GRADUATE WORK

Deposit policy of a commercial bank

(on the example of JSC "Bank" Petrovsky ")

Made by a student of group 23FB-61

distance learning

Kordesova Elena Yurievna

Scientific adviser: Ph.D.,

assistant professor I.G.Zaitseva

_____________________(signature)

Reviewer:

Head of the Vyborg business center

OJSC Bank Petrovsky I.G. Barkovskaya

_____________________(signature)

St. Petersburg 2009

Introduction

Chapter 1 Theoretical foundations for the formation of the deposit policy of commercial banks

1.2 Classification of deposit operations of commercial banks

1.3 Analysis of the Russian market of deposit services

Chapter 2 Deposit policy of a commercial bank (on the example of JSC "Bank" Petrovsky ")

2.1 Place of JSC "Bank" Petrovsky "in the market of banking services

2.2 Types of deposits of Bank Petrovsky OJSC

2.3 Analysis of the deposit portfolio of OJSC Bank Petrovsky

2.4 Organization of the formation and implementation of the deposit policy

Chapter 3 Improving Deposit Policy

3.1 Tools for improving the deposit policy of Bank Petrovsky OJSC

3.2 The deposit insurance system in the Russian Federation and its improvement

Conclusion

Bibliography

Annex 1

Annex 2

Appendix 3

INTRODUCTION

The specificity of a banking institution as one of the types of commercial enterprise is that the vast majority of its resources are formed not at the expense of its own, but at the expense of borrowed funds. The possibilities of banks in raising funds are not unlimited and are regulated by the central bank in any state.

The main part of the banks' resources is formed by borrowed funds, which cover up to 90% of the total need for funds for active banking operations. A commercial bank has the ability to attract funds from enterprises, organizations, institutions, individuals and other banks in the form of deposits (deposits) and open appropriate accounts.

Funds attracted by banks are diverse in composition. Their main types are funds raised by banks in the process of working with clients (deposits), funds accumulated by issuing their own debt obligations (deposit and savings certificates).

The stated topic of the thesis is closely related to the most acute, in my opinion, currently the problem of the Russian banking system - the problem of banking liquidity.

Relevance chosen research topic is that the unstable situation in the financial markets in the current crisis, rising inflation, competition, and other factors - all this has a huge impact on a commercial bank. Therefore, a clear and thoughtful deposit policy allows a commercial bank to maintain its position and develop.

aim graduation research is the development of proposals for improving the deposit policy of a commercial bank in the system of strengthening its economic stability.

Based on this target setting, there were the following tasks :

Consider the theoretical foundations of the formation of the deposit policy of a commercial bank.

Analyze the deposit portfolio of Bank Petrovsky OJSC.

Consider the state and dynamics of attracting deposits;

To analyze the deposit policy of a commercial bank on the example of Bank Petrovsky OJSC.

Object of study of this thesis is JSC "Bank" Petrovsky ".

Subject thesis are attracted funds of individuals and legal entities and their placement through deposit operations and deposit policy in OJSC "Bank" Petrovsky "

practical significance This thesis is that it can be used as additional material for a more detailed study of this topic.

Methodological basis works are: the method of synthesis, analysis, the method of generalization, the dialectical method.

theoretical basis the research compiled legislative acts of the Bank of Russia, including Federal Law No. 177 of December 23, 2003 “On insurance of deposits of individuals in banks on the territory of the Russian Federation”, educational literature, statistical collections, periodicals, reference and information systems.

Information base the thesis was the data of quarterly reports and the internal regulations of JSC "Bank" Petrovsky "g. St. Petersburg.

This thesis has the following structure: introduction, three chapters, conclusion, bibliography, applications.

Chapter 1. Theoretical foundations for the formation of the deposit policy of commercial banks

In modern conditions, for effective functioning, development and achievement of its goals, each commercial bank must develop its own deposit policy, that is, a practical management strategy. As you know, the attraction of financial resources and their subsequent placement are the main forms of activity of a commercial bank.

A fund of funds formed on a paid basis is used to invest in active instruments. Passive operations, therefore, are primary in relation to most of the banking operations aimed at generating income. In this regard, the attracted funds should be considered as an independent object of policy.

Thus, the management of attracted funds is an important component of the bank's business policy. However, issues related to the study of the theoretical foundations of this field of activity have not been sufficiently developed in the scientific literature. This is especially true of the concept of the deposit policy of a commercial bank as an integral element of the liability management strategy.

The definition of the essence of the bank's deposit policy cannot be approached unambiguously, since it varies depending on its subject. The deposit policy is a strategy and tactics of a commercial bank to attract customer funds on a repayable basis.

The bank's deposit policy should include:

Development of a strategy for the implementation of the bank's activities to raise funds in deposits, based on a comprehensive market research, that is, an analysis of the financial environment, the place and role of the bank in the field of raising funds, diagnostics and forecasting;

Formation of commercial bank tactics for the development, offer and promotion of new bank deposit products for customers (in the field of commodity, pricing, marketing and communication policy);

Implementation of the developed strategy and tactics;

Monitoring the implementation of the policy and its effectiveness;

Monitoring the activities of a commercial bank to raise funds.

The main document regulating in commercial banks the process of attracting temporarily free funds of enterprises, organizations and the population to bank accounts in various kinds of deposits (deposits) is the deposit policy of the bank. This is a document that is developed by each bank independently on the basis of the bank's strategic plan, analysis of the structure, condition and dynamics of the bank's resource base and based on the prospects for its development. In addition, such documents are used that determine the main directions and conditions for the placement of attracted funds, such as the Bank's Credit Policy and the Bank's Investment Policy.

The document "Deposit policy of the bank" should define its strategy for raising funds to fulfill the statutory requirements, goals and objectives defined by the memorandums on credit and investment policy, with a focus on maintaining the bank's liquidity and ensuring profitable work. Specifically, the bank provides:

Prospects for the growth of the bank's own funds (capital), and hence the ratio between own and borrowed funds;

The structure of attracted and borrowed funds (deposits, deposits, interbank loans, including loans from the Central Bank of the Russian Federation);

Preferred types of deposits and deposits, terms of their attraction; the ratio between time deposits (deposits) and for the period "on demand";

The main contingent of deposits and deposits, i.e., the category of depositors;

Geography of attraction and borrowing of funds;

Desirable creditor banks for interbank loans, terms for attracting the latter; conditions for attracting deposits (deposits) and interbank loans;

Ways to attract deposits (based on bank account, correspondent account, bank deposit (deposit) agreements, by issuing own certificates, bills of exchange);

The ratio between ruble and foreign currency deposits (deposits);

New forms of attracting funds in deposits;

Special conditions for opening certain types of deposits (deposits);

Measures to comply with the bank's risk standards for borrowed funds.

The deposit policy must first of all meet the following requirements:

- economic expediency;

– competitiveness;

– internal consistency.

The classification of subjects and objects of the bank's deposit policy is summarized in (Fig. 1).

Figure 1 Composition of subjects and objects of the bank's deposit policy

The formation of the deposit policy of a commercial bank is based on both general and specific principles, which is clearly reflected in (Fig. 2).

Figure 2 - Principles of formation of the deposit policy

A number of structural subdivisions of the bank (treasury, financial department, business development department, credit department, securities department), as well as the bank's management bodies are engaged in the development and implementation of the bank's deposit policy in close interconnection with each other: liabilities.

Rice. 3. Enlarged typical bank structure

Thus, the board of the bank determines and approves the main directions of the deposit policy, approves the procedure and conditions for attracting deposits, and exercises general control over the implementation of the deposit policy.

The Assets and Liabilities Management Committee makes fundamental decisions on the formation of a deposit portfolio, analyzes the structure and dynamics of resources, their contingency in terms and amounts with the bank's assets in order to develop, if necessary, decisions to adjust the bank's deposit policy; exercises current control over the implementation of the deposit policy by individual structural divisions of the bank.

The financial management of the bank, together with the treasury, determines the total need of the bank for deposit funds (for a year, including a breakdown by quarters): sets the interest rates for each type of resource (deposits (deposits), bills, interbank loans); determines the amount of reservation of attracted funds in the Bank of Russia; controls the bank's compliance with the risk ratios for borrowed funds established by the Bank of Russia, etc.

Special departments of the bank are directly involved in attracting deposits in various forms: the department of deposits of citizens, the department of securities (issuing own bills, deposit and savings certificates), the credit department or the department of assets and liabilities (deposits of legal entities) and other departments in accordance with the internal organizational structure each bank.

To carry out practical activities to raise funds, banks develop Regulations on deposit (deposit) operations ( separately for deposits of individuals and deposits of legal entities), which stipulate:

Rules and conditions for accepting deposits (deposits);

Legal status of subjects of contractual relations;

The procedure for concluding a bank deposit agreement;

Methods of accepting and issuing a deposit (deposit);

The list of documentation required for opening and using a deposit (deposit), and the requirements for them;

The rights of depositors and the obligation of the bank;

Methods of accrual and payment of interest on deposits (deposits).

Intra-bank instructions on the procedure for making specific deposit (deposit) operations, which are developed by the bank in development of the Regulations on deposits (deposits), contain the organization of the work of a branch (subdivision) of the bank with various categories of depositors; the procedure for issuing documents corresponding to the commission of these operations, the scheme of their document flow; reflection in the accounting of operations for the acceptance and issuance of deposits, accrual and payment of interest on them.

The volume of funds attracted by the bank in deposits (deposits) depends on the state of supply and demand for monetary resources, the deficit or excess of funds from the bank, the state of the deposit market.

In order to attract funds from business entities and citizens into their circulation, banks develop and implement a whole range of activities. So, first of all, an important means of competition between banks for attracting resources is the interest rate policy, because the amount of income on invested funds serves as a significant incentive for customers to place their temporarily free funds in deposits (deposits).

The level of interest rates on deposits (deposits) is set by each commercial bank independently with a focus on the refinancing rate of the Bank of Russia and the state of the money market, as well as based on the provisions of its own deposit policy. First of all, the level of interest rate on deposit (deposit) operations of banks depends on the type of deposits (deposits). As a rule, on demand deposits, characterized by the instability of the balance, high mobility and mobility, minimum interest rates are set.

In order to encourage clients to maintain stable, not declining balances on demand accounts, which generally has a significant impact on the profitability of credit operations, banks set increased interest on them or on the amount of the balance not lower than the minimum calculated by the bank and agreed with the client (which is stipulated in the bank account).

When setting the interest rate on time deposits (deposits), the determining factor is the period for which the funds are placed: the longer the period, the higher the interest rate. An equally important factor is the amount of the deposit, and, therefore, the larger the amount of the deposit and the longer the period of its storage, the higher the interest rate on it, as a rule. An essential point is the frequency of payment of income on deposits (deposits). The interest rate on the deposit is inversely related to the frequency of payment of income, i.e. the less often they are made, the higher the level of the interest rate on the deposit (deposit) set by the bank. It should be noted that paying interest to banks at rates significantly higher than the economically justified level is not illegal. In this case, the material benefit received from the difference between the refinancing rate of the Central Bank of the Russian Federation and the credit institution's rate on specific deposits should be subject to income tax.

Payment of interest on a deposit (deposit) can be made:

· once a month;

once a quarter;

after the expiration of the contract.

In order to stimulate the attraction of customer funds to time accounts in the bank, the conditions of deposits (deposits) may provide for the capitalization of interest. It is possible if the bank uses the compound interest technique when calculating income.

The traditional type of calculation of income is simple interest, when the actual balance of the deposit is used as the basis for calculation, and, based on the interest rate stipulated by the agreement, the calculation and payment of income on the deposit take place with the established frequency. Another type of income calculation is compound interest (interest on interest). In this case, after the expiration of the settlement period, interest is accrued on the deposit amount, and the resulting amount is added to the deposit amount. Thus, in the next billing period, the interest rate is applied to the new deposit amount, which has increased by the amount of previously accrued income.

To raise funds for deposits, commercial banks have begun to widely use foreign experience, in particular, they carry out:

· Development of various programs to attract funds from the population;

· provision of various types of services to depositor clients, including those of a non-banking nature (for example, elements of medical care; subscription to periodicals of economic literature; subscriptions for excursion services in museums, etc.);

Use of a high interest rate on deposits of an investment nature;

program "Bonus percentage".

In addition to a flexible interest rate policy in order to attract funds, banks must provide depositors with guarantees for the reliability of placing funds in deposits. In order to protect investors and depositors and provide them with guarantees of compensation of funds in the event of their bankruptcy, banks should create special deposit insurance funds both centrally and decentralized.

Along with deposit insurance, it is important for depositors to have access to information about the activities of commercial banks and the guarantees they can provide. When deciding on the placement of available free funds, each creditor must be sufficiently informed about the financial condition of the bank in order to assess the risk of future investments. In this regard, invaluable assistance to depositors and investors can be provided by rating assessments of the activities of banks by special agencies and bureaus.

At the same time, it should be noted that banks must also provide comprehensive information about themselves (on the amount of authorized capital, equity, founders, development prospects, performance results, etc.) to their creditors and depositors. This is especially true for individuals who choose banks to deposit their funds. Therefore, in the premises of a bank (branch, branch, additional office) accepting deposits from citizens, for the information of depositors, the following must be presented:

· a license from the Bank of Russia, which gives a particular bank the right to accept deposits from individuals either in rubles or in rubles and in foreign currency;

· auditor's report on the bank's annual report;

· the bank's balance sheet as of the last reporting date and profit and loss statement according to the forms for publication in print;

· position of the bank on the deposits of individuals;

List of types of deposits accepted by the bank from individuals. persons;

conditions for each type of deposits;

· information about the conditions for providing and guaranteeing deposits by the bank;

Forms of documents required for registration of deposits and transactions with them;

· information of the board of the bank (or other management bodies of the bank) on changes in the interest rate for certain types of deposits (indicating the reasons and terms for making changes to the conditions of deposits).

The work of credit institutions to attract creditors' funds into their circulation is associated with certain risks, which they must take into account in their activities and be able to manage them in order to avoid negative consequences for liquidity and stability.

The Bank of Russia establishes for banks and monitors their compliance with certain restrictions on the amount of funds raised. In accordance with the latest instructions of the Bank of Russia, a procedure is established for determining the balances on demand accounts and term accounts of individuals and legal entities (with the exception of credit institutions) for their inclusion in the calculation (exclusion from the calculation) of the instant (H2), current (H3) and long-term liquidity (H4) of the bank.

The approach proposed by the Ordinance implements the method used in international practice for assessing bank liquidity risks, taking into account the so-called "behavioral" adjustments, that is, indicators characterizing the state of assets and liabilities based on accumulated statistical data.

The Ordinance establishes that banks independently determine the appropriateness of using the values of the minimum aggregate balances for calculating liquidity ratios.

It should be noted that not the entire amount of funds attracted by the bank from its customers can act as resources for its active operations. Part of the funds raised in the amount established by the Board of Directors of the Bank of Russia is subject to mandatory deposit on a separate account with the Bank of Russia. The Bank of Russia forms the obligatory reserve fund of the credit and banking system of the state. It can be used to provide credit assistance to commercial banks by the Bank of Russia in various ways, for settlements with depositors and creditors in the event of bankruptcy of a credit institution.

By changing the norms of required reserves, the Bank of Russia influences the credit policy of commercial banks, and, accordingly, the state of the money supply in circulation. For example, a reduction in the mandatory reserve requirements for funds attracted by banks allows them to use the generated resources in their turnover to a greater extent, i.e. increase credit investments in the national economy, and vice versa. Required reserves (reserve requirements) are a mechanism for regulating the overall liquidity of the banking system, used to control monetary aggregates by reducing the money multiplier.

The obligation to fulfill reserve requirements arises for a commercial bank from the moment it receives a license from the Bank of Russia for the right to perform the relevant banking operations.

Required reserve ratios are set by the Bank of Russia for a certain period of time and may be reviewed periodically, but they cannot exceed 20% of a credit institution's liabilities. It should be noted that the norms of required reserves can be differentiated depending on the timing of raising funds, their types (cash of legal entities or individuals), the currency of the deposit (deposit). Usually, the highest reserve ratio is set for demand accounts, since the client can withdraw his funds from them at any time.

The stages of the formation of a savings policy are shown in Figure 4.

Monitoring is a necessary tool for assessing and managing the quality of banking activities in the savings market. It is thanks to monitoring that the commercial bank and supervisory authorities can evaluate the results of the deposit policy pursued by the bank, which is extremely important in the development of monetary policy and other market regulation instruments, as well as to prevent crisis situations in the banking system associated with the loss of customer confidence in financial and commercial institutions.

Next, we consider the stages of formation of the deposit policy of a commercial bank. It is very important to study the formation and implementation of the deposit policy mechanism of a commercial bank, since the successful fulfillment of the goals and objectives that are set for the bank in the process of developing and implementing a deposit policy largely depends on the effectiveness of its functioning.

Figure 4 Stages of formation of a savings policy

Based on the analysis of the current practice of behavior of banks in deposit operations, a scheme for the formation of the deposit policy of a commercial bank is proposed, which is shown in Figure 5.

Figure 5 Scheme of formation of the deposit policy of a commercial bank

Each of the stages of the formation of the deposit policy of a commercial bank is closely related to the others and is mandatory for the formation of an optimal deposit policy and the correct organization of the deposit process. In this regard, the following areas of the deposit policy of a commercial bank can be distinguished:

Analysis of the deposit market;

Determination of target markets to minimize deposit risk;

Minimization of costs in the process of raising funds;

Optimization of deposit and loan portfolio management;

Maintaining the liquidity of the bank and increasing its stability.

An analysis of the current practice shows that the formation of the deposit base of any commercial bank, as a complex and time-consuming process, is associated with a large number of problems, both subjective and objective.

Subjective issues include:

1) scale of activity and weak capital base of Russian commercial banks;

2) the lack of interest of the bank's management in attracting funds from customers, especially the population, which is dictated by the tactical and strategic goals and objectives of the bank;

3) insufficient level and quality of top and middle management;

4) the lack of a science-based concept for conducting a deposit policy in most Russian banks;

5) shortcomings in the organization of the deposit process: the absence of an appropriate department in the bank, or a low level of marketing research on the deposit market, a limited range of deposit services offered, etc.

Among the objective factors are the following:

1) direct and indirect impact of the state and state bodies;

2) the impact of macroeconomics, the impact of global financial markets on the state of the Russian money market;

3) interbank competition;

4) the state of the money and financial market in Russia;

The role of the Central Bank of the Russian Federation as a regulatory body over the past few years has been especially pronounced in matters of setting the refinancing rate and reserve requirements for commercial banks. Changes in the refinancing rate do not allow commercial banks to accurately predict and plan their activities in the field of asset and liability management for the long term and make operations with long-term liabilities rather risky.

A negative impact on the structure of the resource base of a commercial bank has a growing dependence on large interbank loans, since an interbank loan does not contribute to the diversification of risks in deposit operations.

To solve existing problems, when developing a deposit policy, a commercial bank must be guided by certain criteria for its optimization. Optimization of the bank's deposit policy is a complex multifactorial task, the solution of which should be based on the consideration of the country's economy as a whole. Obviously, these interests do not always coincide. Therefore, the optimal deposit policy involves first coordinating their interests.

So, the optimization criteria are as follows:

a) the relationship of deposit, credit and other operations of the bank to maintain its stability, reliability and financial stability;

b) diversification of the bank's resources in order to minimize the risk;

c) segmentation of the deposit portfolio (according to clients, products, risks);

d) differentiated approach to different groups of clients;

e) competitiveness of banking products and services;

f) the need for an effective combination of resources, ensuring the optimal combination of stable and "volatile" resources while increasing the share of stable resources in the deposit portfolio of a commercial bank in conditions of increased risks (including deposit operations);

g) taking into account the concept of the life cycle in the process of forming the range of deposits and the deposit portfolio as a whole.

In order to improve the deposit policy of a commercial bank, the following is necessary:

Each commercial bank must have its own deposit policy, developed taking into account the specifics of its activities and the criteria for optimizing this process;

It is necessary to expand the range of deposit accounts of legal entities and individuals with a term “on demand”, which will allow, even in conditions of insignificant financial savings, the field to satisfy the needs of bank customers and increase the interest of investors in placing their funds on bank accounts;

As one of the ways to improve the organization of deposit operations, it is possible to use different types of accounts for all categories of depositors and improve the quality of their service;

Individual approach (the desire of the bank to provide the client with special benefits).

These are some of the possible ways to improve the deposit policy of a commercial bank and increase its role in ensuring its sustainability.

The relationship between the savings and deposit policy of a commercial bank is as follows: on the one hand, the main directions of the deposit policy are elements of the formation of the savings activity of the bank (for example, the range of deposits, interest rate policy, promotion of the product on the market, organization of the work of the relevant departments of the commercial bank). On the other hand, it is impossible to call the deposit policy an integral element of the bank's savings policy. The bank's deposit policy is a broader concept, which includes, in addition to the strategy and tactics of attracting resources on a repayable basis, the organization and management of the deposit process.

In general, each commercial bank develops its own deposit policy. Also, the bank's management independently determines the degree of importance of these areas, the priority of one or another type of bank policy. First of all, it will depend on the area of operation of a particular bank, its specialization and universalization.

1.2 Classification of commercial bank deposits

The passive operations of a commercial bank characterize the sources of funds and the nature of the bank's relationships. It is they who largely predetermine the conditions, forms and directions for the use of banking resources, i.e. composition and structure of active operations.

Deposit (deposit) operations of a commercial bank are operations to attract funds from legal entities and individuals in deposits for a certain period or on demand, incl. balances of funds on settlement accounts of clients for their use as credit resources and in investment activities. Contribution ( deposit ) - these are funds (in cash and non-cash form, in national or foreign currency) transferred to the bank by their owner for storage under certain conditions.

Deposit operations are a broad concept, since they include all the bank's activities related to raising funds in deposits. A feature of this group of passive operations is that the bank has relatively weak control over the volume of such operations, since the initiative to place funds in deposits comes from depositors. At the same time, as practice shows, the depositor is interested not only in the interest paid by the bank, but also in the reliability of saving the funds entrusted to the bank.

The organization of deposit operations should be carried out subject to a number of principles:

– receipt by the bank of current profit and creation of conditions for its receipt in the future;

– flexible policy in the management of deposit operations to maintain the operational liquidity of the bank;

– consistency between the deposit policy and the return on assets;

– development of banking services in order to attract customers.

Consider in detail deposit accounts and their characteristics.

Deposit accounts can be very diverse and their classification is based on such criteria as sources of deposits (free cash of organizations, savings of individuals, pensions), their intended purpose (receiving income on time deposits upon expiration of their validity, monthly income in the form of interest on the amount of the deposit), the degree of profitability (depends on the amount, term and additional conditions of the deposit), etc.

However, most often the criterion is the category of the depositor and the form of withdrawal of the deposit. Deposit operations are classified:

– deposits of legal entities (enterprises, organizations);

- deposits of individuals.

- deposits of other banks.

2) By economic content:

- according to the order of use of stored funds. Those. receipt of income in the form of interest on attracted funds to the deposit monthly, quarterly, at the end of the contract.

3) According to the form of withdrawal of funds:

– term deposits;

– demand deposits;

- savings deposits of the population

- conditional deposits subject to withdrawal upon the occurrence of predetermined conditions.

The classification of deposits according to the form of withdrawal can be presented schematically in Figure 6 in more detail.

In the practice of Western banks, deposits, if possible, are divided into the following categories:

- "hot money", which is highly likely to be withdrawn (for example, deposits that are sensitive to changes in interest rates, which are caused by economic instability, inflation, sharp fluctuations in exchange rates). Hot money is money whose owners urgently move it from one bank to another in order to get a higher profit. As a result, there is a migration of capital.

- unreliable, which can be withdrawn within 25-30% of their size. Unreliable deposits include deposits with early repayment;

- stable funds (main deposits), the probability of withdrawal of which is minimal. These include term deposits without early repayment.

However, let us return to Russian banks and consider in more detail the classification of deposits presented in Figure 6.

Figure 6 Classification of deposits (according to O.I. Lavrushin)

Let's start with demand deposits, as they occupy the largest share in the structure of attracted funds of banks - about - 50%.

So, demand deposits are funds that can be claimed at any time without prior notice to the bank by the client. These include funds on current, settlement and correspondent accounts related to settlements or intended use of funds. On such accounts there is a constant movement of funds (credits and write-offs). Due to the high mobility of funds, the balance on demand accounts is not constant, sometimes extremely volatile. However, despite the high mobility of funds on demand accounts, it is possible to determine their minimum, non-decreasing balance and use it as a stable credit resource.

The calculation of the share of funds held on demand accounts that can be transferred to term deposit accounts (in order to increase the income for clients from funds placed in the bank and form a stable lending resource for banks) is made according to the formula:

D \u003d Avg.: K vol. x 100%,

where D is the share of funds held during the year in various current accounts that can be transferred to deposit accounts.

Osr - the average balance of funds on the settlement or current account for the year.

K about. - credit turnover on the settlement or current account for the year.

In order to expand active operations and make a profit for the bank, the best way in terms of managing liabilities is to grow and diversify the main types of deposits, which include demand deposits and term deposits. With the help of demand deposits, the problem of making a profit by the bank is solved, since they are the cheapest resource, and the costs of servicing settlement and current accounts of customers are minimal.

Demand deposits are inherently unstable, which limits their use by commercial banks. For this reason, deposit account holders are paid a low interest rate (on a demand deposit for an individual, currently 0.01%) or it is not paid at all (for example, on settlement and current accounts of legal entities, as well as on a correspondent account of commercial banks) . In the face of increased competition in attracting deposits, commercial banks seek to attract customers and stimulate the growth of demand deposits by providing additional services to account holders, as well as improving the quality of their service.

Interest on demand deposits is credited to the depositor, as a rule, once a year at the beginning of a new calendar year.

Demand deposits are the most liquid. Their owners can at any time use the money on demand accounts. Money is deposited or credited to this account, as well as withdrawn or written off both in parts and completely without restrictions, and it is also allowed to withdraw cash from this account. The advantage of demand deposit accounts for their owners is their high liquidity, and for banks, the establishment of a low interest rate or none at all. The main disadvantages of demand deposits for their owners is the establishment of a low interest rate on the account, and for the bank - the need to have a higher operating reserve. Thus, the features of a demand deposit account can be characterized as follows:

– deposit and withdrawal of money is carried out at any time and in any amount without any restrictions;

– the account holder pays the bank a fee for using the account in the form of a fixed monthly rate (for legal entities);

- the bank pays low interest rates (for individuals) or does not pay at all (for legal entities) for keeping funds on demand accounts, which increases the bank's profit.

Term deposits are generally classified according to their term: deposits with a term of up to 3 months; from 3 to 6 months; 6 to 9 months; from 9 to 12 months; over 12 months.

The advantage of time deposit accounts for the client is the establishment of a higher interest rate compared to a demand deposit, and for the bank - the ability to maintain liquidity with a smaller operating reserve. The disadvantage of term deposit accounts for clients is low liquidity. For the bank, the disadvantage is the need to pay increased interest on deposits and thus reduce profits.

There are two types of term deposits:

– term deposit with a fixed term;

– term deposit with prior notice of withdrawal.

Actually term deposits imply the transfer of funds at the full disposal of the bank for the term and conditions under the agreement, and after this period the term deposit can be withdrawn by the owner at any time. The amount of remuneration paid to the client on a term deposit depends on the term, amount of the deposit and the fulfillment by the depositor of the terms of the agreement. The longer the terms and (or) the larger the amount of the deposit, the larger the amount of remuneration, as a rule. Such a detailed gradation encourages depositors to rationally organize their own funds and place them in deposits, and also creates conditions for banks to manage their liquidity. For example, in JSC "Bank" Petrovsky "frequency of payment of income varies from 1 month to the moment of payment of the amount of the entire deposit as a whole.

Deposits with prior notice of withdrawal of funds means that the client must notify the bank in advance of the withdrawal of the deposit within the period specified by the agreement. Depending on the notice period, the interest rate on deposits is also determined.

If the depositor wishes to change the amount of the deposit - to reduce or increase, then he can terminate the current agreement, withdraw and re-register his deposit on new terms. However, in case of early withdrawal by the depositor of funds on the deposit, he may lose the interest provided for by the agreement in part or in full. As a rule, in these cases, the interest is reduced to the amount of interest paid on demand deposits. The current demand rate is 0.15%. Many commercial banks apply prolongation of deposits up to several times (1-3 or more). When prolonging the current deposit in case of a change in the interest rate, the newly established interest rate is applied.

By attracting time deposits, the problem of ensuring the liquidity of the bank's balance sheet is solved.

The most important instruments of the deposit policy of commercial banks are deposit and savings certificates. In the Russian Federation, the circulation of certificates takes place on a legislative basis.

A certificate is a written obligation of the issuing bank to deposit funds, certifying the right of the depositor or his right of the receiver to receive the amount of the deposit and interest on it after the expiration of the established period. Deposit and savings certificates are a type of income security, therefore they cannot serve as a settlement or payment instrument for goods sold or services rendered. There are also restrictions on transferring them from one owner to another. The form of the nominal certificate must have a place for transfer inscriptions.

The certificates issued by the bank must be printed and meet the requirements for such securities.

Commercial banks have the right to start issuing certificates only after the approval of the conditions for their issuance and circulation by the main territorial departments of the Central Bank of the Russian Federation. The conditions must contain the full procedure for issuing and circulation of certificates, a description of the appearance and a sample certificate. The certificate must contain the following mandatory details: name "deposit" (or "savings") certificate; the reason for issuing the certificate (making a deposit or savings deposit); date of deposit, amount (in words and numbers); an unconditional obligation of the bank to return the amount deposited or deposited; date of claiming the amount of the certificate; interest rates and the amount of interest due; name and address of the issuing bank; for a personal certificate - the owner; signatures of two persons authorized to sign such obligations, sealed by the bank.

In addition to dividing certificates into deposit and savings, depending on the category of depositors, certificates can be classified according to other criteria:

1) According to the release method:

- issued on a one-time basis, i.e. a certificate of a certain number and denomination is issued once;

- produced in series, i.e. a batch of certificates is issued, one series and one denomination, but under different numbers

2) According to the design method:

Nominal - by concluding an agreement on the assignment of the right to claim (cession);

- to the bearer - are transferred to the new owner by simple delivery.

Cash settlements for the purchase and sale of certificates of deposit and the payment of amounts on them are carried out only in a non-cash manner.

The certificate is not subject to export to the territory of a state that does not use the ruble as an official currency. The right to claim a certificate of deposit can only be transferred to legal entities registered in the territory of the Russian Federation or another state that uses the ruble as an official currency.

Certificates must be current. If the deadline for receiving a deposit or a deposit under a certificate is overdue, then such a certificate is considered a demand document, according to which the bank is obliged to pay the deposit at the first request of the owner (beneficiary). The Bank may provide for the possibility of early presentation for payment of an urgent certificate. In this case, the bank pays the owner of such a certificate the amount of the certificate and interest at a reduced rate established by the bank when issuing the certificate. Interest on certificates is set upon issuance and is indicated on the forms in percentage and monetary form. At the same time, interest payments due to the owner after the expiration of the certificate do not depend on the time of purchase. You can get a certificate only in the commercial bank in which it was issued or in any of its branches.

The certificate form must contain all the conditions for the issuance, payment and circulation of the certificate (the conditions and procedure for the assignment of rights, the requirement for a certificate. If an operation was performed with a certificate that was not provided for by the conditions contained on its form, such an operation is considered invalid. Production of deposit and Savings certificates, both nominal and bearer, are produced only by printing companies that have a license to issue securities.The Bank independently develops the conditions for issuing and circulation of the certificate.

The conditions for issuing and circulation of certificates, a description of the appearance and a sample of the certificate are approved by the board of the issuing bank and sent in 3 copies for examination to the Main Territorial Directorate of the Central Bank at the location of the correspondent account, which gives an opinion on the observance by the issuing bank of the existing rules for issuing a certificate and in the absence of violations, one copy of the conditions is sent to the Securities Department of the CBR. Certificates, being securities, are not subject to registration and do not require a special decision on their issue by the CRB. At the same time, the territorial administration may prohibit the issuance of certificates, as well as invalidate those issued for the following reasons:

The terms of issue are contrary to the current legislation or the rules of the CBR;

The issuing bank did not timely submit the terms of the issue to the Main Territorial Department of the CBR;

The Bank violates the current legislation and the CBR rules on the process of issuing and circulation of the certificate.

The owner of the certificate may assign the right to claim the certificate to another person. For a bearer certificate, this assignment is carried out by simple delivery, for a nominal one, it is drawn up on the back of the certificate by a bilateral agreement (cession). Upon the expiration of the claim period, the owner of the certificate must submit it to the bank along with an application containing an indication of the method of redeeming the certificate.

In order to account for the sold certificates, commercial banks keep special registration journals or provide for the issuance of a certificate with special sending stubs containing the same registration details.

Certificates are issued for terms from 1 month to 3 years, and for the amount of certificates of deposit - from 5 thousand to 10 million rubles, savings certificates from 1 thousand and more than 1 million rubles. Interest rates depend on the size and term of the deposit, some banks carry out indexation and monthly payment of income.

Consider the features of deposit certificates. A deposit certificate can only be transferred from a legal entity to a legal entity. A certificate of deposit can only be issued to an organization that is a legal entity registered in the territory of the Russian Federation or in the territory of another state that uses the ruble as an official currency. A certificate of deposit has two advantages. First, unlike other deposit policy instruments, it is the subject of an exchange game, and, therefore, its owner can count on extracting additional profit as a result of favorable changes in market conditions. Secondly, if the government implements its intentions to freeze the deposits of enterprises, the purchase of a certificate that is freely circulating on the market will give their owners some freedom of maneuver. In this situation, the certificate becomes an alternative means of payment.

The term of circulation for certificates of deposit (from the date of issue to the date when the owner of the certificate receives the right to demand a deposit or deposit under the certificate) is limited to one year.

In international practice, interest-bearing certificates of deposit, discount, i.e. sold at a price below par and certificates with a "floating" rate. The validity of the last certificate is from 3 to 5 years and the interest rate is determined every 6 months for the next six months. Certificates of deposit can be purchased at any time during their validity period - interest is accrued from the date of purchase.

Some commercial banks issue certificates of deposit that are transferable (or non-transferable) to other owners by endorsement in denominations from 500,000 rubles to 10 million rubles. up to a year, designed for large investors. Transferable certificates of deposit are usually sold to government agencies, pension funds, corporations. They generate income in excess of the interest rate on short-term treasury bills of a shorter term (three months and others) and can be traded on the secondary securities market.

Consider the features of Savings Certificates. A savings certificate can be transferred from an individual to an individual. A savings certificate can only be issued to a citizen of the Russian Federation or another state that uses the ruble as an official currency. The right to claim a savings money certificate is transferred only to citizens of the Russian Federation or another state that uses the ruble as an official payment unit.

In order not to lose the most stable source of credit resources, commercial banks are forced to carry out indexation on savings certificates under inflation conditions by raising the interest rate, which is an incentive for the population to purchase.

Certificates have significant advantages over term deposits issued by simple deposit agreements: due to the greater number of possible financial intermediaries in the distribution and circulation of certificates, the circle of potential investors is expanding; thanks to the secondary market, the certificate can be sold ahead of time by the owner to another person with some income for the time of storage and without changing the volume of the bank's resources, while early withdrawal by the owner of a term deposit means a loss of income for him, and for the bank the loss of part of the resources .

The disadvantages of certificates are: the increased costs of the bank associated with the issue of certificates, as well as the fact that income from them is subject to taxation, in contrast to demand accounts and time deposits. The latter feature is taken into account by banks, so the interest on certificates is usually higher than the interest on term deposits with similar terms and amounts.

So, drawing a conclusion from the above theoretical material, we can say that for commercial banks, deposits are the main and at the same time the most profitable type of resources. An increase in the share of this element in the resource base makes it possible to place a larger volume of attracted funds, thereby increasing the bank's liquidity.

The intensification of competition between banks and other financial structures for deposits of individuals and legal entities has led to the emergence of a huge variety of deposits, their prices and service methods. According to some foreign experts, there are currently more than 30 types of bank deposits in developed countries. At the same time, each of them has its own characteristics, which allows customers to choose the most appropriate and possible form of saving money and paying for goods and services that suits their interests.

It can be seen from the above that deposits among the attracted funds of the bank are an important source of resources. However, such a source of formation of banking resources as deposits also has some disadvantages. First of all, we are talking about the significant material and monetary costs of the bank when attracting funds to deposits, the limited availability of funds within a particular region. Nevertheless, the competition between banks in the market of credit resources forces them to take measures to develop services that help attract deposits.

1.3 Analysis of the Russian market of deposit services

The process of forming a deposit policy is closely interconnected with the bank's interest rate policy, since the deposit interest is an effective tool in the field of attracting resources. At the time of state regulation, the marginal rates of interest were established by law in accordance with the maturity of the deposit. Currently, banks can independently set competitive interest rates based on the discount rate of the Central Bank of the Russian Federation (10.00% since September 30, 2009), as well as the state of the money market and based on their own deposit policy.

A feature of the household deposit market is the significant influence of interest rate levels on the formation of demand for deposits - that is, the interest rates on deposits set by banks largely determine the growth rate of their resource base. Moreover, for different groups of banks, this influence manifests itself to varying degrees. Such heterogeneity of the market can lead to a significant redistribution of market shares among banks, which may be accompanied by the emergence of new major players. Let's try to understand these processes.

An analysis of the cost of banking resources indicates that Russian credit institutions are actively using the factor of manipulating interest rates in their deposit policy in order to ensure the influx of new depositors. Of course, the level of interest rates is not the only factor that determines fluctuations in the deposit base, but from a practical point of view, the task of determining the impact of the cost of deposits on fluctuations in the client base "ceteris paribus" is very relevant.

The increase in deposit rates leads to an increase in the growth rate of the total deposit base of the bank. For example, if in 2006 the average level of interest rates in commercial banks was approximately 10% (at the same time, there was an increase in bank deposits at a rate equivalent to 40% per annum), then the deviation of the rates of attraction by banks to 11% on average provided them with an increase in the growth rate of deposits up to 50 %.

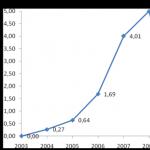

The dynamics of attracted deposits of the population in the banking system, from 2006 to the second half of 2008, had a positive trend. This was due to the growth in household incomes and an increase in the level of confidence in the banking system (Figure 8). Currently, the growth in the volume of attracted funds has slowed down due to the financial crisis. The highest rates in the market of bank deposits of individuals are demonstrated by credit institutions from the “other” group. These medium-sized banks are the most active in attracting new customers, and the size of interest payments becomes the main argument available to them when attracting new depositors (the reliability of these credit institutions is still not capable of significantly influencing their deposit policy by itself).

Figure 8. Dynamics of household deposits for the period (2006-2008)

The deposit insurance system that has appeared in Russia, in addition to obvious advantages, can also bring certain dangers - in the opinion of the population, there is a gradual smoothing in risk assessments of various banks that differ in real levels of financial stability. As a result, it is for these banks that the price factor is the main tool in the competitive struggle. It is no coincidence that in this group of banks the demand for deposits is most sensitive to changes in interest rates. And this explains the highest growth rates of household deposits in this group of banks.

The cost of the corresponding resources in the group of the largest Russian private banks slightly exceeds the levels of the cost of deposits in commercial banks. This group initially enjoyed higher trust among the population (compared to banks from the “junior” groups), which allowed them to provide a moderate cost of attracting deposits for quite a long time. However, in recent years, the competitive advantages of this group of banks have been declining in the eyes of the population, which, on the one hand, is explained by the emergence of a deposit insurance system, and, on the other hand, by the experience of the banking crisis in the summer of 2004, when several largest Russian banks were on the verge of losing solvency. As a result, the status of large banks is gradually leveling off in relation to smaller credit institutions. And, as a result, the price factor, as well as for banks from the "other" group, plays a significant role here - sensitivity to changes in interest rates. At the same time, high sensitivity combined with rather high rates does not guarantee them the same growth rates of their deposit base. This is due to the special "disloyalty" of their clientele, which, reasonably not seeing a significant difference in risks, preferred to transfer deposits to smaller credit institutions offering obviously higher interest rates.

The most significant is the cost of resources of the group of banks with the participation of foreign capital. Their deposit policy is based on high credit ratings of parent structures, which are unattainable for Russian commercial banks. This factor allows banks with the participation of foreign capital to attract funds from the population at low rates rather cheaply. At the same time, since the spring of 2005, the group of banks with foreign capital remains the only category of banks consistently increasing the cost of deposits. This effect appears to be due to two factors.

First, initially, the main clientele of banks with foreign capital were wealthy segments of the population, who value reliability in bank deposits and are ready to put up with low interest rates. However, a deliberately small group of depositors today can no longer provide a significant increase in the volume of attraction. This means that banks are forced to pay attention to other potential depositors who are more focused on earning interest income. Fortunately, the current low levels of deposit rates of banks with foreign capital allow them to be increased without a significant reduction in bank margins.

Secondly, the recent rise in the cost of borrowing in foreign markets has made the Russian deposit market really interesting for banks with foreign capital, and they are ready to actively fight for a place on it, especially in the current financial crisis.

If until recently the sensitivity of the growth rates of deposits for banks with the participation of foreign capital to the value of deposits was actually absent, now we can already state their readiness to attract new depositors.

If you look at the dynamics of foreign currency and ruble deposits, you can see that over the past five years, the growth rate of deposits of individuals in rubles has almost constantly outpaced the growth rate of foreign currency deposits, which was caused by the decline in popularity of the dollar.

Figure 9 Growth rates of ruble and foreign currency deposits

As of July 1, 2008, foreign currency deposits accounted for 13.6% of the total volume of deposits. Today, according to the Bank of Russia, the volume of foreign currency deposits is about 30% of the total.

Speaking about interest rates, the following should be noted: for certain types of deposit accounts, the amount of income is determined by the term of the deposit, the amount, the specifics of the operation of the account, the volume and nature of related services, and depends on the client's compliance with the conditions of the deposit.

The system of interest rates on deposits should be oriented to market conditions, with the indispensable consideration of the emerging hierarchy of reliability of comparable instruments. Thus, a bank that keeps rates at a lower level than competitors close to it in terms of reliability risks losing part of its clientele.

The accrual of interest on deposits by the bank is the main part of operating expenses. Therefore, the bank, on the one hand, is not interested in a high level of interest rates, and on the other hand, it is forced to maintain such a level of interest rates on deposits that would be attractive to customers. Trying to attract deposits, especially of large size and for a long period, commercial banks offer high interest rates to their customers, despite the growth in interest costs. However, the attraction of funds from the population by banks is not unlimited. As of January 01, 2009 the average interest rate on attracted funds is 12% per annum (according to the statistics of the Central Bank). If we trace the dynamics of % rates in commercial banks of the North-West over the past 3 years, we can conclude that the average interest rate on deposits increased by approximately + - (3-4)%. Interest rates on deposits have changed especially noticeably in the context of the crisis that has developed in the world. Only for the 1st quarter of 2009 they increased by approximately (3-5)% in almost all commercial banks.

Chapter 2 Deposit policy of a commercial bank (on the example of JSC "Bank" Petrovsky ")

2.1 Place of JSC "Bank" Petrovsky "in the market of banking services

Before analyzing a specific area of activity of any subject of the economy, it is necessary to give a brief description of it.

Bank Petrovsky was registered by the Central Bank of the RSFSR on November 12, 1990. In 1991, the first 5 branches in St. Petersburg, as well as the first out-of-town office, began work.

In 1992, a cooperation agreement was signed between the Bank and the Department of the Federal Postal Service. As early as next year, together with the Federal Penitentiary Service and the St. Petersburg branch of the Pension Fund of the Russian Federation, Petrovsky began introducing a technology for paying pensions from current pension accounts at the city's post offices. In 1997, "Petrovsky" began to introduce its pension technology in the Leningrad region.

In 1997, the Bank received the status of an authorized Bank of the Government of the Russian Federation category "C", as well as an authorized Bank of the Government of the Leningrad Region.

In 2000, the management of the Bank decided to rename the Bank into OJSC "Petrovsky People's Bank".

In 2002, due to the change of the Bank's shareholders, Petrovsky Narodny Bank was renamed into MDM-Bank St. Petersburg.

In May 2006, the controlling stake in the Bank was acquired by East European Financial Corporation. In accordance with the decision of the general meeting of shareholders of the Bank, a new name of the Bank was approved: Open Joint Stock Company "Bank of the Eastern European Financial Corporation" (abbreviated name - JSC "VEFK Bank").

On October 29, 2008, the Deposit Insurance Agency (DIA), based on the requirements of the Federal Law “On additional measures to strengthen the stability of the banking system in the period up to December 31, 2011”, assumed the functions of an interim administration to manage the EEFC Bank. In February 2009, agreements were reached on the participation of NOMOS-BANK and FC OTKRITIE as co-investors in the capital of VEFK Bank.

As part of the Bank's financial recovery measures, investors represented by NOMOS-BANK and OTKRITIE Financial Corporation bought back 25% of the additional issue of VEFC Bank shares. The remaining 50% of the additional issue was purchased by DIA.

In September 2009, the Bank returned to its original name - Petrovsky Bank.

JSC "Bank" Petrovsky "provides a wide range of services for both legal entities and individuals. The bank offers private individuals such services as deposits in rubles and foreign currency, money transfers, payment of pensions, transfers from ruble and foreign currency accounts, safe deposit, cash transactions, opening and maintenance of plastic cards. The list of services for organizations is quite extensive. Let's name those that are most popular: lending, opening and maintaining ruble and foreign currency accounts, payroll projects.

The priority direction of activity of Bank Petrovsky OJSC is work with the population in the area of attracting deposits. Depositors of Bank Petrovsky OJSC can choose the most convenient scheme for saving and increasing their savings. The Bank offers its customers a flexible system of deposits in rubles and foreign currency for a period of 1 month to 3 years; various types of deposits, allowing you to choose a deposit that meets the needs of the client. JSC Bank Petrovsky issues its own international plastic cards VISA INTERNATIONAL and MASTER CARD INTERNATIONAL . JSC "Bank" Petrovsky "has an extensive correspondent network, consisting of major banks in Russia and the CIS. Bank Petrovsky OJSC has a widely branched (second largest after Sberbank) branch network - 170 branches in St. Petersburg and branches in Russian cities. Purposeful work to improve banking services and expand their range has become the basis for a significant increase in the number of clients of Bank Petrovsky OJSC.

The change of shareholders and top management of VEFC Bank, which took place at the end of April 2009, as well as the Bank's obtaining the status of a credit institution with state participation in the capital, had a positive impact on the attitude towards the Bank on the part of private individuals. reverse the downward trend in the main indicators characterizing the volume of operations for servicing individuals, observed in the previous period. see Figure 10. At the same time, the volume of term deposits grew by 6.6%, balances on pension accounts in the Bank's additional offices - by 15.5%, balances on bank card accounts - by 14.1%.

Figure 10 Dynamics of deposits of individuals for the period from 10.08-09.2009

The bank's average monthly income from transactions with individuals (money transfers, utility bills, safe deposit, etc.) also increased significantly. If, for comparison, in February-March this year. they averaged 7.5 million rubles, then in June the Bank's income increased to 8.3 million, in July - to 8.6 million.

The number of money transfers carried out by the Bank, which, for example, in the spring of this year, was 15-16 thousand units per week, has now reached 20 thousand.

Separately, I would like to note a serious increase in the balances on the accounts of pensioners who receive pensions directly at the offices of Bank Petrovsky OJSC. As you know, pensioners who receive a pension at the Bank can be served both in post offices and in additional offices of the Bank. At the same time, the list of services provided to this category of clients in additional offices is wider than in post offices. This fact is also understood by the pensioners themselves, as of July 2009 the bank serves about 1.2 million pensioners. The balances on the accounts of pensioners for the first half of the year increased by 1 billion rubles (53%).

Speaking about legal entities, it should be noted that since May 2009, account balances have increased by 20% - up to 7.5 billion rubles. If at the beginning of the year corporate clients opened about 150 accounts per week in Bank Petrovsky OJSC, then by the end of September 2009, 250-270 new accounts are opened per week. The total number of accounts of legal entities is now 67 thousand units.

According to Expert magazine, Bank Petrovsky is ranked 41st in the rating of 100 largest banks in Russia in 2008 as of 01.01.2009. The Bank is among the 30 leading banks in attracting deposits from individuals in 2008 at number 26

2.2 Types of deposits of Bank Petrovsky OJSC

Household deposits are of great importance in the resource base of Bank Petrovsky OJSC. Thus, as of September 1, 2009, household deposits amounted to 80.0% of the total resources. This is quite natural, since Petrovsky constantly pays special attention to the deposits of the population.

Consider the current as of 01.09.2009. types of deposits and conditions for them. They can be divided into three main groups: term deposits, pension deposits and demand deposits.

Table No. 1 Types of deposits as of 01.10.2009

| Types of deposits | Deposit term, prolongation | The amount of the down payment and additional contributions | Note | Annual % |

| Poste restante | any | At least 10 rubles. Add. Contributions are unlimited | 0,15 | |

| Autumn |

over 1 year up to 3 years |

From 1000 rubles From 100 dollars From 100 euros |

4.35-14.70 | |

| Autumn-retirement |

over 1 year up to 3 years |

From 1000 rubles From 100 dollars From 100 euros |

Add. contributions / payments capitalization, prolongation are not provided | 4.55-14.90 |

| Petrovsky-classic |

over 1 year up to 3 years |

From 1000 rubles From 100 dollars From 100 euros. |

4.10-14.70 | |

| Petrovsky-classic with a monthly payment of % |

over 1 year up to 3 years |

From 1000 rubles From 100 dollars From 100 euros |

Add. contributions / payments are not provided. % payment monthly |

3.10-13.70 |

| Petrovsky-cumulative |

over 1 year up to 3 years |

From 1000 rubles From 300 dollars From 300 euros Contributions from 500 rubles, 50 dollars, euros |

Add. capitalization payments are not provided | 5.10-13.70 |

| Petrovsky-compound interest |

over 1 year up to 3 years |

From 1000 rubles From 100 dollars From 100 euros |

Add. contributions / payments, not provided | 3.60-14.20 |

| Petrovsky-multicurrency |

over 1 year up to 3 years |

From 30000 rub From 1000 dollars From 1000 euros Contributions are unlimited |

Add. capitalization payments, prolongation are not provided | 6.35-13.70 |

| Petrovsky-universal |

over 1 year up to 3 years |

From 10000 rub From 300 dollars From 300 euros Contributions from 1000 rubles, 50 dollars, euros |

capitalization is not provided | 4.60-13.95 |

| Petrovsky-VIP |

over 1 year up to 3 years |

From 300000 rub From 10000 dollars From 10000 euros |

Add. contributions / payments capitalization, not provided | 5.55-15.20 |

| Pension savings deposit | 2 years |

Contributions are unlimited |

No extension provided | 12.50 |

| Pensioner's current account | any | 5-7 |

Table No. 1 shows that the most expensive deposits for individual clients are the deposits of Autumn-pension, Autumn, Petrovsky-classic and Petrovsky-VIP. This is due to the conditions of these types of deposits, namely the absence of monthly capitalization of interest, or a large amount of the deposit, as, for example, in Petrovsky-VIP.

It can be seen that a special place in the line of deposits is occupied by deposits aimed at pensioners. Thus, we can conclude that Bank Petrovsky OJSC offers a wide range of deposits that are aimed at various market segments. At the same time, special attention is paid to pensioners, for whom a line of deposits is provided that allows them to take into account their interests. A special allocation of deposits for pensioners is due to the fact that they are an important segment of depositors for Bank Petrovsky OJSC.

If we consider the additional conditions for deposits, given for each deposit separately in Appendix No. 1, we can trace the following trend in the use of such a criterion as prolongation. If there is a prolongation of the deposit in the terms of the agreement, then there is a significantly lower interest rate than for deposits without prolongation.

Analyzing the contributions (deposits) of JSC Bank Petrovsky, you can pay attention to the following:

when setting interest rates, the bank always ties deposits (deposits) to the investment period. So, for example, the interest rate of the “On demand” deposit is 0.15%, and the interest rate of the “Pension savings deposit” for 2 years is 12.5%;

the deposit amount is also tied to the interest rate. So, for example, the Petrovsky-accumulative deposit for 1 year and 1 day) in the amount of 1 to 700 tr. accepted at 13.25% per annum, and the same deposits in the amount of 700 tr. and above already under 13.70%;

the interest rate on ruble deposits is not lower than the inflation rate, which saves deposits from depreciation;

proceeding from the fact that income in the form of interest received by taxpayers on deposits in banks is not subject to taxation if:

interest on ruble deposits is paid within the amounts calculated based on the current refinancing rate of the Bank of Russia (10%), increased by five percentage points ,

the established rate does not exceed 9 percent per annum for deposits in foreign currency;

it can be noted that all the proposed deposits are not subject to taxation (the exception is Petrovsky - VIP).

For legal entities Bank Petrovsky OJSC offers its clients various options for placing temporarily free funds for various periods:

· term deposits in Russian rubles and foreign currency;

· Promissory notes of Bank "Petrovsky" in Russian rubles and foreign currency.

The Bank offers legal entities a medium-term financial instrument - a bank deposit.

The deposit agreement certifies the amount of the deposit made to the Bank and the depositor's right to receive, after the expiration of the established period, the amount of the deposit and the interest stipulated in the agreement. Payment of interest on the deposit is made monthly or lump sum after the expiration of the contract. A fixed interest rate is set for the entire term of the deposit. The Bank cannot unilaterally reduce or increase the interest rate stipulated in the agreement. Interest rates are set depending on the terms of placement of funds. Accordingly, the rate depends on the amount and term of the deposit. If the depositor demands the return of the deposit amount before the expiration of the contract, interest is paid at a rate of 0.01% per annum.

2.3 Analysis of the deposit portfolio

The main goal of the deposit policy of Bank Petrovsky OJSC is to attract the optimal amount of funds (by terms and currencies) necessary and sufficient to operate in the financial markets, provided that the minimum level of costs is ensured.

Attracting resources is carried out in the course of specific operations provided for by the current banking licenses. At the same time, the main instruments used by Bank Petrovsky OJSC to attract resources are:

o opening and maintaining accounts of legal entities and individuals, involving the receipt of funds on these accounts;

o opening and maintaining accounts of other banks, involving the receipt of funds into these accounts.

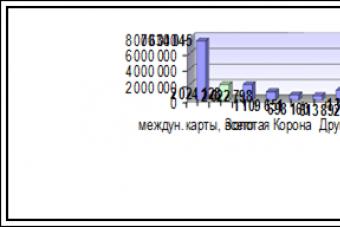

The list of instruments for raising funds can be expanded in the course of further banking activities. In the course of conducting deposit operations, the Bank's divisions are guided by the legislation of the Russian Federation, the regulations of the Central Bank of the Russian Federation, the Charter of the Bank, this Document and internal documents regulating the technical procedure and conditions for conducting specific types of banking operations. If we trace the dynamics over several years, we can note a steady increase in the balances on the accounts of legal entities (Figure 11):

Figure 11 Dynamics of account balances of legal entities of Bank Petrovsky OJSC

We will analyze the deposits of individuals using table No. 2:

Analysis of the deposit portfolio of JSC "Bank" Petrovsky "in 2008 (according to the maturity of investments)

| No. p / p | Name of the article of the PDS | Balance account | The value of MPS, thous. rub. | PDS structure, in % | Changes over the period (+/-) | |||

| on 1.01.0 8 G. | on 1.01.0 9 G. | on 1.01.0 8 G. | on 1.01.0 9 G. | in thousand rubles | V% | |||

Deposits (D), total including: |

Σ item 1 - 7 | 19270123.00 | 18033769.00 | 100.00 | 100.00 | -7% | ||

| I. | Demand deposits (Dvostr), total | 410-423(01), 42309, 425-426 (01), 42609 | 290832.00 | 1 | 2 | 40013 | 15.9 | |

| II. | Term deposits (Ds), total | 17742937.00 | 99 | 98 | -6.8 | |||

| 1. | for up to 30 days | 410-423(02), 42310, 425-426 (02), 42610 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2. | for a period of 30-90 days | 410-423 (03), 42311, 425-426 (03), 42611 | 445687 | 1109708 | 2 | 6 | 148 | |

| 3. | for a period of 91-180 days | 410-423(04), 42312, 425-426 (04), 42612 | 2247860 | 3590845 | 12 | 20 | 1342985 | 59.7 |

| 4. | for a period of 181 days to 1 year | 410-423(05), 42313, 425-426 (05), 42613 | 5946184 | 5155936 | 31 | 29 | -790248 | -13.3 |

| 5. | for a period of 1 to 3 years | 410-423(06), 42314, 425-426 (06), 42614 | 10379573 | 7886448 | 54 | 43 | -2493125 | -24.1 |

| 6. | for a period of more than 3 years | 410-423(07), 42315, 425-426 (07), 42615 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Such an analysis makes it possible to identify the features of the bank's deposit policy and to determine in general the approximate terms for placing the bank's resources. In particular, the results of the analysis allow us to draw a conclusion about the attraction of resources in terms of their cost (“expensive” / “cheap”): time deposits are much more expensive than balances on demand accounts.

Additionally, to formulate the final conclusion on the analysis of deposits by maturity, it is advisable to calculate the following indicators:

The coefficient of urgency of the structure of deposits (d in D):

d in D = Ds/D, where Ds is the volume of time deposits; D is the total volume of deposits.

As of 01.01.2008 98%

As of 01.01.2009 98%

A high rate of maturity of the structure of deposits characterizes the degree of constancy and stability of the resource base.

In general, the growth in the share of term deposits in the total amount of bank deposits should be assessed positively, because. time deposits as the most stable component of the deposit portfolio provides at an acceptable level and allows to increase the bank's liquidity and conduct operations for the placement of resources for longer periods.

The share of term deposits (Ds) in the total amount of liabilities (P): d = Ds/P.

As of 01.01.2008 38.5%

As of 01.01.2009 21.4%

Commitment Structure Ratio (KSO): KSO = Dvostr./Ds.

As of 01.01.2008 1.3%

As of 01.01.2009 0.1%

The indicator characterizes the stability of the bank's financial resources. The lower the value of the indicator, the lower the relative need of the bank for liquid assets, due to the structure of liabilities.

Figure 12 shows that the largest volume of attracted funds falls on deposits with a term of more than 181 days and more than a year.

Figure 12 Structure of deposits of JSC "Bank "Petrovsky" by terms as of 01.01.2009

Starting from 2005 JSC Bank Petrovsky has been steadily increasing its deposit portfolio, as can be seen in Figure 13.

Figure 13 Dynamics of balances on accounts of individuals

The banking crisis of October 2008 shook the stability of the bank, but today everything has stabilized

2.4 Organization of the formation and implementation of the deposit policy

The deposit policy of JSC Bank Petrovsky is closely connected with the credit and interest rate policy of the bank, being one of the elements of the banking policy as a whole.

The deposit policy is formed with the allocation of the following

Setting goals and defining objectives of the deposit policy;