Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Similar Documents

Comparative (market) approach to real estate valuation. Technology for implementing the sales analysis method. Calculation of the value of a property using the gross rental multiplier. Comparative unit method. Features of real estate appraisal in Russia.

test, added 12/03/2012

Characteristics of real estate as an object of civil rights. The concept and classification of real estate objects. Problems of legal regulation of construction in progress. Participation in civil circulation. Real estate transactions.

term paper, added 05/28/2016

Basic principles and methods of real estate valuation; study of the economic situation in the regional and local market. Determination of the market value of the complex of real estate LLP "Mechanized Works": characteristics, ownership.

thesis, added 20.02.2011

Real estate appraisal, its goals, objectives and purpose. Legal framework for real estate valuation. Review of the system of state registration of real estate objects, rights to property and transactions with it. Legal regulation of the real estate market in the Russian Federation.

abstract, added 09/24/2015

Characteristic features of market relations in the field of real estate. Legal aspects of the economy and rental of real estate, including an analysis of the sources of civil law regulation of relations in the field of real estate. The essence of the basic principles of real estate valuation.

control work, added 05/13/2010

The main types of forms of ownership of enterprises. Characteristics and classifications of real estate objects. Management of certain properties. Management of systems of real estate objects of the Federation. Operations with real estate objects.

course of lectures, added 04/16/2013

Definition of the concept of real estate. Legal essence of real estate objects (rights). Differences between rights and encumbrances. The material essence of real estate objects. Legal status of the land. Examples of description of the location of the land.

FEDERAL AGENCY FOR EDUCATION

SEI HPE "MOSCOW STATE UNIVERSITY OF SERVICE"

Faculty: "Institute of Regional Economics and Municipal Administration"

Department: "State and municipal management"

course project.

Topic: Improving real estate valuation methods.

Discipline: Management of municipal real estate.

Completed by a student

Groups GRDS 3-2

Shevchuk M.V.

Accepted by teacher

Dubovik M.V.

Introduction…………………………………………………………………….3

I Theoretical part

1.1 Classification of real estate……………………………..5

1.2 Methodology for evaluating residential real estate…………………..6

1.3 Housing Market………………………………………………………………9

1.4 Real estate securities market……………………………..13

1.5 Mortgage………………………………………………………………..15

II Analytical part

2.1 Modern principles of real estate market analysis……………18

2.2 Real estate market research………………………………....20

2.3 Methods for assessing the market value of real estate……………...26

2.4 Features of different types of assessment……………………………...34

2.5 The influence of environmental factors on the cost……………...36

III Practical part

3.1 Practical application of the method of comparative sales………..39

3.2 Investment risks and real estate market statistics……………44

Conclusion………………………………………………………………...47

References………………………………………………………….50

Introduction.

The term “real estate” has appeared in Russian legislation since the time of Peter I. However, in the current legislative acts, a clear distinction has not yet been made between movable and immovable property.

Immovable things (real estate, real estate) include land plots, subsoil plots, isolated water bodies and everything that is firmly connected with the land, that is, objects that cannot be moved without disproportionate damage to their purpose, including forests, perennial plantations, buildings , buildings. Immovable things also include aircraft and sea vessels subject to state registration, inland navigation vessels, and space objects. Other property may also be classified as immovable by law. So, for example, the enterprise as a whole as a property complex is also recognized as real estate.

In accordance with the first part of the Civil Code of the Russian Federation, the enterprise is considered not as a subject, but directly as an object of civil rights.

The enterprise as a whole or part of it may be the object of sale, pledge, lease and other transactions related to the establishment, change and termination of rights in rem. An enterprise can also be inherited.

The structure of the enterprise as a property complex includes all types of property intended for its activities, including land plots, buildings, structures, equipment, inventory, raw materials, products, rights of claim, debts, as well as rights to designations that individualize the enterprise, its products, work and services (company name, trademarks, service marks), and other exclusive rights, unless otherwise provided by law or contract.

The state body carrying out the state registration of real estate is obliged to provide information on the registration made by it and the registered rights to real estate objects to any person. This rule will certainly significantly reduce the risk of improper transactions with real estate for participants in civil transactions.

Various forms of ownership: private, ownership of joint stock companies, local, municipal and, finally, federal. It is very difficult to determine the effectiveness of one form or another - it all depends on specific situations.

In general, the housing market is much more developed than other segments. And this is understandable. There is already a certain legislative base here that regulates the processes of housing privatization, obtaining land for the construction of cottages, and so on.

The market for non-residential premises is represented mainly by once purchased or reconstructed premises, converted into offices. But in the course of privatization, more and more objects appear that are rented out for a long-term lease or sold at auctions by property funds, i.e. local authorities. At the second stage of privatization, the real estate market will be replenished with industrial facilities and, to an even greater extent, trade and service facilities.

After the introduction of the right of private ownership of real estate and privatization in the Russian Federation, the state ceased to be the sole owner of the vast majority of real estate, which served as the beginning of the formation of the real estate market.

I Theoretical part

1.1 Classification of real estate objects.

Real estate appraisal is of interest, first of all, for categories of objects that are actively circulating on the market as an independent product. Currently in Russia it is:

apartments and rooms

premises and buildings for offices and shops

suburban residential buildings with land plots (cottages and summer cottages)

vacant land plots intended for development or for other purposes (in the short term)

Warehouse and production facilities.

In addition, real estate objects, as a rule, are part of the property complex of enterprises and organizations (in particular, those being privatized) and significantly affect their value. There are other categories of real estate, the market of which has not yet formed.

A variety of conditions and their combinations affect the assessment of an object. We give an example of signs of classification.

1. Origin

· Natural (natural) objects.

· Artificial objects (buildings).

2. Appointment

Vacant land plots (for development or other purposes)

· Natural complexes (deposits) for their exploitation.

· The buildings

For housing.

For the office.

For trade and the sphere of paid services.

For industry.

· Other.

3. Scale

· Land masses.

· Separate land plots.

· Complexes of buildings and structures.

· Multi-apartment residential building.

Residential house single-family (mansion, cottage)

Section (entrance).

· Floor in section.

· Apartment.

· Room.

· Summer cottage.

· A complex of administrative buildings.

· Building.

· Premises or parts of buildings (sections, floors).

4. Ready to use

· Finished objects.

Requiring reconstruction or major repairs.

Requiring completion of construction.

1.2 Methodology for evaluating residential real estate.

Practical experience indicates that for small residential real estate it is advisable to carry out valuations according to a simplified procedure, which can be based only on the method of comparing market sales. The sales comparison approach to valuation is based on a direct comparison of the property being valued with other properties that have been sold or listed for sale. Buyers often base their judgments of value primarily on properties for sale. Appraisers also use this information along with information about properties sold or leased. This approach is based on the principle of substitution, which states that if there are several goods or services of similar suitability, the one with the lowest price is most in demand and has the widest distribution. In the case of housing, this means that if it can be seen on the market (which it usually does), then its value is usually set at the cost of acquiring a home of equal attractiveness, which will not take much time to replace.

Mass real estate valuation is a special approach to a simplified valuation of a large group of homogeneous objects (apartments). Such an assessment is carried out according to a certain methodology: for the assessed object, the corresponding set of values of a fixed set of its parameters is determined, and then, according to the rules that are unchanged for all objects, the value of its assessment is formed.

Mass evaluation has its own special applications. An example of such an assessment is the assessment of apartments “according to the Bureau of Technical Inventory (BTI)” based on the cost approach. It is performed by a government agency and is used to determine taxes and fees. However, the BTI valuation does not focus on market value. Therefore, no market information is required to build it.

The distinction between the concepts of actual selling price and market value should be emphasized. The prices are divided into the seller's price, the buyer's price and the selling price.

The seller's price is the amount that he receives as a result of the transaction. The buyer's price is the total sum of all costs for the purchase of an apartment. The selling price is the amount of money that the buyer gives to the seller for the apartment.

They differ in the amount of payment for the services of intermediaries and the costs of processing the transaction. An intermediary may or may not be available to both the buyer of the apartment and the seller. The transaction may or may not be insured. The costs of processing a transaction can be distributed among its participants in different ways. Therefore, the selling price characterizes the apartment as such, and the prices of the buyer and seller are highly dependent on the terms of the transaction. As a rule, if the seller has an intermediary, then his payment is deducted from the selling price and reduces the seller's price, and vice versa, the buyer's payment for the services of his intermediary increases the buyer's price in relation to the selling price. Similarly, these prices are affected by the transaction processing fee. Thus, the price of the seller and the buyer can vary significantly (up to 15% or more). But the selling price minimally depends on their specific features of the mechanism for selling and processing the transaction and is determined by the specifics of the apartment itself. Therefore, it is advisable to model the dependence of the selling price on many parameters of the apartment.

According to its definition, the market value of a property depends on those factors that determine the average or more likely price of its sale in the market under normal conditions of the transaction.

At the first level of classification, they can be subdivided into objective and subjective factors.

When determining the market value, objective factors are considered. As for subjective factors, they are associated with the behavior of a particular buyer, seller or intermediary when concluding a transaction, in part not directly determined by its economic conditions (temperament, awareness, honesty, patience, gullibility, personal likes and dislikes, etc.).

Objective factors are mainly economic determining, ultimately, the average price level of specific transactions.

Economic factors can be subdivided into macroeconomic and microeconomic. The first include factors related to the general market conjuncture: the initial level of security of demand for real estate in the region; volumes and structure of new construction and reconstruction; migration factors; legal and economic conditions of transactions; level and dynamics of inflation; dollar exchange rate and its dynamics. In our conditions, the following long-term factors can also be indicated as part of the group of economic factors:

· differences in the dynamics of prices for goods and services, as well as wage conditions that affect the scale of accumulation of funds and the amount of deferred demand;

· the pace and scale of the formation of a new social stratum, which have the opportunity to invest in real estate;

development of the mortgage system;

· Development of a system of foreign representations in the region.

Microeconomic factors characterize the objective parameters of specific transactions. Of these, those that describe the object of the transaction (apartment) are especially important. Factors related to the nature of the transaction and payment terms are also significant. The main procedures for processing transactions and their payment have been worked out. Therefore, when mass appraisal of the market value of apartments, one can and should focus on the typical (average) nature of the transaction, consider this factor constant and not take it into account when assessing the market value of apartments. Then the market value (average price) of an apartment, estimated on a fixed date, is determined by its parameters (characteristics) as a use value.

1.3 Housing market.

The potential scale of this market is enormous. At least 90 percent of housing in any, as they say, civilized country is bought today in installments.

The housing market in Russia acquired a particularly large scale as a result of the privatization of apartments. Free, as in Moscow, or preferential, as in other cities, the transfer of apartments to private ownership has created new opportunities for owners to operate with this type of real estate.

At the same time, forms of buying and selling apartments and other types of housing have also developed. Among these forms, the purchase of apartments by installments is becoming more common. It should be noted that in the West, almost all real estate owned by the population is burdened with debts, the need to pay the cost of housing in installments. In Russia, as a result of privatization, every citizen became the owner of immovable assets (apartments, garden and country plots) that were not burdened with debts. Therefore, Russian citizens are in a much better position in this respect than citizens of other countries.

At the same time, all this will be supplemented by the newly opened possibilities for acquiring housing on credit. Briefly, the scheme is as follows.

The apartment itself serves as material security for lending. Until the loan is repaid, the buyer is legally only its tenant. The buyer immediately lays out the first installment - about 30 percent; the remaining 70 are paid by the bank with which the corresponding agreement is concluded with the real estate company.

The bank or its subsidiary collects documents, executes the purchase and sale transaction, makes settlements with the seller, etc. Therefore, the size of the commission, for example, in Moscow reaches 13 percent of the market price of an apartment. These costs are justified if the transaction is executed with the participation of reliable organizations, since the housing market has acquired a certain criminal connotation in recent months.

A large number of criminal situations arise due to the presence of “left” dollars in almost every transaction, which are transferred from hand to hand after the completion of the official registration procedure.

“Left” dollars is, as a rule, the difference between the market price of an apartment and the amount in which it was assessed by the BTI. Therefore, one does not need to be an expert to understand: to eliminate the "leftists" one has to choose one of two paths: either the conservative path - to bring the evaluation practice of the BTI closer to the real conditions of the market; or a radical way - to abandon this practice and switch to other forms of control over the application price of real estate.

The ever-increasing ratios are bringing BTI valuations closer to market prices by leaps and bounds.

All possible taxes have already been deducted from the income for which an apartment (or other property that can later be sold) was bought by a citizen. Therefore, from any point of view, the sale of property cannot be considered a fact of obtaining additional income; it is only a change in the form of property owned by a citizen. And levying tax on the amount of such a change is a secondary charge of tax on the same income.

The market redistribution of apartments made it possible to improve the use of the housing stock, stimulated the resettlement of part of the communal apartments, and made it possible to partially solve the housing problem.

On the whole, the housing problem not only persists, but is intensifying. This is facilitated by the constant influx of refugees and forced emigrants from neighboring countries into Russia.

Use of apartments for non-residential purposes.

After the privatization of a significant share of the residential sector in cities, the problem of using owned apartments for other than their intended purpose has become more acute.

Of course, the use of residential premises owned by citizens and legal entities for non-residential purposes - to accommodate offices, offices, workshops, computer centers, etc. - by no means contributes to solving the housing problem, since a significant part of the living space is withdrawn from the citywide fund. However, ways to deal with this limit the freedom of the owner and are often illegal.

Even if the housing inspectorate or the militia manages to establish the fact of misuse of the apartment and, having formalized it accordingly, presents it to the court, the judges have no legal grounds to satisfy such a claim. In accordance with Art. 6 of the Law “On the Fundamentals of Federal Housing Policy”, the owner of real estate in the housing sector has the right, in the manner prescribed by law, to own, use and dispose of it, including leasing, renting, pledging, in whole and in parts, etc. if the current norms, housing and other rights and freedoms of other citizens, as well as public interests are not violated. Among the obligations of the owner when using residential premises, established by Art. 4 of the same law, there is no such obligation as the use of residential premises for their intended purpose. True, Art. 7 of the Housing Code of the RSFSR, which establishes that residential buildings and residential premises are intended for permanent residence of citizens.

But in the best case, taking into account this article, on the basis of Art. 48 of the Civil Code of the RSFSR, only a residential lease agreement can be invalidated as not complying with the requirements of the law. But on this basis, it is not possible to terminate the agreement on the transfer of ownership of housing, since not a single legislative act (and this should be only a law, and not a mayor's order or a government decree) contains such a legal basis.

The lack of a clear regulatory framework leads to the fact that even the judiciary is sometimes unable to figure out who and on what grounds has the rights to a particular object. However, the stable demand for offices, retail and warehouse space, as well as the high cost of such property, which guarantees considerable commissions, attract a large number of intermediary structures. If in 2000 only 42 percent of those surveyed were engaged in transactions with non-residential premises, by now this figure has increased to 70 percent.

1.4 Real estate securities market.

The segment of the real estate market is the most underdeveloped. This reflects both the lag of the entire stock market and the insufficient involvement of real estate itself in the commercial turnover. Participants in the real estate market still prefer direct investment. Narrow and range of securities associated with the use and sale of real estate.

First of all, the indisputable advantage of housing bonds is their accumulative nature. They make it possible to gradually accumulate the necessary amount of them to buy an apartment, being a certificate of the right to the footage of housing indicated in the face value.

The denomination of bonds in relation to the footage of real apartments allows at any time to stop at the level of living space and comfort, which will be recognized as sufficient or maximum possible. Although it should be recognized that this positive property of housing bonds is somewhat limited by the fact that they give the right to purchase only newly commissioned housing. A rather limited standard of construction and the specifics of new development areas can significantly narrow the circle of those wishing to purchase bonds to solve their housing problems, and this is precisely their main value. If it were possible to purchase municipal housing with the help of bonds in any district of the city, of any level of comfort and “age”, then their attractiveness would increase significantly. This could ensure an increase in the competitiveness of housing bonds in relation to other means of payment (currency) that are considered sufficiently reliable.

Another undoubted advantage of housing bonds is their anti-inflationary nature: the ability to save money in one way or another from depreciation. Therefore, monthly housing bond price quotes should, at the very least, track inflation. Meanwhile, the mechanism of monthly quotations, provided for by the projected form of issue, is able to absorb only general macroeconomic fluctuations, and significant in time scales, but not current changes in the housing market.

The possibility of changing quotes depending on the timing of obtaining housing when bonds are redeemed, say, within the range of 1 to 6 months, could significantly increase both the attractiveness of this stock market instrument and the degree of its liquidity.

Property valuation. Market valuation methods help to maximize the profitability of real estate, this new resource that businesses and citizens have at their disposal. This assessment becomes necessary already when the owners of land and real estate want to mortgage them to obtain a loan. Without a proper assessment, count on attracting additional investments, including foreign ones.

At the first stage of privatization, when creating joint ventures, such assessments were either not made at all, or were made just by eye. The investor himself determined the price. When it concerned serious objects, Western appraisal firms were involved, which in most cases carried out appraisals in favor of foreign investors, underestimating the real market value of our assets.

Evaluation is also necessary for the secondary issue of shares of privatized enterprises seeking to increase their authorized capital by an amount supported by real material resources. It is the real prospectus that will allow investors to avoid mistakes when setting stock prices. An appraisal is also required in the division of property, in determining the best commercial use of land and real estate, and in all other transactions related to real estate.

Analysis of the prospects for increasing the value of real estate and its commercial use should be based on a strict economic calculation, an accurate and professional assessment of the actual market value of the property. An appraisal is the opinion of a specialist or a group of experts, usually professional appraisers, on the value of a real estate object based on knowledge, experience, using strictly defined approaches, principles and methods, as well as procedural and ethical standards.

Market value refers to the most likely price that a property will sell in a competitive and open market, given all the conditions necessary to make a fair deal.

These conditions are:

1. The buyer and the seller act on the basis of typical, standard motives. The deal is not forced on either side.

2. Both parties have full information to make decisions and act in the best interests of their interests.

3. The object has been put on the open market for a sufficient time, and the optimal moment has been chosen for the transaction.

4. Payment is made in cash or agreed financial terms comparable to cash payment.

5. The transaction price reflects normal conditions and does not include discounts, rebates or special credits by any of the parties associated with the transaction.

6. The object is in normal demand and has a utility recognized in the market.

7. The object is quite scarce, in other words, there is a limited supply that creates a competitive market.

8. The object is endowed with the properties of alienability and is capable of being passed from hand to hand.

1.5 Mortgage.

Mortgage means issuing a loan secured by real estate. The classic mortgage object is a land plot. Mortgage opens the possibility to provide buildings, structures, residential houses, separate apartments as collateral.

Mortgage loans are generally inexpensive, mortgage banks' margins are low, and profits are made from large volumes of loans placed. These banks also attract funds at low interest rates, but due to their very high reliability, the mortgage bonds they place are in steady demand.

There are four entities operating in the mortgage loan market:

1. a borrower seeking to acquire possibly the best real estate;

2. a bank that seeks to obtain the highest possible profit by limiting the risk of a mortgage;

3. an investor who seeks to maximize profits by investing in mortgages;

4. the government, which must create the legal and economic conditions for the functioning of the mortgage lending system.

Mortgage lending facilities should ensure the availability of credit for the borrower, as well as the profitability of lending.

There are several varieties of credit mechanisms that allow, to a greater or lesser extent, to bypass the rather high level of inflation that exists in the country.

The first mechanism is fixed rate lending.

The second mechanism is based on loans with a rate adjusted to the price level in the country, when the loan rate is reviewed periodically (about once a quarter) depending on changes in the price level.

The third mechanism - lending with adjustable deferred payments - was developed by one of the institutions of the US economy specifically for use in Russian conditions. Its essence is that the borrower must pay no more than 30 percent of income on the principal debt or loan. The initial payout is relatively low and increases over time. This allows you to postpone the payment of the main part of the debt to a later date. The principle of this mechanism is that two interest rates are calculated, one of which is called “contract” and is used to calculate the amount of debt, and the second is “payment”, to calculate monthly payments. These rates are not equal.

The Law of the Russian Federation “On Pledge” establishes a general principle regarding the registration of mortgages. It must be registered with the same government agency that is responsible for registering the rights to mortgaged property. From this principle follows the assumption that mortgages on residential premises should be registered by departments of housing privatization.

“Mortgage” agreements relating to buildings and structures located on land must be registered in the “land list” of the territory in which the property is located, which can also currently be interpreted as registration by local land committees, although at the time the law entered into force it could mean local councils.

The mechanism for the sale of pledged property is established by the legislator as a common one for both immovable and movable property.

By virtue of Art. 350 of the Civil Code of the Russian Federation, the sale (sale) of the pledged property, which is foreclosed in accordance with the law, is carried out by sale at a public auction in the manner prescribed by the procedural legislation, unless a different procedure is established by law.

The requirement to sell the pledged property through a public auction is imperative, and if one follows the concept of the pledge rules, then it cannot be circumvented. But if the pledgee still wants to acquire the property that is the subject of pledge, into ownership without a public auction procedure and it is supported by the pledger, then this can be done in accordance with Art. 409 of the Civil Code of the Russian Federation. The article allows for the conclusion of a compensation agreement between the parties, where the creditor states the obligations of the debtor as terminated, and the latter, in return for fulfilling his obligation, provides compensation, that is, in our case, the pledgor transfers real estate to the pledgee.

II Analytical part

2.1 Modern principles of real estate market analysis.

The success of a business in a market economy is largely determined by the quality of information on the basis of which responsible financial decisions are made. That is why the collection and analytical processing of information, including market information, is today both the subject of a separate study from a scientific and methodological point of view, and the subject of an independent business.

The most illustrative illustration of the above is the example of information support for doing business in the stock market. Scientific theories and schools that have been repeatedly awarded Nobel Prizes have been created and continue to improve, many works on technical and fundamental analysis have been written, which have become handbooks for stock market specialists. The worldwide practice of deep testing the knowledge of analysts for their admission to work with information on the securities market is considered normal. And this is despite the fact that in the stock market, in comparison with other markets, the regularities of a perfect market in terms of the awareness of participants should be most clearly identified.

The real estate market, unlike the stock market, is more than far from perfect in many respects, which determines the features of its study. On the one hand, analysts are faced with difficulties, and sometimes the impossibility of correct and unambiguous formalization of economic relationships in the real estate market. On the other hand, it is obvious that there is no prospect of transferring analysis technologies used in other markets to the real estate market in their pure form, since these technologies are adapted for use in a different market environment. In view of the foregoing, high-quality analytical work in the real estate market seems to be a highly complex subject that requires the analyst, in addition to deep theoretical knowledge of real estate economics, constant practice and creative search in research that forms professional intuition.

Studying almost a century of history of the functioning of real estate markets in the developed countries of the world, one can come to the conclusion that insufficient attention paid to the quality of analytical work is one of the main causes of most major crises in the real estate markets. A typical example is the crisis in the US real estate market in the late 80s and early 90s. According to experts, excessive and indiscriminate investment in new construction has led to a glut of the market and, accordingly, lack of market demand for a large number of projects for which loans were issued. This situation was based on unrealistic market expectations stemming from the wrong structure of incentives in the analysis, weak analysis methodology and incomplete data characterizing the current conditions. The structure of incentives that guided developers, appraisers and credit organizations was deformed by the interest of some to receive loans, others to justify obtaining a loan, and still others to allocate their funds. At the same time, all parties solved their problems at the expense of unjustifiably optimistic expectations.

The use of weak analysis methodology, expressed in inadequate assumptions and procedures, in interaction with insufficiently high-quality data from local markets, as a rule, resulted in unsound market research and, accordingly, investment decisions based on them. As a result of the crisis, credit institutions have developed a stable syndrome of distrust in general to any projects and market research in particular. And this, in turn, led to the understanding that real estate market analysts in their work should be guided by some general principles that are necessary (but not sufficient) to obtain accurate conclusions and results. On the other hand, there is an urgent need for understandable and easily identifiable criteria that determine the compliance of market research with the category of validity.

Considering the prospects for the development of the real estate market in Russia, we can assume that the absence of potential crises is an overly optimistic scenario. However, the consequences of such crises may be less significant if already today, at the stage of active market development, some general principles and principles are formulated and implemented in everyday practice.

requirements for analytical studies, on the basis of which investment decisions will be made.

Not only the threat of crises, but also current daily problems - increasing competition, reduced opportunities for short-term super-profits, the start of long-term and capital-intensive commercial real estate development projects, the entry of foreign investors into the market with high requirements for justifying decisions, etc. - objectively testify to the fact that the importance of qualitative analysis in the real estate markets of Russia will become increasingly important in the near future.

2.2 Research of the real estate market for the purpose of substantiating investment decisions.

The ultimate goal of any study of the type under consideration is to measure the ratio of supply and demand for a specific type of product in the real estate market at a specific (usually future) point in time.

The special characteristics of real estate as a commodity, along with the special place of real estate in a market economy, form a fairly wide range of socio-economic information necessary for positioning this product on the market. Current and retrospective macroeconomic characteristics of the national and regional economy, socio-demographic indicators of the regional and local markets, parameters of the regional and local real estate markets - these are just the general areas in which it is necessary to conduct research.

Principle 1. Only information that can really determine the future productivity of the investee should be selected for analysis.

When following this principle, the main difficulty for the analyst is the lack of standard rules or unambiguous recommendations on which to form the initial information. It is here that the analyst must show all his knowledge, professional intuition, creativity and practical experience. Moreover, it is here that the basis for the consistency of the study as a whole is laid.

Principle 2: All current and prospective data on which the study is based should be used to quantify the performance of the real estate investment project under consideration.

However, even carefully selected information that is directly related to the subject of assessment is, figuratively speaking, a “bunch of bricks” from which the analyst must lay down a solid foundation for analytical research in accordance with all the rules of building art. And here you can not do without a strong solution that connects the individual elements into a single monolith.

Principle 3. All individual blocks of information selected to justify an investment decision should be interconnected by a clear logical scheme, culminating in a forecast of future market conditions and the corresponding productivity of the project under consideration. The description of the logic circuit must be presented explicitly.

A positive perception by the customer of a report with the results of a market research, in which there is no logical scheme, can only be if:

a) the analyst takes advantage of the client's ignorance, or

b) the customer is initially favorable to the results.

On the other hand, the construction of a convincing and obvious logical scheme is a demonstration of the highest professional skill of the analyst.

Continuing the reasoning about the need to build a logical scheme of research, let's consider another principle that specifies the content of market analysis.

Principle 4. The content of the market analysis should be reduced to a discussion of the factors that make up the main ratios for determining the performance of a commercial property.

In accordance with this principle, the analyst in the course of the study must formulate the main relationships that determine the performance of the commercial facility, and then identify the hierarchy of parameters-arguments, the functions of which are the factors included in the main expression for performance.

Let us illustrate a practical approach to the implementation of this principle using the following simplified example.

Let the criterion for the performance of the project under consideration be the net operating income (NOI) in a specific period of the future. Then, by definition, the main expression for determining performance will have the following form:

NOI=PGI-V&L+M-FE-VE where

PGI - potential gross income,

V&L - losses from underutilization and defaults.

M I - other income.

FE - fixed operating expenses,

VE - variable operating expenses.

Consider the procedure for identifying the parameters that determine the expected values of the main factors.

Potential gross income is determined by the value of the rental rate, which in turn is a function of the current rental rate, as well as trends in the ratio of market supply and demand over time.

The projected occupancy of a property is a function of the cumulative market capacity, demand parameters, market absorption rate, and the growth of the real estate absorption area. For projects, the projected load determines two indicators - the level of load and the time schedule for absorption by the market to this level.

The growth of the real estate absorption area is determined either by the growth in the number of jobs (employment rate) or by the growth of the population. In turn, the expansion of the absorption area leads to the need for new real estate.

It should be noted that the growth of employment and population growth in one case can be directly related, for example, when new jobs are opened and the influx of new able-bodied people. In another case, population growth can grow without an increase in employment, for example, due to an increase in incoming pensioners or an increase in the birth rate. Qualitative analysis involves the use of several sources of information that provide historical trends and range growth projections, followed by data comparison. Segmentation of range growth is also mandatory, eg by age group, sex, family size, etc. The absence of these positions in the study should be attributed to the inconsistent choice of data for use in the analysis.

Demand parameters are determined by such specific indicators as the area (office or production) per workplace, spending on purchases per capita, the number of apartments or houses per capita, etc. With the help of demand parameters, the amount of required real estate is calculated, which corresponds to the growth in the area of real estate consumption. For example, by applying average spending per purchase to population growth, retail sales are predicted to increase, and thus the need for additional retail space. When analyzing the housing market, population growth segmented by age, income, size or family composition is converted into segmented demand. A sound analysis of demand parameters involves the study of historical trends, the current state and forecasting their likely value in the future. Moreover, a consistent analysis measures the change in demand not only due to new range gains, but also due to changes in the existing population and employment structure. For example, during economic upswings, growing companies require large areas, and changes in the demographic situation towards an increase in people of retirement age will require an appropriate type of housing.

The signs of the inconsistency of the analysis of demand parameters should include, first of all, taking into account constant values, which, as a rule, are characteristic of the moment of analysis, as well as ignoring changes in existing population and employment structures.

The absorption rate, also referred to as the market penetration rate, is the share of total market demand that the project under consideration is expected to absorb in competition with other projects. After the analyst has estimated the total increase in potential demand, it is necessary to determine the critical parameter for the project - the share of total demand that the project in question can probably claim.

Theoretically, the absorption coefficient is a complex function of many factors. In the first approximation, it can be defined as the ratio of the area of the object being evaluated to the total area (including the area of the object) of the competitive offer at the time of its introduction to the market. Such an approach, at a minimum, should be present in every market research that claims to be valid.

It should be noted that when determining the absorption coefficient, the most important conditions are the detailed segmentation of demand and competitive supply. At the same time, one should not lose sight of the duration of competing projects started in the implementation, the volume and duration of projects being prepared for implementation. The first sign of a failed study here is the use of any "average" data.

Losses due to market-wide discounts and incentives to renters are also a factor that should not be overlooked when forecasting potential gross income.

Other revenues, while typically a small part of revenue, still need to be projected to reflect the likely preferences of potential consumers in light of their perceptions of lifestyle, level of service, and per capita spending to reach that level, etc. .d.

Fixed and variable costs are traditionally considered more certain in forecasting. However, such a formulation of the question for the conditions of Russia is only partially valid. For example, taxes on real estate (today these are property taxes, taxes on land) and rent for land, due to legislative unsettledness, can present unexpected “surprises” to a potential investor in the future. Therefore, a consistent market research should include variant forecasting of these positions.

A similar situation is observed with most of the variable costs. An analysis of the public utilities market, most of which are provided by natural monopolies, an unstable tariff policy, requires a quantitative justification of the indicators taken into account. At the same time, it is important to use market information on the expenditure of resources obtained on the basis of indications of control and measuring equipment. In the absence of market analogues in terms of resource consumption, it is more preferable to calculate them according to standards, rather than using invoices issued by utility resource providers.

2.3 Methods for assessing the market value of real estate.

There are three main methods for assessing the market value of real estate:

1. comparison method

2. cost method

3. income capitalization method.

The main valuation method is the method of comparative sales analysis (SAP). This method is applicable when there is a market for land and real estate, there are real sales, when it is the market that forms prices, and the task of appraisers is to analyze this market, compare similar sales and thus obtain the value of the property being valued. The method is based on a comparison of the object offered for sale with market analogues. It finds the greatest use in the West (90 percent of cases). However, this work requires an already established market for land and real estate.

The sales comparison method is used if there is sufficient reliable market information on purchase and sale transactions of objects similar to the one being valued. In this case, the criterion for choosing objects of comparison is the similar best and most efficient use.

The SAP method can also be referred to as the direct sales comparison approach, the sales comparison method, or the market information market method.

The sequence of application of the SAP method is as follows:

1. Recent sales of comparable properties in the relevant market are highlighted. Sources of information are: the appraiser's own dossier, the Internet, an electronic database, real estate firms, real estate brokers' dossiers, archives of credit institutions (mortgage banks), insurance companies, construction and investment companies, territorial departments for insolvency and bankruptcy, territorial departments of the State Property Committee, etc. .

An important point when using the SAP method is the coordination of the results of the comparison of the property being valued. Arithmetic averaging of received data is not allowed. The accepted procedure is to study each result and make a judgment about the extent of its comparability with the property being valued. The smaller the number and magnitude of the amendments to be made, the more weight this sale has in the process of finalizing the approval.

As units of comparison, meters are taken that are traditionally established in the local market. To evaluate the same object, several units of comparison can be applied simultaneously.

The elements of comparison include the characteristics of real estate and transactions that cause changes in real estate prices. Items that must be accounted for include:

the composition of the transferred property rights;

conditions for financing the purchase and sale transaction;

· terms of sale;

time of sale

· location;

· physical characteristics;

economic characteristics;

the nature of the use;

non-property components of value.

2. Verification of information about transactions: confirmation of the transaction by one of the main participants (buyer or seller) or an agent of a real estate company; identifying the terms of the sale.

If there is a sufficient amount of reliable market information, it is allowed to use methods of mathematical statistics to determine the value by comparing sales.

3. Adjustment of the value of comparable properties.

Adjustment can be made in three main forms: in terms of money, percentage, general grouping.

Sales price adjustments for comparable properties are made in the following order:

· First of all, adjustments are made related to the terms of the transaction and the state of the market, which are carried out by applying each subsequent adjustment to the previous result;

· Secondarily, adjustments relating directly to the property are made by applying those adjustments to the result obtained after adjusting for market conditions, in any order.

To determine the amount of adjustments, depending on the availability and reliability of market information, quantitative and qualitative methods are used. Justification of the adjustments taken into account is mandatory. The final decision on the value of the result determined by the sales comparison method is made on the basis of an analysis of the adjusted sales prices of the objects of comparison that are most similar to the object of assessment.

The cost method is practically not applicable to land. It can be used only in exceptional cases of valuation of the land inseparably from the improvements made on it. It is believed that land is permanent and not expendable, and the cost method is used to evaluate man-made objects. When assessed by this method, the value of land is added to the cost of improvements (buildings, structures), and the land is valued separately by other methods.

The cost method of real estate valuation is implemented in the following sequence:

Determining the value of a piece of land;

determination of the replacement or replacement cost of buildings and structures;

Determining the amount of accumulated wear and tear of buildings and structures;

· Determining the market value of real estate using the cost method, as the sum of the value of a plot of land and the replacement or replacement value of buildings and structures minus accumulated depreciation.

The choice of the method adopted for the calculation of the cost of new construction of improvements should be appropriately justified. The use of replacement cost is appropriate in cases where it is difficult to determine the cost of erecting an exact copy of the building due to outdated types of building structures and construction methods used to create the subject property.

Costs corresponding to replacement or replacement value for real estate valuation purposes are calculated as the sum of direct costs, indirect costs and profits of the entrepreneur.

Direct costs include the following costs directly related to construction:

cost of materials, products and equipment;

wages of construction workers;

cost of construction machines and mechanisms;

· the cost of temporary buildings and structures, safety measures, transport and storage costs and other costs that are normatively accepted in the local market;

profit and overhead costs of the contractor.

Indirect costs include costs associated with the construction of a building, but not included in the cost of construction and installation works.

cost of design, technical supervision, geodetic control;

payment for consultations, legal, accounting and auditing services;

the cost of construction financing;

administrative and other expenses of the developer.

The amount of indirect costs is determined taking into account the tariffs prevailing in the market for works and services for these positions.

The profit of the entrepreneur is the prevailing market norm that encourages the entrepreneur to invest in a construction project. The amount of profit is determined by the method of expert assessments based on market information.

The use of the cost method is necessary when analyzing new construction; reconstruction of buildings; assessment for tax purposes; to identify excess income in real estate valuation; when assessed for insurance purposes; assessment of the consequences of natural disasters; assessment of special buildings and structures.

Under the conditions of transition to market conditions, the cost method is decisive in the assessment, since the application of other methods requires extensive market information, which is not available due to an undeveloped market. However, it should always be remembered that construction costs are only the basis of market value and most often they are either more or less than it.

For example, the market value of a luxury hotel located in an unfortunate location (on the outskirts of the city) will be less than the value determined by the cost method. In turn, the market value of the gas station complex at a certain stage may be more than the construction costs.

In the conditions of the market formation, when there is a reorientation of production to new technologies, it may seem that the property has no value at all. For example, if an enterprise produces products that no one needs and its production areas cannot be reconstructed for new production, then the market value of such real estate tends to zero. The use of the costly method in this case will lead to the wrong orientation of potential buyers.

At present, in Russia, this moment is often taken into account in the case of incorrect valuation of fixed assets of enterprises, since their revaluation is carried out mainly according to the cost method, and the appraiser should remember that the book value of fixed assets of enterprises does not correspond to their market value.

The next valuation method, which is applicable specifically for Russia, is the valuation method based on the analysis of the most efficient use of real estate, and this analysis is associated with determining the type of use that will bring the owner the maximum income, i.e. income capitalization method.

The method of capitalization of income in assessing the market value of real estate is implemented in the following sequence:

forecasting future income;

capitalization of future income.

The future income generated by the property is divided into two types: income from operating (operational) activities as a result of commercial rental relationships and income from reversion.

Income from operating (operational) activities is forecasted by drawing up a reconstructed (hypothetical) income statement. Reversion income is projected:

direct appointment of the absolute value of the reversion;

Appointment of a relative change in the value of real estate for the period of ownership;

· using the terminal capitalization coefficient.

Capitalization of future income into present value can be performed:

the method of direct capitalization;

The method of capitalization according to the rate of return.

The initial premise of the direct capitalization method is the constancy and infinity of capitalized income. In the direct capitalization method, the present value of a future stream of income is defined as the ratio of the annual income attributable to an ownership or interest to the capitalization ratio for that ownership or interest.

To calculate the value of full ownership, the determination of the total capitalization ratio is made on the basis of market data. Depending on the availability of initial information, apply:

Comparative sales analysis

calculation using the debt coverage ratio;

equipment of the investment group.

The initial premise of the method of capitalization according to the rate of return is the limited period of receipt of income. In the rate of return capitalization method, the conversion of a finite number of future cash flows into present value is performed at a specific value of the rate of return corresponding to the risk of investing in this type of real estate.

When calculating the present value without taking into account the terms of financing, the capitalization method according to the rate of return is formalized either in the form of an analysis of discounted cash flows, or in the form of capitalization calculation models.

The discount rate used in the analysis of discounted cash flows and taking into account both systematic and non-systematic risks is determined by:

The method of selection from market data on sales of similar objects;

Method of alternative investments in the financial market;

Real estate market monitoring method.

Recently, the demand for the services of appraisers and their professional training in Russia has begun to grow rapidly. This is also due to recent events in the financial sector, when attempts to create a mechanism for lending through credit insurance failed: banks lost a lot on fake insurance. In the case of real estate, which is taken as collateral by the bank when issuing a loan, losses are almost impossible. Thus, real estate and capital markets become inseparable components of the economy as a whole.

Naturally, banks showed great interest in such operations. And all of them need a qualified real estate appraisal, carrying out insurance at the real value of real estate.

Evaluation is also necessary within the framework of regional tax policy. All over the world, the basis of the local taxation system is the property tax, due to this tax, about 70 percent of the local budget is formed. Of course, with the development of the market itself, with the appearance of real values, it is possible to switch to a taxation system that would stimulate the development of the real estate market and at the same time ensure replenishment

local budgets. This also explains the unconditional interest in the assessment shown by local administrations.

The cost of professional appraisal services varies greatly depending on the types of objects being appraised, the complexity of the work and, of course, on which specialists are involved in the appraisal. Typically, the cost of services is measured either in hours multiplied by the hourly rate, or depends on the size of the object, but is never tied to its cost.

2.4 Features of various types of assessment.

Valuation for the purposes of buying or selling and classifying real estate.

When valuing real estate to be bought or sold on the open market, market value or realizable value is used as the basis of valuation for all classes and categories of real estate. At the same time, for specialized real estate, in most cases, the cost method based on market data will be the determining method for calculating the cost.

When valuing real estate for sale during a limited period of time, when real estate is put up for sale on the open market in a timeframe that is significantly less than the adequate marketing period for this type of property, the limited realizable value is used as the basis for valuation for all classes and categories of real estate.

The purpose of the valuation work and the characteristics of the property being valued are of decisive importance for the selection of an appropriate valuation basis.

In general, the classification of the main purposes for which real estate is assessed is as follows:

1. Valuation for buying or selling;

2. Valuation for sale within a limited period of time;

3. Valuation of land and buildings for their use as secured loan obligations;

4. Evaluation for the preparation of accounting and financial statements;

5. Evaluation for inclusion in the prospectuses of the Funds, exchanges;

6. Evaluation to resolve issues in the merger and acquisition of the company;

7. Valuation for pension funds, insurance companies, real estate trust funds.

In practice, there may be other purposes of valuation, and their wording and, accordingly, possible bases of valuation should be agreed between the client and the appraiser.

After clarifying the purpose of the valuation, it should be established to which class and category the property being valued belongs.

For evaluation purposes, two classes of property are distinguished:

· Specialized

Non-specialized

Specialized property is one that, by virtue of its special nature, is rarely, if ever, sold on the open market to continue its existing use by a single owner, unless it is sold as part of the using business.

Examples of specialized property are:

1. Museums, libraries and other similar premises that belong to the public sector;

2. Hospitals, specialized medical facilities, and leisure centers that are not in competitive market demand from other entities wishing to use these types of properties in the area;

3. Schools, colleges, universities and research institutes for which there is no competitive market demand from other organizations;

4. Standard property in special geographical areas and in places remote from the main centers of business located there for the purpose of production or business.

Non-specialized property is all types of property except that which falls under the definition of specialized property. In other words, it is one for which there is a general demand, with or without possible modernization, and which is usually bought, sold or rented on the open market in order to be used for existing or similar purposes, either as an unoccupied property for single ownership, or (regardless of whether she is employed or free) as an investment or for development.

When valuing real estate occupied by the owner for use in the activities of an enterprise (business), the following is used as the basis of valuation:

· market value at existing use - for non-specialized real estate, including real estate valued on the basis of its commercial potential.

· Residual replacement value - for specialized real estate.

Non-specialized and specialized property, in turn, are classified into categories depending on the purpose of ownership. A similar classification principle is used both for evaluation purposes and for other purposes.

2.5 Influence of environmental factors on cost.

Environmental factors, both unfavorable and favorable, are included in the set of factors commonly considered in assessments. Certain factors affect a particular type of property and will directly affect the appraiser's calculations, where they must be taken into account in relation to market data obtained from comparable and unaffected properties. In other cases, all real estate in any region will be affected by these factors.

Relevant environmental and pollution factors generally include the following categories:

natural factors such as radon or methane, air pollution or noise;

· technogenic pollution factors as a result of production activities in the past or present on the given land, or as a result of ingress from neighboring sites;

pollution factors in the form of electromagnetic and other fields;

pollution factors when using materials from recycled materials.

All classes of real estate are susceptible to the effects of environmental factors on value, but real estate offered for sale or as collateral for loans is particularly sensitive to these factors.

Works on the environmental audit of real estate are not included in the real estate valuation work. In cases where the appraiser has reason to believe that environmental factors may significantly affect the value, he should inform the client about the need to engage a professional environmental expert.

The appraiser should inform the environmental expert of the context of his study, including the current and potential future use of the site, which will be expressed in terms of value based on best and most efficient use. In general, the environmental expert should answer the following questions:

Whether the source of pollution or hazard can be successfully and economically removed;

· if the pollution or hazard cannot be completely eliminated, can it be isolated or sealed off to make the property fit for that use for a certain, even limited, period;

• whether it is possible to mitigate the impacts of the pollution or hazard in any way;

· what is the most effective means of pollution control and means of its regulation;

In cases where it is possible to eliminate the source or eliminate the consequences of pollution, the assessment can be made taking into account the corresponding estimated costs of such liquidation or elimination.

III Practical part.

3.1 Practical application of the method of comparative sales.

At the end of 2000, cottage construction began in the Podolsk region. Low-rise residential complexes - rows of semi-detached cottages that have common walls with the same type of neighboring houses. The word "condominium", denoting property created and equipped by the labors of like-minded neighbors, is not very popular. Therefore, to designate dwellings that are exotic for us, built on the principle of “common walls and roof - your own yard”, the English word “town house” has taken root in Russian everyday life.

Yet, for example, the market value of the cottage using the method of comparative sales.

The total area is 120 sq.m., the cottage has 6 rooms, 3 bedrooms, a bathroom, a shower room, a finished basement. There is no garage as of the valuation date. Plot area - 1000 sq.m.

For the analysis, we will use data on five sales of comparable properties in the same area.

Table number 1.

| Object №1 | Object №2 | Object №3 | Object №4 | Object №5 | |||

| Selling price | 65000 | 78000 | 56000 | 70000 | 54000 | ||

| Ownership | complete | complete | complete | complete | complete | ||

| Conditions fi- funding | non-market, the price is overpriced by 3000 | non-market, the price is overpriced by 8000 | market | market | market | ||

| Terms of sale | market | market | market | market | market | ||

| Market conditions (time) | 2 weeks | 6 weeks | 1 year | 1 year | 1 year | ||

| House area | 120 sq.m. | 145 sq.m. | 120 sq.m. | 145 sq.m. | 120 sq.m. | ||

| Land area | 10000 sq.m | 12000 sq.m | 10000 sq.m | 12000 sq.m | 10000 sq.m | ||

| Number of rooms | 6 | 7 | 6 | 7 | 6 | ||

| Number of bedrooms | 3 | 3 | 3 | 3 | 3 | ||

| Bath | 1 | 1 | 1 | 1 | 1 | ||

| Shower | 1 | 1 | 1 | 1 | 1 | ||

| Basement | not finished | not finished | not finished | not finished | finished | ||

| Garage | There is | There is | There is | There is | No | ||

As can be seen from the initial data, the objects of comparison differ from those being assessed in terms of financing, time of sale and physical characteristics.

The amount of adjustment for financing conditions is determined by comparing the sale price of objects with market and non-market financing. In this case, loan payments are discounted at the market% rate. In our example, the adjustment values are defined as 3000 for object No. 1 and 8000 for object No. 2.

Since all comparable properties have market terms of sale, no adjustment for terms of sale is required.

To adjust for market conditions (time of sale), it is necessary to select objects that differ only in this element. In our case, object No. 1 and No. 3 differ only in the terms of financing and the time of sale. Adjusting the selling price

object No. 1 on the terms of financing, you can determine the adjustment for the time of sale:

(62000 - 56000) / 156000 = 0.1.i.e. market prices will rise by 10% per year.

Thus, all comparable properties are brought into the same conditions for financing and sale time, which creates a single base for making adjustments for the remaining elements of comparison.

In a number of objects of comparison, differences in size are represented by a different number of rooms and different areas of the house and plot. Moreover, a plot of 12000 sq.m. corresponds to a house with an area of 145 sq.m. with 7 rooms and a plot of 10000sq.m. corresponds to a house with an area of 120 sq.m. with 6 rooms. Hence, the size adjustment from the comparison of objects No. 1 and No. 2 has the following form:

70000 – 62000 = 8000.

The adjustment for the presence of a garage is derived from a comparison of objects No. 3 and No. 5:

61600 – 59400 = 2200.

The adjustment for the completed basement is determined from a comparison of objects No. 2 and No. 4:

77000 – 70000 = 7000.

The results of the adjustments made are shown in Table No. 2

Table number 2.

| Object №1 | Object №2 | Object №3 | Object №4 | Object №5 | |

| Selling price | 65000 | 78000 | 56000 | 70000 | 54000 |

| Transfer of ownership veins | complete | complete | complete | complete | complete |

| Legal correction. | 65000 | 78000 | 56000 | 70000 | 54000 |

| Financing conditions. | not market | not market | not market | not market | market |

| Adjustment for the terms of the financers. | - 3000 | - 8000 | 0 | 0 | 0 |

| Adjusted Price | 62000 | 70000 | 56000 | 70000 | 54000 |

| Terms of a transaction | commercial | commercial | commercial | commercial | commercial |

| Adjustment on the terms of the deal | 0 | 0 | 0 | 0 | 0 |

| Market Adjusted Price | 2 weeks | 6 weeks | 1 year | 1 year | 1 year |

| Market Adjustment | +10 % | +10 % | +10 % | +10 % | +10 % |

| Adjusted price | 62000 | 70000 | 61600 | 77000 | 59400 |

| Location | similar | similar | similar | similar | similar |

| Size | 120sq.m. | 145sq.m. | 120sq.m. | 145sq.m. | 120sq.m. |

| Size adjustment | 0 | - 8000 | 0 | - 8000 | 0 |

| Garage | There is | There is | There is | There is | No |

| Correction for the presence of a garage | - 2200 | - 2200 | - 2200 | - 2200 | 0 |

| Completed basement | No | No | No | Yes | No |

| Basement adjustment | + 7000 | + 7000 | + 7000 | 0 | + 7000 |

| Adjusted price | 66800 | 66800 | 66400 | 66800 | 66400 |

| Total net correction | 1800 | 11200 | 10400 | 3200 | 12400 |

| Same in % | 3 | 14 | 19 | 5 | 23 |

| From the sale price, the total gross correction | 11200 | 25200 | 14800 | 17200 | 12400 |

| From sale price | 19 | 32 | 26 | 25 | 23 |

For each object of comparison, an adjusted price was obtained. In accordance with the conditions of the problem, it is required, based on the data of adjusted sales prices, to derive the value of the market value.

The justification for deriving a single indicator of market value is to give each member of a series of adjusted sales prices a weighting factor, taking into account the degree of difference between the objects of comparison and the objects of assessment. At the same time, it should be taken into

attention to the range of sales price dispersion, the total % of adjustments taken in absolute terms, the total % of adjustments, defined as the difference between positive and negative adjustments, and any other data.

In this example, we have an almost very narrow range of sales prices - from 66400 to 66800. However, the sale price with smaller adjustments is assigned a larger share - for object No. 5, the number of adjustments = 2. In addition, the sum of the total gross adjustment for object No. 5 is also almost the smallest. Therefore, the sale price of object No. 5 - 66400 was taken as the market value of the object of comparison.

3.2 Investment risks and real estate market statistics.

Real estate market statistics usually contain information on rental rates and profitability. For data comparability, the information refers only to first-class objects. It is believed that such facilities meet the highest requirements for location, equipment, communications, planning solutions, etc., and rental rates are determined in the same standards for measuring and distributing costs between the owner and the tenant for maintenance, repairs, insurance, etc. .

Information on rental rates is considered available. For its unification, only verification of the mentioned adequacy is required. Information about profitability indicators is more difficult to prepare. Since there are not so many purchase and sale transactions, they take into account previously completed transactions, integrate data on various objects, take into account time gaps, inflation and other processes. Profitability indicators also carry information about regional risks, and the expert principle prevails here. Therefore, statistics is one of the specializations in the real estate markets.

The activation of business and investment in the region is necessarily accompanied by activation in the office market, an increase in demand, occupancy and rental rates. At the same time, new construction and modernization of offices is stimulated, followed by service departments, shopping malls, leisure centers, etc. Such processes are now characteristic of the largest business centers: the traditional financial capitals of America and the Old World, the rapidly growing capitals of Southeast Asia, China and India. An analysis of rental business statistics points to a number of interesting phenomena. For example:

Data on rental rates are significantly more dynamic than data on yields; the dynamics of rental rates is characterized by a certain fluctuation, reflecting (albeit with shifts) the general processes of ups and downs; changes in indicators of office and retail real estate may not coincide in time and magnitude; improvements in the market situation are reflected in the growth of rental rates and, less often, in the decline in profitability indicators (due to their noticeably less dynamic); an asymmetric picture also takes place when the market situation worsens;

The values of profitability indicators are better (lower), the more reliable and stable the regional economy, and the social situation. The leaders of the stable rental business are London, Paris and Frankfurt, where the area of change in profitability is in the area of 5-6%;

Changes in indicators for Eastern European capitals are less dynamic; this can be explained both by smaller volumes of markets, fewer transactions, and, apparently, by less interest of Western experts and business circles in these markets; profitability indicators for Eastern European capitals are stable - 2-3 times higher than those for Western capitals. And in the period after the August 1998 crisis, the profitability indicators in Moscow were 4 or more times worse. And this was not only due to a real fall in the value of real estate, but rather as a result of an expert assessment of the state of instability and increased business risks in the region;

Additional analytical information is proposed to be obtained using the calculated indicator of the specific capitalized value (UCS) - as an estimate of the cost of some average unit of the commercial area of the leased object.

Such an assessment, along with a prompt response to fluctuations in rental rates, carries expert opinions about the success and risks of a business.

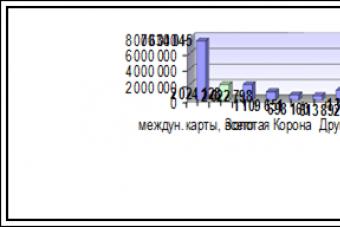

Initial information - rent statistics for European cities - can be found in Western publications (for example, in the monthly "EuroProperty"). We will choose as representative objects: Frankfurt, London and Paris - the centers of the most stable business, St. Petersburg, Prague and Warsaw - the centers of the transitional economy with the most risky (in Europe) indicators of the rental business.

Rental office business.

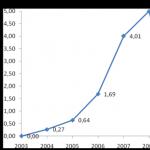

The observation period 01.99-08.00 for the Western capitals showed in general the progress of the rental office business. We note the absolute stability of the yield for London (5.00-5.50%) and the improvement in the yield for Frankfurt (from 5.75 to 4.90-5.50%) and Paris (from 6.25-6.75 to 5.50-6.00%). For the Eastern European capitals, the same period is characterized by a deterioration in performance. An analysis of the calculated data of the UKS allowed, in addition, to bring into line the external discrepancy in the logic of rental rates (their excess in St. Petersburg and Warsaw until mid-1999 over the rates in Paris and Frankfurt). As a result, the low rates of UKS at high rental rates do not yet allow optimistic expectations of investment growth.

Rental business.

The observation period 05.99-08.00 for the western capitals is characterized by a general deterioration in indicators (which is clearly seen with the help of the UKS). This suggests that there may be sufficiently long periods of market activity, after which the sale of acquired retail space will not bring real income at all.

For Eastern European capitals, the observation period of 05.99-08.00 is associated with the passage of a period of long-term stagnation and, possibly, the beginning of an exit from it (an improvement in the dynamics of indicators was noted, although the gap in the indicators of the UKS in comparison with Western capitals seems to be gigantic - almost an order of magnitude). Therefore, for the time being, we should limit ourselves to the statement that there may be quite long periods in the retail space markets when investments in the acquisition of retail real estate in Eastern European capitals can bring a noticeable positive effect, including during periods of recession in Western markets. This can serve as a good argument when looking for ways to "inter-regional" diversification of the real estate portfolio.

Conclusion.

Completion of the period of formation of the real estate market is characterized by a transition from extensive to intensive development. It is obvious that in the near future the market will not see such a rapid growth in the number of transactions as in the first half of the 1990s. Moreover, during a certain period, the housing market can only stabilize the number of transactions. It is also quite possible to increase the level of prices, especially in the secondary market. But at the same time, prices for elite housing not only did not decrease, but even increased, which indicates the prospects for new high-quality housing construction. The heads of firms also note the aggravation of competition in the market. Most of them are inclined to believe that if 1995 was characterized by a moderate degree of competition, then in 2001 it became high and will remain so.