with high control of behavior and striving for self-control.

The level of the coping strategy "problem solving planning" is statistically significantly higher in the group of young people from the USA. This means that, compared with Russians, American subjects tend to overcome difficult life situations by purposefully analyzing the situation and possible behaviors, developing a strategy for solving the problem, planning their own actions, taking into account objective conditions, past experience and available resources.

It can be noted that there were no statistically significant differences in hardiness indicators in groups of young people from Russia and the United States. This means that despite the differences in the ways of coping with stress and SAD, the measure of the ability of young people from Russia and the United States to withstand a stressful situation, while maintaining internal balance and without reducing the success of their activities, does not differ.

Thus, the analysis made it possible to identify the national characteristics of coping with TJS among young Russians and Americans.

Young people from Russia in difficult life situations tend to move away from the situation and thereby reduce its significance for themselves, and this manifests a certain contemplativeness of the Russian mentality. It is also shown that young people from Moscow are more inclined than their New York peers to resort to social support in TLS, which can be seen as a reflection of collectivist tendencies in the Russian character as opposed to individualistic tendencies in the American one.

Young Americans are more likely than their Russian peers to show self-control and control their behavior in TLS, which reflects the American national trait of emotional restraint. Also, young people from the United States, unlike their Russian peers, are more prone to problem solving planning, which reflects the propensity of Americans in general to be success-oriented, which involves planning activities.

- A brief description of the specific result of the statistical processing. For example, "The level of the coping strategy" distancing "is statistically significantly higher in the group of young people from Russia."

- Extended description of the result of statistic processing. For example, “This means that, compared with Americans, Russian subjects tend to overcome difficult life situations due to a subjective decrease in its significance and the degree of emotional involvement in it; they are more characterized by the use of intellectual methods of rationalization, switching attention, detachment, humor, depreciation, etc.”

- Interpretation of the result of statistical processing. For example, “The revealed differences in the use of the “distancing” coping strategy, from our point of view, are associated with differences in the Russian and American mentality. In particular, with the greater activity of Americans in foreign activities and the greater contemplation of Russians.

- A generalizing conclusion based on the results of the analysis of statistical data: “So, the analysis made it possible to identify the national characteristics of coping with TJS among young Russians and Americans.

- Young people from Russia in difficult life situations tend to move away from the situation and thereby reduce its significance for ... (see above)”

Types of Empirical Research in Psychology WRCs

Most often, in term papers, diploma or master's works in psychology, within the framework of empirical research, it is supposed to state some psychological patterns. That is, to reveal what is and this type of research is called ascertaining.

For example, in the example above, we see the pattern ascertaining research- the researcher reveals differences in coping strategies among students from the USA and Russia and does not influence the situation in any way.

However, in some cases, psychologists are not limited to ascertaining, but want to somehow correct or improve the situation.

For example, a psychologist conducts a comparative analysis of anxiety in boys and girls of older preschool age. Receives some data, for example, that in the group of boys the number of children with a very high level of anxiety is statistically significantly higher than in the group of girls.

One can, of course, confine oneself to stating this fact. However, most often the task is to correct anxiety in children. This problem is solved in the framework formative research.

Thus, the purpose of the formative study is the correction (reduction) of any unfavorable psychological quality that is excessively expressed in the subjects. It can be anxiety, aggressiveness, a tendency to deviant behavior, etc.

The goal of formative research may also be the development of some positive psychological quality that is not sufficiently developed in the subjects. It can be, for example, self-actualization, self-attitude, self-confidence, etc.

The forms of implementation of the formative experiment can be various corrective or developmental programs, psychological trainings, etc.

And, finally, the third type of empirical research in psychology graduate theses is control study. Its purpose is to check how effective the program of correction or development of any psychological quality turned out to be.

As a rule, as part of a formative empirical study, the subjects are retested according to the methods that were used in the ascertaining study.

If the indicators have improved, for example, the aggressiveness of adolescents has decreased or the stress resistance of employees has increased, then the program or training is recognized as effective.

In term papers in psychology, only ascertaining research is carried out.

In bachelor's theses and dissertations in psychology, ascertaining variants of empirical research are most often encountered, but it is also possible to use formative and control studies.

Master's theses in psychology often contain topics that involve formative and control empirical research.