Index(from lat. - indicator,) - a statistical relative indicator that characterizes the ratio of socio-economic phenomena in time, in space, or the choice of a conditional level as a basis for comparison. With the help of indices, it is possible to determine quantitative changes in various indicators of the functioning of the national economy, the development of socio-economic processes, etc.

In economic work, with the help of indices, it is possible to objectively and accurately show changes in the growth or decline in production, changes in crop yields, the state of the cost of product prices, the number of employees, labor productivity, wages, changes in prices on stock markets, and others.

Indices differ from average values in that they embody, as a rule, summary, generalizing indicators, i.e. express some content inherent in all the phenomena and processes under consideration. For example, an enterprise producing a variety of products cannot be estimated by comparing the change in production volumes using a simple addition of units of output, some kind of common meter is needed. Such a meter is the cost or cost.

With all the diversity, indices can be divided into two groups. Some indicators are expressed in absolute values, characteristic of all units of the statistical population, others are indicators calculated for some unit (indicators of prices, cost, productivity, labor productivity, wages, etc.). Conventionally, the first group of indicators is called quantitative, and the second group is conventionally called quality indicators. most typical quantitative index is the volume index, i.e. index of the physical volume of production, trade turnover, national income, etc.

Quality indexes --- these are indices of prices, prime cost, distribution costs, purchasing power of the ruble, labor productivity, etc.

From the point of view of element coverage, there are individual and general indexes..

Individual indices denoted by (i) and characterize the dynamics of individual elements included in the set.

Depending on the calculation method general indices (I) subdivided into:

- aggregate;

-- averages of individual (arithmetic and harmonic averages)

H and in the example of t / turnover, consider all the listed indices:

Let's introduce symbols: p - price, q - physical volume t / turnover, or the number of goods sold. The product of the price (p) and the quantity of goods sold (q)

Gives t/turn: p * q = pq.

Individual indexes are one-commodity , because characterize the change in the price or physical mass of one product in the reporting period compared to the base one,

The individual price index is denoted by (i p) and is calculated using the formula: i p = p 1 / p 0

where / p 0 is the price in the base period;

p 1 - price in the reporting period.

If, according to the condition of the problem, the change in prices is given in%, then i p is determined by the formula:

i p = 100 + price change in %

Where the price in January is the price in the base period, and the price in September is the price in the reference period.

For example: the individual price index for apples will be: 38.2: 37.5= 1.019, which means the price per 1 kg. Apples in September increased by 1.9% compared to January

(the index value of 1.019 was expressed in % 1.019x100% = 101.9%, 101.9% - 100% = + 1.9%).

The individual index of physical volume t/turnover is denoted by i q and is calculated by the formula:

i = q 1 / q 0 where q 0 --- the physical volume of goods in the base period;

q 1---- the physical volume of the same product in the reporting period.

General indices are multi-commodity because determine the change in prices or the physical volume of the commodity mass of all or several goods. Aggregate indices act as the main form of the general index, A average indices obtained by converting the aggregate. (See table 5.)

In economic categories, there is a dependence: the price multiplied by the physical volume of the mass of commodities gives tons / turnover (p x q = pq). The same relationship exists in indices: the price index multiplied by the physical volume index gives the ton/turnover index: Ip x Iq = Ipq

If instead of the indicated 2 first indices we write down the aggregate indices of prices and the physical volume of the commodity mass, then we get turnover index in actual prices, which will show the change in turnover due to two factors (prices and quantity).

(See Table 5.) The relationship of indices is shown in Table 6.

EXAMPLE 2. Based on the data on the sale of goods in the store, calculate:

1) individual price indices for each product;

2) AVERAGE HARMONIC price index;

3) COMPARISON ARITHMETIC index of physical volume t/return;

4) TOTAL INDEX T / TURNOVER in actual prices;

5) Identify the relationship of indices in relative and absolute terms.

To determine individual indices, we use the formula:

i p = 100 + price change in %

Then, for example i p for item A i p = 100 +5 = 1,05 ,etc.

To calculate the average indices, we use the formulas from Table 5

| Goods | Realization in t.r. | Price change in % | I | pq/i | |

| Base Per. | otch.trans. | ||||

| A | 480.5 | +5 | 1.050 | 457.6 | |

| B | 680.7 | 690.9 | +10.5 | 1.105 | 625.2 |

| IN | 215.6 | 250.8 | 1.000 | 250.8 | |

| Total: | 1306.3 | 1422.2 | 1333.7 | ||

| Average harmonic price index | 1.066 | ||||

| The arithmetic average index of physical. volume t/o | 1.021 | ||||

| Component relationship formula for common indices | 1.089 | ||||

| General index t / o | 1.089 |

Conclusion: t/turnover in the reporting period increased by 8.9% compared to the base period, incl. due to changes in prices for goods, t / turnover increased by 6.6%, and due to changes in physical mass increased by 2.1%.

Absolute increase in t / turnover due to price changes: (1422.2 - 1333.7 = + 88.5 t.r.), due to changes in physical mass: (1333.7 - 1306.3 = + 27.4 t. R.).

Absolute increase in t / turnover due to 2 factors = (1422.2 - 1306.3 \u003d 115.9 tr.)

The relationship of indices in relative terms:

Ip x Iq = Ipq , we substitute the values \u200b\u200binto this formula: 1.089 \u003d 1.066 x 1.021

Relationship in absolute terms:

Δåpq (p q) = Δåpq (p) + Δåpq (q)

Substitute the values:

115.9t.r. = 88.5t.r. + 27.4t.r

Ph.D., Assoc. Department of E&ASU UTI TPU

CORRELATION ANALYSIS OF THE WORLD STOCK INDICES AND THE RUSSIAN RTS INDICATOR

Stock indices are the basis of derivative financial instruments that are used for investment purposes. They are composite indicators of changes in prices of a certain group of securities. If we analyze the previous state of the stock index and its current value, then we can determine the dominant dynamics in the group of securities, based on the calculation on which it is built. Therefore, changes in the index over time are more important, as they allow one to judge the general direction of the market. Thus, depending on the selection of indicators, a stock index may reflect the behavior of a certain group of securities, other assets, and the market as a whole. It depends on what securities make up the sample used in the calculation of the index, they characterize: the market as a whole, the market for a certain class of securities (government bonds, corporate bonds, shares), sectoral market (securities of companies in the same industry: telecommunications, transport , insurance, Internet sector). The study of the relationship between stock indices expresses the general trend in the development of the modern world economy.

At the moment, there are about 500 different stock indices in the world, among the world ones it should be noted: Dow Jones, MEXComposite, NASDAQ 100, NYSEComposite, CAC-40, CACGeneral, DAX 30, FT-SE 100, Nikkei, TSE 300, IPC, Hang Seng Index, and among Russian ones - RTS and MICEX. Methods for calculating indices are constantly being improved, which allows maintaining the adequacy of stock indicators in relation to new market changes.

There are many ways to study stock indices: averages and moving averages, regression analysis, Fourier analysis, etc. The development of research in this area is facilitated by the availability of quantitative statistics that characterize the dynamics of market conditions in the form of stock indices, which contributes to the high practical value of research results. To study the relationship of global stock market indicators, the best method is correlation analysis.

The relationship between the RTS index and most of the world's stock indicators can be characterized as unstable (Table 1). The strongest interaction of the RTS index in 2009 can be traced with the indices of Austria (0.82), Finland (0.81), Great Britain (0.81) and Ukraine (0.80). In 2010, correlation was noted with the indices of Canada (0.96), Ukraine (0.94), Austria (0.93), Australia (0.93), Germany (0.92), USA (0.92). In 2011, a strong interaction was observed with the indices of Denmark (0.64), Austria (0.61), Great Britain (0.63), and the Netherlands (0.62).

Table 1

Correlation coefficients of world stock indicators

with RTS index

| Correlation index name | Index convention | Correlation coefficient | |||

| for 2009 | for 2010 | for 2011 | |||

| Canada TSE300 | TSE | 0,78 | 0,96 | 0,44 | |

| Ukraine PFTS | PFTS | 0,80 | 0,94 | 0,44 | |

| Australia All Ordinaries | ASX | 0,76 | 0,93 | 0,47 | |

| Germany DAX | DAX | 0,74 | 0,92 | 0,59 | |

| US S&P 500 | SPX | 0,74 | 0,92 | 0,31 | |

| AustriaATX | ATX | 0,82 | 0,92 | 0,61 | |

| Denmark KFX | KFX | 0,79 | 0,92 | 0,64 | |

| Singapore Straits Times | STI | 0,79 | 0,91 | 0,57 | |

| Finland Helsinki General | HEX | 0,81 | 0,91 | 0,57 | |

| UK FTSE 100 | FTSE | 0,81 | 0,90 | 0,63 | |

| The Netherlands AEX General | AEX | 0,78 | 0,90 | 0,62 | |

| Greece General Share | ASE | 0,75 | 0,89 | 0,58 | |

| Pakistan Karachi 100 | KSE | 0,74 | 0,89 | 0,03 | |

| Spain Madrid General | IGBM | 0,72 | 0,88 | 0,56 | |

| Hungary BUX | BUX | 0,73 | 0,88 | 0,52 | |

| Poland Warsaw Stock Exchange | WIG20 | 0,74 | 0,87 | 0,62 | |

| France CAC 40 | CAC | 0,74 | 0,86 | 0,61 | |

| Belgium BEL20 | BEL20 | 0,76 | 0,86 | 0,52 | |

| Israel TA100 | TA100 | 0,69 | 0,85 | 0,57 | |

| Japan Nikkei 225 | NIKKEI | 0,70 | 0,82 | 0,44 | |

| Argentina | MERVAL | 0,70 | 0,82 | 0,40 | |

| Malaysia KLSE Comp. | KLSE | 0,68 | 0,80 | 0,42 | |

| S. Korea Seoul Comp. | KS11 | 0,69 | 0,80 | 0,46 | |

| Peru Lima General | IGRA | 0,66 | 0,80 | 0,48 | |

| Mexico IPC | IPC | 0,66 | 0,75 | 0,43 | |

| China Shanghai Comp. | SSEC | 0,64 | 0,69 | 0,25 | |

| India BSE 30 | BSE | 0,67 | 0,69 | 0,41 | |

| Turkey ISE National 100 | XU100 | 0,69 | 0,67 | 0,60 | |

| Indonesia Jakarta Comp. | JKSE | 0,72 | 0,65 | 0,45 | |

| Brazil Bovespa | BUSP | 0,65 | 0,57 | 0,46 | |

| Chile IPSA | IPSA | 0,70 | 0,34 | 0,44 | |

From Table. 1, it follows that the correlation of the RTS index with world stock indicators is affected by the geographic location and share of the country in the global economy. The weakest connection can be traced with the markets of Asia (China, Turkey and India) and Latin America (Mexico, Peru and Brazil). Stable dependence of the RTS index is observed with the indices of countries: France, Denmark and Great Britain. A comparative analysis of the correlation coefficients of the Russian index with foreign ones gives an idea of the degree of influence of individual world markets on the Russian stock market. Based on the data obtained, it is possible to study the trend in the development of world markets, monitor the dynamics of the correlation coefficients between Russian and foreign indices: a significant decrease in the coefficient gives a signal of a weakening of the relationship, and vice versa.

The study of the relationship has features associated with measuring the correlation between indices:

First, the correlation coefficient is measured not between stock indices, but between relative changes in stock indices: the longer the study period, the greater the distortion.

Secondly, it is very important to approach the issue of choosing the period of change for stock indices: the shorter the period of return, the more likely it is that the correlation coefficient will not take into account real-life influences that manifest themselves with a certain lag; as the period lengthens, the number of observations decreases and, accordingly, the correlation coefficient becomes less significant.

Thirdly, when assessing the dynamics of the correlation coefficient, the problem arises that the assessment of the correlation in certain periods is distorted due to changes in the amplitude of fluctuations in stock indices.

The study of the relationship of stock indices is an objective necessity of a market economy, since they reflect the level of development of a certain set of securities. This makes it possible to use indices both for assessing global market processes and for measuring the current market infrastructure. The objective conditions of modern economic development increasingly require the development of reliable methods for quantitative and qualitative assessment of stock indices.

1. Stock indices. Methods of calculation. [Electronic resource].

2. Correlation of the RTS index and other RZB indicators. Part 1. [Electronic resource].

3. Stock indices. Definition and calculation methods. [Electronic resource].

4. Stock indices. Definition and calculation methods. [Electronic resource].

© Platonova A.S., 2012

UDC 330.3

BBC 455

Popova A.A.,

student of BashSU, Ufa

Scientific adviser - Alekseeva L.E.,

Ass. Department of STEP BashGU, Ufa

WHY IN RUSSIA DO NOT WORK

ECONOMIC LAWS?

The modern Russian economy continues to be in a protracted long-term economic crisis, not being able to achieve in many respects the pre-crisis indicators of the early 1990s. A feature of the current stage of world economic development is the combination of the beginning of an increased wave of the long-term cycle with a medium-term crisis. Depressive post-crisis economies in most countries are characterized by low prices and deflationary processes, which is quite natural for the crisis and depression phase of the medium-term cycle. For the Russian economy, stable and high enough for the crisis rates of price growth are noted. What is the reason for this and why does Russia have its own way of development, unlike other countries?

The question of the relationship between inflation and a decline in production was raised by J. M. Keynes in his theory of a depressed economy. According to Keynesian theory, economic growth in a depressed economy should not be accompanied by rising prices. At the beginning of the formation of a new technological order, the economy is in a depressed state, and all the conclusions of the Keynesian theory justify themselves.

Why, then, in the Russian economy, these laws do not apply, and the decline in production in the conditions of the economic crisis is accompanied by rather significant inflation rates? What determines the rise in prices in the modern post-crisis Russian economy?

One of the elements of a possible rise in prices could be an increase in wages. However, the crisis and post-crisis period (2008-2010) is characterized by a decrease in real and even nominal wages. Thus, wage growth cannot be the source of price growth in the specified period. In addition, wages in our country, unlike developed countries, are at such a low level that for many years it is no more than 1/3 of the created GDP, the remaining 2/3 is the cost of other factors, including raw materials, materials and media. It is the last element of costs that is especially important in our country, it is for it that prices are steadily growing, and not because it is due to some market reasons, but in accordance with the “Concept for the long-term socio-economic development of Russia until 2020”. According to this concept, the average price of electricity should increase over 2011-2015. - in the range from 35 to 45%, and will be at the current rate in 2015 - 7.8 - 8 cents per kW, and in 2016-2020. - in the range from 15 to 25% and 9.5-10.6 cents per kW in 2020, respectively. The average gas price for all categories of consumers will increase in 2011-2015. 1.5-1.6 times in 2016-2020 - by 2-5%. The implementation of this concept into practice causes the current rise in prices in the Russian market, exacerbating the crisis in the economy and deepening differentiation in Russian society, because according to statistics, it is the poorest segments of the population who suffer most from inflation. Natural monopolies benefit from rising prices, which receive colossal income by appropriating economic rent from the use of natural resources that are a national treasure, they also appropriate monopoly rent, distributing these incomes among a small number of shareholders who are already far from poor. people.

Thus, without freezing energy prices, it is impossible to stop inflation.

Apparently, a way out of the crisis should be sought by stimulating solvent consumer demand, which is decisive, because even investment demand, the creation of which is so much talked about, is derived from the demand for consumer goods. There will be consumer demand, there will be money for entrepreneurs to invest in the development of production, because according to statistics, it is the own funds of enterprises that are the main source of investment at the present stage.

In conclusion of the article, I would like to note that in modern conditions the state is called upon to protect the interests of society, otherwise even objective economic analyzes cease to operate and the development of the economic situation is difficult to imagine and predict.

List of used literature

1. Federal State Statistics Service: http://www.gks.ru/wps/wcm/connect/rosstat/rosstatsite/main/

2. Glazyev S.Yu. Strategy and concept of socio-economic development until 2020: economic analysis / www.apn.ru

3. http://www.ceoconsulting.ru/technologies/statistics/rpas_rds/

There are interrelations between the most important indices, which allow obtaining others on the basis of some indices. Knowing, for example, the value of chain indices for a certain period of time, it is possible to calculate the basic indices. Conversely, if the basic indices are known, then by dividing one of them by the other one can obtain chain indices.

The existing relationships between the most important indices make it possible to identify the influence of various factors on the change in the phenomenon under study, for example, the relationship between the index of the cost of production, the physical volume of production and prices. Other indexes are also related. So, the production cost index is the product of the production cost index and the index of the physical volume of production:

The index of time spent on production can be obtained as a result of multiplying the index of the physical volume of production and the value, the reciprocal of the index of labor intensity, i.e. labor productivity index:

There is an important relationship between the indices of the physical volume of production and the index of labor productivity.

The labor productivity index is calculated based on the following formula:

,

,

those. represents the ratio of the average production output (in comparable prices) per unit of time (or per employee) in the current and base periods.

The index of the physical volume of production is equal to the product of the labor productivity index and the index of working hours (or the number of employees):

.

.

The relationship between individual indices can be used to identify individual factors that affect the phenomenon under study.

8. Properties of Laspeyres and Paasche indices:

In the market economy, a special place among the indices of qualitative indicators is given to price indices.

The main purpose of the price index is to assess the dynamics of prices for industrial and non-industrial consumption goods. In addition, the price index acts as a general measure of inflation in macroeconomic studies; used in adjusting the legally established minimum wage, setting tax rates.

Price indices are needed in the development of feasibility studies and projects for the construction of new enterprises. They cannot be dispensed with when recalculating the main indicators of the system of national accounts (total social product, national income, capital investments, etc.) from actual (current) prices into comparable ones.

Thus, Price indices are needed to solve two problems:

reflecting the dynamics of inflationary processes in the national economy of the country;

recalculation of the most important cost indicators of the SNA from actual prices to comparable ones when studying the dynamics of socio-economic phenomena.

Two types of indexes are used to implement these tasks, which are different in content:

actual price index;

deflator index.

One of the most important indicators of price statistics, widely used in the economic and social policy of the state, is consumer price index (CPI). It is used to revise government social programs, serves as the basis for raising the minimum wage, reflects the real purchasing power of the money that various segments of the population have to meet their material, cultural and spiritual needs.

The exchange index is a calculated value, which is formed on the basis of the prices of all shares included in the calculation of this index, which are traded on this exchange.

Stock indices are calculated based on a certain number of securities. The number of shares that affect the calculation of a certain stock index is usually indicated at the end of its name, for example, DAX 30, CAC 40, FTSE 100. Thus, a change in the value of a stock index reflects the price dynamics of tens, hundreds and even several thousand shares.

Exchange indices are special mathematical indicators reflecting the dynamics of the stock market, market sectors or another representative group of assets circulating on the market.

Stock indices are instruments that give an idea of the current state of the stock markets, in other words, they show the direction of the market. Often they are also called stock.

The stock index is especially interesting for analysts in dynamics: the assessment of the direction of market movement is carried out precisely on the basis of the change in the index over time, and the prices of shares in a selected group can change in absolutely different directions. Depending on the selected indicators, stock indexes allow you to get an idea of changes within a single sector or the entire market as a whole.

In the modern securities market, there is a variety of exchange (stock) indices. Indices can be sectoral, regional, composite and global. They can be used on any market: commodity, currency, stock. Nowadays, there are more than two thousand different stock indices in circulation. The publication of indicators of the main stock indices can be found in the public domain.

FUNCTIONS OF EXCHANGE INDICES

Stock indices were invented so that traders can get the information they need about what is happening in the market. Therefore, initially they performed only an informational function. Reflecting the direction of movement of stock quotes - up or down, the indices showed the trends that the exchange market takes and the speed of their development.

With time and the improvement of the technique for developing stock indices, their new functions also appeared:

1. Indicative function - the stock index is a starting point for analyzing the behavior of investors and portfolio managers.

2. Demonstrative function - a benchmark for selecting securities in an investment portfolio, determining the direction and proportion of investment.

3. Diagnostic function: the change in the price of certain shares can be compared with the index of the market or segment and draw conclusions about the demand for shares in the context of the entire market.

4. Predictive function - the accumulation of certain data on the state of stock indices made it possible to use them as a forecast.

5. Speculative function (object of trade) - stock indices are able to instantly respond to changes in a wide range of economic, political and social phenomena.

METHODS FOR CALCULATION OF EXCHANGE INDICES

Four main methods are used to calculate stock indices:

1. The arithmetic mean method is simple.

2. Simple geometric mean method.

3. Arithmetic weighted average method.

4. Method of weighted geometric mean.

The simple arithmetic mean method is calculated as follows: the prices of all assets included in the index at the close of trading are added up and the sum is divided by the number of assets. This method is the simplest. Its disadvantage is that it does not take into account the weight of each asset. Currently, this method is used to calculate the Dow Jones indexes.

The geometric mean simple method is carried out by multiplying the prices of the stocks that make up the index. This product is then taken to the nth root, where n is the number of stocks in the index. This also does not take into account the difference in trading volumes of shares of different companies.

The formula for calculating the index by the weighted arithmetic mean method and the weighted geometric mean method contains an additional element. Most often, the market capitalization of the company is used as weights. Those. the change in the company's price is multiplied by its size (capitalization). Such weighting leads to the fact that large companies affect the index more significantly than small ones.

The stock index can be calculated at a certain frequency:

1. At the beginning of each month (on a specific date).

2. Daily by the set time (Skate-Press indices are calculated daily by 2 pm Moscow time), following the results of the trading session (RTS system indices).

3. In real time (the World Index is recalculated immediately after the conclusion of the next transaction).

The stock index, taken in isolation, without connection with other indices, is not of particular interest. They are valuable in that they are calculated on a specific date and in the aggregate represent a certain picture.

MAIN EXCHANGE INDICES

The Dow Jones Stock Index (DJIA) is one of the most famous indices in the world. It was first used over a hundred years ago. Since 1928, the index has been consistently calculated using the stock prices of thirty companies. The arithmetic average of the stock prices of these thirty largest US companies, also called "blue chips" (blue chips), is the famous Dow Jones stock index. Its value is measured in points. An increase (or decrease) in the index by one point means that the average price of the shares included in the calculation has increased (or decreased) by one dollar.

In addition to the main one, Dow Jones stock indices are also calculated for specific market sectors:

a) for the shares of 20 leading transport companies;

b) for the shares of 15 leading public utilities companies;

c) a composite index, which includes the prices of shares of 65 companies;

d) several other indices.

The value of the Dow Jones index goes far beyond the US. Since the New York Stock Exchange concentrates about 50% of the total exchange turnover of developed countries. With this in mind, it is calculated on the exchanges and officially announced every half an hour.

The DAX stock index (DAX 30) was first introduced in 1988 and is today the main stock index in Germany. Its calculation takes into account the stock prices of thirty leading German companies from different sectors of the economy. Shares of companies included in the calculation of the DAX30 index are listed on the Frankfurt Stock Exchange. The index is weighted by market capitalization.

According to the results of trading in the electronic system, the Xetra DAX index is calculated, it practically coincides with the DAX 30. However, the electronic session is longer, so closing prices can vary significantly. The DAX 100 and the CDAX composite index for the shares of 320 companies are also calculated.

The FTSE 100 (Footsy) stock index began to be calculated on January 3, 1984. It is a weighted arithmetic index calculated on the basis of the 100 largest UK companies by market capitalization listed on the London Stock Exchange.

Once every three months, at the end of the quarter, 250 companies are selected from the list of the London Stock Exchange, ranking from 101 to 350. Based on the quotes of their shares, the weighted average exchange index by capitalization is calculated - the FTSE 250 index.

For the shares of 350 companies listed on the London Stock Exchange, the FTSE 350 stock index is calculated, which combines the FTSE 100 and FTSE 250 indices. To account for shares that are not included in the FTSE 350, a separate stock index is calculated - FTSE SmallCap.

The Nikkei has been published since September 1950. It is calculated as a weighted average of the stock prices of the 225 most actively traded Tokyo Stock Exchange First Section companies.

Stock indices of the NASDAQ family are intended for reliable orientation in the US high-tech market and help to adequately take into account the impact of US political and economic events on business areas related to the functioning of this market. The most famous are the NASDAQ 100 and NASDAQ Composite indices, and in the calculation of the latter index, almost all stocks traded on the NASDAQ exchange are used. These are shares of high-tech companies that are engaged in the production of computer equipment and equipment, the creation of software and telecommunications, and the introduction of biotechnology achievements.

Stock indices САС-40 and САС General are the main indices for the French stock market. CAC 40 is calculated on the shares of the 40 largest issuers traded on the Paris Stock Exchange. The index futures contract is arguably the most popular and traded futures contract in the world. CAC General is calculated on the shares of 250 of the largest and most stable French companies. This index is calculated by the Paris Bourse and the Society of French Bourses.

The stock index Standard & Poor's 500 (S&P 500) has received the figurative name "barometer of the American economy" for its special significance. The market value-weighted stock index includes the value of the shares of 500 US corporations traded on the New York Stock Exchange and the NASDAQ Stock Exchange, two of the most important US stock exchanges. Corporations are represented in the following proportion: 400 industrial, 20 transport, 40 financial and 40 utility companies.

Russell Stock Indices are calculated by the Frank Russell Company. Among the most famous: Russell 3000 Index reflects the dynamics of the shares of the 3000 largest US companies by market capitalization, which account for about 98% of the value of the entire US stock market. Russell 1000 Index reflects the performance of the 1000 largest companies from the Russell 3000 Index, which account for about 92% of the total capitalization of companies represented in the Russell 3000 Index. The Russell 2000 Index reflects the performance of the 2,000 smaller companies represented in the Russell 3000 Index, which account for about 8% of the total market capitalization of the Russell 3000 Index companies.

The MSCI Emerging Markets index includes 26 emerging market indices, including Russia, Mexico, Thailand, etc. The calculation of the emerging countries stock market index (another name is the emerging countries index) is carried out by Morgan Stanley. The same company takes care of the publication of the index.

The IPS index is calculated on the basis of stock quotes of 35 leading Mexican companies as weighted by capitalization. The list of stocks for calculating the IPS stock index is not permanent and is updated every 2 months.

The Bovespa Stock Index takes into account the most liquid stocks of Brazilian issuers listed on the São Paulo Stock Exchange. It is the leader among stock indices in terms of instability: 10 times there was a tenfold decrease in its value. The reason for the instability of the index was the catastrophic inflation in Brazil (up to 2500% per year), which swallowed up the famous "Brazilian economic miracle".

The RTS stock index is calculated based on the total value of shares of 50 Russian companies. It is considered the main indicator in the Russian securities market. RTS, or the Russian Trading System (RTS), is a stock exchange founded in 1995 with the aim of creating a centralized Russian securities market based on the regional stock markets that were functioning at that time. The family of RTS indices (RTS) includes several indices and is designed to assess the market capitalization of the largest companies in the Russian Federation.

MICEX (Moscow Interbank Currency Exchange) is a trading platform where the vast majority of transactions involving shares of Russian issuers are concluded. The MICEX Exchange Index is a weighted by effective capitalization exchange index of the market for the most liquid shares of Russian issuers traded on ZAO MICEX Stock Exchange. An index management system is used to calculate this index. The inclusion of specific companies in the MICEX index is handled by the Index Committee.

Application of stock indices

Stock indices are used for market analysis, trading and comparing the effectiveness of investment strategies.

The stock index is an indicator of the economic situation in the country where a particular company is located. By comparing narrow indices with each other, as well as comparing the dynamics of stock prices for one individual share of a company, a trader can predict the growth or fall of the shares of this company.

Some stock indices are based on securities, namely futures and options. By analyzing the behavior of indices, investors can also predict the fate of these securities in the market.

Comparing the performance of a fund (or portfolio) with stock indexes allows you to evaluate the achievement of the fund manager in comparison with the benchmark (benchmark - the underlying index).

Trading an index, compared to stock trading, gives traders a number of advantages. These include the lack of need:

- study the financial statements of companies,

- calculate coefficients,

- evaluate the prospects for the development of the company and / or industry.

Introduction

In today's world, the processes of globalization and integration are of great importance for the development of financial markets. National stock markets are largely dependent on the global financial market, they are being integrated into the world economy. Moreover, economic phenomena and processes taking place in individual countries can have an impact on the global financial market. Thus, the question arises about the mutual influence of the world and national stock markets.

Knowing the peculiarities of the interaction of various stock indices would make it possible to more accurately predict and mitigate the possible negative consequences for the whole world due to the collapse of individual economies, as well as learn how to take advantage of the benefits that stock market interconnections can provide.

The purpose of this work is to determine the relationship between the national stock indices of various countries and, in particular, to identify the significance of these relationships for Russia. The period of the financial crisis of 2014-2015 falls under consideration, which makes it possible to identify the factors that influenced the deterioration of the economic situation in Russia along with the introduction of economic sanctions against our country. At the same time, the degree of influence of the crisis in Russia on other countries and the world oil and gold markets will be considered.

It is widely known that the dynamics of energy prices has a great impact on the Russian economy and many world stock markets. At present, there are very few empirical studies confirming this relationship; moreover, the authors of studies in this area often disagree on the nature of the impact of oil prices on the stock markets of various countries. Therefore, the study of this issue is relevant and can help economists and investors more accurately predict fluctuations in the Russian stock market depending on oil prices, as well as other factors that will be investigated in this paper.

To achieve these goals, the following tasks are required:

1) Study the work of other researchers, consider their research methods and results;

2) Collect data and bring them into a form convenient for research;

3) Choose a methodology for data exploration, evaluate models and draw conclusions.

The object of the study is the national stock indices of the following countries: Russia (RTSI), USA (S&P 500), Germany (DAX), England (FTSE 100) and Japan (Nikkei 225).

The subject of the study is the relationship between national indices, their nature and factors influencing their changes. Futures prices for oil and gold will be considered as factors that can affect the correlation between stock indices.

The objectives of the research determine the structure of the work. The first part reviews the literature and draws conclusions based on the results obtained by other authors. The second part of the study contains an econometric model and an interpretation of the empirical results.

Chapter I. Theoretical foundations of the study

Review of previous studies

The question of the nature of the interdependence between the world and national stock markets has been studied repeatedly. Features of the interaction of various stock indices are the object of study by many scientists around the world. Of interest are not only the national stock indices of various countries, but also a variety of factors influencing their interactions. Let's take a look at some of the research in this area.

In the work of Peresetsky A.A. and Korhonen I. considered the period from 1997 to 2012. The focus is on the relationship of the Russian stock market with the global financial market, as well as oil prices. Some other emerging markets are also analyzed. In their analysis, the authors used moving regression to build a model on the available data and assess the degree of dependence of the indicators.

For the analysis, daily stock indices and world oil prices were taken. The national indices of Russia, the USA and Japan, as well as South Africa, Turkey and several countries of Eastern Europe were considered.

The model was based on the difference in the opening time of trading sessions in the markets of different countries. Lag variables should have been added to the analysis, since the trading session in Europe starts a few hours later than in Russia, and the time difference between New York and Moscow is even greater. The authors note that the US national index turns out to be more significant for the Russian stock market, since the closing of the trading session in New York is much closer in time to the opening of trading in Moscow than the closing of trading in Europe. Thus, US stock indices include more recent and relevant information for Russia than Europe.

Following this logic, we can assume that the Japanese stock index also has a significant impact on the Russian financial market, since the closing of the trading session in Tokyo is even closer in time to the opening of trading in Moscow than the closing of the session in New York.

According to the results of the study, the Japanese stock market has a significant impact on the indices of developing countries throughout the entire period under review. The impact of oil prices on emerging markets, including Russia, was not so significant. Due to this, the authors conclude that, taking into account Russia's dependence on energy resources, we can talk about a high degree of integration of our country into the world economy.

Summing up, it should be said that developing countries are becoming more and more integrated into the global economy, and the stock markets of developed countries have an increasing influence on their markets.

A similar study was carried out in another paper by Peresetsky. Here the author notes that although oil prices had a strong influence on the Russian stock market before, since 2006 they have lost their significance. Moreover, the S&P 500 (USA) and Nikkei 225 (Japan) have a great influence on the Russian stock market. In addition to the markets of developed countries, other factors were considered that can influence national stock indices - political and economic news. However, although significant endogenous shocks were found in the Russian economy, possibly related to these factors, the author found it difficult to identify their true causes.

Babetski Y. and others studied the stock markets of Russia and China, their interdependence and correlation with the markets of the USA, Eurozone and Japan. To build the model, the authors used the stock indices of these countries. Since among the researchers who studied this area earlier, there was no consensus about which of these markets - Russia or China - is more dependent on developed countries, Babetski J. et al. made an attempt to assess the correlation between these two markets and find out the nature of their dependence on the global economy.

If we trace the dynamics of the stock indices of Russia and China, we can see that the Chinese index approximately repeats the trends of the US, Eurozone and Japan indices at least until 2007. The Russian national index differed from them more strongly, but approached the indicators of developed countries after 2006.

In their work, the authors used the concept of beta and sigma convergence. Beta convergence describes a situation where the rate of economic growth in poor countries is faster than in developed ones, and sigma convergence is simply a decrease in the degree of differentiation in the levels of development of regions. The authors analyzed the so-called industry and national data for the period from 1995 to 2010. Thus, two studies were carried out. The first included national stock indices and their interactions, the second included sectoral indices within each country.

According to this study, in the modern world, the process of integration of countries into the world economy and the convergence of national stock indices is actively taking place.

In the article by Peresetsky A.A. and Ivanter A. considered not only the relationship of stock markets in different countries, but also the correlation of various financial markets in Russia. The period from 1996 to 1997 is analyzed, when the economy is still stable on the eve of the 1998 crisis. The markets of GKOs, securities, the foreign exchange market and the GKO futures market were considered. It was found that the integration between GKOs and securities markets has increased over time. Thus, the securities markets could significantly influence government decisions regarding the interest income of GKOs.

In terms of outside influence, the Asian financial crisis has hit the Russian stock market hard. This influence was expressed not only in a change in quantitative indicators, such as interest rates, but also in a qualitative change in the structure of some sectors of the Russian economy and their relationships.

In their work, Asgharian H. et al. aim to trace the interdependence of stock indices of various countries, which will help predict changes in financial markets and reduce the risks of financial investors.

In their study, the authors used the SAR model and analyzed a sample of 41 countries from 1995 to 2010. The following factors that are believed to influence national stock markets were also considered: financial integration, economic integration, and geographic proximity.

The authors found that economic factors are most significant for the relationship of stock indices. In particular, the similarity in the structure of production and trading partnerships are important aspects of the interdependence of stock indices.

One of the conclusions of this study is that the correlation of various financial markets was higher before 2002, although many other authors argue that the process of integrating stock markets into the world economy is underway and, therefore, the relationship between national stock indices has only strengthened over the years.

In the article by Fedorova E.A. the dependence of the Russian stock market on the stock markets of developed and developing countries is considered. The methodology included correlation analysis, causal analysis, testing for stationarity of time series, building a vector autoregressive model, and cointegration analysis. For analysis, we took the national stock indices of Russia, China, the USA and Germany, as well as the VIX index for the period from 2000 to 2012. It was assumed that the markets of developed and developing countries should have a significant impact on the Russian stock market, since it is highly dependent on various external factors. According to the results of the correlation analysis between the RTS index and the indices of developing countries, a positive relationship was indeed found. The results of the study of the influence of developed countries on the Russian index turned out to be contradictory - the correlation analysis revealed a high correlation between these variables, while the Granger test gave the opposite result. After evaluating the VAR model, it was found that the US and German indices do not have a significant impact on the Russian stock market. A negative relationship was found between the RTS and VIX indices.

Also of interest are studies of the impact of oil prices on the stock markets of developing countries. The opinions of various scientists about the nature of this dependence differ.

In particular, Fedorova A.E. and Lazarev M.P. in their article, they consider the dependence of the Russian stock market on oil prices, as well as its global production. The following methods were used in the study: construction and evaluation of a vector autoregressive model, correlation analysis, cointegration analysis; Granger causal test and stationarity test were performed.

It is assumed that the Russian economy should be strongly influenced by oil prices, as it is one of the largest exporters of this resource. The authors proposed to distinguish between stable and crisis periods and consider the results for them separately, since the nature of the relationship between the national stock market and world oil prices can be different at different times.

Despite the initial assumptions, it turned out that oil prices have the same impact on the market in both stable and crisis times, and this relationship is positive. But world oil production has only a short-term impact on the stock market in a stable period, while in a crisis this indicator loses its significance.

Also in the article by Fedorova E.A. the dependence of the stock markets of the BRICS countries on the price of oil was considered. The methodology used is the same: vector autoregression, correlation analysis, causal analysis, cointegration analysis. In general, according to the results of the study, the correlation of the stock indices of all the countries considered with oil prices turned out to be positive. This is explained by the fact that the energy industry in the BRICS countries plays an important role for their economies. The calculation of the Russian stock index, for example, is based on the shares of large companies, of which about half belong to the oil and gas complex.

Since, according to some studies, the impact of oil prices on the Russian market has recently become less significant, we should also consider other factors that can influence the relationship of stock indices. For example, Fedorova E.A. and Lanets I.V. in their work, they considered the gold market as one of the most important aspects of the world economy, capable of influencing stock markets. The article analyzed the relationship between the stock indices of the BRIC countries and gold prices from 2000 to 2012. The methodology included checking the time series for stationarity using the Dickey-Fuller test, vector autoregression, casual analysis, cointegration analysis, correlation analysis. According to the results of the study, in the BRIC countries, with the exception of China, there is a long-term mutual influence of the considered variables.

The precious metals market is showing growth in times of major financial turmoil. Perhaps this is due to the fact that gold is often seen as a reliable investment asset, which investors use during crises. Moreover, it is used by the states of different countries as reserves and reserves. Thus, it is not surprising that while the exchange rates and stock indices are falling, the gold market, on the contrary, is strengthening its positions.

The relationship between the price of gold and the RTS index is considered in the study by Fedorova E.A. and Cherepennikova Yu.G. . The generalized autoregressive conditional heteroscedasticity model with Markov switching (MS GARCH) was used for data analysis. Particular attention in the study was paid to periods of crisis. It was found that during such periods the RTS index decreased, while gold prices, on the contrary, grew. Thus, the relationship between the Russian stock index and gold prices is inverse.

Fedorova E.A. and Lanets I.V. the article examined the dependence of the world market of precious metals on various factors at the macro and micro levels. It was noted that if gold attracts investors mainly as an asset for investment, as it is a reliable alternative to the international currency, then other precious metals find their use mostly in industry. However, not only gold has recently been considered as a hedge instrument, but other precious metals, such as platinum, silver, and palladium, can also be involved for this purpose. The study uses a GARCH model to estimate the volatility and returns of these metals. According to the results of the analysis, in the considered case, profitability, and not volatility, is the determining factor when choosing investments, and a portfolio consisting of four metals - gold, palladium, silver and platinum - is inefficient.

In the article by Samoilov D.V. the RTS index and the factors influencing it are considered. The period from 2007 to 2009 is analyzed, while the author divides the time under consideration into three periods. The first period is the time before the crisis, the second is characterized by rising and falling oil prices, the third is the crisis itself. The following data are used for the study: oil price futures (Dow Jones), S&P 500, FTSE 100, RTS, VIX indices. The time series were tested for stationarity, the Granger test for causality was carried out, cointegration testing was carried out using the Johansen test, and a vector error correction model was built. According to the results of the Granger test, in the period before the crisis, the Russian stock index was dependent on the US and British national stock indices, as well as on the VIX volatility index; the latter are significantly affected by oil prices. The crisis period itself is characterized by some decrease in the influence of the US and British indices on the RTS index, however, the interconnections of other variables remain. When evaluating the VEC model, the significance of the S&P index in the first and last periods was revealed, while during the period of rising oil prices, the VIX index had a significant impact on the Russian financial index instead of it. In general, the author comes to the conclusion that the Russian stock market is becoming more and more integrated into the world economy and correlated with the markets of Western countries.

Some previous studies on the interconnectedness of national stock markets are summarized in Table 1. Here you can visually review the studied indicators, indices and countries, as well as the time frame and brief conclusions reached by various authors in their works.

Table No. 1. Summarizing the results of previous studies.

|

Countries, indices and other indicators |

||||

|

Peresetskiy |

MICEX, S&P 500, Nikkei 225, oil (WTI), gas, news shocks. |

Oil prices have lost their significance since 2006. The S&P 500 and Nikkei indexes have a great influence on the Russian stock market. |

||

|

Peresetsky, Korhonen |

MICEX, S&P 500, Nikkei 225, oil price (WTI) |

The S&P 500 is significant for the Russian stock market. Nikkei 225 has a significant impact on the indices of developing countries throughout the entire period under review. The impact of oil prices on emerging markets has not been as significant. Russia is integrating into the world economy. |

||

|

Peresetsky, Ivanter |

Indices GKO, OFZ, etc. |

The integration of the Russian stock market into the world economy is growing. The 1998 crisis led to its weakening. |

||

|

Samoilov |

RTSI, S&P 500, FTSE 100, oil prices, VIX index |

The interconnectedness of the considered stock markets is being strengthened. Oil prices and the S&P 500 become more significant during a crisis, while the influence of the FTSE on the Russian index falls. |

||

|

USA, Japan, Hong Kong, Korea, Singapore, Taiwan |

The stock indices of all the considered countries correlate with each other; the Asian crisis of 1997 led to the strengthening of these relationships. |

|||

|

Fedorova, Nazarova |

Russia, USA, Germany, UK, Japan, China |

The relationships between the considered markets are subject to the processes of globalization and integration in the world economy. |

||

|

Gilmour, McManus |

Czech Republic, Hungary, Poland, USA |

The stock markets of these countries are highly interconnected. |

||

|

USA and 15 developing countries |

The dependence of countries on the US stock market is the greater, the closer the country is to the US. Also, the stock markets of other countries influence each other, this influence is of particular importance in European countries and Japan. |

|||

|

Felix, Dufrene, Chatterjee |

Thailand, Malaysia, USA, UK, Japan |

No significant correlation was found between the considered stock markets in the long run. |

||

|

Phylaktis, Ravazzolo |

Hong Kong, South Korea, Thailand, Malaysia, Taiwan, USA, Japan |

|||

|

North American countries |

The integration of stock markets has a significant impact on the relationship between the considered countries during the crisis. |

|||

|

Basher, Sadorsky |

BRIC countries, oil price |

The oil price has the greatest influence on the stock indices of Brazil and Russia; the effect of influence on the markets of China and India is reversed. |

||

|

Aloui, Nguyen, Njeh |

25 developing countries, oil price |

There was no strong influence of the oil price on the stock markets of developing countries. There is a positive relationship, but in the long run it has little effect on the economies of developing countries. |

||

|

Wang, Wang, Huang |

USA, Germany, Japan, Taiwan, China, oil and gold price, US dollar |

There is an inverse relationship between gold prices and the stock indices of the considered countries. |

||

|

India, gold, wholesale price index, oil, inflation, GDP |

Significant factors for the formation of relationships between the considered variables are gold prices, the wholesale price index and inflation. |

|||

|

De Gooijer, Sivarajasingham |

Developed countries, countries of Southeast Asia |

The Asian financial crisis preceded the increased integration of stock markets with developed countries. |

||

|

Gold prices |

Crisis periods were characterized by significant fluctuations in gold prices. |

|||

|

USA, oil price |

World oil prices directly affect the US stock index. |

|||

|

Brazil, Russia, India, China, oil price |

No significant correlation was found between oil prices and the stock indices of the BRIC countries. |

|||

|

Fedorova, Pankratov |

Russia, oil price |

The Russian stock market directly depends on the price of oil. |

||

|

Russia, China, Japan, oil price |

There is no significant dependence of the stock markets of India, Russia and China on the price of oil. |

|||

|

FTSE 100 Gold Prices |

When stock market volatility increases, quotes rise. |

|||

|

Russia, S&P 500, oil prices, news |

To explain the yield and its volatility, news shocks are not significant. The impact of the S&P and the shocks associated with it is significant. |

|||

|

Jalolov, Miyakoshi |

Russia, Germany, USA, oil and gas prices |

The profitability of the Russian financial market does not significantly depend on energy prices. |

||

|

Anatolyev |

Russia, USA, Europe, Asia, oil prices |

Oil prices are gradually losing their significance, US stock indices, on the contrary, are strengthening their influence on other economies. The European markets have a more significant influence on the Russian stock market, which is associated with a greater degree of integration. |

||

|

Fedorova, Safina, Litovka |

RTSI, Dow |

The Russian stock market is subject to constant influence from the US market. The global stock market is largely subject to the processes of economic globalization and integration. Intermarket interactions are becoming increasingly important and significant for the development of individual markets. |

||

|

Fedorova |

RTSI, Brazil, India, China, South Africa, oil prices |

The relationship between oil prices and national stock indices of the considered countries is positive. |

||

|

Fedorova, Pankratov |

MICEX, DAX, FTSE, DJA, HSI |

The Russian national stock index is more strongly influenced by the European markets, especially the German one. The significance of the Dow Jones index for the MICEX increased during the crisis. |

||

|

Fedorova |

RTSI, euro and dollar exchange rates |

The stable period is characterized by an inverse relationship between the Russian stock market and the US dollar exchange rate, while the euro exchange rate correlates weakly with the RTS index. All these interrelations lose some of their significance in a crisis. |

||

|

Fedorova |

RTS, S&P 500, GOLDEN_DRAGON, DAX, VIX |

The correlation between the national stock indices of developing countries and the RTS is positive. It turned out that the Russian stock market is not significantly affected by the DAX and S&P indices. A negative correlation was found between the Russian National Stock Index and the VIX volatility index. |

||

|

Fedorova, Cherepennikova |

RTS, gold prices |

A negative correlation was found between gold prices and the RTS index. This was especially noticeable during periods of crisis, when gold prices rose, and Russian stock index quotes fell. |

||

|

Fedorova, Lanets |

BUSP, RTSI, BSE, SSEC, gold prices |

In the considered countries, the interdependence of gold prices and national stock indices was found, which is significant in the long term. Only China stands out from the general picture, in the stock market of which such dependence is not traced. |

As can be seen from Table 1, the opinions of different scholars on the same issues often differ. Nevertheless, many authors note the ongoing processes of globalization and the increased integration of developing countries into the world economy. The influence of oil also remains significant for the stock markets, however, some researchers note that its influence is gradually decreasing. In this paper, an attempt will be made to confirm or refute these conclusions.

Financial crisis 2014-2015

According to many economists, the immediate impetus for the start of the financial crisis in Russia in 2014-2015. the economic sanctions imposed by a number of countries against Russia, as well as the fall in prices for energy resources, although the prerequisites for a slowdown in growth and a recession arose as early as 2013.

However, in addition to the reasons already mentioned, it is possible to identify a number of other factors that, to a greater or lesser extent, influenced the complication of the economic situation in Russia. Among them, some economists name structural shifts and imbalances dictated by the fact that the country has not yet fully recovered from the crisis of 2008-2009, as well as some unsuccessful decisions of the state. In particular, perhaps the emphasis should have been on diversifying the economy, that is, directing resources to the development of various industries in addition to the energy complex. Due to the lack of alternatives, Russia has become too dependent on oil prices.

One of the first stages of the crisis was a significant drop in oil prices. This was due to an increase in the supply of oil on the world market and had a negative impact on several oil exporting countries at once. Since energy resources in Russia make up a significant share of all exports, such a drop in prices could not affect state revenues. This event led to a weakening of the national currency, which, however, cannot be unequivocally called an unfavorable event, since oil revenues remained the same in terms of rubles.

Another factor in the beginning of the crisis was the economic sanctions against Russia, imposed by a number of states in response to the annexation of Crimea. The United States, many European countries, Japan and others have joined the sanctions. They included a ban on cooperation with various banks, companies, as well as enterprises of the Russian military-industrial complex. For this reason, Russia lost a large amount of income, and, superimposed on the structural crisis and the fall in oil prices, the sanctions caused serious damage to the economy of our country.

In general, the financial crisis in Russia was dictated not only by external, but also by internal factors. At the same time, it will be interesting to reveal the impact of the Russian national stock index, which reflects changes in the Russian economy, on the stock markets of other countries, as well as the world oil and gold markets.

Methodology

This section will describe the methods used in this study. The main points of the work will be testing for stationarity, Granger causality, testing time series for cointegration and building a VEC model. Since the sample is supposed to be divided into several parts corresponding to certain periods, these methods of analysis will be applied to each part separately.

Time series testing for stationarity

Before carrying out further research, one should first check the time series for stationarity. A conventional VAR model can only be built if the time series is stationary, so the test results determine our choice between it and the error correction model.

The Dickey-Fuller test is usually used to test for stationarity. In this work, it was decided to use the procedure of Dolado et al., which is based on the extended Dickey-Fuller test.

The Dickey-Fuller test is based on the following equation:

Since we will be using the Augmented Dickey-Fuller (ADF) test, keep in mind that it is non-zero. The main hypothesis is the presence of a unit root, mathematically this is expressed in equality. If it is rejected, then there are no unit roots and the time series are stationary.

The Dolado-Jenkinson procedure is to evaluate five models in sequence. It allows us to figure out how best to bring our data to a stationary form - by taking the first differences, or by building a regression with a linear trend.

First, an extended Dickey-Fuller test is performed, evaluating the model with a constant and a trend. Then we evaluate the significance of the trend in the model and, if the hypothesis of its significance is rejected, we perform an ADF test for the model without a trend. The same steps should be taken when evaluating the significance of a constant. The final step is another Dickey-Fuller test to find out if there is trend stationarity in the data, or if we should go to the first differences.

Causality according to Granger

The Granger test allows you to identify causal relationships between variables. In our case, it will allow us to find out the nature of the relationship between the national stock indices of Russia, the USA, England, Germany and Japan, as well as to determine what effect oil and gold prices have on them. The test is based on vector autoregression, each two variables are tested in pairs. The influence in each pair must be one-sided, that is, if the variable x affects the prediction of the variable y, That y should not affect the prognosis x. If there is a mutual influence of two variables, then most likely they are significantly influenced by another variable.

Granger causality is a necessary but not sufficient condition for causality.

The F-statistic is used to perform the Granger test. The null hypothesis is the negation of the dependence of the variable x from a variable y; coefficients in this case are equated to zero. In the alternative hypothesis, the variables are simply swapped, that is, now y does not depend on x. To find a causal relationship, one of the hypotheses must be rejected - it will follow that one variable is significant for predicting the other. If both hypotheses are rejected, then the variables will be mutually related to each other (and probably influenced by the third variable). Not rejecting the hypotheses, in turn, will allow one to conclude that there is no relationship at all between the two variables.

The equation looks like this:

Cointegration Testing

To conduct further research and determine the type of model, testing of time series for cointegration is also required. If it is found, then VECM should be built - a vector error correction model.

We talk about the existence of cointegration of our data when there is such a linear combination of non-stationary time series that is stationary. The Johansen test is used to evaluate data for cointegration.

To conduct the test, the data must first be assessed for stationarity, since cointegration is a characteristic of non-stationary time series.

To test for cointegration, the following vector autoregressive model is evaluated:

The next step in checking the cointegration of time series using the Johansen test is the following equation:

The key point in this approach is the estimate of the rank of the matrix P. It corresponds to the number of cointegrated vectors. The main hypothesis corresponds to the zero cointegration rank, that is, the absence of cointegration in the data. If the rank of the matrix is incomplete, then the time series are cointegrated.

We will use the Bayesian Information Criterion (BIC) and the Akaike Information Criterion (AIC) to explain the number of lags in the Granger and Johansen tests, and to choose the order of the VAR model. It is required to improve the quality of the model, as well as to reduce the number of its parameters.

The Akaike information criterion in our case is calculated by the following formula:

The Bayesian information criterion looks like this:

We should choose the smallest values of both criteria, based on these indicators, we will understand what lag length should be used in all models.

Building a VEC Model

The final stage of the study is the construction of a vector model for error correction. Unlike the usual VAR model, it can be built in the case of non-stationary time series.

The vector error correction model has the following form:

Along with vector autoregression, it was decided to analyze the impulse response functions (IRF) for the RTS index. The analysis was carried out for each period - stable, pre-crisis and the crisis itself - separately. The purpose of the study of these functions was to trace how the RTS index reacts to single deviations (impulses) of the explanatory variables.

Chapter II. Empirical results

Data Description

The following indices are used to build the model: Russia (RTSI), USA (S&P 500), England (FTSE 100), Germany (DAX), Japan (Nikkei 225). It was also decided to take into account the impact of oil and gold prices on national stock indices. For this, futures prices for these two investment goods (Dow Jones index) were taken. Daily data were used for the period from January 5, 2012 to April 30, 2015.

The choice of variables is determined by the objectives of this study. The Russian National Stock Index is key in our analysis; the indices of the US, England, Germany and Japan, by assumption, should have a significant impact on it. The markets of gold and oil play an important role in the global economy, and therefore it is interesting to trace the influence of the prices of these investment goods on the interactions of national stock indices.

The data used in the work and their designations in the estimated model are clearly shown in Table No. 2. To build the model, the logarithms of all indicators are taken. The first differences are used to build a VAR model if the time series is non-stationary but there is no cointegration.

Table No. 2. Symbols for variables.

|

Index |

Symbol |

Logarithms |

First differences |

|

|

Russian stock index RTS |

||||

|

US stock index S&P 500 |

||||

|

UK FTSE 100 stock index |

||||

|

German stock index DAX 30 |

||||

|

Japanese stock index Nikkei 225 |

||||

|

Oil futures prices |

||||

|

Futures prices for gold |

For convenience, the sample was divided into three parts, each of which corresponds to a certain period:

· September 1, 2014 - December 31, 2014 (crisis, sharp growth of the dollar, 89 observations);

· January 2, 2015 - April 30, 2015 (beginning of stabilization, decrease in fluctuations in stock markets, 84 observations).

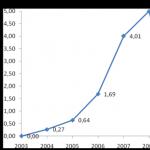

Rice. 1. Logarithms of the dollar, RTS, futures prices for oil and gold.

The graph clearly shows that since September 2014, the growth of the dollar exchange rate and the fall of the RTS index begin (Fig. 1). The beginning of January 2015 was marked by the cessation of the fall and the beginning of stabilization in the data. It was these indicators that served as a guideline for dividing the sample into three parts.

The last two periods are of the greatest interest for the study, as they mark the beginning and development of the crisis of 2014-2015. in Russia. The calmer economic conditions of 2012 and 2013 were taken for comparison with the period of economic turmoil, since the relationship between national stock indices, as well as the impact of oil and gold prices on them in stable and crisis times, may differ.

During the collection of data, some problems arose related to their structure and features. In particular, holidays, when trading on the stock exchange is not held, do not always coincide with each other in different countries, which is why there are gaps in the data on the indices. Another difficulty was that the opening of the trading sessions of various national stock indices takes place at different times. That is, it was necessary to compare data that did not coincide with each other in time. This lag makes it difficult to evaluate the model, as different indices respond to certain factors at different times; for the same reason, some indices can have a stronger influence on others. This time difference had to be taken into account in the model.

It was decided to fill in the gaps in the data with the values of the previous observation. Those gaps in which the holidays of different countries coincide with each other were simply removed from the sample. To combat the second problem, a lag variable was introduced, that is, the dependence of the opening prices of the Russian stock index on the closing prices of the US, German, and British indices, the previous day's gold and oil futures prices, and the current Japanese index was taken into account.

In Table 3 you can see the descriptive statistics of the logarithms of our data for the entire considered period. The hypothesis of normal distribution for all variables is rejected at the 5% significance level.

national stock index

We should now consider each period into which our sample is divided, separately. In the pre-crisis period, the hypothesis of normal distribution is still rejected at the 5% significance level for futures prices for oil and gold and all national stock indices, except for RTSI (Table No. 4). The distributions of almost all variables have a flat top because the kurtosis is less than 3. The distribution of the FTSE 100 index has a long left end because the skewness is less than zero.

In the second period (crisis), the hypothesis of the Harke-Beer test at the 5% level of normal distribution is rejected only for the RTS, S&P 500 and oil futures prices. The distributions of these three variables have a long left end, since the value of the skewness is less than zero; you can also notice that the oil futures price distribution has a flat top (kurtosis factor less than 3).

For the stabilization period, the hypothesis of normal distribution at the 5% significance level is not rejected for futures prices for gold and oil, as well as for the RTS index. The distributions of the S&P 500, DAX, and FTSE 100 indices have a long left end (the skewness coefficient for them is less than zero). The DAX, Nikkei 225, and S&P 500 distributions have a flat top because their kurtosis is less than 3.

We will separately consider the standard deviations of our variables for each period and make preliminary assumptions regarding the change in stock indices and futures prices for gold and oil, as well as their possible influence on each other.

Table No. 7. Standard deviations of variables in each period.

As can be seen from Table No. 7, if we take the entire study period as a whole, then rather high values of standard deviations belong to the Nikkei 225, RTSI, and oil futures prices. This speaks to the volatility and some instability of these markets during these three plus years. Considering the shorter periods into which we divided the sample will give us more specific and meaningful results, as it will allow us to compare time periods with each other and find out which markets became more stable in 2015 and which did not.

Thus, it can be seen that the standard deviation of the DAX variable decreased greatly in the second period and only slightly increased in the third, which indicates a relatively stable position for this market. A decrease in the standard deviation compared to the pre-crisis period is also observed in the S&P 500, Nikkei 225, FTSE 100 and gold futures prices. In the second period, a sharp increase in the standard deviation of futures prices for oil and RTSI is striking, from which we can conclude that these two variables are closely interconnected with each other. True, unlike oil prices, the Russian stock index during the stabilization period could not return to lower standard deviation values.

Data analysis

The analysis consists in building a vector model of error correction for the data of the period from January 2, 2012 to April 30, 2015. Before this, it is necessary to evaluate the time series for stationarity and cointegration. The Granger test will complement our study by determining the cause-and-effect relationships between variables.

Stationarity check using the Dolado-Jenkinson procedure.

The procedure of Dolado et al. is to evaluate five models in turn using the least squares method. First, an extended Dickey-Fuller test is performed for complete statistics with a trend and a constant. We then check to see if the trend should be included in the model; the same is done for a constant.

Table No. 8 shows the results of the Dolado-Jenkinson procedure for the first period (January 5, 2012 - August 29, 2014). First, an extended Dickey-Fuller test was performed for complete statistics with a trend and a constant; according to its results, the hypothesis of the presence of a unit root is rejected at a 5% significance level for all indicators, except for the S&P 500. Then the need to include a trend in the model was checked - at 5%, the trend turned out to be insignificant for all variables. Since the trend was excluded from the model, the next step was to run an ADF test for the statistics with a constant. The constant also had to be tested for significance, and at the 5% significance level, this hypothesis was rejected for all indicators. Further, the extended Dickey-Fuller test was carried out without a constant and without a trend, the hypothesis of the presence of a unit root was again rejected at a 5% significance level.

Thus, the time series of all variables, with the exception of the S&P 500, have a unit root and are stationary in differences. The data on the US stock index have trend stationarity; the model for this indicator has both a trend and a constant.

The number of lags for all variables in the pre-crisis period is zero according to the Bayesian Information Criterion (BIC).

Table No. 8. Results of the ADF test for the first period (690 observations).

|

t-stat. for trend |

ADF (constant model) |

t-stat. for a constant |

ADF (first differences) |

||||||

|

Variable |

|||||||||