Keywords

DEPOSIT POLICY/ DEPOSIT POLICY / RATING SYSTEM/ESTIMATE RATING SYSTEM/ COEFFICIENT ANALYSIS/ RATIO ANALYSIS / FINANCIAL INDICATORS/FINANCIAL INDICATORS/ POINT-WEIGHT ASSESSMENT METHOD / POINT RATING AND WEIGHTS EVALUATION METHODannotation scientific article on economics and business, author of scientific work - Mitrokhin V.V., Gribanov A.V., Vilkova M.V.

Item. One of the pressing problems in the field of banking analysis is the lack of effective tools to assess the effectiveness of deposit policy credit organizations. The methods used are focused on the analysis of the economic situation of banking institutions, which does not make it possible to evaluate the effectiveness of measures taken within the framework of certain areas of banking activity, including deposit policy credit organizations. Goals. Development of an assessment methodology deposit policy commercial bank, analysis of existing methods, justification taking into account the identified limitations of the author's approach; approbation of the author's methodology on the example of a credit institution. Methodology. A systematic approach, analysis and synthesis, comparison and comparison method, as well as economic and statistical methods are used. Results. A methodology for assessing deposit policy jar. Application area. When evaluating deposit policy banking institutions. Conclusions. Grade deposit policy is one of the key tasks in the activities of a credit institution. Current methods either do not allow evaluating the effectiveness deposit policy bank segregated from a comprehensive assessment of the effectiveness of its activities as a whole, or focused on certain key aspects of this process. The authors proposed a methodology for evaluating the effectiveness of deposit policy, built on the analysis of three groups of indicators and allowing to study the latter in the context of its impact on the stability of a credit institution.

Related Topics scientific papers on economics and business, author of scientific work - Mitrokhin V.V., Gribanov A.V., Vilkova M.V.

-

Accounting and analytical support of the bank's business processes: deposit operations

2017 / Baeva Elena Alexandrovna, Cheremisina Natalia Valentinovna -

Features of assessing the investment potential of a commercial bank

2018 / Chugunov Victor Ivanovich, Loginov Dmitry Valerievich - 2016 / Litvinova A.V., Parfenova M.V., Litvinov E.O.

-

Clustering of regions of the Russian Federation by the level of deposit risk

2018 / Lunyakova Natalya Avtandilovna, Lavrushin Oleg Ivanovich, Lunyakov Oleg Vladimirovich -

Improving the deposit policy on the example of VTB24 bank (PJSC)

2017 / Kharlamova E.S. -

Methodology for constructing a deposit matrix of a commercial bank

2014 / Balabanova Natalya Vladimirovna, Valinurova Anna Aleksandrovna, Goryunova Yulia Leonidovna -

A comprehensive methodology for building a balanced interest rate policy of a commercial bank in the field of credit relations

2014 / Smulov A.M., Abdyukova E.I. -

Analysis of financial results of credit institutions in the Republic of Mordovia

2015 / Kolesnik N.F., Golovanova V.S. -

The influence of deposit policy on the financial stability of a commercial bank

2016 / Zhilan Oksana Dmitrievna, Danilova Maria Romanovna -

Formation of a deposit policy by a commercial bank

2019 / K. O. Kotlyarov

A methodology for assessing the efficiency of the commercial bank""s deposit policy

Importance This paper concentrates on the issues of deposit policy of credit institutions including organization and management of deposit processes. Objectives The paper aims to develop a methodology for deposit policy assessment of a commercial bank. Methods As the methodological base of the study, we used the systems approach, method of comparison, and economic and statistical methods. Results The paper presents a newly developed technique of assessment of the commercial bank's deposit policy . Conclusions and Relevance The proposed methodology for evaluating the effectiveness of the bank's deposit policy is based on three sets of indicators and allows it to be explored in the context of the impact on the sustainability of the credit organization. The results presented can be used to evaluate the deposit policy of banking institutions.

The text of the scientific work on the topic "Methodology for assessing the effectiveness of the deposit policy of a commercial bank"

pISSN 2071-4688 Banking

METHODOLOGY FOR ASSESSING THE EFFICIENCY OF THE DEPOSIT POLICY OF A COMMERCIAL BANK

Vladimir Vladimirovich MITROKHINA% Alexey Vladimirovich GRIBANOV, Maria Viktorovna VILKOVAs

a Candidate of Economic Sciences, Professor of the Department of Finance and Credit, National Research Mordovian State University. N.P. Ogaryova, Saransk, Russian Federation [email protected]

ь postgraduate student of the Department of Finance and Credit, National Research Mordovian State

university. N.P. Ogaryova, Saransk, Russian Federation

with Economist of the Risk Assessment Department of AKSSB KS BANK (PJSC), Saransk, Russian Federation [email protected]

Article history:

Received 10/04/2017 Received in revised form 11/06/2017 Approved 11/20/2017 Available online 12/22/2017

UDC 336.717.3 JEL: G21

Keywords:

© Publishing house FINANCE and CREDIT, 2017

annotation

Item. One of the pressing problems in the field of analysis of banking activities is the lack of effective tools to assess the effectiveness of the deposit policy of credit institutions. The methods used are focused on the analysis of the economic situation of banking institutions, which does not make it possible to evaluate the effectiveness of measures taken within the framework of certain areas of banking activity, including the deposit policy of credit institutions.

Goals. Development of a methodology for assessing the deposit policy of a commercial bank, analysis of existing methods, justification, taking into account the identified limitations of the author's approach; approbation of the author's methodology on the example of a credit institution.

Methodology. A systematic approach, analysis and synthesis, comparison and comparison method, as well as economic and statistical methods are used. Results. A methodology for evaluating the bank's deposit policy has been developed. Application area. When evaluating the deposit policy of banking institutions. Conclusions. Assessment of the deposit policy is one of the key tasks in the activities of a credit institution. The current methods either do not allow assessing the effectiveness of the bank's deposit policy, segregated from a comprehensive assessment of the effectiveness of its activities as a whole, or are focused on certain key aspects of this process. The authors propose a methodology for evaluating the effectiveness of the deposit policy, which is based on the analysis of three groups of indicators and makes it possible to study the latter in the context of its impact on the stability of a credit institution.

For citation: Mitrokhin V.V., Gribanov A.V., Vilkova M.V. Methodology for evaluating the effectiveness of the deposit policy of a commercial bank // Finance and credit. - 2017. - V. 23, No. 48. - S. 2888 - 2902. https://doi.org/10.24891/fc.23.48.2888

At present, the domestic financial market operates in a highly competitive environment, which makes its development and sustainability a top priority and one of the priorities of the Bank of Russia. Its solution is impossible without

the availability of effective tools for assessing the financial condition of a credit institution, as well as key areas of its activities. One of these areas, the qualitative implementation of which determines the stability of the functioning of credit institutions, is their

deposit policy. This implies a direct need to define the term "deposit policy" in the context of the sustainable development of a commercial bank.

In our opinion, the concept of "sustainable development" in relation to a commercial bank must be defined from the standpoint of a synergistic approach: a steadily developing credit institution should be characterized by the ability to maintain and restore financial stability in the course of its operation, despite the negative impact of external and internal environmental factors, thanks to the developed mechanisms resolution of continuously arising conflicts (contradictions), and in the process of stabilization to move to a new level of self-development; the development of a commercial bank is achieved through a critical analysis of newly received data on factors that bring the system out of balance, updated strategies and tactics of the organization, containing a risk assessment and a system of preventive measures, developed and on an ongoing basis through a critical analysis.

In turn, the concept of "deposit policy" must be disclosed in a broad and narrow sense: in a broad sense, a deposit policy is understood as an integral element of banking policy, which is part of the process of transforming funds attracted by a credit institution into investment resources and providing, through comprehensive strategic planning and a combination of sequentially related actions, methods and methods of management; formation of an effective structure of the resource base, which makes it possible to ensure a given level of profitability and liquidity of a credit institution with uninterrupted deposit financing of its commercial activities; in a narrow sense, the deposit policy is understood directly as the process of raising funds, focused on ensuring the stability of the bank (long money, a variety of attraction tools, an acceptable interest rate policy, etc.).

We believe that if the deposit policy of a commercial bank ensures its sustainable development, it should be recognized as effective. Note that determining the degree of effectiveness of the deposit policy of a particular credit institution is an urgent need in the practice of banking analysis. Taking this into account, let us determine the critical, in our opinion, requirements for the methodology for its assessment.

First, the methodology should provide an opportunity to assess the effectiveness of the deposit policy of a commercial bank segregated from the assessment of its activities as a whole. This is due to the fact that a comprehensive assessment of the activities of a credit institution is extremely complex, and its use reduces the reliability of the results obtained.

Secondly, the evaluation of the effectiveness of the deposit policy of a commercial bank must be carried out in the context of its sustainable development, and therefore for a number of reporting periods. Thus, the methodology should provide the analyst with the possibility of horizontal analysis to identify the main trends in the development of credit institutions. The methodology should also contain elements of a vertical analysis of the credit institution's balance sheet, in particular, the grouping of attracted funds by sources of attraction and by maturity.

Thirdly, the methodology should ensure the objectivity of the results obtained, as a result of which we prefer ratio analysis and an approach based on assigning a rating to credit institutions. This, in turn, will give the analyst the opportunity to compare the effectiveness of the deposit policy of several credit institutions.

Fourthly, the methodology should include the necessary and sufficient system of financial indicators.

Fifthly, the methodology should provide an opportunity to assess the effectiveness of the deposit policy of a commercial bank, both internal and external.

observer, which implies free access to all necessary information.

We have analyzed the currently existing methods for evaluating the effectiveness of the deposit policy of commercial banks. They can be conditionally divided into three groups:

1) methods based on the rating system of assessments of commercial banks. With the help of these methods, an analysis of a certain set of credit institutions is carried out, the choice of which is determined by the purpose and objectives of the relevant study. At the same time, depending on the organization of the assessment procedure, rating methods are divided into methods carried out on the basis of financial statements or on the basis of expert assessments. Accounting valuation methods are based on a rigidly formalized system of financial ratios (which often imposes certain restrictions on the analyst, since not all information about the valuation object can be expressed in numerical representation), while expert assessments are based on a certain amount of subjectivity (professional judgment, experience and qualifications of the specialist conducting the study);

2) methods based on the coefficient analysis of commercial banks. This group of techniques is extremely popular among analysts due to its simplicity. In addition, these methods have a number of other important advantages: firstly, they enable the analyst to operate with relative values and, accordingly, compare banks with different parameters; secondly, knowledge of the normative values (or the range of normative values) allows the analyst to identify inefficient credit institutions; thirdly, they are objective and standardized. However, this group

methods cannot be considered fully perfect. In particular, one of their shortcomings is the difficulty of interpreting the results obtained: a detailed system of financial ratios, on the one hand, allows a comprehensive assessment of the activity of the analyzed commercial bank, but on the other hand, it significantly complicates the systematization and structuring of the information received. In addition, despite the existence of normative values, one should be guided by them with extreme caution, since they significantly depend on the conditions for the credit institution to carry out its commercial activities;

3) methods based on financial analysis of commercial banks. Note that the methods of this particular group are most often used to assess the effectiveness of the deposit policy of commercial banks segregated from the assessment of the effectiveness of their activities as a whole. We also note that absolute indicators, such as revenue or net profit, play a dominant role in financial analysis, which makes it difficult to compare credit institutions whose scale of activity differs significantly from each other. It is important to pay attention to the fact that within the framework of this area, the assessment procedure is carried out in a multi-stage and complex manner, including: a) a horizontal (temporal) analysis, through which information is provided on the dynamics of financial indicators characterizing the efficiency of a commercial bank for a number of reporting periods; b) trend analysis, which is a logical continuation of the horizontal analysis and through which the main trends in the dynamics of the studied financial indicators are determined; c) vertical (structural) analysis, in which the structure of absolute financial indicators characterizing the efficiency of a commercial bank,

is revealed through the specific gravity of the individual elements that make it up; d) ratio analysis, through which the values of financial ratios that characterize the efficiency of a commercial bank are compared with the normative or with the values of financial ratios of compared credit institutions.

It has been established that none of the studied methods fully satisfies the system of requirements previously put forward by us:

1) the vast majority of currently existing methods do not allow evaluating the effectiveness of the deposit policy of a commercial bank segregated from a comprehensive assessment of the effectiveness of its activities as a whole, and therefore does not allow it to be given an exhaustive assessment;

2) the same few works in which the evaluation of the effectiveness of the deposit policy of a commercial bank is carried out segregated from the complex one, are often of a theoretical nature and are not applied in practice. In the same works in which researchers use financial ratios to assess the effectiveness of the deposit policy of a commercial bank, the latter, as a rule, either do not allow assessing the deposit policy in the context of the stability of a credit institution, or their choice is determined by the subjective experience of analysts who form their assessment basis based on own preferences.

That is why we propose the author's methodology for assessing the effectiveness of the deposit policy of commercial banks, segregated from the assessment of its activities as a whole, developed in full accordance with the previously put forward requirements. In order to test the developed methodology, the effectiveness of the deposit policy of AKSSB "KS BANK" (PJSC) was assessed, its effectiveness was correlated with

the regional market as a whole. Note that the completeness of the analysis in this case and in accordance with the requirements for the methodology can be ensured by data obtained from publicly available sources. In particular, these are official reports disclosed by credit institutions on the website of the Bank of Russia (forms No. 0409101, No. 0409102, No. 0409123). In addition, special attention should be paid to the fact that the developed methodology is based on the point-weight method, as well as the method for evaluating the effectiveness of the deposit policy of a commercial bank through the analysis of a system of indicators, which makes it possible to ensure the objectivity of the results obtained, as well as to consider them in dynamics over time. a range of reporting periods. The proposed method is carried out in several stages.

Stage 1. Calculation of coefficients characterizing the effectiveness of the deposit policy. In our opinion, it is necessary to evaluate it through a system-vector analysis of the three main directions of its development. Firstly, this is the formation of the most efficient structure of the resource base of a credit institution; secondly, it is the formation of the most effective active-passive potential of a credit institution; and thirdly, this is the formation of the most stable resource base of a credit institution. Determining the extent to which the individual potential of each of these vectors is realized, we carry out a comprehensive assessment of the effectiveness of the deposit policy. In accordance with the above, for remote evaluation of the effectiveness of the deposit policy of commercial banks, we propose to use a system of financial ratios, which, in turn, consists of three subsystems (Table 1).

In the first subsystem, we propose to include a group of coefficients,

1 The regional banking sector of the Republic of Mordovia is represented by three credit institutions: AKSSB KS BANK (PJSC) (registration number 1752), JSCB AKTIV BANK (PJSC) (registration number 2529), PJSC CB MPSB (registration number 752).

characterizing the structure of the resource base of a commercial bank, which will introduce elements of a vertical analysis of its resource base into the methodology for assessing the effectiveness of the deposit policy of a commercial bank. In particular, this subsystem will include indicator coefficients that make it possible to correlate the share of time deposits (K1), demand deposits and funds on settlement and current accounts (K2), interbank loans (K3) with their standard values.

It is proposed to include in the second subsystem a group of coefficients that characterize the effectiveness of the use by a credit institution of funds raised in its resource base. In this case, we are talking about coefficients-indicators that characterize the degree of consistency of the interest rate policy of a commercial bank on its active and passive operations (otherwise - the net SPRED of a credit institution) (K4), its ability to generate net interest income (otherwise - the interest margin of a credit institution) ( K5), as well as the profit he receives from each ruble of the resource base advanced for the formation of bank assets (in other words, the profitability of the assets of a credit institution) (K6) .

And, finally, in the third subsystem, in our opinion, it is necessary to include coefficients that characterize the stability of the resource base of a credit institution. These include coefficients-indicators that allow us to estimate the average quarterly term of keeping a deposit ruble in deposit accounts of legal entities and individuals (K7 and K8, respectively), the share of the total amount of funds attracted for the quarter to deposit accounts of legal entities and individuals, remaining in resource base of the bank (K9 and K10, respectively), as well as the share of funds attracted to demand accounts and settlement and current accounts, which can be used by the bank as a stable resource (K11 and K12, respectively) .

For AKSSB "KS BANK" (PJSC) and the banking sector of the Republic of Mordovia as a whole were

the data necessary for calculating the coefficients-indicators, as well as the values of the latter as of the first day of each quarter in dynamics from 07/01/2014 to 07/01/2017 were analyzed.

Stage 2. Digitization of the coefficients characterizing the effectiveness of the deposit policy into points. For each of the indicators used, the scales of their values are calibrated into points, which allows, firstly, to monitor the dynamics of changes in the effectiveness of the deposit policy of both a particular credit institution and the banking sector of the region as a whole over the required time interval; second, to compare the effectiveness of the deposit policy of a particular credit institution with the effectiveness of the deposit policy of its closest competitors or, as in our case, with the efficiency of the regional market as a whole; thirdly, to conduct a comprehensive assessment of the effectiveness of the deposit policy of a commercial bank using a system-vector analysis of a set of financial indicators of a different nature, a priori excluding the possibility of their automatic summation. Thus, it is the digitization of indicator coefficients into points that makes it possible to satisfy the previously put forward requirements for the methodology for assessing the effectiveness of the deposit policy.

Note that when digitizing the values of the indicator coefficients into points, their scaling must be done independently of each other. At the same time, preference should be given exclusively to linear scaling, since the range of changes in input variables is obviously determined by analyzing quarterly data using coefficients that characterize the effectiveness of the deposit policy. As criterion points for digitization, we propose to use the minimum value of the input variable, its median and maximum value. Let us note that we

it was the median that was chosen, and not the average value of the input variable, since it has a high rarity (insensitivity to errors and sample heterogeneities) . Thus, the criteria points will set the boundaries for two ranges:

1) in the first range, the value of the variable, measured in points, is in the interval , with the range of values of the input variables [xme;xmax]. Digitization into points in this case is carried out according to the following formula:

v_g 5"(Xi Xme)

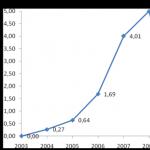

The scheme of the transformation mechanism, in accordance with which the values of the coefficients-indicators are digitized into points, is shown in fig. 1.

The values of the coefficients characterizing the effectiveness of the deposit policy of AKSSB "KS BANK" (PJSC) and the banking sector of the region as a whole, digitized into points, are considered.

Stage 3. Evaluation of the effectiveness of the deposit policy. At this stage, we are performing a comprehensive system-vector assessment of the effectiveness of the deposit policy of AKSSB "KS BANK" (PJSC), as well as its comparison with the effectiveness of the deposit policy of credit institutions in the region as a whole, which allows us to most fully demonstrate the capabilities of the developed methodology.

In particular, a horizontal analysis of the effectiveness of the deposit policy in the banking sector of the Republic of Mordovia in

On the whole, it indicates that it cannot be recognized as highly effective in the studied time interval (Fig. 2). For example, as of 07/01/2017, the effectiveness of the deposit policy implemented by credit institutions in the region is estimated at 53.18 points out of 120 possible.

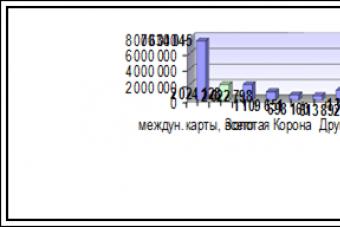

At 13.61 points out of 30 possible, the efficiency of credit institutions in the region is assessed in terms of the formation of the structure of their resource base, which makes it possible to assess this vector of development of their deposit policy as medium effective (Fig. 3).

At 22.47 points out of 30 possible, the effectiveness of credit institutions in the region is assessed in terms of the formation of their active-passive potential, which makes it possible to assess this vector of development of their deposit policy as highly effective (Fig. 4).

At 17.11 points out of 60 possible, the effectiveness of credit institutions in the region is assessed in terms of the formation of a stable resource base, which makes it possible to assess this vector of development of their deposit policy as ineffective (Fig. 5).

A comprehensive analysis of the results obtained indicates that, as of the last reporting date in the analyzed time interval, commercial banks registered in the Republic of Mordovia realized their individual potential to the least degree in terms of forming a stable resource base. At the same time, the dynamics of the development of the deposit policy of AKSSB "KS BANK" (PJSC) in this direction, as a whole, repeats the dynamics of the regional market, a clear evidence of which is the diagram shown in fig. 5. However, noteworthy is the fact that a slight increase in the stability of the resource base, noted for credit institutions of the Republic of Mordovia as a whole, in the period from 01.10.2015 to 01.04.2016 is accompanied by a decrease in the stability of the resource base of AKSSB "KS BANK" (PJSC) particular. This is mainly due

different dynamics of the coefficient-indicator K7, which characterizes the average period of storage of the deposit ruble on the deposit accounts of legal entities for the analyzed period. Indeed, despite the fact that in the case of AKKSB "KS BANK" (PJSC) the average amount of funds in the deposit accounts of legal entities for the quarter increased from 01.10.2015 to 01.04.2016 by 1.25 times, the amount of deposits of legal entities issued during the quarter , increased by 10.87 times. This clearly indicates a sharp decrease in the stability of the bank's resource base, which is all the more negatively assessed, since it runs counter to the trends of the regional market, in which the average amount of funds on deposit accounts of legal entities for the quarter decreased slightly over the same period of time by 1.03 times with a simultaneous decrease in the amount of deposits of legal entities issued during the quarter by 1.63 times. In turn, it should be noted that, as of the last reporting date of the analyzed time interval, KS BANK (PJSC) managed to realize its individual potential to a greater extent in terms of forming a stable resource base than credit institutions in the region as a whole: if As of July 1, 2017, the efficiency of credit institutions in the region in terms of the formation of a stable resource base was assessed as low-efficient, while the effectiveness of KS BANK (PJSC) in terms of the formation of a stable resource base was assessed as medium-efficient. This is mainly due to the fact that in the II quarter. In 2017, AKKSB KS BANK (PJSC) was less subject to the outflow of funds from deposit accounts of legal entities than other commercial banks registered in the Republic of Mordovia. Indeed, if in the regional market the amount of deposits issued for the quarter increased from 04/01/2017 to 07/01/2017 by 1.2 times, then in the case of KS BANK (PJSC) it decreased by 1.23 times, which had a positive effect on the dynamics of the coefficient-indicator K7 in particular and the effectiveness of the deposit

policies regarding the formation of a stable resource base as a whole.

In turn, as of the last reporting date in the analyzed time interval, commercial banks registered in the Republic of Mordovia most successfully implemented their deposit policy in terms of building their active-passive potential. Indeed, the analysis of the diagram shown in fig. 4 indicates that since January 1, 2017, the efficiency of using the funds raised by them has steadily increased. This is primarily due to the growth in the profitability of banking assets, which directly affected the values of the coefficient-indicator K5. Here it is necessary to pay special attention to the fact that although the dynamics of the development of the deposit policy of AKSSB "KS BANK" (PJSC) in the analyzed direction, as a whole, repeats the dynamics of the regional market (a clear evidence of this is the diagram shown in Fig. 4), from 01.01.2017 for this commercial bank, there is a decrease in the efficiency of using the funds attracted by it. This is even more negatively assessed, as it goes against the tendencies of the regional market. In fact, this circumstance is due mainly to a decrease in the profitability of banking assets, which directly affected the values of the indicator coefficient K6. Indeed, if in the IV quarter. 2016 AKKSB "KS BANK" (PJSC) received a net profit of 17 million rubles, then in the II quarter. In 2017, a commercial bank received a net loss of 1 million rubles.

Analysis of the diagram shown in fig. 3 indicates that the dynamics of the development of the deposit policy of AKSSB "KS BANK" in terms of the formation of an effective structure of its resource base is in line with the dynamics of the regional market as a whole. However, against the general background, it becomes obvious that this commercial bank does not fully implement its individual

potential for this vector of deposit policy development. This is mainly due to the fact that starting from 01.04.2016 KS BANK (PJSC) has been actively attracting interbank loans to finance commercial activities, which negatively affects the values of the indicator coefficient K3. Indeed, if as of 01.04.2016 the share of short-term interbank loans in the total amount of funds attracted by KS BANK (PJSC) from other credit institutions was equal to zero, while as of 01.07.2016 it was 0.69% , and as of 07/01/2017 - 91.3%. It should be noted that the short-term nature of interbank lending is an indirect sign of the speculative nature of its deposit operations: funds attracted for a short period are not directed by a credit institution to the real sector of the economy.

In turn, the system-vector analysis of the effectiveness of the deposit policy of AKSSB "KS BANK" (PJSC) allows us to evaluate it as an average effective one during the entire analyzed time period. The dynamics of its development must be recognized as corresponding to the dynamics of the regional market as a whole (Fig. 2). At the same time, it should be especially noted that in the first half of 2017, KS BANK (PJSC) failed to fully realize its potential. Indeed, the effectiveness of the deposit policy pursued by this credit institution was lower than the effectiveness of the deposit policy of the regional banking sector. This indicates that the effectiveness of the deposit policy of AKSSB "KS BANK" (PJSC) can and should be increased. The analysis previously performed using the proposed methodology allows us to single out two directions of its development. First of all, it is necessary to increase the effectiveness of the deposit policy of this commercial bank in terms of the formation of its active-passive potential; secondly, it is necessary to increase the efficiency of the deposit policy of this commercial bank in terms of the formation of an effective structure of its resource base

(From the diagrams shown in Figures 4 and 3, respectively, it follows that according to these vectors of development of a credit institution, there is a trend that unfavorably distinguishes it from the general regional background).

Let's summarize. Comparison of the concepts of "efficiency" and "deposit policy" is carried out by the authors by defining the deposit policy in the context of the sustainable development of a commercial bank. The main requirements for the methodology for evaluating the effectiveness of the deposit policy of a credit institution are determined. Through a comprehensive analysis of currently existing assessment methods, it is established that none of them fully satisfies the system of requirements put forward. The author's methodology for evaluating the effectiveness of the deposit policy is proposed. It is tested on the example of a specific commercial bank (AKKSB "KS BANK" (PJSC), Republic of Mordovia, registration number 1752) in combination with an assessment of the effectiveness of the deposit policy in the banking sector of the Republic of Mordovia as a whole. It is established that the developed methodology is remote (in other words, equally accessible to both internal and external analysts); makes it possible to assess the effectiveness of the deposit policy of a credit institution segregated from the assessment of its activities as a whole in dynamics for a number of reporting periods (horizontal analysis) based on a system-vector analysis of financial ratios (including elements of a vertical analysis of the structure of a credit institution, its active passive potential and stability of its resource base); allows you to get objective and reliable results, determine the place of a particular commercial bank in the regional market; makes it possible to determine the vector of further development of the deposit policy of the analyzed credit institution in order to increase its efficiency. Thus, the goals set for the researchers in this work are recognized as achieved.

Table 1

Coefficients used in the remote assessment method of the deposit policy efficiency of the AKKSB KS BANK (PAO)

Name, designation and description of the coefficient Calculation formula

Group 1. Coefficients characterizing the structure of the resource base of a commercial bank

Coefficient of the structural component of term deposits in the resource base of the bank (K1), reflecting the deviation of their share from the minimum allowable standard value 50% (Average dep. 50%) 50% " jar, %

Coefficient of the structural component of demand deposits and funds on settlement and current accounts in the resource base of the bank (K2), reflecting the deviation of their share from the maximum allowable standard value of 30% 30% " where U.v. - the share of deposits "on demand" and funds on settlement and current accounts in the resource base of a commercial bank,%

The coefficient of the structural component of interbank loans in the resource base of the bank (K3), reflecting the deviation of their share from its maximum allowable standard value 20% Y 1 mbq 20% "where Umbk is the share of interbank loans in the resource base of a commercial bank,%;

Group 2. Coefficients characterizing the effectiveness of the use of borrowed funds by the CB

Net SPREAD (K4), characterizing the level of consistency of the interest rate policy of a commercial bank on its credit and deposit operations, % W.100%---100%, CV SP KV - loans issued for the analyzed period, rub.; PR - interest expenses incurred for the analyzed period, rub.; JV - interbank loans and deposits attracted by the bank for the analyzed period, rub.

Profitability of banking assets (interest margin) (K5), which characterizes the ability of a commercial bank to generate net interest income using income-producing assets, %

Return on assets (ROA) (K6), which characterizes the profitability of the bank's assets and expresses the measure of its profitability in the analyzed period, the profit received by the bank from each ruble advanced for the formation of its assets,% analyzed period, rub.; SVB is the average balance sheet currency of a credit institution for the analyzed period, rub.

Group 3. Coefficients characterizing the degree of stability of the resource base of a commercial bank

Average storage period for the deposit ruble on deposit accounts of legal entities for the analyzed period (K7), days. DYusrT VDYu "where DYuav is the average value of funds in the deposit accounts of legal entities for the analyzed period, rubles; T is the number of days in the analyzed period, days; VDYu is the turnover on issuing deposits of legal entities in the analyzed period, rub.

Average storage period for a deposit ruble in deposit accounts of individuals for the analyzed period (K8), days. DFsr.-t VDF " where DFsr - the average for the analyzed period the amount of funds in the deposit accounts of individuals, rubles; VDF - the turnover on the issuance of deposits of individuals in the analyzed period, rubles.

The level of settling of funds received during the analyzed period on the deposit accounts of legal entities (K9), which makes it possible to assess the share of the total amount of funds attracted to the deposit accounts of legal entities in the analyzed time interval, remaining in deposits, % DUc-DYun PDYu "where DUc is the value funds on deposit accounts of legal entities at the end of the analyzed period, RUB DYUN - the amount of funds on deposit accounts of legal entities at the beginning of the analyzed period, RUB MU - turnover on receipt of deposits of legal entities in the analyzed period, RUB.

The level of settling of funds received during the analyzed period on the deposit accounts of individuals (K10), which allows to estimate the share of the total amount of funds attracted to the deposit accounts of individuals in the analyzed time interval, remaining in deposits, % DFK-DFN PDF "where DFk is the value funds in deposit accounts of individuals at the end of the analyzed period, rubles AFN - the amount of funds in deposit accounts of individuals at the beginning of the analyzed period, rubles PDF - turnover on receipt of deposits of individuals in the analyzed period, rubles.

The degree of stability (minimum balance) of funds on demand deposit accounts (K11), which allows to estimate the share of funds on demand accounts that can be used as a stable resource, % DUdv-100%, PD a.i. " where Dd.v. - the average value of funds for the analyzed period on deposit accounts "on demand", rubles; PDdv. - the turnover on receipt of deposits "on demand" in the analyzed period, rubles.

The degree of stability (minimum balance) of funds on settlement, current accounts of legal entities and individuals, as well as individual entrepreneurs (K12), which allows to evaluate the share of funds on settlement and current accounts that can be used as a stable resource, % DURS-100%, PD r.s. where Dr.s. - the average for the analyzed period the amount of funds on settlement and current accounts, rubles;

In modern conditions, for effective functioning, development and achievement of its goals, each commercial bank must develop its own deposit policy, that is, a practical management strategy. As you know, the attraction of financial resources and their subsequent placement are the main forms of activity of a commercial bank.

A fund of funds formed on a paid basis is used to invest in active instruments. Passive operations, therefore, are primary in relation to most of the banking operations aimed at generating income. In this regard, the attracted funds should be considered as an independent object of policy.

Thus, the management of attracted funds is an important component of the bank's business policy. However, issues related to the study of the theoretical foundations of this field of activity have not been sufficiently developed in the scientific literature. This is especially true of the concept of the deposit policy of a commercial bank as an integral element of the liability management strategy.

The definition of the essence of the bank's deposit policy cannot be approached unambiguously, since it varies depending on its subject. The deposit policy is a strategy and tactics of a commercial bank to attract customer funds on a repayable basis.

The bank's deposit policy should include:

Development of a strategy for the implementation of the bank's activities to raise funds in deposits, based on a comprehensive market research, that is, an analysis of the financial environment, the place and role of the bank in the field of raising funds, diagnostics and forecasting;

Formation of commercial bank tactics for the development, offer and promotion of new bank deposit products for customers (in the field of commodity, pricing, marketing and communication policy);

Implementation of the developed strategy and tactics;

Monitoring the implementation of the policy and its effectiveness;

Monitoring the activities of a commercial bank to raise funds.

The main document regulating in commercial banks the process of attracting temporarily free funds of enterprises, organizations and the population to bank accounts in various kinds of deposits (deposits) is the deposit policy of the bank. This is a document that is developed by each bank independently on the basis of the bank's strategic plan, analysis of the structure, condition and dynamics of the bank's resource base and based on the prospects for its development. In addition, such documents are used that determine the main directions and conditions for the placement of attracted funds, such as the Bank's Credit Policy and the Bank's Investment Policy.

The document "Deposit Policy of the Bank" should define its strategy for raising funds to fulfill the statutory requirements, goals and objectives defined by the memorandums on credit and investment policy, with a focus on maintaining the bank's liquidity and ensuring profitable work. Specifically, the bank provides:

Prospects for the growth of the bank's own funds (capital), and hence the ratio between own and borrowed funds;

The structure of attracted and borrowed funds (deposits, deposits, interbank loans, including loans from the Central Bank of the Russian Federation);

Preferred types of deposits and deposits, terms of their attraction; the ratio between time deposits (deposits) and for the period "on demand";

The main contingent of deposits and deposits, i.e., the category of depositors;

Geography of attraction and borrowing of funds;

Desirable creditor banks for interbank loans, terms for attracting the latter; conditions for attracting deposits (deposits) and interbank loans;

Ways to attract deposits (based on bank account, correspondent account, bank deposit (deposit) agreements, by issuing own certificates, bills of exchange);

The ratio between ruble and foreign currency deposits (deposits);

New forms of attracting funds in deposits;

Special conditions for opening certain types of deposits (deposits);

Measures to comply with the bank's risk standards for borrowed funds.

The deposit policy must first of all meet the following requirements:

Economic expediency;

Competitiveness;

Internal consistency.

The classification of subjects and objects of the bank's deposit policy is summarized in (Fig. 1).

Figure 1 Composition of subjects and objects of the bank's deposit policy

The formation of the deposit policy of a commercial bank is based on both general and specific principles, which is clearly reflected in (Fig. 2).

Figure 2 - Principles of formation of the deposit policy

A number of structural subdivisions of the bank (treasury, financial department, business development department, credit department, securities department), as well as the bank's management bodies are engaged in the development and implementation of the bank's deposit policy in close interconnection with each other: liabilities.

Rice. 3.

Thus, the board of the bank determines and approves the main directions of the deposit policy, approves the procedure and conditions for attracting deposits, and exercises general control over the implementation of the deposit policy.

The Assets and Liabilities Management Committee makes fundamental decisions on the formation of a deposit portfolio, analyzes the structure and dynamics of resources, their contingency in terms and amounts with the bank's assets in order to develop, if necessary, decisions to adjust the bank's deposit policy; exercises current control over the implementation of the deposit policy by individual structural divisions of the bank.

The financial management of the bank, together with the treasury, determines the total need of the bank for deposit funds (for a year, including a breakdown by quarters): sets the interest rates for each type of resource (deposits (deposits), bills, interbank loans); determines the amount of reservation of attracted funds in the Bank of Russia; controls the bank's compliance with the risk ratios for borrowed funds established by the Bank of Russia, etc.

Special departments of the bank are directly involved in attracting deposits in various forms: the department of deposits of citizens, the department of securities (issuing own bills, deposit and savings certificates), the credit department or the department of assets and liabilities (deposits of legal entities) and other departments in accordance with the internal organizational structure each bank.

In order to carry out practical activities to raise funds, banks develop Regulations on deposit (deposit) operations (separately for deposits of individuals and deposits of legal entities), which stipulate:

Rules and conditions for accepting deposits (deposits);

Legal status of subjects of contractual relations;

The procedure for concluding a bank deposit agreement;

Methods of accepting and issuing a deposit (deposit);

The list of documentation required for opening and using a deposit (deposit), and the requirements for them;

The rights of depositors and the obligation of the bank;

Methods of accrual and payment of interest on deposits (deposits).

Intra-bank instructions on the procedure for making specific deposit (deposit) operations, which are developed by the bank in development of the Regulations on deposits (deposits), contain the organization of the work of a branch (subdivision) of the bank with various categories of depositors; the procedure for issuing documents corresponding to the commission of these operations, the scheme of their document flow; reflection in the accounting of operations for the acceptance and issuance of deposits, accrual and payment of interest on them.

The volume of funds attracted by the bank in deposits (deposits) depends on the state of supply and demand for monetary resources, the deficit or excess of funds from the bank, the state of the deposit market.

In order to attract funds from business entities and citizens into their circulation, banks develop and implement a whole range of activities. So, first of all, an important means of competition between banks for attracting resources is the interest rate policy, because the amount of income on invested funds serves as a significant incentive for customers to place their temporarily free funds in deposits (deposits).

The level of interest rates on deposits (deposits) is set by each commercial bank independently with a focus on the refinancing rate of the Bank of Russia and the state of the money market, as well as based on the provisions of its own deposit policy. First of all, the level of interest rate on deposit (deposit) operations of banks depends on the type of deposits (deposits). As a rule, on demand deposits, characterized by the instability of the balance, high mobility and mobility, minimum interest rates are set.

In order to encourage clients to maintain stable, not declining balances on demand accounts, which generally has a significant impact on the profitability of credit operations, banks set increased interest on them or on the amount of the balance not lower than the minimum calculated by the bank and agreed with the client (which is stipulated in the bank account).

When setting the interest rate on time deposits (deposits), the determining factor is the period for which the funds are placed: the longer the period, the higher the interest rate. An equally important factor is the amount of the deposit, and, therefore, the larger the amount of the deposit and the longer the period of its storage, the higher the interest rate on it, as a rule. An essential point is the frequency of payment of income on deposits (deposits). The interest rate on the deposit is inversely related to the frequency of payment of income, i.e. the less often they are made, the higher the level of the interest rate on the deposit (deposit) set by the bank. It should be noted that paying interest to banks at rates significantly higher than the economically justified level is not illegal. In this case, the material benefit received from the difference between the refinancing rate of the Central Bank of the Russian Federation and the credit institution's rate on specific deposits should be subject to income tax.

Payment of interest on a deposit (deposit) can be made:

· once a month;

once a quarter;

after the expiration of the contract.

In order to stimulate the attraction of customer funds to time accounts in the bank, the conditions of deposits (deposits) may provide for the capitalization of interest. It is possible if the bank uses the compound interest technique when calculating income.

The traditional type of calculation of income is simple interest, when the actual balance of the deposit is used as the basis for calculation, and, based on the interest rate stipulated by the agreement, the calculation and payment of income on the deposit take place with the established frequency. Another type of income calculation is compound interest (interest on interest). In this case, after the expiration of the settlement period, interest is accrued on the deposit amount, and the resulting amount is added to the deposit amount. Thus, in the next billing period, the interest rate is applied to the new deposit amount, which has increased by the amount of previously accrued income.

To raise funds for deposits, commercial banks have begun to widely use foreign experience, in particular, they carry out:

· Development of various programs to attract funds from the population;

· provision of various types of services to depositor clients, including those of a non-banking nature (for example, elements of medical care; subscription to periodicals of economic literature; subscriptions for excursion services in museums, etc.);

Use of a high interest rate on deposits of an investment nature;

program "Bonus percentage".

In addition to a flexible interest rate policy in order to attract funds, banks must provide depositors with guarantees for the reliability of placing funds in deposits. In order to protect investors and depositors and provide them with guarantees of compensation of funds in the event of their bankruptcy, banks should create special deposit insurance funds both centrally and decentralized.

Along with deposit insurance, it is important for depositors to have access to information about the activities of commercial banks and the guarantees they can provide. When deciding on the placement of available free funds, each creditor must be sufficiently informed about the financial condition of the bank in order to assess the risk of future investments. In this regard, invaluable assistance to depositors and investors can be provided by rating assessments of the activities of banks by special agencies and bureaus.

At the same time, it should be noted that banks must also provide comprehensive information about themselves (on the amount of authorized capital, equity, founders, development prospects, performance results, etc.) to their creditors and depositors. This is especially true for individuals who choose banks to deposit their funds. Therefore, in the premises of a bank (branch, branch, additional office) accepting deposits from citizens, for the information of depositors, the following must be presented:

· a license from the Bank of Russia, which gives a particular bank the right to accept deposits from individuals either in rubles or in rubles and in foreign currency;

· auditor's report on the bank's annual report;

· the bank's balance sheet as of the last reporting date and profit and loss statement according to the forms for publication in print;

· position of the bank on the deposits of individuals;

List of types of deposits accepted by the bank from individuals. persons;

conditions for each type of deposits;

· information about the conditions for providing and guaranteeing deposits by the bank;

Forms of documents required for registration of deposits and transactions with them;

· information of the board of the bank (or other management bodies of the bank) on changes in the interest rate for certain types of deposits (indicating the reasons and terms for making changes to the conditions of deposits).

The work of credit institutions to attract creditors' funds into their circulation is associated with certain risks, which they must take into account in their activities and be able to manage them in order to avoid negative consequences for liquidity and stability.

The Bank of Russia establishes for banks and monitors their compliance with certain restrictions on the amount of funds raised. In accordance with the latest instructions of the Bank of Russia, a procedure is established for determining the balances on demand accounts and term accounts of individuals and legal entities (with the exception of credit institutions) for their inclusion in the calculation (exclusion from the calculation) of the instant (H2), current (H3) and long-term liquidity (N4) of the bank Instruction of the Bank of Russia dated 16.01.2004. No. 110-I.

The approach proposed by the Ordinance implements the method used in international practice for assessing bank liquidity risks, taking into account the so-called "behavioral" adjustments, that is, indicators characterizing the state of assets and liabilities based on accumulated statistical data.

The Ordinance establishes that banks independently determine the appropriateness of using the values of the minimum aggregate balances for calculating liquidity ratios.

It should be noted that not the entire amount of funds attracted by the bank from its customers can act as resources for its active operations. Part of the funds raised in the amount established by the Board of Directors of the Bank of Russia is subject to mandatory deposit on a separate account with the Bank of Russia. Required reserves are deposited with the Bank of Russia in accordance with Bank of Russia Regulation No. 255-P, dated March 20, 200, “On Required Reserves”. The Bank of Russia forms the obligatory reserve fund of the credit and banking system of the state. It can be used to provide credit assistance to commercial banks by the Bank of Russia in various ways, for settlements with depositors and creditors in the event of bankruptcy of a credit institution.

By changing the norms of required reserves, the Bank of Russia influences the credit policy of commercial banks, and, accordingly, the state of the money supply in circulation. For example, a reduction in the mandatory reserve requirements for funds attracted by banks allows them to use the generated resources in their turnover to a greater extent, i.e. increase credit investments in the national economy, and vice versa. Required reserves (reserve requirements) are a mechanism for regulating the overall liquidity of the banking system, used to control monetary aggregates by reducing the money multiplier.

The obligation to fulfill reserve requirements arises for a commercial bank from the moment it receives a license from the Bank of Russia for the right to perform the relevant banking operations.

Required reserve ratios are set by the Bank of Russia for a certain period of time and may be reviewed periodically, but they cannot exceed 20% of a credit institution's liabilities. It should be noted that the norms of required reserves can be differentiated depending on the timing of raising funds, their types (cash of legal entities or individuals), the currency of the deposit (deposit). Usually, the highest reserve ratio is set for demand accounts, since the client can withdraw his funds from them at any time.

The stages of the formation of a savings policy are shown in Figure 4.

Monitoring is a necessary tool for assessing and managing the quality of banking activities in the savings market. It is thanks to monitoring that the commercial bank and supervisory authorities can evaluate the results of the deposit policy pursued by the bank, which is extremely important in the development of monetary policy and other market regulation instruments, as well as to prevent crisis situations in the banking system associated with the loss of customer confidence in financial and commercial institutions.

Next, we consider the stages of formation of the deposit policy of a commercial bank. It is very important to study the formation and implementation of the deposit policy mechanism of a commercial bank, since the successful fulfillment of the goals and objectives that are set for the bank in the process of developing and implementing a deposit policy largely depends on the effectiveness of its functioning.

Figure 4 Stages of formation of a savings policy

Based on the analysis of the current practice of behavior of banks in deposit operations, a scheme for the formation of the deposit policy of a commercial bank is proposed, which is shown in Figure 5.

Figure 5 Scheme of formation of the deposit policy of a commercial bank

Each of the stages of the formation of the deposit policy of a commercial bank is closely related to the others and is mandatory for the formation of an optimal deposit policy and the correct organization of the deposit process. In this regard, the following areas of the deposit policy of a commercial bank can be distinguished:

Analysis of the deposit market;

Determination of target markets to minimize deposit risk;

Minimization of costs in the process of raising funds;

Optimization of deposit and loan portfolio management;

Maintaining the liquidity of the bank and increasing its stability.

An analysis of the current practice shows that the formation of the deposit base of any commercial bank, as a complex and time-consuming process, is associated with a large number of problems, both subjective and objective.

Subjective issues include:

1) scale of activity and weak capital base of Russian commercial banks;

2) the lack of interest of the bank's management in attracting funds from customers, especially the population, which is dictated by the tactical and strategic goals and objectives of the bank;

3) insufficient level and quality of top and middle management;

4) the lack of a science-based concept for conducting a deposit policy in most Russian banks;

5) shortcomings in the organization of the deposit process: the absence of an appropriate department in the bank, or a low level of marketing research on the deposit market, a limited range of deposit services offered, etc.

Among the objective factors are the following:

1) direct and indirect impact of the state and state bodies;

2) the impact of macroeconomics, the impact of global financial markets on the state of the Russian money market;

3) interbank competition;

4) the state of the money and financial market in Russia;

The role of the Central Bank of the Russian Federation as a regulatory body over the past few years has been especially pronounced in matters of setting the refinancing rate and reserve requirements for commercial banks. Changes in the refinancing rate do not allow commercial banks to accurately predict and plan their activities in the field of asset and liability management for the long term and make operations with long-term liabilities rather risky.

A negative impact on the structure of the resource base of a commercial bank has a growing dependence on large interbank loans, since an interbank loan does not contribute to the diversification of risks in deposit operations.

To solve existing problems, when developing a deposit policy, a commercial bank must be guided by certain criteria for its optimization. Optimization of the bank's deposit policy is a complex multifactorial task, the solution of which should be based on the consideration of the country's economy as a whole. Obviously, these interests do not always coincide. Therefore, the optimal deposit policy involves first coordinating their interests.

So, the optimization criteria are as follows:

a) the relationship of deposit, credit and other operations of the bank to maintain its stability, reliability and financial stability;

b) diversification of the bank's resources in order to minimize the risk;

c) segmentation of the deposit portfolio (according to clients, products, risks);

d) differentiated approach to different groups of clients;

e) competitiveness of banking products and services;

f) the need for an effective combination of resources, ensuring the optimal combination of stable and "volatile" resources while increasing the share of stable resources in the deposit portfolio of a commercial bank in conditions of increased risks (including deposit operations);

g) taking into account the concept of the life cycle in the process of forming the range of deposits and the deposit portfolio as a whole.

In order to improve the deposit policy of a commercial bank, the following is necessary:

Each commercial bank must have its own deposit policy, developed taking into account the specifics of its activities and the criteria for optimizing this process;

It is necessary to expand the range of deposit accounts of legal entities and individuals with a term “on demand”, which will allow, even in conditions of insignificant financial savings, the field to satisfy the needs of bank customers and increase the interest of investors in placing their funds on bank accounts;

As one of the ways to improve the organization of deposit operations, it is possible to use different types of accounts for all categories of depositors and improve the quality of their service;

Individual approach (the desire of the bank to provide the client with special benefits).

These are some of the possible ways to improve the deposit policy of a commercial bank and increase its role in ensuring its sustainability.

The relationship between the savings and deposit policy of a commercial bank is as follows: on the one hand, the main directions of the deposit policy are elements of the formation of the savings activity of the bank (for example, the range of deposits, interest rate policy, promotion of the product on the market, organization of the work of the relevant departments of the commercial bank). On the other hand, it is impossible to call the deposit policy an integral element of the bank's savings policy. The bank's deposit policy is a broader concept, which includes, in addition to the strategy and tactics of attracting resources on a repayable basis, the organization and management of the deposit process.

In general, each commercial bank develops its own deposit policy. Also, the bank's management independently determines the degree of importance of these areas, the priority of one or another type of bank policy. First of all, it will depend on the area of operation of a particular bank, its specialization and universalization.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Introduction

1. Theoretical foundations of the interest rate policy of banks in relation to deposit operations

1.1 Economic aspects of the bank's interest rate policy

1.2 Legal framework for interest rate policy

1.3 Classification and types of interest rate policy of the bank

2. Analysis of the interest rate policy of OJSC Bank Petrocommerce in relation to deposit operations

2.1 General characteristics of OJSC Bank Petrocommerce

2.2 Analysis of the financial performance of JSC Bank Petrocommerce

2.3 Assessment of the interest rate policy of OJSC Bank Petrocommerce in relation to deposit operations

Conclusion

List of sources used

Applications

Introduction

The specificity of a banking institution as one of the types of commercial enterprise is that the vast majority of its resources are formed not at the expense of its own, but at the expense of borrowed funds. The possibilities of banks in raising funds are not unlimited and are regulated by the Central Bank. The main part of the banks' resources is formed by borrowed funds, which cover up to 90% of the total need for funds for active banking operations. A commercial bank has the ability to attract funds from enterprises, organizations, institutions, individuals and other banks in the form of deposits and open appropriate accounts.

In modern conditions, for effective functioning, development and achievement of its goals, each credit institution must develop its own deposit policy, that is, a strategy for the practical management of liabilities. As you know, the attraction of financial resources and their subsequent placement are the main forms of activity of a commercial bank. A fund of funds formed on a paid basis is used to invest in active instruments. Passive operations, therefore, are primary in relation to most of the bank's operations aimed at generating income. In this regard, the attracted funds should be considered as an independent object of banking policy. The management of attracted funds is an important component of the bank's business policy. However, issues related to the study of the theoretical foundations of this field of activity have not been sufficiently developed in the scientific literature. This is especially true of the concept of the interest rate policy of the bank in relation to deposits.

The relevance of the chosen research topic is that the unstable situation in the financial markets in the current crisis, rising inflation, competition, and other factors - all this has a huge impact on a commercial bank. Therefore, a clear and thoughtful deposit policy allows a commercial bank to maintain its position and develop.

The purpose of the final qualifying work is to analyze the interest rate policy of Bank Petrocommerce OJSC in relation to deposit operations and develop proposals for improving the deposit policy of a commercial bank in the system of strengthening its economic stability.

During the study, the following tasks were set:

- consider the theoretical foundations for the formation of the interest rate policy of a commercial bank in relation to deposit operations;

- give a general description of the activities of OJSC Bank Petrocommerce;

- to analyze the financial activity of OJSC Bank Petrocommerce;

- to analyze the deposit policy of a commercial bank on the example of OJSC Bank Petrocommerce.

The object of study of the final qualification work is JSC Bank "Petrocommerce".

The theoretical basis of the study was the legislative acts of the Bank of Russia, educational literature, statistical collections, periodicals, reference and information systems.

The financial statements and internal documents of OJSC Bank Petrocommerce served as the information base of the WRC.

1. Theoretical foundations of the interest rate policy of banks in relation to deposit operations

1.1 Economic Acinterest rate policy of the bank

The main socio-economic function of commercial banks is financial intermediation, the essence of which is to transfer cash flows from entities that have an excess of funds to entities that need them. For the performance of this function, banks receive income in the form of interest, which allows them to develop. In turn, the effectiveness of intermediation is largely determined by the possibility of allocating resources at rates exceeding borrowing rates, which makes the formation of the interest rate policy of commercial banks relevant.

The development of market relations in Russia, on the one hand, created opportunities for the market formation of the interest rate and increased differentiation of interest rates depending on the location of banks, their type, size, duration of operation, the degree of development of regional competition, etc., on the other hand, exacerbated the problems of managing interest rates and their inherent risks.

In the context of increased competition, tougher legislation, a decrease in the overall level of profitability in the banking market, and a decrease in the interest margin between attracted and placed resources, it is possible to maintain the level of profit due to the growth of total turnover and the volume of transactions.

The development by the bank of its interest rate policy, which stipulates general approaches to pricing for the services provided, calculates and fixes interest rates on loans and deposits for a certain period of time, and its implementation in practice allows the bank to have pricing guidelines for today and for some future, coordinate other areas of banking management in terms of income and expense management, profit management, etc., which ultimately ensures the effective operation of the credit institution as a whole.

Interest policy is a set of measures to regulate economic relations through interest rate management.

The interest rate policy of commercial banks is aimed at maximizing net interest income from banking operations, credit risk insurance and liquidity management of the bank's balance sheet. That is, the interest rate policy management process is aimed at solving the following tasks:

- assistance in making a profit at the moment and creating conditions for its receipt in the future;

- regulation of cost pricing (deposit and loan interest rates);

- minimization of interest rate risk;

- maintaining a balance of assets and liabilities in terms of amounts and terms;

- ensuring balance liquidity.

The interest rate policy of the bank is determined by the duration of the gap between the terms of the release of attracted and placed funds and fluctuations in interest rates, the level of interest risk, which is expressed in the risk of losses as a result of the excess of interest rates paid by the bank on attracted funds over the rates on loans.

We can single out the main principles for constructing an interest rate policy:

- close connection with the commercialization of banking activities;

- simultaneous regulation of interest rates on deposit (passive) and loan (active) operations;

- establishment of differentiated interest rates, ensuring the profitability of the bank's operations, and the procedure for their payment on a contractual basis.

The bank's interest rate policy is influenced by external and internal factors.

External factors include:

- state of the financial market;

- inflation rate;

- Demand for banking services;

- the level of banking competition;

- policy of the Bank of Russia and the Ministry of Finance of the Russian Federation;

- regional specificity;

- the state of the social environment.

Internal factors include:

- range of services rendered by the bank;

- qualifications and experience of personnel;

- composition of the bank's clients.

When forming the interest rate policy, the bank takes into account that different sectors of the financial market are characterized by different interest rates.

The money market rates used in short-term lending operations between financial institutions (including government ones) are the official discount rate, the rate on short-term interbank loans.

The rates of the securities market are mainly the rates of return of various bonds at the time of their issue and subsequently in the secondary market.

Rates on bank transactions with non-bank borrowers and lenders are rates associated with the provision and attraction of funds to specified borrowers and lenders.

The main principle of the interest rate policy pursued by a commercial bank in the field of resource allocation is to ensure maximum income with a balanced asset structure and a minimum level of risk of non-return of the issued resources.

Thus, the interest rate policy of a commercial bank today is aimed at the appropriate management of liquidity and profitability of its balance sheet. An effective interest rate policy should ensure the flexibility of prices for credit and deposit resources, liquidity and profitability of the bank.

1.2 Regulatory rightsNew fundamentals of interest rate policy

Banks are legal entities and are economically independent. They carry out their own interest rate policy in relation to each specific client, the end result of which is making a profit, as the main goal in the conditions of market relations. Economic and legal responsibility for the bank's work with clients lies with the founders and shareholders of the bank.

Prior to the formation of a loan portfolio, a commercial bank needs to form an interest rate policy in relation to credit and deposit operations in such a way as to maximize profits. Accordingly, the interest rate on deposit transactions is at a lower level than on credit transactions. Interest rates on various deposit instruments have their own peculiarities of formation. The rates on deposits of individuals are usually lower than the rates on deposits of legal entities due to the smaller volume of deposits and the high costs of forming a resource base. At the same time, the deposits of individuals are well managed, and by increasing the interest on deposits, a rapid inflow of resources can be ensured.

The main regulatory documents regulating the interest rate policy of commercial banks is the Regulation of the Central Bank of the Russian Federation No. 39-P "On the procedure for calculating interest on operations related to the attraction and placement of funds by banks" . It defines the procedure for calculating interest on active and passive operations of the bank related to the attraction and placement of funds of the bank's customers - individuals and legal entities, both in the national currency of the Russian Federation and in foreign currencies, as well as for the use of funds held on bank accounts.

Banks can charge interest in one of four ways: using simple interest, compound interest, using a fixed or floating interest rate in accordance with the terms of the agreement. If the agreement does not specify the method of calculating interest, then interest is calculated according to the simple interest formula using a fixed interest rate. When calculating the amount of interest on attracted and placed funds, the interest rate (in percent per annum) and the actual number of calendar days for which funds are attracted or placed are taken into account.

Interest can be calculated in one of four ways: using simple interest, compound interest, using a fixed or floating interest rate in accordance with the terms of the agreement. If the agreement does not specify the method of calculating interest, then interest is calculated according to the simple interest formula using a fixed interest rate. When calculating the amount of interest on attracted and placed funds, the interest rate in percent per annum and the actual number of calendar days for which funds are attracted or placed are taken into account.

For participants in credit transactions, the influence on the level of interest rates of market forces and government regulation is of great importance. The state adjusts the level of the interest rate primarily in order to ensure the priority development of certain sectors of the economy. Another goal of regulating interest rates is to create equal conditions for participants in the national credit system.

An important factor determining the cost of resources attracted and placed on the credit market is the interest rate policy of the Central Bank. Most Central Banks conduct their monetary policy on the basis of interest rate regulation, i.e. determines the price of money in the economy. The Central Bank influences the level of interest rates of commercial banks by using methods of direct (directive) and indirect regulation.

Direct regulation methods include:

Limiting the upper level of interest rates;

Establishing the difference between loan and deposit interest.

Direct setting of the limit of interest rates by the Central Bank on active and passive operations of commercial banks can lead to increased competition in the market of credit resources, limiting the possibility of attracting them, the need to increase the authorized capital, reducing lending by reducing risky loans, and increasing interest rates on loans. prime borrowers.

The most effective instruments of indirect influence on the level of interest rates include:

The value of the minimum reserve requirements of the Central Bank;

Volume, conditions and market price of loans provided to commercial banks;

Liquidity ratios;

The mechanism of taxation of commercial banks.

Changes in tax rates directly affect the level of interest rates, i.e. the higher the tax rates, the higher the interest rates for the loan, and vice versa. An increase in the required reserves of the Central Bank also leads to an increase in interest rates for loans.