Rakhimova Regina

Download:

Preview:

The main comprehensive school in the village of Syyryshbashevo -

branch of the Municipal budgetary educational institution

middle school c. Tuzlukushevo

municipal district Chekmagushevsky district of the Republic of Bashkortostan

Research competition within the framework of

Small academy of sciences for schoolchildren

Topic: What is money and

why do they need a person?

(nomination "Economics and Entrepreneurship")

Performed:

Rakhimova Regina, 7th grade student

OOSH c. Syryshbashevo -

Head:

Shaibakova Guzalia Talgatovna,

social studies teacher

branch of MBOU secondary school c. Tuzlukushevo MR Chekmagushevsky district of the Republic of Belarus

Chekmagush, 2018

Contents:

Introduction……………………………………………………………..……….3

- The emergence of money…………………………………………………….5

2. Russian money………………………………………………….…………8

3. Investigation of the reason for the need for reasonable treatment

with money…………………………………………………………………..11

Conclusion………………………………….………………………….…..14

References………………………………………………….…….15

INTRODUCTION

Ever since mankind invented money, they have played a very important role in life and society and each person individually. Money is an integral and essential part of the financial system of every country. And no matter how we call them - rubles, dollars, euros, they serve as a means of payment, a means of storing value and a unit of account in all but the most basic economic systems.

The relevance of research.We hear the expression "no money" all the time. There is not enough money for everyone. And not only for those who have a small salary, but also for those who have a large one. Why is this happening? Probably because many people simply do not know how to count their money, do not know how much they need to live until the next salary, and do not know how to spend correctly so that there is no constant overspending.

Object of study: economy.

Subject of study: money.

Hypothesis: if we find out why people need money, then we can manage it wisely.

Research methods:analysis of the necessary information, observation, questioning, comparison.

Target of our research: to study the history of metal and paper money, to form a conscious attitude of children and adults to the reasonable handling of money.

We have placed before us tasks :

- Learn about the history of money creation.

2. Analyze the knowledge gained during the study.

3. Make a conclusion about the need for a reasonable use of money.

Ways to solve these problems:

- Using literature to study the history of the origin of money.

- Find out what a family budget is.

- Study the family budget, its revenue and expenditure parts.

- Study the prices of the same food in different stores.

Expected results:

- THE ORIGIN OF MONEY.

The history of money begins from those ancient times when people had to change one thing for another in order to get what they needed. If they needed an ax, they would find someone who had one and exchange it for something the owner needed. The same thing is happening today, only with the difference that today we give the seller money in exchange for what we want, although the exchange of goods for goods has been preserved to this day. Today there are types of money: the ruble - RUB, the official currency of Russia ( R ), dollar - USD, the official currency of the USA and El Salvador ($), euro - EUR - the official currency of the European Union (€) and others.

What is the origin of the word "money"? According to the most common version, the Russian word "dengi" ("money") comes from the Turkic "tenge" or "denge". At present, tenge is a monetary unit in Kazakhstan, as well as a bargaining chip in Turkmenistan.

In the beginning there was barter

The living conditions of our ancestors were such that food, clothing and shelter were obtained by hard work. Rarely was something superfluous produced that could be traded. But over time, the main occupations of people - hunting and gathering, were replaced by more efficient ones - agriculture and livestock breeding: from time to time, surpluses of one or another product began to appear. A tribe that had a surplus of animal skins but was short of grain could trade with another tribe that had a surplus. This is how barter was born.

With the development of human society, barter flourished. The most famous example is the deal of Peter Minota in 1626: for beads and trinkets, worth $ 24, Minota received an island in Manhattan. In 1993, this island was valued at $50.4 billion.

In Rome, soldiers were often paid with bags of salt (the word "salary" came from there) because there was little salt and it was necessary for the preservation of products.

Barter in Russia went through the same stages in its development as in other countries. In the northern regions, the skins of martens, sables, squirrels, and foxes served as “commodity” money. The name of the ancient Russian monetary unit "kuna" takes its origin from the fur of the marten.

The emergence of money

The development of trade forced sellers and buyers to agree on a system that would be the ideal solution to the problem of commodity exchange. Money appeared, setting the price of goods. Over time, the term currency appeared. It was not always the money familiar to us - coins and banknotes. History knows examples when one of the forms of currency was a cow. Different countries had completely different, sometimes even unexpected forms of currency: stone money in Iceland, elephant wool in Africa, ivory in Fiji, tobacco in the Solomon Islands, tea briquettes in Siberia, etc.

Metal money

Over time, goods stood out that were easily exchanged. These were furs, precious stones, grain, salt, furniture, utensils, clothing, precious metals, etc. It was from precious metals (gold and silver) that the first coins began to be minted.

It is believed that the first coins appeared in 687 BC, in Lydia, today the Asian part of Turkey, and Croesus was the first Lydian king to mint gold coins. Lydian coins minted from electrum- varieties of native gold, with a high content of silver.

At first they circulated in the form of ingots, and then, the ingots began to be branded, - this is how coins appeared - metal plates with a pattern. To confirm the established weight of the pieces of metal, a pattern was stamped on them. The minted drawing played the role of a seal, or brand, with which the ruler guaranteed the accuracy of the weight of the coin. Coins spread rapidly in the Hellenic world. The experience of making coins was successful and soon spread to Europe.

The coins were expensive, and most importantly, comfortable and durable. They could not die or deteriorate on the way to the market, they easily fit in the palm of your hand or in a purse. In addition, the use of coins made it possible to pay by the piece (count), rather than weigh them.

Only half a century has passed, and coins have already begun to be produced in droves. By this time, regardless of European civilization, coinage was also invented in Ancient China. Their coins were created in an original way of casting, they had square holes in the middle, which made it possible to put them on a cord for easy storage.

In Russia, coins appeared in the 10th century, they were minted from silver (previously, money minted in other countries was used). The "silver coins" of the Russian prince Vladimir have been preserved. On one side, the prince is depicted sitting on a throne (“table”), and on the other, a family sign. The inscription on the coin reads: "Volodymyr is on the table, and all is his silver."

In order to have small, change money, coins were often cut into two or four pieces and paid with them.

paper money

Paper money - banknotes - can be of different sizes, colors and denominations. But their value lies in the economic strength of the country that produces them.

Despite the fact that the receipts of the Babylonians, dated 2500 BC, are recognized as the oldest paper money. BC, the oldest banknotes (judging by the remains found) could have been printed in China. In 1273, Kubla Khan issued notes made of crimson bark and marked with his seal and the treasurer's signature. Kwan is the oldest surviving paper money.

The first European bank note - a banknote - was printed in Sweden in 1661. And the first paper money of the British Empire was in the form of promising notes. They were issued to Massachusetts soldiers in 1690, during the unsuccessful siege of the city of Quebec, when no trophies were obtained for payment. The idea became popular with other colonists, and the soldiers were not the only ones who were paid in this way.

- MONEY OF RUSSIA

First money

On our territory, the minting of coins, silver and gold, dates back to the time of Prince Vladimir the First (Kievan Rus, the end of the 10th - the beginning of the 11th centuries). In the 12th and 13th centuries, Russian coins disappeared from circulation. Kievan Rus broke up into separate principalities, and the minting of a single coin for all ceased. Historians call this time the coinless period.

In the XII - XV centuries. the princes tried to mint their own “specific” coins. In Novgorod, foreign money was in circulation - "Efimki". In the Principality of Moscow, the initiative to mint silver coins belonged to Dmitry Donskoy (XIV century), who began to melt Tatar silver “money” into Russian “hryvnias”. Ivan III (end of the 15th century) established that the right to mint coins should belong only to the “senior” of the princes, the holder of the Moscow throne. In 1534, during the reign of Elena Glinskaya - the mother of Ivan the Terrible - a single monetary system was created for the entire Russian state. A horseman with a sword was depicted on a small silver coin - the coins were called sword coins. On bigger money, they minted a rider armed with a spear. Under Ivan the Terrible, the first streamlining of the Russian monetary system took place.

Under Peter I, the issue of a gold coin began. In the 18th century, the most common gold coin was the chervonets. Gold and silver became the basis of money circulation. Bimetallism persisted until the end of the 19th century.

Ingots of silver - hryvnia began to serve as money. They weighed 170 - 200 g and were rectangular or hexagonal in shape. The purchasing power of the hryvnia was very high. For one hryvnia they gave 200 squirrel skins.

A solid hryvnia has not always been convenient for settlements with small trading operations. A smaller “coin” was needed, and hryvnias began to be cut in half. So they were born"rubles".

Such coins began to be called spear - hence the word came"penny".

Paper money in Russia

The first Russian paper money appeared in 1769 under Catherine I. They were called banknotes and circulated in the form of state treasury bills.

The first issue (issue) included 10,000 banknotes with a denomination of 25 rubles, 5000 at 50, 3333 at 75 and 2500 at 100 rubles. Offices and colleges received the right to use them "for expenses along with money ...".

Paper for new money was made by the Krasnoselskaya factory under the supervision of executors sent from St. Petersburg. To protect banknotes from forgery, firstly, watermarks served, secondly, authentic signatures of officials and, thirdly, relief embossed images placed inside two vertical ovals in the center of the banknote.

At first, paper money was very popular among the population: according to a contemporary, they were accepted even more willingly than silver and copper. Indeed, the advantages of "papers", especially in transfers and transportation, are undeniable.

By the beginning of the 20th century money printing technology flourished. As a result of many years of creative searches, an image of the “Russian currency” was found with a predominance of not a virtuoso technical, but an aesthetic beginning. Artistic excellence not only testified to the high prestige of the ruble, but also served as its best defense. Indeed, even the most virtuoso master could not accurately reproduce the individual manner of the author of portraits of Catherine II and Peter the Great on 100- and 500-ruble banknotes. The opinions of experts agree that these banknotes of the beginning of the 20th century are among the best achievements in the history of currencies.

The beginning of the 20th century was difficult for our state. Two revolutions completely changed the life of the state. These same revolutions left a noticeable mark in the history of the ruble. The collapse of the monarchy required a new symbolism. The crown “fell off” from the double-headed eagle, and next to it appeared the image of a half-naked woman - a symbol of freedom, traditional for European art.

After the reforms of 1922-1923 for the first time, images of figures appeared on the Soviet ruble - their author was the sculptor I. Shadr.

After the Great Patriotic War, the ideological canon changed. On the new banknotes of large denominations, Vladimir Ilyich Lenin was depicted, with whom the image of the Moscow Kremlin was adjacent. And what is striking - in style, the 1947 monetary series reproduced the later banknotes of the Russian Empire.

And, finally, the last pages of our history: the collapse of communism, the collapse of the USSR and a kaleidoscope of economic and other reforms. Over the past decades, there has been an avalanche-like issue of new banknotes - first Soviet, then Russian - of ever larger denominations. Hastily worked out in conditions of growing inflation, they disappeared just as quickly. But with each time, the protection of banknotes increased, became more complicated. And you can not ignore the latest banknotes of 2017 for 200 and 2000 rubles. Here the protection system is on a completely different level.

Paper money - banknotes and treasury bills - are required to be accepted as a means of payment in the territory of this state. Their value is determined only by the number of goods and services that can be bought with this money.

- RESEARCH OF THE REASON FOR THE REASONABLE HANDLING OF MONEY.

Functions of money.

Money is a medium of exchange. People receive money in return for the goods and services they provide; in the future, they can spend money on those goods and services that they need. Most often, people use the following functions of money: a measure of value, a means of circulation, a means of payment, a store of value, world money. The paper money we use is paper money, it is a substitute for real money.

For our study, we need to understand what a family budget is.

Family budget - the ratio of income and expenses for a week, month or year, characterizes her well-being, the degree of prosperity. In the Russian Federation, the total monetary income of a family is formed by: wages, material assistance, lump-sum allowances and other payments subject to taxation; all types of pensions and compensations to them; scholarships for students and students of educational institutions; monthly allowances for children, as well as allowances for child care; the cost of natural products of subsidiary farming used for personal consumption; income from property, interest from deposits in banks, stocks and other securities. The expenditure part of the seed budget consists of cash expenditures for paying taxes and making various contributions, for the purchase of short-term and durable goods, as well as payment for services and savings.

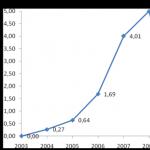

With my parents at home, we analyzed our family budget, determined its revenue and expenditure parts. The income part will be considered as 100 points. Having carefully studied the expenditure part, we designed it in the form of a diagram.(Annex 2)

According to the results of the work carried out, it was established that the family can only spend the amount that its members have earned. Parents spend most of the money they earn on food, buying clothes and paying utility bills. You should always keep this in mind when you want to ask your parents for money for entertainment.

Money should be spent wisely, soberly assessing your financial capabilities and needs. Savings allows you to reduce unnecessary costs and spend money on more necessary things.

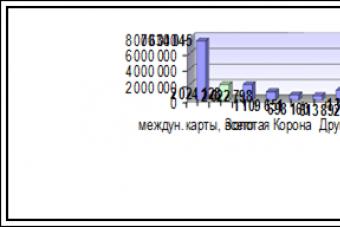

Research prices for some products in stores.Using the method of observation and survey, we decided to find out how the prices for selected products differ in different stores. We visited the following stores: Pyaterochka, Magnit, Milyash and Beryozka.

The results of the observation were presented in the form of a table. As a result of the study, it was found that the same products in different stores cost differently. (Annex 3)

Having studied the prices in different stores, we came to the conclusion that when going to the store for a purchase, you need to remember that the price of goods in all stores is different. In order to save money earned, you need to find a better place to buy. Based on the study, we conclude that it is more profitable for the buyer to purchase products in supermarkets. In large stores, in supermarkets, you can always find goods at a lower price than in small private shops. You also need to pay for various promotions that are often held in supermarkets.

Research on the topic: "Desired and Necessary".

Having studied the prices of various goods, we decided to find out what goods can be bought for 200 rubles. On the instructions of the teacher, I made a list of goods that I would like to buy, found out their exact cost in the store. Then I tried to check what useful products could be bought with this money. (Appendix 4).

In the first case, I was guided only by my desires, and in the second, both the interests of the family and our health would be taken into account.

There is a well-known folk wisdom “Buy not what you want, but what you need”. When you want to buy or ask your parents what you want, do not forget that your whim can cost the same as a necessary thing for the family.

CONCLUSION

In the course of the study, we planned to find out what money is, the history of its occurrence and why a person needs it, to substantiate the reason for the need for a reasonable handling of money. Using various research methods, we have achieved our goal.

Money is metal and paper signs, which is a measure of value in the purchase and sale. At different times, shells and axes, golden fleece and furs, salt, neck jewelry - beads, etc. were money. Then coins appeared from various metals. Further, there was a need for “doublers” of money, all kinds of tokens and coupons were used.

In the course of the study, establish that people need money so that they can first buy the main thing (food, clothing, hygiene items, basic necessities), pay for housing and communal and transport services, education, and only then additional (car, European-quality repair , an expensive toy, a new phone, etc.) You can live both poor and rich on the same money, so you need to be able to handle them correctly.

My family buys food in stores where the price is lower than in other stores. Therefore, we can spend the money we save as we see fit. The knowledge that I have acquired during my research will help me in my later adult life, planning my purchases and expenses, all this will save me time and money.

Literature:

- Mukhina E.A. People and money "On the role of money in world history" 2006

- "Lessons in Financial Well-being" (for children and their parents) Jane Pearl

- Children's encyclopedia "I know the world" Economics ""

- Campbell R. McConnell Stanley L. Brew "Economics" - M., 1992

- "Course of economic theory" edited by prof. Chepurina M.N., prof. Kiseleva E.A. - Kirov, "ACA", 1997

- Internet site materials:

Applications.

Annex 2.

The budget of the family of Rakhimova Regina

Appendix 3

Products | The shops |

|||

"Tabysh" / "Nakhodka" | "Magnet" | "Milash" | "Birch" |

|

Granulated sugar (1 kg) | 30 rub. | 30 rub. | 55 rub. | 48 rub. |

Salt (1 kg) | 7 rub. | 7 rub. | 13 rub. | 13 rub. |

Pasta (1 kg) | 25 rub. | 24 rub. | 48 rub. | 35 rub. |

Vegetable oil (1 l) | 50 rub. | 51 rub. | 70 rub. | 65 rub. |

Eggs (1 dec.) | 40 rub. | 40 rub. | 65 rub. | 60 rub. |

Rice (1 kg) | 31 rub. | 32 rub. | 65 rub. | 60 rub. |

Milk (1 l) | 37 rub. | 35 rub. | 55 rub. | 57 rub. |

Butter (200 g) | 50 rub. | 90 rub. | 60 rub. | 65 rub. |

Total: | 270 rub. | 309 rub. | 431 rub. | 388 rub. |

Appendix 4

Wishlist | Necessary |

||

Product | Price | Product | Price |

Cola | 85 rub. | Milk | 57 rub. |

Crackers | 10 rub. | Bread | 24 rub. |

Chips | 35 rub. | Butter pack | 60 rub. |

chocolate bar | 55 rub. | Salt | 13 rub. |

Macron noodles | 7 rub. | Tea | 46 rub. |

Candies | 8 rub. | ||

Total: | 200 rub. | Total: | 200 rub. |

Preview:

To use the preview of presentations, create a Google account (account) and sign in: https://accounts.google.com

Slides captions:

Research competition within the framework of the Small Academy of Sciences for schoolchildren "What is money and why does a person need it?" Completed by: Rakhimova Regina, a student of the 7th grade of the secondary school in the village of Syryshbashevo - a branch of the MBOU secondary school in the village of Tuzlukushevo MR Chekmagushevsky district of the Republic of Belarus .Syyryshbashevo - branch of the Municipal Budgetary Educational Institution Secondary School c. Tuzlukushevo municipal district Chekmagushevsky district of the Republic of Bashkortostan

Ever since mankind invented money, they have played a very important role in life and society and each person individually. Money is an integral and essential part of the financial system of every country.

Object of study: economics. Subject of research: money. Hypothesis: if we find out why people need money, then we can manage it wisely.

The purpose of the study: to study the history of metal and paper money, to form a conscious attitude of children and adults to the reasonable handling of money. Research objectives: To get acquainted with the history of the creation of money. Find out what a family budget is. Analyze the knowledge gained during the study. Make a conclusion about the need for a reasonable use of money.

The history of the emergence of money A long time ago, in the Stone Age, people did without money. Why did they need them? They received everything they needed for life from nature. After all, the main thing for a person would be food and housing. So there was a mutually beneficial exchange - barter. Why does a person do everything himself, isn’t it better to distribute duties and change one product for another that you cannot do yourself?

C deal of Peter Minota in 1626

Kuns In ancient Rus', kuns were in circulation - leather money. It was the skin of a marten, hence the name. Hryvnias In Kievan Rus, the minting of coins began under Prince Vladimir, but very soon ceased. The first coins of Rus' - hryvnia, a small oblong ingot of silver.

First coins Lydian coin of the 6th century BC. e. (rub, one-third stater) The first Chinese coins (circa 500 BC) were made of bronze in the form of tools and cowrie shells, which previously served as money.

The beginning of the production of coins in Russia At the end of the X century. in Kievan Rus begins minting their own coins of gold and silver. She was called zlatnik (zolotnik). On this ancient Russian coin with inscriptions in the Slavic language, Prince Vladimir Svyatoslavovich and the family coat of arms of the Rurikovich were depicted. The first silver coin in Rus' was srebrenik (silver coin). For the minting of silver coins, silver coins of the Arab states were used. Chasing took place in Kyiv itself, under Prince Vladimir. The inscription on the coins of Prince Vladimir (980 - 1015) read: "Vladimir is on the table, and behold his silver"

Paper money - conventional banknotes printed on special paper and having an exclusively forced exchange rate.

Paper money appeared in China in the 8th century AD. Initially, these were receipts that were issued for valuables deposited, or certificates of taxes paid.

On the authenticity of money Moiré pattern. An area that changes color from different angles. When the banknote is tilted, multi-colored iridescent stripes appear. First appeared on banknotes of the 2004 modification. Relief inscriptions. For visually impaired people, the banknote has special embossed marks. The inscription “Bank of Russia ticket” is also made in relief printing. Security thread. A "diving" metallized polymer strip is introduced into the paper. Separate sections of the security thread come to the surface of the paper and look like shiny rectangles that form a dotted line.

On the authenticity of money Watermarks. Located on the white fields of banknotes. When viewed against the light, both lighter and darker areas compared to the background should be visible. Color changing paint. The 500-ruble bill has the emblem of the Bank of Russia, the 1000-ruble bill has the emblem of Yaroslavl, the 5000-ruble bill has the emblem of the Bank of Russia and the coat of arms of Khabarovsk.

Each time, the protection of banknotes increased and became more complicated. And you can not ignore the latest banknotes of 2017 for 200 and 2000 rubles. Here the protection system is on a completely different level. Holographic objects have already appeared here, which can be seen using a special application on Android.

Functions of money Money is a medium of exchange. People receive money in return for the goods and services they provide; in the future, they can spend money on those goods and services that they need. Functions of money Measure of value Means of circulation World money Means of accumulation Means of payment

Investigation of the reasons for the reasonable handling of money Family budget - the ratio of income and expenses for a week, month or year, characterizes its well-being, the degree of prosperity.

Income of Regina Rakhimova's family

According to the results of the work carried out, it was established that the family can spend only the amount that its members have earned. Parents spend most of the money they earn on food, buying clothes and paying utility bills. Conclusion: money should be spent wisely, evaluating your capabilities and needs. Savings allows you to reduce unnecessary costs and spend money on the things you need most.

Study of prices for some products in the shops of the city Using the method of observation and survey, we determined how the prices for selected products differ in the shops of the district. After visiting the Tabysh, Magnit, Milyash, Beryozka stores, they put their observations in the form of a table. As a result of the study, it was found that the same products in different stores cost differently.

The cost of food in the shops of the area. Products Stores Tabysh/Nakhodka Magnit Milyash Birch Sugar (1 kg) 30 rub. 30 rub. 55 rub. 48 rub. Salt (1 kg) 7 rub. 7 rub. 13 rub. 13 rub. Pasta (1 kg) 25 rubles 24 rub. 48 rub. 35 rub. Vegetable oil (900 g) 50 rubles 51 rub. 70 rub. 65 rub. Eggs (1 dec.) 40 rubles 40 rub. 65 rub. 60 rub. Rice (1 kg) 31 rub. 32 rub. 65 rub. 60 rub. Milk (1 kg) 37 rubles 35 rub. 55 rub. 57 rub. Butter (200 g) 50 rubles 90 rub. 60 rub. 65 rub. Total: 270 rubles. 309 rub. 431 rub. 388 rub.

Conclusion: going to the store for a purchase, you must remember that the price in all stores is different. In order to save money, you need to find a better place to buy.

Research: Desirable and Necessary

Desired and necessary Desired Necessary Commodity Cost Commodity Cost Cola 85 rub. Milk 57 rub. Croutons 10 rubles Bread 24 rubles Chips 35 rub. A pack of butter 60 rubles. Chocolate 55 rub. Salt 13 rub. Macron noodles 7 rub. Tea 46 rub. Sweets 8 rub. Total: 200 rubles. Total: 200 rubles.

Conclusion In the course of the study, we planned to find out what money is and why a person needs it, justified the reason for the need for a reasonable handling of money. Using various research methods, we have achieved our goal. My family buys food in stores where the price is lower than in other stores. So after buying the necessary products with the money saved, I can treat myself a little and buy what I desire. The research that we did taught me a lot, I began to be more careful about the money that my parents earn.

Probably, each of us at least once asked such a simple, but at the same time very important question: "What do we need money for?". The answer will be provided in the article.

What is money?

Money is called a kind of commodity, which, in fact, is a general and universal equivalent of the cost of many other goods or services. Karl Marx, for example, noted that all existing goods can be easily measured by the degree of effort and labor expended on their manufacture. This can be done, for example, by comparing the qualifications of the employee and the cost of working time. Thanks to this comparison, we will be able to determine the price of absolutely any product. This can be done with the help of another universal product - money.

Money is needed to determine the measure of value, to make savings and payments. At the same time, all finances must be supported by something. Perhaps this is with the help of precious reserves. In the Russian Federation, gold is such a reserve.

Is money evil?

Having dealt with what money is needed for, it is worth moving on to an equally important question about the essence of finance. Many people like to talk about how all money is "real evil" and should be eliminated and never used at all. What are the citizens who say such things guided by? As a rule, they look at things somewhat one-sidedly.

Finance is a very convenient tool that allows you to correctly assess the cost of a product. In the hands of a reasonable person, money will be only a means of satisfying their own needs. But there are crazy people in our world who are ready to do anything for the sake of finances. Here you can draw a classic parallel with a knife: in someone's hands a knife is a convenient household tool, and in someone else's it is a dangerous murder weapon. So why does a reasonable person need money? The answer is simple and logical: to exchange their own labor for various elements and services necessary for quality life support.

Buying time

It is worth returning to the question of why money is needed. Three undeniable advantages of finance will be outlined below.

The first and, probably, the main advantage of money is the saving of time. Unfortunately, we cannot even buy an extra hour of life for ourselves (as it appears, for example, in many science fiction films). However, for a certain share of finances, it is quite possible to buy someone else's time, thereby significantly saving your own. What exactly are we talking about?

Do-it-yourself car repairs can take a significant amount of time; and in the end it will not be possible to guarantee that the car is perfectly repaired. And if you give it to professionals, then your own time will be saved, and the car will be repaired with high quality. The same can be said about ateliers, hairdressers, laundries, etc. All this is called the service sector. Various businesses that are ready to perform this or that service save our precious hours significantly. And again, money contributes to this.

Improving life

Whatever the case, life is pretty boring. Many people are only able to work, not having time to enjoy the delights of the world around them. How to get out of this situation? Here again we have to turn to the question of what money is needed for.

Traveling around the world, meeting interesting people, enjoying the benefits of the surrounding world - all this is possible thanks to money. A person who earns well is able to have a good rest. And competently combine work and leisure will help, again, only finances. Money really makes people's lives better, more colorful and interesting. But it is here that danger can await: often a person is not able to stop, and therefore he indulges in "everything bad." That is why finances must be used wisely. On the other hand, a person who earns well, but at the same time lives a boring and monotonous life, should think: is he doing everything right?

We prolong life

It has already been said above that it is impossible to buy extra life hours, days or years. This is, of course, absolutely true. However, do not forget that with the help of money you can improve your health and, although not guaranteed, but still extend your life path.

Of course, here everything depends to a greater extent on the person himself, on his actions. You can give huge sums for treatment, but at the same time lead a far from healthy lifestyle. But do not forget about those cases when people do expensive operations to prevent an early death. Here again we are talking about the service sector, but this time about a very peculiar one: it directly concerns the extension of life.

So why do people need money? If the answer is very short, then in order to live.

Five more reasons

For someone, the three benefits presented will not seem enough money. That is why it is worth giving five more proofs that finance is a convenient and useful thing. Here's what the money is for:

All the evidence presented above will surely be enough to finally answer the question posed about what the money is for.

What role does money play in a person's life? How much do people depend on them? And what needs to be done to have a lot of money in order to provide yourself with everything you need in this life? Let's figure it out. We all know that the importance of money in our life is enormous, and at the same time, the ability to earn money and manage it wisely is not really taught anywhere. At school, this topic is not discussed at all, and in many financial and economic institutions they mainly teach theories that are very far from practice. Therefore, even a good economic education does not give a person a complete understanding of what money is and how it works. And this is quite understandable, because any specialists are trained, first of all, for hired labor, and not for managing money. Therefore, much of what we need for life is for us, and not for someone else - we need to teach ourselves. What we will do on this site.

The Importance of Money

Money is important. And we know it. But at the same time, we all have a different attitude towards them. Someone is ready for anything for the sake of money, but for someone money is far from being in the first place in life. And at the same time, such people do not live in poverty. Why is that? Everything is very simple - the importance of money is determined by two things: the need for them and the ability to extract them. If I know that thanks to my skills I will never be left without money, no matter what I have to do in life - I do not glorify money, I do not make it the center of my life, I do not worship it. Why should I do this if I know that I can always earn them, what should I be afraid of? On the other hand, if a person is nothing of himself or thinks that he is nothing of himself and does not know how to raise money, they will be of great importance to him, because he does not make them, but they make him. As a result, the struggle for money that we are witnessing today is the struggle of people for their lives, both literally and figuratively. That is, people need money for survival and for becoming a person.

And in the same way, if a person does not know how to manage money, he constantly feels the need for them, which means that they are a deficit for him, which in turn makes them a vital resource for him. And in order to manage money, as I said above, you need to be able to manage resources, including human resources, including yourself. And in order to manage resources, you need to have the appropriate knowledge, including more extensive knowledge about money, which I give you on this site. A person who does not have an understanding of what money is cannot find the right place for it in his life and the right use. Well, yes, money is a means by which you can get a lot of what you want, but how does this tool work and what is needed so that money is not a problem for you? This is what few people understand. And how to understand it? Look at those who already have a lot of money and analyze these people. Study them in detail. Find out more about them and then compare their qualities with yours and you will see the difference between you and them. This will allow you to improve yourself in the right way in the right places to become stronger. And money and power in this world, as you know, go to strong people.

In my opinion, I write about things that are so obvious that it is somehow even embarrassing to write about them. But by God, people don’t understand them a damn thing, because I see how easily and simply they are controlled with the help of money, turning them into obedient and weak-willed puppets who are ready to sell their mother for money. But the money is often not worth it. Pay attention to the happiness that follows money - how long and real is it if money came to a person by chance? She is fleeting. Give most people a lot of money, a million or ten million, and after they screw it all up, their lives will only get miserable. The thing is, living for money is a very narrow, very limited life. People do not notice much in their lives and do not know how to enjoy what they have if they constantly think only about money. At the same time, the most offensive thing about this is that they often do not have enough money themselves. And now you know why. Because it is necessary not to think about money, but about what leads to it.

money and mind

I like it when I have money, especially when there is a lot of it. But even more I like to improve the ways of their extraction. And I hate it when money comes to me too easily, because I know that it relaxes me. I am absolutely convinced that easy money is a real evil, the same as, say, the oil curse. When a person has money, a lot of money, he spends it, practically without thinking about how competently and efficiently he does it. But when he does not have them, he either works like a horse for them, if he does not have a mind, or he thinks about how to acquire them, if he still has a mind. That is, in the first case, the process is thoughtless, often instinctive, not involving your mind. Moreover, even when buying human power, you do not think about the possibility of doing it without money - you are not looking for an opportunity to get what you need from people without money. So you don't think. What do you think contributes more to your mental development? Spending money or looking for ways to get it? Answer this question for yourself, because in the end such obvious things should be more understood by people on their own than explained to them by someone else.

In this game of money, there will always be winners and losers, whatever one may say. But that's not what matters, what matters is who you are. And you will be who you make yourself. If you make yourself the master of money, with the help of proper self-development, which implies the study of important things for life, such as managing people, managing money, other resources, your life will be wonderful. And if you make yourself a slave of money, who is ready to do any work, just to get money, you will fulfill other people's orders and feel need all your life. Well, usually. So money in a person's life is what he himself makes it.

Why do people need money

Everyone knows what money is. But if you ask the townsfolk what money is for, the answers will be completely different. Why? First of all, because the function of money is multifaceted, and also because our attitude to money is laid down in our childhood, depending on the environment in which we were brought up and what values our parents instilled in us.But really, what is the money for? Are they evil, or are they good? Do they corrupt us or stimulate us to develop? Let's try to find answers to these difficult, but at the same time important questions for us.

Money in the global sense

To begin with, let's try to figure out why, in principle, money is needed and could humanity live without it?

There is a wonderful expression "Money rules the world!". We often say this phrase, but we don’t think at all about the meaning of these words. In fact, money is of the utmost importance to the system in which we all live. We can say that money made people out of us. In the global sense, money is not only the equivalent of the cost of certain things and services, it is a way to maintain order and stability in our civilized world.

Look: in order to receive money, each person is forced to do something, earn it, and not just live his life aimlessly. That is, thanks to money, a person observes a certain discipline. To earn money, a person creates some benefits that benefit society. Thus, he not only earns himself, but, in parallel, develops this society. But a person spends the money received on himself, but, again, invests it in the economy of the state, in its development.

Subordination to such a system of circulation of money allows the state to control us. And if we suddenly all at once give up money, the world familiar to us will immediately fall apart, turning into chaos. World history knows many such examples, and given that the modern economy has long been bursting at the seams, in the future we risk once again facing social madness on a global scale.

Thus, when forming your attitude to money, you need to think not only about yourself, but also about the entire system, thanks to which we live in a relatively calm world. We are talking about the relative calm of the world, because even in the global sense, the existence of money has a side effect. Even states want to have as much money and power as possible, and therefore “hot spots” appear on Earth every now and then, and innocent people die.

Money in the understanding of man

And now let's go directly to the question of the meaning of money for each of us. And here for a particular person, this value may differ. To begin with, let's talk about the owners of large financial resources, and people who have grown up in prosperity.

For the most part, a person who was brought up in full prosperity does not feel much need for money. He knows that there are always enough of them, he is not disturbed by the constant thought: “Where to get the money?”, and therefore he can devote his life to personal development and self-realization, while simultaneously increasing the funds he has. That is, money in the life of such a person does not play a primary role, but still their importance is not questioned.

Thanks to big money, such a person gains freedom, which means that he can do charity work, create something, develop his own business, involving other people in it, and therefore benefit both himself and those around him. In this way, a person makes this world a better place, using for this the freedom and the opportunities that money gives. And as a reward for his attitude to life and to money in particular, this person receives universal recognition and respect. And this is perhaps the best example of the attitude towards money.

True, some people perceive the freedom that money gives, somewhat distorted. Freedom in their understanding very soon turns into omnipotence and permissiveness. That is why their behavior and their actions go beyond the generally accepted norms.

Each of us had to see wealthy and even frankly rich individuals who, having a lot of money, began to feel like real “masters of life”. Such people can afford absolutely everything: rowdy on planes, drive into the oncoming lane in an expensive car, arrange an accident, including with victims, be rude to law enforcement officers, and at the same time not worry about the consequences at all. They are not at all interested in the opinions of others, and all because with unlimited finances, they can pay off responsibility.

Moreover, these people are used to "boasting" about money - buying defiantly expensive clothes, spending fabulous sums on cars, living in luxurious apartments and relaxing in such a way that the whole world would envy their ability to "overspend"! Do you know for what purpose such huge funds are spent? In this way, recognition and respect are bought, that is, those high statuses that these people cannot achieve by being engaged in creation and good deeds.

So, every day I feel how the value and self-sufficiency of my space increases even without my participation.

Why do you need money? The psychologist answers

Protection from a terrible and frightening world, confirmation of one's right to exist, a way to avoid intimacy. All these are different types of misuse of money. If you deal with these problems, then the question of exactly how much money you need can be decided in a completely different way.

Many people come to therapy with the question, "I can't make enough money, what am I doing wrong?" According to psychologist, Gestalt therapist Tanya Amvrosimova, most often it's not about money at all.

In fact, money is just pieces of paper. They cannot be eaten, they cannot be lived in, they will not protect from cold and heat. Each of us puts meaning into money on our own, and it will differ depending on our needs.

Why do you need to know this at all? First, many needs, at least partially, can be satisfied not only by increasing the amount of money in the bank account. Secondly, some needs, no matter how much you would like, cannot be satisfied at the expense of money at all. And then, of course, it is possible to solve the issue of increasing earnings, but the result will not bring happiness and pleasure.

They periodically come to me for a consultation with the question: “I can’t earn enough money, what am I doing wrong?” One of the answers is that behind the desire to improve one's financial situation is not at all a craving for money. By the way, another popular topic in my office: "I have everything, but I feel empty in my soul." Very often, the roots of this problem also lie in the substitution of needs, but more on that another time.

And now - some of the most common hidden meanings of money in a person's life, which we unearthed together with clients. Each of them has advantages and pitfalls. All of them are only partially about money, and for the most part - about completely different needs, which are best solved not by increasing your income. Well, not only them.

If the surrounding world seems to be something terrible, and your life seems like a feather driven by waves across the sea. Or to put it more down to earth:

- if you are scared to the core by the need to communicate with fellow travelers in the subway, officials in institutions, sellers in stores, and in general all these strangers, far from always tactful and pleasant people in communication;

- if you feel powerless before fate, before life circumstances, then money can seem like a wall that protects you from the need to communicate, decide and choose something in your life.

Obvious advantages: for money, you can hire people who will talk instead of you. Instead of the subway, you can drive your own car, buy business class tickets on an airplane, hire a housekeeper to do your shopping for you, and so on.

Implicit cons: if you have not received a fabulous inheritance, then you will need to earn money. And for this, most likely, you will just have to communicate, decide and choose. And after, having received the money, you will be forced to either save as much as possible so that it is enough for a lifetime, or continue to earn it. Don't you think that there is some catch in the idea of making money a reliable protection from the world?

It so happened that the amount of money is rigidly connected with your assessment of yourself, and of those around you, of course. A lot of money - you can be proud of yourself, you can respect yourself, and in general you can consider yourself a person. Money is tight - ". Are you still trying to say something?

Obvious advantages: money is power. Many people are ready to respect, be tactful, attentive and caring to those who have more money. With their help, you can get a good attitude of a certain circle. A person with money most often has many acquaintances, so outwardly loneliness does not threaten.

Implicit cons: a feeling of inner emptiness and yet loneliness. All the same common truths: acquaintances will not replace close friends, love cannot be bought. You can buy manifestations of love, but intimacy is still built on other foundations. Another disadvantage is the level of internal anxiety going off scale, because if there is not enough money, then I will have to admit that I am a complete loser in this life. And it is precisely the internal attitude - no one likes losers, and indeed, who needs them like that - that scares me the most.

Proximity protection

We are all smart and we know that it is bad to give a child expensive toys instead of wasting emotions, time and love on him. But often adult men and women replace tenderness, attention, joy and all other manifestations of feelings in a relationship with money and gifts. For example, the husband earns money for the family and. All. Or a woman sends money to her mother and. everything too. No, there is nothing wrong with money, but why then does a feeling of artificiality arise and discontent accumulates among your loved ones?

Obvious advantages: people with money are valued in our society, so it will not be so easy for a partner to leave you, even if the only thing you are ready to share is material wealth. Fortunately, your self-perception does not depend on the availability or absence of funds, and helping other people financially is one of the very good types of help and care.

Implicit cons: your self-perception is independent of whether you have money or not, but without a penny in your pocket, you are likely to feel about as “cosy” with other people as a naked person in a busy square. People who are afraid of relationships are trying to replace intimacy with money. It doesn’t matter why - they don’t know how to support them, they don’t feel good enough, they are ashamed of their clumsiness, they don’t know how to withstand aggression in relationships, without which they can’t go anywhere. At the same time, they really really want these intimate relationships, but it is impossible to get them for money. Here is such a paradox.

Before using what you have read, you need a mandatory consultation with professionals.

Why did we all come to Oriflame? We want to be beautiful and well-groomed because it is a cosmetics company? Yes, sure!

But the main reason is to build a business and get a well-deserved profit, that is, money!

Money and business are connected by an inseparable thread. Wherever we work, and whatever we do, we do it for money! It just so happens that it is money that contributes to the achievement of all our goals.

Whatever we dream of, to make dreams and desires come true, we need these beautiful pieces of paper and jingling coins. In some families, talking about money is generally not accepted. That is, it is a completely closed topic that is not subject to discussion. The reasons for this phenomenon may be different, but the main one is a dislike for money.

There are actually a lot of people who do not like money and believe that happiness is not at all in them.

Such people, until the end of their lives, live paycheck to paycheck, and inspire their children that this is the most correct way in life. Such people, not having all the essentials for a normal life, do not consider themselves beggars at all. They consider themselves to be honest. Such people are sure that it is impossible to earn big money honestly.

In fact, there are many ways to earn honest money, even very big money. This requires patience, a great desire to work, and a goal is needed, for the achievement of which, in principle, a person works.

When we love something or someone, the most tender and kind feelings wake up in us. We have wings on our backs.

We are getting kind!

We are just happy!

Loving money does not mean worshiping it at all. You just need to learn how to protect, preserve and increase them. What a pity that they still don't teach this in elementary school.

When a person shows a special attitude towards money, they begin to (in some magical way) multiply.

Why do we need money?

With money you can buy clothes and food, with money we pay for utilities and the education of children. For money, we buy everything we need for coziness and comfort. To be beautiful and well-groomed, we use money to buy cosmetics and visit beauty salons. For money, we celebrate the birthdays of our children, have fun and travel.

A sincere and honest person who once fell in love with money begins to appreciate it. Such a person becomes worthy of money.

The Universe rewards a person for love and careful attitude to money, and sends all kinds of ways of honest earnings.

A person who dreams of traveling knows that money is needed for this. Since the dream is bright and pure, he involuntarily attracts cash flow. And the money appears NO WHERE!

A promotion, a cash bonus, or even an inheritance from an unknown aunt, suddenly falls on your head. This is the law of the universe, and it exists!

In the world, there are 4 financial categories to which certain people belong.

Any person can go up or down these four steps several times.

But in life no nothing is possible. Everything has been tried and tested.

It all depends on the great desire and the goal. And each person decides for himself whether to go up or down the financial steps.

This is when expenses exceed income. Financially dependent people live in poverty and constant debt. The minimum amounts are borrowed from friends and relatives. After receiving a salary, debts are distributed and immediately borrowed again. Such people start working immediately after graduation. They go to work at a plant or factory, where they are escorted to retirement. They don't even dream about loans.

They do not dream about everything else, even about the most necessary. Only very strong-willed people can get out of this state. The rest vegetate in poverty for generations

2) Independence (independence)

This is when income equals expenses. In this financial state, people work for themselves. They have their own small shop or mini-bakery, car service or manicure room.

A person is absolutely free because he does not run to work by 8 in the morning. But sometimes, people start spending much more than they earn. Then you need to urgently change your views and bad habits, otherwise a person risks getting bogged down in debts and loans.

The second financial step is the most profitable and available to absolutely everyone!

At the same stage, there are people who are engaged in network marketing.

oriflame company, provides incredible opportunities that help you get closer to your dream. Business with Oriflame can be built by anyone who wants financial independence!

Most importantly, take your job seriously and responsibly, and learn how to spend your honestly earned money.

If you properly and competently manage your income and expenses, you can provide yourself and your family with a stable and constantly growing income for many years.

3) Prosperity (wealth)

In a state of wealth, a person still works, but only for his own pleasure. Such people allow themselves a lot. Expensive foreign cars, apartments and country mansions. But... some businessmen

begin to buy yachts, factories and ships. And if you do not completely control your high incomes and even higher expenses, you can, after some time, return to the second stage of your financial condition.

4) Complete freedom (millionaires)

This is when a person stops working altogether. People who belong to the third or second financial category can work for him.

Millionaires often take advantage of the fact that they hire people from the first category in their own factories and factories. These people are willing to work for the minimum wage.

Numerous enterprises work non-stop and give huge profits. And when a person reaches such a state, he can really have everything that is only invented in this world.

But as a rule, everything millionaires are very stingy. Well, relatively stingy, by their rich standards.

A lot of people don't aspire to the millionth fortune. They are quite satisfied with the second financial stage. People who have a dream always achieve financial independence!

Are you not with us yet?

Then come to Oriflame and achieve your goals, because everyone has their own!

Registration in Oriflame: here

Ok, most of us think about money at least once a day. There is practically no person who would not experience emotions at the sight of a large bundle of fresh banknotes. These pieces of paper, although they do not give the same sensations as sex, but break weak brains worse than skydiving.

Here, for example, is a wad of money from the sale of one of my projects and my big toe. Excites?

You can’t just take it and calmly look at these vulgarly scattered pieces of paper.

A common thing, you say. And in this I, perhaps, agree.

We all want to sooner or later earn or have a large amount of money on the ball. Often without even thinking about what, in fact, we need them for?

No, there are, of course, the main guides - to buy a car, an apartment, go to a five-star hotel and stock up on all sorts of nishtyaks to the very tomatoes. But do these beacons need to be placed on your “business plan for life”, which everyone has in the stash?

I often ask myself this question. And I'm just as opportunistic a bastard as the rest of you. I want a nice car, a big apartment, a dacha with a swimming pool, a fast sports bike, and a device for massaging the prostate to the heap (and what, aim, it’s all 146%). Everything is like everyone else.

Let's move away from this material tinsel a little and dig a little deeper.

At this stage of my mental development, I have come to the conclusion that the phrase "at this stage of my mental development" is a very convenient marker that I recommend using. We often do not understand each other precisely because we are at different levels of self-consciousness. Or awareness, if you like. Like drunk and sober. How full and hungry. Like rich and poor. So any dispute, for example, can be much easier to turn into a constructive direction if everyone adheres to the position “at this stage of my mental development, I ...”

It was word for word. Let's get back to money.

At the moment, for myself, I have identified three fundamental crutches that can be laid in the foundation of the answer to the question of why I need money.

1. Money is needed to buy time.

Remember the movie with Justin Timberlake, where you could buy time for money every day, extending your life indefinitely. The poor worked every day to extend their existence for a day, and the rich stupidly had fun, having an unlimited supply of precious seconds.

Dream, right?

The same thing happens in our short life. We cannot buy time for ourselves, but with financial resources, we can buy someone else's time while saving our own.

In this regard, I am amused by the people who tell me. And what, you couldn’t glue the wallpaper yourself, armless chtol? I couldn’t repair my car, why did I give it away for the loot? I would save!

And these same people do not understand that I am buying myself precious time, instead of wasting it on activities that are completely uninteresting to me. And the more money you have, the more hours you can save yourself for point number two, which is.

2. Money is needed in order to diversify your life

Whoever says anything, but a ringing coin in your pocket can saturate your life with new impressions. You can try something new every week, seasoning your existence with pepper, curry and other interesting seasonings.

Whoever says anything, but a ringing coin in your pocket can saturate your life with new impressions. You can try something new every week, seasoning your existence with pepper, curry and other interesting seasonings.

Undoubtedly, there are people who, even without money, are able to get around the whole world on foot, by bike or by hitchhiking. But what is their percentage of the total? Negligibly small.

Having a good income behind your soul, you can paint your life so colorfully that “it will be interesting for the Lord to watch you” and he will throw you another twenty years to find out how all this rock and roll will end.

Look at Richard Branson. A person has tried so many things in his life that it remains only to dive into the Mariana Trench and take a selfie from there, having previously checked in.

If you have financial resources, but your life is boring and monotonous, then think about it - are you doing everything right?

3. Money is needed in order to prolong your life

You are 75 years old, your life is running out, will you extend it?

Today I heard on the news that Kobzon has health problems and he broke through the sanctions in order to go to Germany for treatment.

These are the realities that rich people prefer to treat serious illnesses in clinics in the USA, Israel, Germany, and so on. Well, we do not have the technology and specialists who can help.

If you have money, you can recover and live another 10 years. No money - you got it. Deal with current affairs urgently and get ready to move to a better world.

Even if the disease is not so serious, then with the availability of resources you can get to a better clinic, to a more adequate doctor, to faster service.

There is a twist here. You can catch yourself sick, trying to earn all the money in the world. In the end, a vicious cycle will turn out. Earned, dude, it turns out, his treatment. Do we need it? I don't know yet.

In any case, it is better to be rich and sick than sick and poor. It's pointless to argue here.

These are the three pillars on which my worldview currently rests, regarding all these earnings, careers and aspirations for millions.

And what do you need loot for? If needed, of course. You never know.