9.2 Methodology for calculating the economic efficiency from the introduction of new equipment and technology

Continuous improvement of engineering and technology is accompanied by significant additional investments.

The introduction of new equipment and technology into production is justified only when it provides an economic effect:

Reducing the cost of producing a unit of output;

Improving the quality of products (savings for consumers);

Growth in labor productivity.

Improvement of working conditions;

Additional capital investments aimed at increasing the perfection of engineering and technology must be compensated by savings in production costs.

Based on these guidelines, "Methodological recommendations for a comprehensive assessment of the effectiveness of measures aimed at accelerating scientific and technological progress in the oil industry" - RD-39-01 / 06-0001 - 89 were developed.

The currently used unified system of indicators for determining the economic efficiency of the introduction of new equipment and technologies includes:

Production cost;

Increase in labor productivity;

Saving;

Presented costs;

Payback periods;

Economic effect;

In addition to the main indicators, when choosing the most cost-effective options for introducing new equipment and technology, auxiliary natural indicators are used - the specific consumption of fuel, energy, raw materials, materials, the number of workers released, the equipment utilization rate, etc.

In addition, the socio-economic results of the introduction of new technology (improvement of working conditions, etc.) are considered.

The economic effect of the introduction of new technology shows the feasibility of implementation and is determined for a conditional year, that is, from the date of implementation and for the entire next year, if the volume of implementation subsequently increases or implementations are transferred to a number of related enterprises, then this technique allows recalculation according to the newly achieved volume and, accordingly, to obtain a new economic effect is the total saving of all production resources (living labor, total labor, capital investments) that the national economy will receive as a result of the production and use of new technology, which ultimately translates into an increase in national income.

The economic effect of activities for a conditional year is determined by the formula:

E T \u003d R T -3 T, (9.1)

where E t - economic effect for the billing period;

Р t - proceeds from sales (industrial and technical, scientific and technical purposes) in the year at prices established in a centralized or contractual manner;

З t - valuation of costs for the implementation of activities for a conditional period.

The main indicator of the effectiveness of the introduction of new technology is the annual economic effect, the definition of which is based on a comparison of the reduced costs for the replaced (basic) and implemented technology.

These costs are the sum of the cost and standard profits:

Z \u003d C + E n * K, (9.2)

where З - reduced costs in rubles;

C - the cost of a unit of production in rubles;

E n \u003d 0.15 - standard coefficient of capital investments;

K - specific capital investments

The concept of "investment" implies all one-time costs associated with the acquisition, creation and growth of the production assets of the enterprise. The amount of capital investment can be determined by the average annual cost of production assets that the enterprise has.

The annual economic effect is the total savings in production resources (living labor, materials, capital investments) that the national economy receives. As a result of the production and use of new, higher quality equipment, which in

ultimately expressed in an increase in national income. Thus, this indicator reflects the national economic efficiency.

The calculation of the annual economic effect is made according to various formulas depending on the types of new equipment and products being introduced. If during the implementation of the STP measure the price and volume of output (work) does not change over time, the effectiveness of the implementation of the measure is characterized by a change (reduction) in the cost of production. The annual economic effect from the introduction of new technology at the same time:

E G \u003d (C 0 -C T)xQ T ±ΔH T, (9.3)

where Co, Ct - the changing part of the cost of production (work) without and with the implementation of the STP measure;

Qt - annual volume of production (work);

ΔНт - change in the amount of taxes and payments from the balance sheet profit (income) as a result of the implementation of the STP measure.

Payback period:

T 0K \u003d Δ K / ΔС, (9.4)

where ΔК - additional capital investments, in thousand rubles.

ΔС - savings in operating costs, in thousand rubles;

9.3 Calculation of the annual economic effect from the introduction of block compressor units with a capacity of 4 m3 / min. for compression and transport of petroleum gas

The efficiency of the proposed technique is ensured by the reduction of current operating costs.

Initial data Table 9.1

| Name | Unit. | Block compr. installation | Compressor 7VKG-30/7 | |

| 1 | Capital investments for purchase and installation | thousand roubles | 2500 | 2000 |

| Depreciation period | years | 15 | 15 | |

| % depreciation | % | 6,7 | 6,7 | |

| Depreciation deductions | thousand roubles | 100,5 | 134,0 | |

| 2 | Oil | T | 0,6912 | 2,0736 |

| good norm | kg/hour | 0,08 | 0,24 | |

| price 1 t | Rub | 15000 | 15000 | |

| sum | thousand roubles | 10,4 | 31,1 | |

| 3 | Salary (with 100% bonus) | thousand roubles | 235 | 235 |

| annual fund of working time | hour. | 1996 | 1996 | |

| Machinist 4th grade | people | 5 | 5 | |

| rate | rub | 14.0 | 14.0 | |

| amount (from night.evening.20%) | rub | 89832 | 89832 | |

| Locksmith repairman 5 times. | people | 1 | 1 | |

| rate | rub | 8,472 | 8,472 | |

| sum | rub | 16910 | 16910 | |

| 4 | Electricity | thousand roubles | 276 | 709 |

| Power | 35 | 90 | ||

| Quantity | kWh | 287280 | 738720 | |

| price 1 kW/hour | rub | 0.96 | 0.96 | |

| 5 | Maintenance | thousand roubles | 22,3 | 23,6 |

| 6 | Overhaul | thousand roubles | 12,6 | 36 |

∆ K \u003d 2500 - 2000 \u003d 500 thousand rubles. - capital investments.

Let us calculate the economic effect from the introduction of a new set of equipment.

Determine the benefits of saving energy. Electricity costs during the operation of old equipment - 709 thousand rubles, with a new block installation - 276 thousand rubles.

From email en. = 709-276 = 433 thousand rubles.

Thus, the economic effect for one year and excluding VAT will be:

E 1 \u003d C el.en. - E n ∙ ∆K = 433 - 0.15 ∙ 500 = 358 thousand. rub.

In view of VAT:

E common. \u003d E 1 - 24% \u003d 272.08 thousand rubles.

Reducing the cost of gas pumping by 1 thousand m3 will be:

E per. = E common. /Q per. \u003d 272080 / 6000000 \u003d 6.5 rubles.

Labor productivity is found by the following formula:

![]() m3/person

m3/person

Chppp - the number of PPP.

Cost of pumping after implementation:

C 2 \u003d C 1 - E lane. \u003d 470 - 6.5 \u003d 463.5 rubles.

C 1 \u003d 470 rubles. - cost before implementation;

We calculate the profit before implementation:

![]() \u003d 6000 ∙ (500 - 470) \u003d 180,000 rubles.

\u003d 6000 ∙ (500 - 470) \u003d 180,000 rubles.

T transfer - average tariff for pumping 1 thousand m3. gas.

We calculate the profit after implementation.

Methodology for calculating economic efficiency

The main indicators of economic efficiency of the introduction of new technology.

The main indicators of the effectiveness of the introduction of new technology include the following:

1) annual economic effect from the introduction of new technology;

2) the efficiency of one-time costs for the creation of new technology;

3) the payback period of one-time costs for the creation of new technology.

These indicators can be both expected, allowing to judge the economic efficiency of the new equipment planned for use, and actual, evaluating the effectiveness of existing equipment.

The concept and methods for determining the annual economic effect from the introduction of new technology.

The economic effect can be defined as the difference between the reduced costs before and after the introduction of new technology.

For example, if an automated system is implemented instead of a manual system for working with equipment, then the difference in the reduced costs is determined accordingly between the automated and manual systems. In this case, the cost of the basic option includes only the current costs of the basic technology:

Labor costs of employees working on new equipment;

Current material costs (energy costs, equipment maintenance);

Depreciation of fixed assets used by new equipment.

If new equipment is introduced instead of the old one, then the difference in the reduced costs is determined between the costs of the new and old equipment.

The costs of introducing new technology include:

Current material costs;

One-time costs for the creation of new technology.

If a new technique is being introduced at a newly created enterprise, then it is possible to compare the projected costs at this enterprise (organization) with the options for standard costs at similar enterprises (organizations) or with the cost options of possible firms involved in the introduction of technology (firms - performers) 5 .

The total costs of introducing a new technology are determined by the index of reduced costs, which is calculated by the formula:

Zp \u003d C + EnK, where

Zp - reduced costs;

C - current costs;

En is the normative coefficient of economic efficiency of one-time costs;

K - one-time costs (capital investments).

Current (operational) costs are repeated in production cycles, they are carried out synchronously with production activities and constitute the cost of products or services. Operating costs are calculated as a sum per year.

One-time costs include:

a) non-capital costs

b) capital costs

The normative coefficient of efficiency of one-time costs is considered as the normative profit that should be received from the introduction of technology. The size of the standard coefficient of efficiency of one-time costs is closely related to their payback period.

Costs are the sum of current and one-time costs reduced to a single size using the standard coefficient of economic efficiency.

To determine the economic effect of the introduction of new technology, it is necessary to compare the reduced costs of the base and proposed options. For this purpose, the annual economic effect indicator is used, which can be represented by the following calculation methods:

the base variant is zero, and the implemented variant is indicated by one.

In general, the formula can be expressed as follows:

E \u003d Eg - En * K, where

E - annual economic effect (annual economic profit);

Eg - annual savings (profit) caused by the introduction of technology;

K - one-time costs associated with the purchase of equipment;

E is the rate of return (normative profit) (normative efficiency ratio).

The annual economic effect is an absolute indicator of efficiency. The system is considered efficient if E > 0.

Comparison of the value of the annual economic effect for various options makes it possible to choose the most effective option for the introduction of technology with the smallest amount of annual reduced costs or with the largest annual economic effect.

The concept of efficiency and methods for determining the effectiveness of one-time costs.

The performance indicator is a relative value that compares results with costs.

Definition of efficiency:

k - the cost of modernizing equipment.

The one-time cost effectiveness is calculated as the ratio of the difference between the current costs of the base and proposed options to the sum of the one-time costs of the proposed option.

In the conditions of a modern market economy, each area of business has its own value of the rate of return (efficiency ratio), the size of which is set in excess of the bank rate and therefore is not a constant value 6 .

Payback period of one-time costs.

Of great importance is the determination of the time during which all one-time costs associated with the introduction of new technology will fully pay off. The payback period is the reciprocal of the efficiency ratio.

Payback period determination:

.

.

Calculation of economic efficiency digital

printing machine

Here is a calculation of the economic efficiency of investments in a digital printing complex, which was acquired by the State Unitary Enterprise PPP Nauka Printing House of the ARC RAS. The complex includes a Xerox DocuTech-6155 digital printing machine complete with a scanning and layout station, as well as a Zechini finishing line, including folding, a mini-binder and a cutting machine.

This equipment was purchased by the printing house at its own expense. As a result of the financial analysis of the company's balance sheet, it turned out that the acquisition of expensive equipment led to a deterioration in the financial structure and a lack of funds. Under these conditions, the management of the printing house sold part of the equipment under a leaseback scheme. This made it possible to actually keep the production equipment at the enterprise and obtain significant funds at its disposal. However, it is clear that the funds received are borrowed capital, for the use of which the printing house will have to pay the leasing company in the future.

To assess the effectiveness of the acquisition of Digital Printing House under a leasing scheme, a model of an investment project was built, which is valid for the life of the equipment specified in the financial lease (leasing) agreement. The idea of building the model was to calculate the net present value for separate time intervals during the investment project implementation period. Some of the approaches developed to evaluate the effectiveness of investments from the implementation of the CTcP system were used in the calculations.

It was advisable to take the time interval in the calculations equal to a calendar month, since, firstly, leasing payments and income tax payments are made monthly, and secondly, this choice is explained by the short duration of the investment project (4 years) and the necessary accuracy of determining the term payback.

For each month, the proceeds from the sale of products for the project were calculated by multiplying the average monthly number of produced accounting units of products by the average price of the accounting unit. In this case, it was convenient to take an A3 sheet, sealed on one side, the so-called "click" as an accounting unit. This is convenient, firstly, because the DocuTech-6155 digital press is equipped with a counter that determines the number of printed clicks; secondly, the main part of the production is single-fold folded and stitched sheets of A3 format; thirdly, the contract with Xerox provides certain payments for each click printed on this equipment.

The cost of production was calculated as follows. Monthly expenses for wages and UST of workers servicing the machine were summed up; payments to Xerox for printed clicks; monthly service by the service department of the equipment supplier, including refueling the machine with consumables and current repairs. Then the amount received was adjusted taking into account the average percentage of general production and general business expenses for the printing house, and when calculating this percentage, payments under the leasing agreement were deducted from the sum of general production and general business expenses to eliminate double counting. The final cost was calculated by adding the payments under the finance lease agreement to the result.

Net present profit for each month is calculated by discounting the net profit at the start of the investment project, i.e. the difference between sales income and the cost of printing works, reduced by the amount of income tax.

The net present value of a capital project is equal to the sum of the net present benefits over the lifetime of the equipment. At the same time, we note that when using a leaseback scheme to replenish the finances of an enterprise, depreciation deductions for operated equipment and property tax payments fall on the leasing company, and therefore are included in the amount of leasing payments.

An analysis of investments in the equipment complex “Digital Printing House” of the State Unitary Enterprise PPP “Nauka”, financed under the leaseback scheme, showed that the project is effective. Net present income amounted to 2857 thousand rubles; yield index 1.397; payback period 24 months.

Calculations were made based on the actual download and cost per click, however, in addition to these data, it is necessary to have an idea of how the economic efficiency of an investment project will change depending on various factors, primarily download and cost per click. Such information is needed so that the printing house has information about its capabilities and can use them with the greatest benefit.

Therefore, using the Microsoft Excel program, a table was constructed for calculating the reduced profits for the life of the equipment. This made it possible to model the investment project in terms of its economic efficiency, depending on the most significant factors, such as equipment loading and the price of finished products in this market sector.

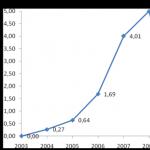

In order to identify ways to increase the return on investment, dependences of the value of net present value on the price of printing works performed on a digital printing press were built. On fig. Figure 1 shows two such dependencies at equipment load of 60% and 80%, allowing you to assess the level of current return on investment in "digital printing" depending on the average market prices in this market segment.

Rice. 1. Net present value of investment at current and one-third more utilization

In particular, when the equipment is used by 60%, the point of zero profitability corresponds to an average price of 0.83 rubles. per accounting unit. With an increase in equipment load by a third, the critical price decreases to the level of 0.67 rubles. in one click. If the average market price is one ruble, then with an increase in utilization from 60 to 80%, the net present income from capital investments will increase not by 20 or 30%, but by more than 2.5 times.

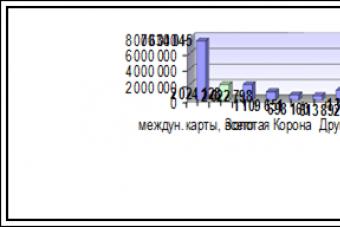

For the purposes of planning activities to attract orders, a graph of the dependence of the net present investment income on the number of A3 format sheets per month was built (Fig. 2). The two sharp declines in the profitability of the project, shown in this figure, are due to the need to switch at a given level of workload to another shift of personnel work. This schedule allows the printer to determine the minimum number of orders to attract to maintain the profitability of the project at a given level. For example, it can be seen from it that, under the accepted conditions, it is unacceptable to reduce output below 750 thousand sheets. A3 format per month; to receive net present value for the project in the amount of 5 million rubles. it is necessary to issue monthly at least 1 million sheets.-ott. A3 format.

Rice. 2. Net present income depending on the number of sheets.-ott. A3 format per month

Very useful information for managing an investment project is data on the dependence of the payback period of equipment on the load. For the considered capital project, they are shown in fig. 3, from which it can be seen that the payback of the project increases sharply with an increase in equipment load during two-shift operation, i.e., each new completed order significantly increases the efficiency of the entire project. So, with an increase in the useful time of equipment from 60 to 80% per shift with two-shift operation (i.e., from 120 to 160% of the time of one shift), the payback period will be almost halved, from 40 to 21 months.

Rice. 3. Equipment payback period

Production capacity utilization in the printing industry is subject to significant seasonal fluctuations. At a low level of utilization, it is important to know what price will provide the minimum acceptable payback period. To determine the cost of a click depending on the load of the equipment, diagrams were constructed for the payback periods corresponding to the service life of the equipment, i.e. the life of the project and the duration of the leasing agreement (Fig. 4). It can be seen from the diagram that it is advisable to set the minimum price for an accounting unit of production depending on the actual load in the corridor between the two lines of extreme payback options for the project. For example, when loading a digital printing machine 120% of the time of one shift (which means working in two shifts with a load of 60% for each shift), the minimum price should not be less than 85 93 kopecks. per sheet.-ott. A3 format.

Rice. 4. The minimum average price of an accounting unit of production with payback during the life of the equipment and the term of the leasing agreement

The calculation showed that for SUE PPP "Printing House" Nauka "the optimal scheme for financing large investment projects for the purchase of equipment was leasing. To sum up, it is necessary to remind once again that digital presses pay off only at a high level of utilization. Before purchasing expensive technological equipment, it is necessary to calculate various options for financing the transaction, such as raising own funds, a loan, or using a leasing scheme 7 .

List of used literature

Boikov V.P. Economics of the printing company: 2nd ed., revised. and additional Publishing house "PETERSBURG INSTITUTE OF PRINTING", 2004

Margolin A. Calculation of the economic efficiency of the implementation of the CTcP UV-Setter system.//Polygraphy. 2003. No. 3. S. 19─21.

Popova T.K., Kusmartseva N.V. Guidelines for calculating economic efficiency. M.: 2007

Problems of the economy and progressive technologies in the textile, light and printing industries: Sat. tr. graduate students and doctoral students. - St. Petersburg.

Issue. 5: Days of Science 2003. - 2003.- p.65.

Stepanova G.N. Strategy for the development of printing enterprises: (conceptual and methodological aspects) /G. N. Stepanova; Ministry of Education Ros. Federation, Moscow. state un-t printing. - M.: MGUP, 2004.- p.22.

Trofimova L. Economic indicators used to assess the effectiveness of the enterprise. //Auditor. – 2005 - No. 9

http://www.citybusines.ru/biznes-plan/izdatelskijj-biznes-i-poligrafija/favicon.ico

1 http://www.citybusines.ru/biznes-plan/izdatelskijj-biznes-i-poligrafija/favicon.ico

2 Boykov V.P. Economics of the printing company: 2nd ed., revised. and additional Publishing house "PETERSBURG INSTITUTE OF PRINTING", 2004

3 Stepanova G.N. Strategy for the development of printing enterprises: (conceptual and methodological aspects) /G. N. Stepanova; Ministry of Education Ros. Federation, Moscow. state un-t printing. - M.: MGUP, 2004.- p.22.

4 Problems of the economy and progressive technologies in the textile, light and printing industries: Sat. tr. graduate students and doctoral students. - St. Petersburg.

Issue. 5: Days of Science 2003. - 2003.- p.65.

5 Popova T.K., Kusmartseva N.V. Guidelines for calculating economic efficiency. M.: 2007

Management efficiency (4) Test work >> Economic theory

decision making, calculations, drawings, etc.). ... 1). Annual economic Effect from implementation new technology into control... implementation new technology; - capital expenditures before and after implementation new technology; - normative coefficient efficiency ...

Calculation economic efficiency development and creation of the program

Coursework >> Economics... from 08/07/01 No. 120 F3. New ... technical-economic... 0 For calculation economic efficiency data needs to be entered... economic efficiency implementation programs, cost definitions or prices are determined by: Notional annual savings from implementation ...

Calculation economic efficiency implementation new aircraft type (2)

Coursework >> Transport... Calculation economic efficiency implementation new type of aircraft" Contents Introduction Calculation economic efficiency implementation new ... Implementation into operation new aviation technology with high fuel efficiency... shares from ...

Calculation economic efficiency maintenance zones

Task >> EconomicsCosts and costing. Calculation economic efficiency maintenance zones. Literature. ... finally, from careful attitude entrusted to them technology. Number of... car designs will result in implementation the latest devices, widespread use...

The basis of the methods of determination is the comparison of the costs of new equipment with the effect obtained from it.

There are absolute (general) and comparative efficiency of new technology. Absolute - is measured by the ratio of the effect obtained from the new technology (in the form of an increase in output and a decrease in its cost or an increase in profits) to the costs of its creation and implementation. Comparative - is used to select the best option for new equipment from the available samples by determining the payback period for capital investments or comparing the reduced costs by options.

To determine the economic potential of implementation - the effect obtained from the maximum number of units of new equipment under optimal conditions - and the actual (possible) scale of implementation for individual years, the following is calculated: cost reduction for the production of new equipment equivalent in capacity to the old one; increase in output, which can be obtained as a result of the use of new technology; increase in profits for the producer and consumer by increasing production, reducing costs and changing prices. The transition to the manufacture of new products can be associated with additional costs for the manufacturer (in particular, with insufficient experimental and other preparatory work), which at first can lead to a reduction in its profits or even losses. Additional costs in the transition to the use of new technology may be at its consumer. This is offset by the subsequent increase in profits as production increases and costs decrease. In addition, a temporary reduction in profits or losses can be covered by a bank loan. The price of new equipment is set at such a level as to ensure the interest of producers in production, and consumers - in the use of new equipment.

In addition to cost, about e economic efficiency of new technology can also be judged by such indicators as the release of labor, the facilitation and improvement of working conditions, the reduction in the consumption of scarce materials, the improvement in the quality and reliability of products, which cannot always be reflected in their cost and prime cost.

Distinguish between planned and actual economic efficiency of new technology.

Planned - is determined according to planned data on the volume of production, capital investments, cost and payback of capital investments.

Data on planned and actual economic efficiency of new technology are used in determining the desirable directions for its development and in planning its implementation. When planning the effectiveness of new equipment, when the price is not yet known, the costs of new equipment can be determined according to estimates for its manufacture, and in the absence of estimates, according to enlarged standards and taking into account analogues.

Actual - is measured by the ratio of reducing the cost of production or increasing profits from the introduction of new technology to capital investments for these purposes. The costs of new equipment are added to the costs of its delivery and installation, the construction of production facilities (or savings on capital investments due to the freed up space are deducted), as well as the costs of increasing (or savings are deducted) working capital associated with the introduction of new technology. The data obtained are compared with the costs that would be required with the same technical base and the same production volume. In addition to capital investments, the cost of production for new and old equipment is also compared. If the introduction of new technology is associated with an increase in output, then the cost price is recalculated for the increased volume, taking into account the conditionally constant part of the costs and its changes.

Section One Conclusions

Thus, the following conclusions can be drawn:

1. Innovative activity - a type of activity associated with the transformation of ideas-innovations into a new improved product introduced on the market; into a new or improved technological process used in practice; into a new approach to social services.

2. Innovative activity involves a whole range of scientific, technical, organizational, financial and commercial activities.

3. The following main types of innovative activity are distinguished: instrumental preparation and organization of production; production start-up and pre-production developments, including product and process modifications; retraining of personnel for the use of new technologies and equipment; marketing of new products; acquisition of intangible technology in the form of patents, licenses, know-how, trademarks, designs, models and services of technological content; purchase of machinery or equipment related to the introduction of innovations; production design necessary for the development, production and marketing of new goods, services; reorganization of the management structure.

4. The choice of the method and direction of the innovative activity of an enterprise depends on the resource and scientific and technical potential of the enterprise, market requirements, stages of the life cycle of equipment and technology, and features of industry affiliation.

5. When designing, developing and implementing innovations, it is necessary to determine the necessary costs for their implementation, possible sources of financing, evaluate the economic efficiency of introducing innovations, compare the effectiveness of various innovations by comparing income and costs.

Economic efficiency of new technology, an indicator that characterizes the national economic results and the economic feasibility of the production of new technology and its application. A distinction is made between fundamentally new technology, the introduction of which is at an early stage (for example, fast neutron reactors, lasers, cryogenic power lines, hovercraft), and new technology that has not been sufficiently introduced (for example, computers, automatic lines with numerical control, etc.). .). A fundamentally new technique requires large investments in “finishing”, the transition to mass production, promotion into new areas of application, etc., but in the future it can be expected to have a significant effect. New technology requires less investment in fine-tuning and improvement, and production costs depend on the scale of possible implementation; the effect of this type of new technology can be implemented faster and also depends on the scale of implementation.

The fundamental differences between the innovative activity of an enterprise and the current production are that the assessment of the current state of the enterprise, including equipment and technology, is based on identifying the conditions for success based on past experience and current trends. Such an analysis is characterized by the use of a retrospective correlation between the results of economic activities and costs. Characteristic approaches are: a comprehensive economic analysis of the efficiency of economic activity, an analysis of the technical and organizational level of production, an analysis of the use of production resources and an analysis of the relationship between cost, output and profit.

To analyze the innovative activity of an enterprise, it is necessary to analyze and forecast future success factors in the face of uncertainty and justify the costs of the future period. In contrast to the deterministic economic processes of current production, the processes of introducing new equipment and technology with their subsequent commercialization are stochastic in nature. Therefore, the analysis of the impact on profit should be built on the basis of forecasting methods, methods of expert assessments, multiple regression analysis, as well as situational and simulation modeling.

Indicators of the technical level of innovation

In a market economy, the analysis of the effectiveness of innovation becomes more complicated, acquiring a multi-stage and multi-stage character. At the first stage of the analysis of the effectiveness of new equipment and technology, traditional generalizing and particular indicators of the technical level and effectiveness of new equipment and technology should be used. The classification of indicators of the technical level of innovation is given in fig. 16.3.

Rice. 16.3. Classification of indicators of the technical level of new equipment and technology

For the successful implementation of an innovation, it is necessary to choose an adequate technological solution and an appropriate level of organization and production apparatus. An analysis of the level of technology and technology used requires the study of not only novelty and priority, but also such important properties as the ability to adapt to existing conditions, the ability to readjust the production apparatus. Of particular note is such a property of technology, technology and organization as flexibility.

In the context of an expanding market space, multiple diversification, the pace of renewal is increasing, and the variety of types of products and the equipment and technologies used for their production is increasing. Goods, equipment and technology at different stages of the life cycle, belonging to different models and generations, simultaneously appear in production. In this regard, the variability of technology and the need to adapt the production apparatus to these changes sharply increase.

There is a growing need to use special methods to increase the effect of new technological solutions “taking root” in existing production conditions. The system "equipment - technology - product" is constructed according to special methods based on the so-called built-in heterogeneity, i.e. skillful combination of functional features of fragments of newly developed technological solutions with existing production processes.

Indicators of the technical level of production

Methodologically, it is necessary to distinguish between indicators of economic efficiency of raising the technical and organizational level and indicators of the level itself, i.e. state of engineering, technology, organization, management and R&D. An approximate diagram of the most important indicators of the achieved technical and organizational level of production is shown in fig. 16.4.

An increase in the technical and organizational level of production is ultimately manifested in the level of use of the main elements of the production process: labor, means of labor and objects of labor. That is why such economic indicators as labor productivity, capital productivity, material intensity, turnover of working capital, reflecting the intensity of the use of production resources, are indicators of the economic efficiency of increasing the level of new equipment and technology used. The above indicators (labor productivity, capital productivity, material intensity and turnover of working capital) are called private indicators of intensification. Their analysis should be carried out according to the factors of the technical and organizational level. Along with private indicators, general indicators are also used.

All summary indicators, characterizing the increase in the economic efficiency of measures for technical and organizational development, are combined into the following groups:

increase in labor productivity, relative deviation of the number of employees and wage fund;

increment of material output (reduction of material consumption), relative.

increase in capital productivity (decrease in capital intensity) of fixed production assets, relative deviation of fixed production assets;

increase in the speed of turnover of working capital, relative deviation (release or binding) of working capital;

increase in the volume of output due to the intensification of the use of labor, material and financial resources;

increment of profit or production cost;

increment of indicators of the financial condition and solvency of the enterprise.

Rice. 16.4. Scheme of indicators of the technical and organizational level of production deviation in the cost of material resources

The proposed system of indicators of the economic efficiency of new technology is the same for all branches of material production. The analysis methodology is given in the Guidelines for a comprehensive assessment of the effectiveness of measures aimed at accelerating scientific and technological progress.

Technological level of production

The progressiveness of the applied technical and technological solutions is closely related to the level of production capabilities and the so-called technological level of production.

To the greatest extent, the technological level of production depends on the technological method of influencing the substance, the technological intensity of the process, the technological controllability of the process, and its adaptive-organizational level.

The level of technological impact is characterized by the type and degree of impact, the use of technical means on the subject of labor (i.e., by the degree of mechanization, automation, by type of physical, chemical, mechanical or combined impacts).

The level of technological intensity of the process is characterized by the degree of use of material, energy and time parameters of the technological process. The level of technological controllability shows the flexibility of the process and the possibility of changing its parameters under the influence of the requirements of external conditions in order to maximize efficiency.

The level of technological organization of the process is determined by the degree of achievement of optimal structural relationships in the technological process according to the principle of continuity, multiplicity, non-waste process, etc.

The level of adaptation of the technological process is characterized by the most realistic possibility of the technology functioning in compliance with the specified mode in conjunction with the already existing production and the environment.

Generalized criteria for the technological level of production are presented in Table. 16.1.

Table 16.1. Generalized criteria for the technological level of production

|

Criterion |

Type of implementation |

|

Level of technological impact |

The degree of mechanization, automation, chemicalization, biologization, electronization; type of physical, chemical, mechanical, electronic, ionic or other impact. The degree of use of computers. ACS, etc. |

|

Technology Intensity Level |

Processing speed, output; consumption norms of raw materials, materials, energy; the duration of the technological cycle; the amount of production waste; improving product quality; degree of use of equipment, production areas, etc. |

|

Level of technological controllability |

Flexibility of the process and the ability to adjust parameters under the influence of external requirements in order to maximize efficiency; the possibility of automatic control of the process; maintaining stability and reliability; process safety |

|

Technology organization level |

Combination of technological methods; continuity of processes; number of technological stages of processing; direction of movement and movement of material flows; non-waste processes |

|

Process adaptation level |

Reliability, trouble-free, safety; ensuring high stable product quality; compliance of labor tools and technology with the requirements of labor protection, technical aesthetics, ergonomics, biosphere compatibility and environmental safety of the process |

Economic evaluation of innovations

The quality of the technological process is realized in its ability to create innovation. It is evaluated both from the standpoint of technical and technological characteristics, and the system of economic indicators. Widely used technical-economic and functional-cost methods of analysis make it possible to establish the relationship between the technical and economic indicators of processes and to find an algorithm for the optimal functioning of production systems.

As follows from the foregoing, a very important stage of innovation activity is the search for fundamental relationships and interdependencies between indicators of the technical level, the quality of applied innovations, the conditions for their production and operation, and economic efficiency. The fact is that it is impossible to solve the problem of quality and economic efficiency of new equipment and technology separately. It is most expedient to apply a generalized technical and economic model (or, in the simplest version, a block diagram), which reveals the impact of technical level indicators on generalizing technical and economic indicators: cost, productivity, reduced costs, etc. To do this, at the very initial stage of designing an innovation, it is necessary to choose an alternative option: 1) the optimal properties of the innovation with maximum economic efficiency or 2) the most perfect level of innovation with satisfactory economic efficiency.

The useful effect of an innovation, both in production and in operation, cannot always be estimated using cost estimates. Therefore, two criteria are used: the criterion of minimum reduced costs and the integral (generalizing) indicator of the quality of innovation. If it is impossible to establish a quantitative functional relationship between particular quality indicators and reduced costs, then expert or statistical methods are used to determine the weighted average of the generalized innovation indicator, calculated as a weighted arithmetic average or as a weighted geometric average.

The next step may be to establish the relationship between the value of the reduced costs and a general indicator of the technical level of the product or process. The tool of this approach is correlation and regression modeling.

The proposed methodology uses both traditional normative approaches and the cost-effectiveness method. With the change in the economic situation during the transition to a market economy for the enterprise, there was a reorientation of the criteria for the technical and technological level and the economic efficiency of innovations. In the short term, the introduction of innovations worsens economic performance, increases production costs, and requires additional investment in the development of R&D. In addition, intensive innovation processes, including the introduction of new equipment and technology, disrupt stability, increase uncertainty and increase the risk of production activities. Moreover, innovations do not allow the full use of production resources, reduce the utilization of production capacities, and can lead to underemployment of personnel, to mass layoffs.

On the one hand, the innovative activity of an enterprise is a system of successively conducted production and commercial activities, where the quality of innovations depends entirely on the state and technical and organizational level of the production environment.

On the other hand, it is the market that acts as the decisive arbiter of the selection of innovations. He rejects the highest priority innovations if they do not meet commercial benefits and maintain the competitive position of the enterprise. That is why technological innovations are divided into priority, important for the economic and technological security of the country, and commercial innovations necessary for the enterprise in the transition to the market. The criteria for the technical level and effectiveness of new technologies should be adequate both to the requirements of scientific and technical state policy, and commercial feasibility, and to the corresponding sources of funding.

So, for indicators of profitability and financial stability of an enterprise, a new technology is undesirable in more than half of the cases. Moreover, the variability of technology in industries characterized by a long life cycle, capital-intensive and capital-intensive industries can cause reparable damage if it is not properly forecasted, implemented and exploited.

In knowledge-intensive, progressive industries, the situation is the opposite: it is technological “shifts and breakthroughs” and the introduction of new technologies that dramatically increase the competitiveness of an enterprise and lead to profit maximization in the long run. Moreover, since the early 1990s The competitive status of large companies is largely associated not only with new products, but also to a greater extent with the availability of the latest technologies from the company. This is the case with the flagships of the world economy, Sony, Panasonic, IBM, General Electric, Johnson and Johnson, as well as the Russian Gazprom and Rosvooruzhenie, etc.

The transition to the production of new systems and new generations of products is possible only on the basis of new technologies. Special methods of adaptation of the organization, management and marketing in this case are necessary.

When introducing fundamentally new technological solutions, production activities may become unprofitable not only in the short term, but also in the long term, this can be explained due to several reasons:

the use of new technology is started prematurely, before the costs are brought into line with the real price level;

the enterprise does not have sufficient experience in the implementation and operation of new technology;

The R&D underlying the development of a new technology is not competitive;

a real analysis of the economic situation, corporate structure and market segmentation has not been carried out;

there is no potential demand;

wrong marketing strategy;

the behavior of possible competitors is not taken into account;

no influence of firm factors (company image, its trademark, its industry affiliation, etc.) was revealed.

The latter deserves additional explanation, since in structurally weak or old industries, the appearance of a new product of high quality, but not corresponding to the price, can cause a sharp drop in demand, including for the previous generation models. To eliminate the inefficiency of technological decisions made, it is important to identify the relationship between the implemented technology and the competitiveness of the company and its behavior. This relationship reveals the following strategic technological factors:

investment in R&D (share of R&D expenses in profit, share of expenses in sales volume);

positions in competition (leadership in research and development, leadership in products, leadership in technology);

the dynamics of new products (the duration of the life cycle, the frequency of the appearance of new products, the technological novelty of products);

technology dynamics (long life cycle, frequency of new technologies, number of competing technologies);

the dynamics of competitiveness (technological differences in the production of products, technology as an instrument of competition, the intensity of competition).

The above strategic technological factors reveal the dependence of the firm's market strategy on the characteristics of R&D and the technology used. Success requires such qualities of a new technology as adaptability, flexibility, the ability to “embedded” in old production, synergy opportunities, a clear R&D strategy and the availability of patents and technology licenses, highly qualified personnel, and adequate organizational and management structures. It is impossible to reduce all these concepts to any single indicators, therefore, in a market economy, the market acts as an arbitrator and expert in the quality of technology, and only economic efficiency can be the criterion for the whole variety of properties.

structures. The advantage of using the proposed methodology by production and business structures is based on operational planning and designing changes in production and business activities, a comprehensive assessment of their effectiveness, taking into account risk factors.

Thus, it should be stated that the implementation of changes in production and entrepreneurial activity is not straightforward. The trajectory of changes in production and entrepreneurial activity varies depending on the actions of active elements of the business structure, the influence of the external environment and targeted control actions. Constant monitoring of the state of implementation of changes in production and business activities implies the need for regular adjustments of all parameters of functioning and planned final results of production and business activities of business structures.

Bibliographic list

1. Schumpeter, J. Theory of economic development / J. Schumpeter; per. from English. - M.: Progress - Academy, 1982. - 686 p.

2. Golofast, V. L. Integral assessment of the effectiveness of changes in the production activities of enterprises /

V. L. Golofast, A. E. Miller // St. Petersburg State Polytechnical University Journal. Ser. Economic sciences. - 2010. - No. 2 (96). -

3. Miller, A. E. Integral approach to resource regulation of interaction between business structures / A. E. Miller / / Manager. - 2010. - No. 3-4 (7-8). - S. 44-50.

MILLER Alexander Emelyanovich, Doctor of Economics, Professor (Russia), Head of the Department of Economics, Taxes and Taxation. Address for correspondence: [email protected]

The article was received by the editors on February 25, 2014. © A. E. Miller

UDC 338.465.2

S. V. KONDRATYUKOV E. S. STAURSKY

Omsk Academy of the Ministry of Internal Affairs of Russia

BASIS OF CALCULATION

ECONOMIC EFFICIENCY OF INTRODUCING NEW TECHNOLOGY

In the article, the authors made an analysis of the state of fixed assets in Russia. The structure of the total accounting value of fixed assets in Russia by type of economic activity is shown. The features of calculating the economic efficiency of the introduction of new technology are analyzed.

Key words: new technology, innovations, economic efficiency of introducing new technology.

In Russia, due to the underestimation of the role of technical and economic cybernetics, the existence of costly methods of management of a predominantly extensive type, the long transition of the economy to market principles, the level of automation of production in the manufacturing industries is at a low level.

The scale of aging and depreciation of the fixed assets of Russian enterprises dictate the need for an early renewal of the machine park, not only at the expense of imported samples, but also with the help of domestic industry. If management approaches to the formation and development of the domestic machine tool industry are not changed, then Russia's further lag in the organization of competitive modern manufacturing enterprises is ensured.

Today, the development and production of new metal-cutting machine tools, including equipment with numerical program control (CNC) and automatic lines, has practically stopped in Russia. Practically no real attempts are being made to introduce flexible production and industrial

ny robots, started back in the mid-80s of the last century at individual Soviet enterprises.

This state of affairs with the main means of production predetermines Russia's further lag in the organization of competitive modern manufacturing enterprises.

Causes reasonable doubt and the accuracy of estimates of existing fixed assets of enterprises. So, their last inventory was carried out more than 20 years ago.

At the end of 2010, the total book value of fixed assets in Russia was 93.2 trillion rubles, the residual book value was 49.3 trillion rubles.

At the end of 2010, 20.0% of the total book value of fixed assets in Russia belong to the state form of ownership, 80.0% - to non-state.

The structure of the total accounting value of fixed assets in Russia by type of economic activity (as of the end of 2010):

Agriculture, hunting and forestry - 3.1%;

Fishing, fish farming - 0.1%;

Mining - 9.7%;

Manufacturing industries - 8.6%;

Production and distribution of electricity, gas and water - 7.3%;

Construction - 1.6%;

Wholesale and retail trade; repair of vehicles, motorcycles, household and personal items - 3.3%;

Hotels and restaurants - 0.6%;

Transport and communications - 27.8%;

Financial activities - 2.3%;

Operations with real estate, rent and provision of services - 23.5%;

State administration and ensuring military security; compulsory social security - 4.6%;

Education - 2.9%;

Health care and provision of social services - 2.3%;

Provision of other communal, social and personal services - 2.3%.

All this is happening in the period of progressive development of the world post-industrial society in the direction of innovation and information technology. The result of this process is the further development of the theory and practice of management, and the transformation of traditional production into a fully automatic cycle with the introduction of computer-aided design systems and unmanned (and waste-free) technologies.

Replacing a person in production with automatic machines and mechanisms that perform the main and auxiliary operations of technological processes makes it possible to minimize the likelihood of control errors that necessarily accompany the activities of a living organism (worker).

“In production, mental and physical labor are combined. It is easier to automate those types of labor that do not require complex work of thought, it is more difficult to automate mental labor.

In this regard, the history of the emergence and development of industrial machines is the process of designing devices and implementing them, first of all, in auxiliary (loading, unloading, moving) operations, as well as in unified basic production operations of material processing.

In this case, technical problems are closely intertwined with the economic effect of the introduction of automation.

The technical and economic (complex) approach to production automation, which implies obtaining an effect in a long period of management, aims to increase labor productivity and product quality while reducing the cost of marriage and downtime. At the same time, in a competitive and unstable economy, the payback period for new projects to modernize production comes to the fore.

The basis of the feasibility study for the introduction of automatic machines and the refinement of objects to be automated is the assessment of the expected changes in the productivity of the equipment as a whole, the reduction in the number of both main and auxiliary production personnel, the reduction of setup and changeover times, as well as the reduction of downtime.

In addition, it is necessary to take into account the increase in efficiency from automation associated with increased

improving the quality of products (reducing defects), expanding the range (flexible production), saving resources and reducing the cost of production.

Obviously, in general, the condition for the economic efficiency of automating the workplace, site, workshop and enterprise as a whole can be represented by the following inequality:

E auth. > E rev.

Where is Eavt. - economic effect obtained as a result of the work of automated production;

Eobor. - the economic effect of the operation of traditional equipment (basic version) with a predominance of manual labor.

Let us represent the assessment of the economic efficiency of automation using aggregated cost components by the following expression:

E \u003d aSz.pl. + (a- 1) Sat. - Sa.o. -EnDK + + EnKfDCH

A is the expected coefficient of change in the productivity of automated equipment;

Sz.pl. - wages of workers and maintenance personnel replaced by automatic equipment;

Sat. about. - the cost of maintaining and depreciating the equipment of the base case;

Sa.o. - operating costs and the amount of depreciation deductions from the cost of automatic equipment;

En is the normative coefficient of economic efficiency of additional capital investments;

DK - additional capital investments in measures for the introduction of automatic machines (new technology);

Kf - an indicator of the average capital-labor ratio of one production worker;

DC - the number of workers released as a result of automation.

The payback period for additional capital investments in production automation is calculated as follows:

DK - EnKfDCH

aSz.pl. + (I - 1) Sat. - Sa.o.

Thus, it is considered economically feasible to introduce automation of production upon receipt of a positive value of the annual (or other time period) effect (E > 0) or the payback period of machines is less than the standard values (payback period of the basic equipment).

As the most important private technical and economic indicators of the introduction of new technology, the following are used: the growth rate of equipment productivity, the reduction in the number of workers, the level of additional capital investments in automation measures.

All methods practically come down to comparing the costs and effectiveness of the introduction of new technology in comparison with the standards in force for basic equipment.

The literature provides simpler dependencies that can be applied to assess the economic efficiency of the automaton.

So, the payback period of an automatic machine or a robot is calculated as follows:

Where C is the cost of the machine; Z - the cost of maintenance and repair of the machine (for a certain period of time); R is the economic effect of saving labor and other resources (over a certain period of time).

Then the profit received from the introduction of new technology:

Where K is a coefficient depending on the service life of new equipment and depreciation deductions (K = 0.9-1.7 with a service life of 1-16 years and depreciation deductions in the range of 6-30%).

In the conditions of automated production, the economic analysis of options should not be limited to choosing only basic efficiency criteria and developing options for identity with the old (basic) equipment.

Thus, “the object of economic analysis should be studied not as a set of separate elements, but taking into account the links between the elements of the system, the coordinated intensities of the work of the elements of the system, both within the group of machines under consideration, and in interaction with other groups of machines organized in one production process.

Obviously, such a comprehensive study can be carried out only on the basis of economic and mathematical modeling.

The purpose of modeling is to choose the optimal one from a wide variety of options for organizing the production process, that is, the best one that best suits the technical, technological and organizational features of a particular production.

The analysis should precede the introduction of new technology and begin at the pre-design stage of automated production. Taking into account the systematic approach to economic and mathematical analysis, the following stages are distinguished:

Determination of the flows and intensity of movement of objects of labor in accordance with the production program (in this case, the structure and composition of automated workplaces, production sites, workshops is determined);

Construction of the optimal layout of automatic and other equipment at the selected production areas (initial optimality criteria (minimum material flow, maximum equipment productivity, etc.) can be adjusted at subsequent design stages);

For each automated workplace and system of automated workplaces, a variant of the optimal organization of the work of automatic machines is found: "warehouse - conveyor - robot - machine tool - conveyor - warehouse". The found variant should be characterized by the maximum load of the equipment and its productivity, the minimum

nym values of interoperational turnover reserves, the choice of the optimal number of automatic machines and the number of their serviced robots;

The automated system of machines formed at the previous stages of modeling must be described as a whole, to represent the interconnected operation of the entire complex, taking into account the reliability of the machines (their time between failures), maintenance and programming time for various characteristics of material and information flows.

The system of automata formed in this way, which satisfies the main goals of industrial automation, must be evaluated for potential economic efficiency. Based on the magnitude of the expected economic effect and the assessment of the expected social consequences of automation, which find both quantitative and qualitative expressions, a decision is made to continue the technological design and proceed to the practical implementation of the technical project.

Thus, the effective introduction of new technology as a means of production will allow an enterprise to reduce costs (production costs), improve quality, eliminating the unfavorable human factor (decrease in defects and downtime), and in the future move to unmanned and waste-free technologies, which is positive impact on market position among competitors.

Bibliographic list

1. Fixed assets in Russia - Access mode: http:// newsшss.sh/doc/mdex.php/Main_funds_in_Russia (date of access: 01/03/2014).

2. Kozlovsky, V. A. Efficiency of readjustable robotic production / V. A. Kozlovsky. - L.: Mashinostroenie, 1985. - 224 p.

3. Radunskaya, I. L. People and robots / I. L. Radunskaya. - M.: Sov. Russia, 1986. - 272 p.

4. Timofeev, A. V. Robots and artificial intelligence / A. V. Timofeev. - M.: Nauka, 1978. - 192 p.

5. Biryukov, V. V. Evaluation of the effectiveness of investment projects for the development of transport systems: evolution and development of approaches / V. V. Biryukov // Bulletin of SibADI. - 2012. - No. 2 (24). - S. 97-101.

KONDRATYUKOV Sergey Vladimirovich, Candidate of Economic Sciences, Associate Professor (Russia), Associate Professor of the Department of Economic Theory and Financial Law. Address for correspondence: [email protected] STAURSKY Evgeny Stanislavovich, Candidate of Technical Sciences, Associate Professor (Russia), Senior Lecturer of the Department of Economic Theory and Financial Law.