"Financial system of the Russian Federation"

Introduction

financial market economy

It is believed that the concept of the financial system is the development of a more general definition - finance. In theory, a system is what solves a problem. As problems of modern society, which the financial system is designed to solve, we can name:

insufficient pace of economic development;

disproportions in the development of the economic system;

lagging behind in adapting to changes in external commodity and financial markets;

low level of satisfaction of the needs of the individual, etc.

There are two main types of systems: closed and open. A closed system has rigid fixed boundaries, its actions are independent of the environment surrounding the system. An open financial system is characterized by fairly frequent and intense interaction with the external environment. Financial resources, information are objects of exchange with the external environment through the permeable boundaries of an open system. The openness of the financial system in market conditions is due to the variety of forms of ownership, in particular, joint-stock ownership.

The variety of forms of ownership opens up the possibility of creating a number of financial instruments: leasing, franchising, pledge, mortgage, etc. This openness is determined by the ability to freely sell and buy currency, securities, perform foreign economic insurance operations, participate in the activities of international financial organizations, etc.

The definition is known: "the financial system is a system of forms and methods of formation, distribution and use of funds of the state and enterprises." In another work, three interrelated areas are distinguished in the total set of financial relations: the finances of economic entities (enterprises, organizations, institutions), insurance, and public finances.

We will consider the financial system as a form of organization of monetary relations between all subjects of the reproduction process for the distribution and redistribution of the total social product.

The topic of the course work is very relevant for today, since a reliable financial system is the core in the development and functioning of a market economy and a necessary prerequisite for the growth and stability of the economy in the state. This system is the basis that mobilizes and distributes the savings of society and facilitates its daily operations. A market economy that operates according to market principles includes many elements, but the most important thing is to create a sound financial system. Once a sound financial system is in place, money and capital markets can develop, especially primary and secondary markets for national government securities.

The purpose of the course work is to reveal the essence and structure of the modern financial system in the market economy of the Russian Federation and its development trends.

Course work defines the following tasks:

identification of the main functions;

disclosure of the main areas and links of the financial system;

consideration of the state and development of the financial system in recent years.

1. Essence and structure of the financial system

.1 Concept and functions of the financial system

The state controls society and consists of a number of structures: political, economic, social, religious, etc.

The basis of the economic structure is the relations that have arisen in the state, in which four subjects participate: the state, the region, the economic entity, and the citizen. Each entity has its own rights and obligations. Entering into relations with each other, they participate in commodity-money relations, which leads to the creation of the financial system of the state.

By definition, the financial system is a set of financial relations. By their nature, financial relations are distributive, and the distribution of value is carried out, first of all, by subjects. Subjects form special-purpose funds depending on what role they play in social production: whether they are direct participants in it, whether they organize insurance protection or carry out state regulation. It is the role of the subject in social production that acts as the first objective criterion for the classification of financial relations.

The financial system within a particular country includes:

the state financial subsystem, which ensures the receipt of funds in the budget and their spending;

the banking subsystem, which contains financial institutions that provide settlements, loans, investments, cash transactions;

a subsystem for the circulation of government securities, which serves to raise funds in the secondary securities markets.

There are a number of reasons why financial institutions differ significantly from one country to another. These include the level of accessibility and complexity of technology and different sizes, as well as the difference in the historical, cultural and political development of a particular state. The functions of the financial system are also transformed over time, that is, they are subject to change. Functions in financial institutions can change significantly, as well as expand.

Analyzing the main function of the financial system, which is the efficient allocation of financial resources, at the most general level, we can talk about six basic or key functions of this system:

Providing ways to move economic resources over time, across state borders and from one sector of the economy to another.

Provide ways to manage risk.

Provide settlement methods that facilitate trade.

Providing a mechanism for pooling financial resources and separating ownership in different enterprises.

Provision of price information to coordinate the decentralized decision-making process in different sectors of the economy.

Providing ways to solve the incentive problem.

The first function, the movement of resources in time and space, means that the financial system provides ways to move economic resources over time, from one geographical region to another, and also from one economic sector to another.

Student loans, home loans, retirement savings, and investment in manufacturing facilities all move resources from one point in time to another. The financial system plays a very important role in the movement of resources in space. Sometimes the capital needed to carry out a business project is very far from the place where it could be used with the greatest efficiency. Thus, for example, households in Germany can raise capital by saving money, which, quite possibly, could be most effectively used somewhere in Russia. And the financial system provides a number of mechanisms that facilitate the movement of monetary resources from Germany to Russia. The efficiency of the economy is greatly enhanced by all sorts of innovations, thanks to which scarce monetary resources flow from where they do not bring high income, and are used where they give high profit.

Like the movement of monetary resources, risks also move - the second function. There are intermediaries in the financial system, such as insurance companies, that specialize in risk transfer activities. They collect special insurance premiums from clients who want to reduce their risks and transfer them to investors who, for a certain fee, agree to pay insurance claims and bear the risk.

Often, capitals and risks are linked together and transferred through the financial system at the same time, as a result of which the financial flow also characterizes the flow of risks.

The third function of the financial system is to enable payments to be made in ways that encourage the exchange of goods, services, and assets. This is one of the most important functions of the financial system, as it provides people and firms with efficient ways to make payments in the process of purchasing goods and services.

One example of improving the efficiency of the payment system is the replacement of such means of payment as gold with paper money. Today, gold is a scarce resource that is used in medicine and jewelry, and paper money is the main means of payment. Compared to gold, the authenticity of paper money is easier to verify and much more convenient to use in everyday life, for example, to carry in your pocket. In addition, printing money is a much less expensive process than mining, melting down and minting gold coins. The efficiency of settlements has increased even more due to the subsequent emergence of alternative means of making payments: checks, credit cards and electronic payment systems.

The fourth function of the financial system provides a mechanism for pooling funds to establish a large-scale enterprise or to share the capital of large enterprises into shares among a large number of owners.

In the modern economy, the minimum investment required to run a full-fledged business often exceeds the financial resources of an individual and even a large family. The financial system provides an opportunity (for example, through stock markets or banks) to pool household funds into larger capital, which is then used by firms in need of them.

Through the financial system, individual households are able to participate in investments that require large sums of money by pooling their resources and then subdividing their shares in the total investment.

For its fifth function, the financial system provides price information that helps to harmonize independent decisions made in various sectors of the economy.

Newspapers, radio and television provide daily information on stock prices and interest rates. Of the millions of people who receive this information, relatively few are professional securities traders. However, very often people who are very far from the stock market use information based on securities quotes to make financial decisions.

Solving the psychological problems of incentives is the sixth function of the financial system. These problems arise because the parties to contracts often do not have the ability to constantly monitor each other and control each other. There are three types of problems associated with incentives. They have received the following names: the problem of "moral hazard", the problem of "bad choice" and the problem of "principal-commission agent".

The problem of moral hazard or irresponsibility arises when the possession of an insurance policy causes the insured party to take more risk or be less willing to prevent an event leading to a loss. It is the irresponsibility of one of the parties that often causes such problems. Another problem that arises due to the uneven amount of information of the parties to the transaction is the problem of adverse selection. It lies in the fact that people who buy insurance against a particular type of risk are usually much more exposed to this risk than the general population. The problem of the relationship between the committent and the commission agent is that the commission agent often makes decisions that are different from those that the committent would have made if he had all the knowledge that the commission agent has and would make decisions on his own. As a result, a contradiction often arises between the interests of commission agents and committents.

1.2 Characteristics of the spheres and links of the financial system

The financial system is the totality of links and spheres; a set of institutions of the financial system that exists in the enterprise, in the state, etc. The first area where finance is needed is the state. The system by which the government collects and spends money is called public finance. In addition to the state, there are various types of enterprises, therefore, the second area is called enterprise finance. It is a tool by which a company raises funds. The third area is other finance (including insurance finance).

Links of the 1st sphere: 1. The state budget (huge financial resources are concentrated in it). 2. Extra-budgetary funds (funds that are concentrated in the hands of non-governmental, but state-owned organizations).3. State loan.

Links of the II sphere (finances of enterprises): 1) finances of enterprises operating on a commercial basis; 2) finances of institutions and organizations that carry out non-commercial activities; 3) finances of public associations (trade unions, political parties, public funds).

Insurance is a specific area that has its own links: 1) Social insurance (all methods); 2) Personal insurance; 3) Property insurance; 4) Liability insurance; 5) Business risk insurance.

1.3 General government finance

Let's take a closer look at public finance. They include the budgetary system (state budget), state off-budget trust funds, state credit, state insurance fund.

The state budget is a form of formation and use of a centralized fund of funds to ensure the functions of public authorities. It is the main financial plan of the country, approved for each year as a law. A significant share of the national income is concentrated in the state budget to finance the main areas of the national economy, socio-cultural events, the defense of the country, the maintenance of the state apparatus, etc. With its help, the national income is redistributed, which makes it possible to purposefully influence the pace and development of social production and society in in general.

Off-budget funds are funds from the federal government and local authorities associated with the financing of expenses not included in the budget. Extra-budgetary funds have a strictly designated purpose:

Pension Fund of the Russian Federation;

RF Social Insurance Fund;

State Employment Fund;

compulsory health insurance funds.

The state credit system reflects credit relations regarding the mobilization by the state of temporarily free funds of enterprises, organizations and the population on the basis of repayment to finance public expenditures.

The insurance system provides compensation for possible losses from natural disasters and accidents, and also contributes to their prevention.

The interaction between the subsystems of the financial system is carried out, as a rule, through the mediation of institutions of the banking system.

Each subsystem, in turn, is divided into links depending on industry affiliation, ownership, nature of activity, etc. The relationship of the financial system is based on the finances of economic entities (enterprises), financial support for reproduction costs, carried out in three forms:

self-financing;

lending;

public funding.

1.4 Business finance

The finances of economic entities are an integral part of the unified system of finances. An economic entity is an artificial formation created by a group of individuals or legal entities. This association allows not only to unite the entrepreneurial efforts of different people in one direction, but also to limit the scope of responsibility for the consequences of the activities of such a team. Usually, the founder is responsible for the results of the company's activities only to the extent of his contribution to the authorized capital.

However, the legislation also allows the creation of such forms of association as a general partnership. Its participants (general partners), in accordance with the agreement concluded between them, are engaged in entrepreneurial activities on behalf of the partnership and are liable for its obligations with all their property. Moreover, one person can be a participant in only one full partnership.

On the issue of economic entities, there is no consensus in the economic literature. What is included in the system of economic relations that determine the finances of business entities. Some scholars believe that finance cannot include monetary relations arising from the sale and purchase of goods, as well as from monetary remuneration, which affects the financial relations of an enterprise, but does not itself serve as an element of these relations. However, scientists - supporters of the reproductive concept of finance refer to the mentioned relationships as financial ones, since they recognize the existence of financial relations in production and exchange. So, during the exchange, income is formed, from the sale of products from which the supplier enterprise forms consumption and accumulation funds. The progress of implementation may be accompanied by the application of financial sanctions in case of non-compliance with the requirements of supply contracts, the formation of mutual types of debts of the supplier and the buyer. Monetary relations arising from wages, payment of bonuses, are accompanied by the formation and expenditure of special funds: wages, consumption, working capital (in terms of costs for work in progress, stable liabilities). Proponents of the reproductive concept believe that financial relations are present at all stages of the circulation of production assets of enterprises.

In this regard, we can conclude that the finances of economic entities also perform a reproductive sub-function within the distribution function. Its content is to ensure the correspondence between the movement of material and monetary resources in the process of their circulation with simple and expanded reproduction.

Business entities are divided into two groups according to the results of their activities. The main goal of the first is to make a profit, this is a group of commercial organizations. The main goal of the second is not to make profit and distribute it among the founders, it is a group of non-profit organizations.

Commercial organizations include, in particular, the so-called enterprises of the real sector of the economy (industry, agriculture ...), enterprises of the financial sector (banking, investment, insurance companies), and the service sector.

Non-profit organizations include religious organizations, political parties and movements, charitable and other foundations. They can engage in entrepreneurial activities only if this contributes to the achievement of statutory goals.

The finances of economic entities, in comparison with the finances of other subjects of society, are most regulated, since, being artificial formations, they must be completely controlled by the founders, as well as by the authorities. The main document of financial reporting is the balance sheet of the company. However, it should be borne in mind that finance is a category that is constantly developing and becoming more complex, mirroring the development and complexity of the economy. Therefore, with the development of the economy in the field of finance, phenomena will constantly, again and again arise that have not previously been encountered and, accordingly, not subject to regulation.

Of the economic entities, the most overregulated are banks, which are obliged to draw up, in particular, daily balance sheets. A perfectly justified measure, given that the failure of one bank can lead to the bankruptcy of all its clients. Another difference in the banking industry is that the failure of one bank undermines the credibility of the entire industry as a whole.

A high degree of regulation implies a high degree of accountability. Indeed, authorities (tax authorities, statistics authorities…) can collect practically any information from business entities.

cash fund

Commercial organizations have two cash funds - a profit fund, that is, the result of economic activity, and a depreciation fund, that is, funds officially withdrawn from taxation in order to update fixed assets.

There may be an erroneous impression that the company has another cash fund, in the income of which the proceeds from the work performed and the sale of property, and in the expenses - all expenses. It can be called "company budget". But this fund of money does not belong to the company, since the company cannot dispose of it as arbitrarily as the profit fund. In particular, the revenue side of such a "budget" consists of funds belonging to customers and, if the company does not fulfill its obligations to supply goods, then these funds must be returned to the owners. Also, the authorized capital is not the cash fund of the company. Funds of the Criminal Code are the property of the founders.

Commitments

The presence of obligations is a natural situation for business entities. Moreover, this is not only attracting loans, but also obtaining a deferred payment for already received goods. Therefore, a company with a large amount of liabilities may, ceteris paribus, look preferable to a company with a small amount of liabilities.

In addition, a large amount of liabilities reduces the current size of the cash fund, which can be considered an indirect protection against the fact that the bank servicing the company's accounts will go bankrupt. At the same time, the growth of obligations also has a negative side - an increase in the risks of their non-fulfillment, an increase in the cost of servicing them.

A debt owed to a company is called accounts receivable. A company's debt to third parties is called accounts payable. It is generally accepted that overdue debt is debt, the term of which exceeded three months.

The difference between the obligations of economic entities and other entities of the company is the completeness of accounting for obligations. So, companies keep records of liabilities not in the amount of current debt (that is, not in the amount of the principal amount of the debt), but in full, that is, the principal amount of the debt plus interest that has not yet been accrued, but will only be accrued for the entire loan period.

Strict regulation of economic entities also applies to influence. In any case, if the shareholders make the appropriate efforts, they can make the use of "Influence ..." relatively objective, amenable to their control. In this case, the traditional disadvantages of "Influence ..." - susceptibility to emotions, arbitrariness - will be minimized.

"Influence..." applies to the finances of subsidiaries and associates. This means, in particular, intervention in the spending of funds, the formation of a tariff policy, the implementation of a procurement policy, and a policy of tax optimization.

However, if the insolvency or bankruptcy of the company is caused by the founders or other persons who have the right to give instructions binding on this legal entity, or otherwise have the ability to determine its actions, such persons, in the event of insufficient property of the company, may be subject to subsidiary liability under his obligations.

Finance Evaluation Criteria

From the point of view of the owners of commercial organizations, the criterion for assessing finances is data on the amount of profit, as well as information on the amount of funds that they can receive in the event of a sale or liquidation of the company.

In addition, relative indicators are used that characterize the intensity of the use of the initially invested funds and the current financial condition of the company, for example, the amount of profit per one ruble of fixed assets, per share, per ruble of the authorized capital, per ruble of revenue.

2. State and trends in the development of the financial system of the Russian Federation

.1 Modern problems of financial market development in Russia in the context of globalization

Financial markets have always had a significant impact on the level and pace of socio-economic development. In the context of globalization, they are turning into a particularly powerful factor of economic, political and other influence on public life.

By providing external financing resources, the financial market forms investment and innovative support for social reproduction. Also, the development of financial markets is accompanied by a sharp increase in new derivatives and speculative transactions, which, given the global nature of financial capital, creates large-scale threats to social development.

In the context of the growing involvement of the Russian financial market in the global financial system, the problem of developing a sound strategy for its development, which makes it possible to ensure the necessary stability of the market in the face of negative external and internal influences, becomes actual.

The peculiarities of the Russian financial market include a significant asymmetry of its structural and functional organization. This is expressed primarily in the non-diversified nature of the financial market, the low share of freely traded shares, the dominance of companies and banks with state participation, and high dependence on foreign capital.

The asymmetry of the financial market reduces its attractiveness for both Russian and foreign investors. For domestic participants, it is excessively isolated from the real sector, for foreign participants it is too risky and undiversified.

Despite the positive developments, the Russian financial market remains predominantly speculative. Thus, the share of the credit market in investments in fixed assets is about 10%.

Due to the existing structural and functional characteristics, the Russian financial market turned out to be very sensitive to external factors. The high dependence on external conditions allowed the world crisis to quickly spread to the territory of Russia.

In the conditions of economic development, state regulation of the financial market ensures the integrity, balance and stability of the entire financial system of the country. Direct state regulation is carried out through the creation of a system of legal norms, the implementation of which is ensured by state bodies. Indirect is the implementation of tax and monetary policy, management of state property, etc.

Recently, the issue of improving the regulation of the financial market has been increasingly raised, which is especially important in the period of overcoming the consequences of the crisis and the decline in the pace of development of the domestic economy. In addition, the solution of the tasks defined by the strategy for the development of the financial market of the Russian Federation for the period up to 2020 also requires improving the quality of state regulation and involving the entire investment potential in circulation,

2.2 Problems in the implementation of project finance in Russia

One of the most effective ways to implement large-scale long-term projects is the use of project financing, which allows you to optimally distribute risks among numerous project participants. In the works of domestic and foreign authors, there is no single approach to the definition of the term "project financing". Moreover, it is necessary to recognize the fact that within our country the very method of project financing used to organize the financing of investment projects is periodically understood and interpreted insufficiently correctly. Project financing is often confused with the concept of "investment credit", "project financing".

For example, project finance is understood as a modern form of long-term international lending. This is not about irrevocable subsidies, but about lending to investment projects for a certain period.

The most complete interpretation of project financing seems to be the provision of financial resources to the company for the implementation of an investment project in the form of borrowed funds and equity participation of investors in the activities of the project company, when the result of the project acts as collateral, and repayment of borrowings is carried out at the expense of project cash flows.

Project financing is still quite a rare banking service due to the fact that project financing is a highly costly mechanism and carries increased risks. However, if this is an interesting and profitable project, implemented by a team of professionals who also have experience in creating a successful business from scratch, banks may make an exception. In 2010, the scale of bank project financing continues to grow, as the projects most often financed are natural resources, energy projects, large infrastructure projects and projects in telecommunications networks. Examples of the implementation of project financing are projects - Blue Stream, Western High-Speed Diameter, Sakhalin-1,2,3, etc.

In a crisis, there are a number of problems of project financing.

First, it is the volume and mechanisms of financing energy and infrastructure projects. Financing should be provided to stabilize the labor market and address the energy deficit in the economy.

Secondly, the interaction of public and private structures in the process of implementing existing and initiating new projects.

Thirdly, during the financial crisis, the share of the private sector in project financing has slightly decreased, while the share of state guarantees has increased.

Fourth, it is important to form a mechanism for stimulating and guaranteeing investors and owners. Such a policy should lead to an increase in various preferential conditions for attracting resources to Russia and improving the investment climate.

During 2008-2010 certain steps were taken to solve these problems. In 2008 an anti-corruption plan was adopted; and the Law on Foreign Investment came into force, clarifying the legal regime in key sectors.

The solution of all the problems raised and the borrowing of Western experience in project financing allows us to more actively develop and use the advantages of this form of financing in solving the investment tasks set in Russia.

2.3 Current trends in the development of national banking systems

At the end of XX - beginning of XXI centuries. there was a rapid and deep globalization of the world economy, in particular, the process of globalization developed at a faster pace in the financial sector. As a result, thanks to the decisions taken at the Jamaica Monetary Conference, a global financial system was formed, characterized by the absence of strict control and regulation of liquid and huge financial flows moving around the world, directed by economic entities to the most profitable industries in different countries.

Banks of developed countries began to play a significant role in the new global financial system. The main trend of the past decades has been to strengthen and improve the activities of banking institutions in developed countries by expanding, diversifying and increasing business value.

Shortcomings in the past functioning of national banks were revealed during the global financial crisis of 2007-2009, as a result of which the total volume of losses in the global financial system amounted to 2.2 trillion. US dollars,

The main such drawback was the weakening of control over the activities of banks in different countries, which made it possible to develop and implement financial innovations in the form of highly profitable financial products backed by highly overvalued assets, and, as a result, taking on high risks.

As a result, the following main trends in the development of national banking systems have emerged.

First, strengthening state control and regulation not only over the reliable and high-quality activities of banking institutions, but also over the systemic stability of the national banking sector. At the national level, many countries have already adopted a set of legislative acts that establish more stringent requirements for the activities of banking institutions. At the international level, the Basel Committee on Banking Supervision has developed a reform of the global banking sector, called Basel III.

Secondly, the time of crisis demonstrated the resilience of the national economies of developing countries. This means that their financial institutions did not reduce the scale of their activities during the crisis, but, on the contrary, increased their influence and continue to develop. Accordingly, there is a risk that the banks of developed countries may be forced out of the global financial arena.

Thirdly, there is currently a balance in the world between the consumption of financial resources and their savings. In the global financial system, the bulk of capital is accumulated in the banking systems of developing countries, which is subsequently used in developed countries. Developing country banks are overflowing with deposits, while developed country banks are short of depositors and rely on volatile financial markets to raise funds.

The inevitable increase in government spending by developing countries and their need for capital will cause high volatility in financial markets and an imbalance in the consumption of financial resources and their savings in the global financial arena.

As a result, it is the banking institutions of developing countries that will continue to strengthen their role in the global financial arena, gradually crowding out the banks of developed countries. However, this threatens the world economy with new financial shocks.

2.4 The role of plastic cards in the Russian payment turnover

Now in Russia there is a formation of "industry" of plastic cards. All over the world, millions of trade, hotel and various service enterprises are involved in the sphere of plastic cards circulation; the number of users of such cards is approaching 500 million. Almost all banks in developed and developing countries work with cards. An analysis of the development of this "industry" shows that bank plastic cards are developing most successfully. And this is understandable, because the card itself is a payment instrument that crowns the system, which is based on settlement and payment relations, i.e. non-cash payments carried out on a modern technical and technological basis. An important role is played by the resource base of banks, which allows to constantly develop and improve the technological and technical base. This, in turn, enables banks to constantly improve and expand the range of services provided to their customers. As you know, the dominant settlement and payment systems have become "European", "VISA" and "America Express", which are transnational corporations. The payment instruments of these systems are used in many countries of the world - both in internal and external payment transactions.

The purpose of the development of card circulation is to reduce the volume of cash circulation through various forms and methods of non-cash payments and ensure their protection. This can be done by creating a specialized system of settlement and payment relations, integrated into the Western European settlement and payment system. Within the framework of international systems, Russian banks can use international payment instruments; the same payment instruments in rubles can be used in the internal payment turnover, which, by the way, is already actively used by leading Russian commercial banks. This may become an essential technical element in the practical implementation of the full convertibility of the Russian ruble.

A difficult question remains regarding the transition to chip cards (that is, equipped with microprocessors). Undoubtedly, “chip technology” has a future, and most importantly, it allows you to dramatically expand the circle of plastic card users (since the pre-paid money will be fixed on the card), not to resort to authorization in different modes. The breakthrough of a large volume of plastic cards into the settlement and payment turnover does not mean that other payment instruments have become of secondary importance. Our main form of payment is still cash. Cash circulation generates huge costs associated with printing paper money, minting coins, issuing them into circulation, processing, transportation and storage. It is possible to reduce cash circulation, reduce the costs associated with servicing the retail settlement and payment turnover, only when using a variety of payment methods in this turnover. These are, first of all, advance payments, debit and credit cards, credit checks (in particular, Eurochequecard), bank and traveller's checks. At the same time, it is always necessary to clearly understand what space can be effectively filled by one or another means of payment. The system of advance payments, like plastic cards, is connected with the circulation of personal income. It consists in the fact that the bank automatically credits to the current account of the client or debits from it amounts according to a pre-concluded agreement.

The big problem of creating an "industry" of plastic cards is providing it with expensive technological equipment purchased in developed countries. It would be cheaper for Russian consumers to create this equipment in Russia according to the VISA and Europe standards. For these purposes, an investment company with the participation of Western banks and firms is needed to select from among the numerous conversion enterprises those that could manufacture the appropriate equipment and means of communication. The market for the sale of such equipment in Russia is provided for many years to come.

2.5 Priorities in the development of the Russian banking system in the context of financial globalization

The intensive development of the Russian banking system in recent years was determined by the process of transformation of the planned economy into a market one.

As a result of the financial crisis, the Russian banking system suffered significant losses. The crisis led to a decrease in the number of credit institutions and the concentration of banking capital. In order to overcome the consequences of the financial difficulties of banks that emerged during the crisis, the Central Bank of the Russian Federation implemented a comprehensive program of restructuring the banking system.

Thus, the priority of the current stage of development of the Russian banking system is to ensure sustainability. Therefore, in my opinion, the next stage of sustainable development will be built on this basis. Sustainable development, understood as the desire to ensure the successful functioning of the organizational system (including the bank) in the long term, is a key component of management both for individual banks and for the Russian banking system as a whole in the medium term. Without solving these problems, ensuring the stability and efficiency of the Russian banking system will be a difficult task.

The successful development of the Russian banking system should be based on positive international experience. The most important aspect in this regard is the adaptation of international standards and best international practice of bank business to the realities of the Russian banking system.

Conclusion

Financial systems arose with the birth of class society and developed as part of the political, social and economic system of the state.

The history of economic development and finance shows that during periods of relative prosperity and sustainable development, states use a liberal approach to revive business activity, and during periods of crises and increased social tension, the role of the state and public finance in social and economic transformations is enhanced.

Broad and narrow interpretations of the subject of finance are possible, associated with the use of the provisions of systems theory, known as aggregation and decomposition procedures in research.

An argument in favor of the fact that finance covers all stages of the reproductive process may be that the movement of funds is both spatial and temporal. At the same time, movement in time exists objectively and always regardless of the will of economic entities. Such movement objectively ensures the redistribution of funds even when there is no spatial movement.

There is a close relationship between prices, wages, loans with the possibility and intensity of sources of financial resources, the time value of financial flows. The presence of such a close relationship can make it possible to classify price, salary, credit as relatively independent categories, but included in the sphere of financial relations.

Taxes are a backbone financial instrument that formally and directly ensures the inclusion of prices, salaries, loans, and insurance in the sphere of finance.

The composition of decentralized finance, in addition to monetary relations that mediate the circulation of the monetary funds of enterprises, can also include monetary distribution and redistribution relations within financial and industrial groups, holdings, as well as the finances of entrepreneurs without forming a legal entity, investment activities of citizens to maintain or change their social status .

Finances play a different role in the activities of organizational and production systems operating in the commodity market as part of a sales strategy or marketing strategy.

There is an ever closer connection between financial relations and property relations, which is reflected, in particular, in the development of procedures for privatization, financial leasing, pledge, conversion of debt securities, etc.

Thus, having familiarized ourselves with the general issues of the structure of the financial system of the Russian Federation, we can say that finance is monetary relations that arise in the process of distribution and redistribution of the value of the gross social product and part of the national wealth in connection with the formation of cash income and savings from business entities and the state and using them for expanded reproduction, material incentives for workers, satisfaction of social and other needs of society. The essence of finance is manifested in its functions: distribution, control and regulation. An important specific feature of finance that distinguishes them from other distribution categories is that financial relations are always associated with the formation of cash income and savings that take the form of financial resources.

List of sources used

.Finance: Textbook / Ed. M.V. Romanovsky, B.M. Sabanti. M.: Prospect: Yurayt, 2000.

.Banking: Proc. allowance / Ed. G.N. Beloglazova, L.P. Krolivetskiy. St. Petersburg: Peter, 2002.

.Lomtatidze O.V. The state as a factor influencing the behavior and development of financial markets / finance and credit. 2009. No. 27. - With. 47.

.Gvardin S. Development and regulation of the financial market / Financial newspaper. 2009. Oct. (No. 41). - With. 12.

.Goloshchapov D.N. Globalization of the financial market and inflation / Finance and Credit. 2009.№5. - With. 71-74.

.KoksharovA. Where is the weak link. / Expert - 2010, No. 40

.Kulikov A.G. Money, credit, banks. 2009 p. 198 25

.Organization of the Central Bank: Proc. allowance / Ed. G.N. Beloglazova, N.A. Savinsky. St. Petersburg: SPbGUEF, 2000.

.Edited by A.M. KOVALEVOY, Moscow "Finance and statistics", 2005

.Molyakov D.S., Shokhin EZH Theory of enterprise finance. - M.: Finance and statistics, 2000

.en.wikipedia.org/wiki/Financial_system

.Balabanov A., Balabanov I. Finance. St. Petersburg: Peter, 2002.

.Krushvits L. Financing and investment. St. Petersburg: Peter, 2000.

Tutoring

Need help learning a topic?

Our experts will advise or provide tutoring services on topics of interest to you.

Submit an application indicating the topic right now to find out about the possibility of obtaining a consultation.

1.20. Modern financial system of Russia, characteristics of its spheres and links. Prospects for the development of the Russian financial system.

The basis of the financial system of the state are centralized public finances (budgetary system, state credit, financial resources of the Central Bank). Decentralized finance includes:

1) finances of organizations (commercial and non-commercial organizations).

2)finance of financial intermediaries (banks, insurance companies).

3) household finances.

Financial system- a set of various spheres of financial relations, in the course of which funds of funds are formed and used; financial system- a system of forms and methods of formation, distribution and use of funds of funds and enterprises.

The financial system of the Russian Federation includes the following links:

Centralized finance: 1) State budget system; 2) Extra-budgetary special funds; 3) State loan; 4) Insurance funds;

Decentralized finance: 5) Finance of enterprises of various forms of ownership.

budget system The Russian Federation includes 3 links: the federal budget; budgets of national-state and administrative-territorial formations; local budgets. All budgets function autonomously. The budget system is the main link in the financial system (it accounts for more than 40% of all financial resources).

Extrabudgetary funds- funds of the federal government and local authorities related to the financing of expenses not included in the budget. Formation of off-budget funds is carried out at the expense of obligatory earmarked contributions. The main amounts of deductions are included in the cost and are set as a percentage of the wage fund. Extra-budgetary funds have a strictly designated purpose. The total number of off-budget funds is over 40. The main ones in terms of size and significance are social funds (Pension, Medstrakh, Social Insurance).

State loan reflects credit relations regarding the mobilization by the state of temporarily free funds of enterprises and the population on the basis of repayment to finance public expenditures. Individuals and legal entities act as lenders, while the government acts as a borrower. The need to use state credit is due to the impossibility of meeting the needs of society at the expense of budget revenues. The mobilization of huge financial resources results in a large public debt.

insurance fund provides compensation for possible losses from natural disasters and accidents, and also contributes to their prevention. Currently, along with state insurance organizations, insurance is carried out by non-state insurance companies.

Enterprise Finance are the basis of the country's financial system, because serve the process of creating and distributing the social product and national income. The security of centralized monetary funds with financial resources depends on the state of the finances of enterprises.

One of the main tasks of the Ministry of Finance in developing the Federal Budget of Russia for 2015-2017 was to provide a margin of safety for the budget in the face of declining revenues and economic growth. This dictates the need to ensure a surplus or a small budget deficit. The budget deficit for the three-year period is planned at the level of 0.6% of GDP (for comparison: in the European Union, a budget deficit of 3% of GDP is considered normal).

We need to cut costs and live within our means. To save money, the government reduced part of the costs, part was postponed to the period after 2017. This primarily affected the costs of rearmament of the army, a significant part of which was shifted by a couple of years. Also, the authorities were forced, for example, to limit the indexation of salaries of state employees by the level of inflation. In total, more than a trillion rubles of expenses will be redistributed during the three-year period.

At the same time, the budget provides for substantial expenditures on programs to support new territories - Crimea and Sevastopol. In addition to intergovernmental transfers, they will receive money for infrastructure and stimulating economic development. First of all, this is the Kerch Bridge, these are roads, new infrastructure that has not been updated there for decades, these are industrial parks, various clusters, and so on. Next year, 104 billion rubles will be spent on this, and then expenses will be increased to 130 billion rubles. In addition, the authorities supported the regions of the Far East - they increased funding for infrastructure facilities, for which they allocated 7, 15 and 20 billion rubles over the years.

The continuation of sanctions and current oil prices, coupled with the devaluation of the ruble, threatens Russia with a slide into a deep recession in 2015, which may force the Bank of Russia to abandon the free float of the currency and return to interventions and control over capital flows, experts from the Higher School Development Center write in the next review. economy.

The Russian economy has been stagnant since the end of 2013, and the conflict with the West and the sanctions imposed on the Russian Federation over Crimea and interference in the affairs of Ukraine against the backdrop of falling oil prices and the depreciation of the ruble only exacerbate the problems.

As of mid-November, the ruble has depreciated by a third compared to the beginning of the year against the dollar and by 23 percent against the euro. In October alone, the Central Bank spent $30 billion to support the exchange rate, and in early November, the Bank of Russia announced a transition to free exchange rate formation.

According to the head of the Bank of Russia, under a stressful scenario, the Central Bank of Russia is ready to allocate $85 billion for foreign exchange transactions in 2015. The stressful macroeconomic scenario of the Central Bank, according to Nabiullina, assumes that the price of oil in 2015-2017 will be equal to $60 per barrel. However, its implementation is unlikely, the head of the Bank of Russia believes.

According to her, even under a crisis scenario for the development of the Russian economy, the Central Bank expects the ruble to strengthen in 2015 and inflation to reach 4 percent in 2017. For 2015, the Central Bank predicts inflation at 8 percent. The total cost to the Russian economy from mutual sanctions could reach 3 percent of GDP in three years, HSE experts calculated based on estimates from the Bank of Russia.

In 2014, the net capital outflow, according to the Bank of Russia, could amount to $128 billion, which is $67 billion higher than in 2013.

Russian Finance Minister Anton Siluanov said that the net outflow of capital from Russia in 2014 could amount to $120-130 billion. In early October, the ministry expected that over $90 billion, but not more than $100 billion, could be withdrawn from the country by the end of this year. At the same time, in early November, the Higher School of Economics reported that since the beginning of the year, the outflow of capital from the Russian Federation has already exceeded $110 billion.

In an interview with Bloomberg, Finance Minister Anton Siluanov said that our economy will slide into recession only if the price of oil falls to $60 per barrel. "If oil prices drop to $60 per barrel, then growth will be negative," he said. Siluanov said that the government would take a stricter approach to the budget and use anti-crisis tools. The minister assured that "all social obligations will be fulfilled, no one intends to revise them." At the same time, "secondary priorities will be deferred to a later date."

According to Siluanov, the fall in oil prices and the deterioration of the economic situation will not be as serious as in 2008-2009, and the economy will recover when it manages to adapt to new conditions. “Most likely, the price of oil will fluctuate next year in the range of $80-$90,” the minister predicts.

FACULTY OF MANAGEMENT

TEST

discipline: FINANCE AND CREDIT

topic: MODERN FINANCIAL SYSTEM OF RUSSIA

Completed by: Babina A.V.

group No. 23-253P

record book No. 981

Checked:

Saint Petersburg

St. Petersburg Academy 1

management and economics 1

Introduction 3

The financial system of Russia is a set of financial institutions, each of which contributes to the formation and use of appropriate monetary funds, and state bodies and institutions that carry out financial activities within their competence. The presence of various institutions within the financial system is due to the fact that finance covers the entire economy of the country and the social sphere with its influence. 3

The financial system today is the subject of debate and discussion. The problems of modern society, which the financial system is designed to solve, include: insufficient rates of economic development, disproportions in the development of the economic system, a lag in adapting to changes in external commodity and financial markets, excessive social tension that adversely affects the reproduction process, a low level of satisfaction needs of the individual, etc. 3

1. The main links of the financial system of the Russian Federation 5

2. Financial management and financial policy 10

3. Public financial management bodies 14

Conclusion 20

Introduction

The financial system of Russia is a set of financial institutions, each of which contributes to the formation and use of appropriate monetary funds, and state bodies and institutions that carry out financial activities within their competence. The presence of various institutions within the financial system is due to the fact that finance covers the entire economy of the country and the social sphere with its influence.

The financial system today is the subject of debate and discussion. The problems of modern society, which the financial system is designed to solve, include: insufficient rates of economic development, disproportions in the development of the economic system, a lag in adapting to changes in external commodity and financial markets, excessive social tension that adversely affects the reproduction process, a low level of satisfaction individual needs, etc.

The financial system is a financial relationship grouped according to a certain attribute. Financial relationships, as such, are present almost everywhere in our lives. So, they are formed between the state, on the one hand, individuals and legal entities, on the other; between two legal entities, as well as between individuals. It follows from this that our personal finances, household finances (public finances) and the family budget constitute a certain area of financial relations, i.e. part of the financial system.

That is why, today, more than ever, it is important to have an idea about the financial system of the Russian Federation, to know its structure and follow its changes in order to be competent in this matter.

1. The main links of the financial system of the Russian Federation

Financial system - this is a system of forms and methods of formation, distribution and use of funds of funds of the state and enterprises. 1

The financial system is a combination of various spheres (links) of financial relations. These links are characterized by the peculiarities of the formation and use of funds of funds, as well as a different role in social reproduction.

The role of the state in the socio-economic development of society determines the need for centralization at its disposal of a significant part of the financial resources. Therefore, the basis centralized(or national) finance are the budgets of the corresponding levels (in the Russian Federation, federal, regional and local budgets are allocated). 2

In addition, public finances also include state non-budgetary funds and state lending.

Federal, regional and local budgets represent a form of formation and use of centralized funds of funds necessary to ensure the functions of the state and local governments. The budget plays a leading role in creating economic conditions for ensuring national security, maintaining government bodies, conducting fundamental research, ensuring environmental protection, maintaining and developing the social and cultural sphere, as well as enterprises of various forms of ownership.

An important link in national finances are also state off-budget funds - funds of funds generated outside the budget and intended, as a rule, for the realization of the rights of citizens in the field of social and medical security.

State loan reflects credit relations related to the mobilization by the state of temporarily free funds of enterprises, organizations and individuals on the terms of repayment, payment and urgency to finance public expenditures. The borrowers in the state loan are legal entities and individuals, and the creditor is the state represented by its executive authorities.

State debt is formed as a result of credit relations in which the state acts as a borrower, and citizens, enterprises and organizations, including foreign ones, act as creditors. Public debt is used, as a rule, to cover the budget deficit, as well as to stabilize the money circulation in the country.

Distinguish public domestic debt - debt obligations of the Government of the Russian Federation to legal entities and individuals, denominated in national currency, as well as public external debt - Government borrowings from various foreign sources denominated in foreign currency.

National finance plays a leading role in regulating economic processes and distribution relations at the macro level. The formation and distribution of national finances are centralized, national finances are accumulated at the disposal of the state and local self-government bodies.

decentralized finance- these are finances of the credit-banking sphere, insurance companies, commercial enterprises and non-profit organizations. 1

By attracting free funds from economic entities and individuals, the finances of the credit banking system and insurance are formed.

The finances of the credit and banking system (or credit funds) serve as the main source of meeting the demand of business entities and individuals for additional monetary resources. Even with a very high level of self-financing, as a rule, only own funds are not enough for doing business.

Credit funds serve not only the current needs of enterprises, but also their investment activities.

The consumer lending market is currently growing very dynamically, individuals have the opportunity to obtain a loan for the purchase of household appliances and furniture, vehicles and real estate, payment for educational services, etc.

The financial market is also part of the credit and banking system. We note in particular that the financial market is one of the mechanisms by which the finances of the credit and banking system participate in lending to the state - by acquiring government securities. 2

Insurance company finance represent a link in the financial system that provides coverage for possible losses in the event of adverse events - insured events.

Insurance funds are insurance funds, which can be organized in the following organizational forms:

Centralized insurance (reserve) fund;

Self-insurance funds;

Insurance funds of insurers (insurance companies).

Centralized Insurance Fund It is formed at the expense of national resources, has a natural form, contains stocks of products, materials, raw materials, food, which are constantly updated. The purpose of this fund is to compensate for damage and eliminate the consequences of natural disasters and major accidents that caused great destruction and casualties. The sources of formation of the centralized insurance fund is the replenishment of state stocks and reserves.

Self-insurance funds are formed by economic entities in order to ensure their own activities in the event of adverse situations and are used to cover losses, redeem bonds and buy back shares (in the absence of other funds), as well as to acquire fixed assets. The size of self-insurance funds is not regulated by law.

Insurance funds of insurers (i.e., insurance companies) are created by a wide range of participants, which may include both enterprises and individuals. Such insurance funds have a targeted use: for example, a real estate fire insurance fund, a civil liability insurance fund for car owners resulting from traffic accidents, etc.

Policyholders (participants of the insurance fund of insurers), contribute to the fund relatively small (compared to the possible amount of damage in the event of an insured event) amounts of money - insurance premiums, and since insured events are relatively rare and occur, as a rule, only for a small number of policyholders, the insurer covers all the losses of policyholders at the expense of the total collected insurance premiums. 1

Until 1990, there was a state monopoly on insurance in the USSR; now, along with state insurance organizations, there are many non-state insurance companies that have licenses to carry out insurance activities.

Business finance are formed from their own cash income and savings of these enterprises. The basis of the unified financial system of the country is the finance of commercial enterprises that serve the reproduction and distribution of the gross domestic product and form the predominant part of the financial resources of the national economy.

The main source of functioning and development of commercial enterprises is profit. At the same time, enterprises have real financial independence, independently managing the financial results of their activities, forming production and social funds, seeking the necessary funds for investment, including using the financial resources of other parts of the financial system. 1

The provision of national financial resources with financial resources significantly depends on the state of the finances of commercial enterprises. In turn, various enterprises can use a bank loan, insurance funds, budgetary resources, and sometimes a state loan in their activities. 2

Nonprofit Finance take an indirect part in reproductive processes, since the goals of the functioning of such organizations are not directly related to making a profit. The activity of non-profit organizations is to provide socially significant services, the consumption of which is accompanied by strong external effects for the whole society and each specific member of it. These services include, first of all, the sphere of national security, education, healthcare, etc.

The state, by adopting relevant laws and regulations, influences through the financial system the formation of both centralized and decentralized financial resources. For this, tools such as taxes, a credit system, a pricing mechanism, etc. are used.

National finances are organically connected with other parts of the financial system. On the one hand, the main source of budget revenues is the gross domestic product created in the sphere of production, then the budget and social non-budgetary funds are formed through taxation. On the other hand, the process of expanded reproduction is carried out by enterprises not only at their own expense, but also with the possible involvement of direct appropriations from the budget or state credit.

In addition, the finances of enterprises are connected with the credit system. With a lack of own funds, especially to replenish working capital, enterprises use bank loans.

To solve their financial and economic problems, enterprises can also attract funds from other business entities, the most common of which is the issuance of securities - shares, bonds, etc. 1

Thus, the single essence of the financial system determines the interconnection and interdependence of the links of the financial system.

Financial system of the Russian Federation

Introduction

Chapter 1. The history of the development of the financial system in Russia

1 formation of the Russian financial system

2 The essence and structure of the Russian financial system

Chapter 2. The modern financial system of Russia

1 Management of the financial system in Russia

2 Dynamics of the financial system of Russia for 2009-2014

3 Problems of development of the modern financial system of the Russian Federation

Conclusion

List of sources used

Application

Introduction

At a time when market relations are developing, finance plays a particularly important role. Such a union of financial relations contains the state budget system, off-budget funds, state credit and insurance funds. The functional and regulatory role of such systems is a single part of economic relations in the state, the most important tool in the implementation of its policy. Financial issues are discussed by the general public, while solving various problems associated with it, they cause clashes in parliaments, confrontation between political power and the population, i.e. today they are of great importance in the life of modern society. The spheres of influence of finance include the following: the pace of development of production, investment, the state of financial markets and banking systems, savings, unemployment, the standard of living of the population, etc. With the help of all of the above, on the one hand, such large-scale tasks as the development one or another sector of the national economy, but on the other, narrower ones, for example, the amount of pensions for pensioners. It is this awareness of finance in all spheres of society that is due to the fact that there are huge scales of national and planetary production, the deepening of the social division of labor, there are leaps in scientific and technological development, the growth of public consciousness, and there is a need to protect the environment.

The relevance of the topic is that a reliable financial system is the core in the development and best functioning of a market economy and a necessary condition for the growth and stability of the economy as a whole. Such a system is the foundation that mobilizes and distributes the savings of society and facilitates its daily operations. It follows that while the structural transition from a largely centrally planned and controlled economy to a market economy involves many elements, the most important thing is to create a sound financial system. Only after such a process, the creation of such a reliable financial system, can the money and capital markets develop successfully, especially the primary and secondary markets for national government securities.

The object of the course work is the financial system of the Russian Federation.

The subject of the course work is the financial and economic relations that arise in the process of functioning of the financial system of the Russian Federation between the state, municipalities, business entities and the population.

The purpose of this work is to study the development of the financial system of Russia, based on the goal, the following tasks were identified:

consider the formation of the financial system of Russia;

explore the essence and structure of the Russian financial system;

study the governing bodies of the financial system in Russia;

analyze the dynamics of the Russian financial system in 2012-2014;

identify the problems of the modern financial system of Russia.

Chapter 1. The history of the development of the financial system in Russia

.1 Formation of the Russian financial system

financial economic state

In the Russian Empire, the development of market relations was largely held back by serfdom. Until the abolition of serfdom in 1861, the Russian economy was not a mechanism for replenishing the revenue side of the budget.

Until the second half of the XVIII century. emergency financial resources for the Russian state and its government were mainly requisitions (compulsory alienation) or forced loans from monasteries and private individuals.

During the reign of Catherine II (1762-1796), one of the forms of state credit was the issue of banknotes to cover the state budget deficit, which led to the development of inflationary processes; there was also borrowing of credit resources from state-owned banks.

In the process of reforms of Alexander I (1801-1825), the Ministry of Finance was established. And the first minister of finance in the history of the Russian Empire was Count Aleksey Vasilyevich Vasiliev, who had previously been state treasurer. In the 19th century 13 people have been replaced as Minister of Finance. Among them, the most famous were E.F. Kankrin, S.Yu. Witte.

In the early years of the reign of Alexander I, the issue of banknotes intensified especially noticeably. The wars with Turkey (1806-1812) and Sweden (1808-1809) required large expenditures. The inflationary process in Russia depreciated the money savings of the propertied strata. Under these conditions, the government of Alexander I took certain measures that contributed to the stabilization of monetary circulation, which were based on the “Finance Plan”, prepared in 1809 by the famous statesman of this era M.M. Speransky with the assistance of Professor N.S. Mordvinova.

In accordance with the "Finance Plan", the monetary reform was supposed to be carried out by withdrawing and destroying all previously issued banknotes, as well as establishing a new issuing bank, which was supposed to have a sufficient supply of silver to secure the banknotes planned to be put into circulation. In addition, according to the "Plan" it was supposed to improve the organization of the monetary system of Russia, the basis of which was to be the silver ruble. Speransky had a negative attitude towards fiat money and considered it necessary to eliminate their circulation in the country. Speransky proposed measures to improve the organization of the internal state credit system, which were based on the idea of transforming (consolidating) part of the current interest-free debt in the form of banknotes issued into circulation into long-term debt with the state paying interest to creditors. To do this, Speransky proposed to issue interest-bearing debt obligations - bonds of a long-term state loan and sell them to everyone for banknotes. From the "Finance Plan" only a few provisions were put into practice.

Ideas M.M. Speransky were forgotten, and the government could not complete the reforms due to the outbreak of war in 1812. The government's policy in the field of finance, state credit and money circulation took a new course. It was decided to keep banknotes in circulation and prevent them from being replaced by coins. Banknotes were declared legal tender, having circulation throughout the empire.

In addition, in 1831, in accordance with the Manifesto, the government decided to issue tickets of the State Treasury (series) to accelerate the receipt of state revenues. Tickets were put into circulation in large quantities and gave the right to receive income at the rate of 4.32% per annum. The maturity date was 4 years. Issues of tickets followed one after another, and expired tickets were exchanged for new ones. In reality, the notes of the State Treasury have turned into a long-term state loan.

In July 1839, with the adoption of the Manifesto “On the Structure of the Monetary System”, its reform began, the purpose of which was to introduce new principles for organizing this system, and to eliminate depreciated state banknotes from circulation. On July 1, 1839, the Decree “On the Establishment of the Deposit Office of the Silver Coin at the State Commercial Bank” was also published, which declared the tickets of the Deposit Office to be legal tender, circulating throughout the country along with the silver coin.

By carrying out this reform, the government of Nicholas I tried to simultaneously streamline the circulation of money and make the most of the issue of paper banknotes for the benefit of the State Treasury. The monetary reform gave impetus to the rapid development of commodity-money relations in Russia.

One of the initiators of the new credit and monetary policy in the 1880s. became Minister of Finance Nikolai Khristoforovich Bunge - the largest economist who defended his doctoral dissertation "Theory of Credit". Bunge was a supporter of the market economy.

Beginning in 1881, the Russian government made every effort to accumulate gold reserves. External and internal loans, as well as the growth of taxation of the population contributed to the stabilization of the budget, all this together became a prerequisite for the monetary reform of 1895-1897.

As a result of the reform, Russia received a stable gold currency and paper banknotes equivalent to gold and freely exchangeable for this metal. A monetary system based on gold caused an even greater influx of foreign capital.

In the late 90s. an economic crisis broke out in Russia. Its first herald was the monetary crisis that began in the summer of 1899 - the shortage of free capital increased sharply, due to the growth in demand for money, the exchange rate of many securities fell sharply, a number of banks went bankrupt, and credit was significantly reduced.

Russia began to get out of the economic crisis only in 1904. But new shocks awaited it - the Russo-Japanese War of 1904-1905. and the surge of the revolutionary movement in 1905-1906.

At the beginning of the 10s. XX century, the state of the empire's economy began to improve.

The First World War interrupted the extensive development of the banking system. Russia experienced a huge need for funds to finance the war. In 1914-1916. The Russian government produced massive annual issues of State Treasury tickets. An inflationary process developed in the country, it was seized by devastation, famine, accompanied by mass rallies, strikes, and demonstrations.

The result of the growth of the money supply, not supported by commodity production, was the fall in the purchasing power of the ruble. Prolonged and severe inflation set in.

By the time of the February Revolution, the actual metal backing of credit notes was about 13%. The country's gold reserves were shrinking. The ruble, having become paper within the country, gradually turned into a closed currency in foreign markets.

In February 1917, a very difficult financial situation developed in the country.

The period 1917 - mid-1921 was marked by the liquidation of pre-revolutionary credit institutions, and its most significant legislative act was the Decree of the Central Executive Committee of December 14, 1917 on the nationalization of banks.

With the transition to the NEP, the prerequisites for the development of banking appeared. On June 30, 1921, the Council of People's Commissars issued a Decree on the abolition of restrictions on monetary circulation, as well as on the measures necessary for the development of deposit and transfer operations.

A major step in the restructuring of financial work was the tax reform of 1930, which led to a change in the system of payments by enterprises to the budget and the introduction of a two-channel system for withdrawing deductions from profits and a turnover tax, which included many taxes and fees.

In 1938, the formation of the budget system of the USSR was completed. Local budgets and the social insurance budget were officially included in the unified state budget, the expansion of the functions of local councils and their budgetary rights was accompanied by a steady increase in revenues.

In the 30s. 20th century the government of the USSR consistently pursued a policy of centralized management and planning of the national economy. During the Great Patriotic War (1941-1945) there were no fundamental changes in the country's financial system.

In the post-war years, the state budget was subordinated to the task of eliminating the consequences of the war and restoring the destroyed economy.

An attempt to improve the economic mechanism was made in 1965 through a reform aimed at strengthening the stimulating effect of profit on the development of production. The reform provided for the organization of a new system of economic incentives.

At the end of the 70s. in order to change the difficult situation that has developed in the country's economy, an economic model of sectoral self-support and self-sufficiency was developed.

In the first half of the 80s. in order to improve the economic mechanism of the country, an experiment was conducted to disseminate new methods of management at enterprises, and later they began to introduce full self-financing and self-financing.

However, all these activities did not lead to an increase in the country's financial resources. There was a deficit in the state budget. And the budget deficit, in turn, had a negative impact on the economy, undermined the stability of money circulation, and gave rise to inflationary processes.

1.2 The essence and structure of the Russian financial system

Financial system<#"813836.files/image001.gif">

Figure 1.1 The financial system of the Russian Federation.

In its structure, public finances include: the state budget and off-budget funds.

The state budget is an annual plan of state revenues and expenditures. Namely, it is money that allows the state to perform economic and social functions. The state budget includes the budgets of the government and local budgets. Hence it follows that the approval of state budgets for the next year is always stormy. The government seeks to reduce the rights of the regions, and the latter are trying to leave more funds at their disposal. Extra-budgetary funds are those funds that have a strictly designated purpose: a pension fund, a social insurance fund, etc., and are accumulated outside the state budget system.

The budget is income and expenditure. The income part of 80-90% is formed at the expense of taxes from enterprises and the population. The other part comes from the use of state property, foreign economic activity. The structure of the expenditure side of the budget includes expenditures for social and cultural needs, expenditures for the development of the national economy, for defense, and public administration. In a socially oriented economy, taxation is based on the principles of obligation to pay, social justice and links with the receipt of benefits.

Spheres of the financial system<#"813836.files/image002.gif">

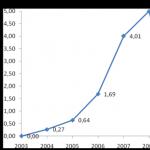

Figure 2.1 Dynamics of federal budget revenues in 2009-2013